August Brings Solid Inflows to Bond Funds and Outflows From Equity Strategies

Seven charts on U.S. fund flows last month.

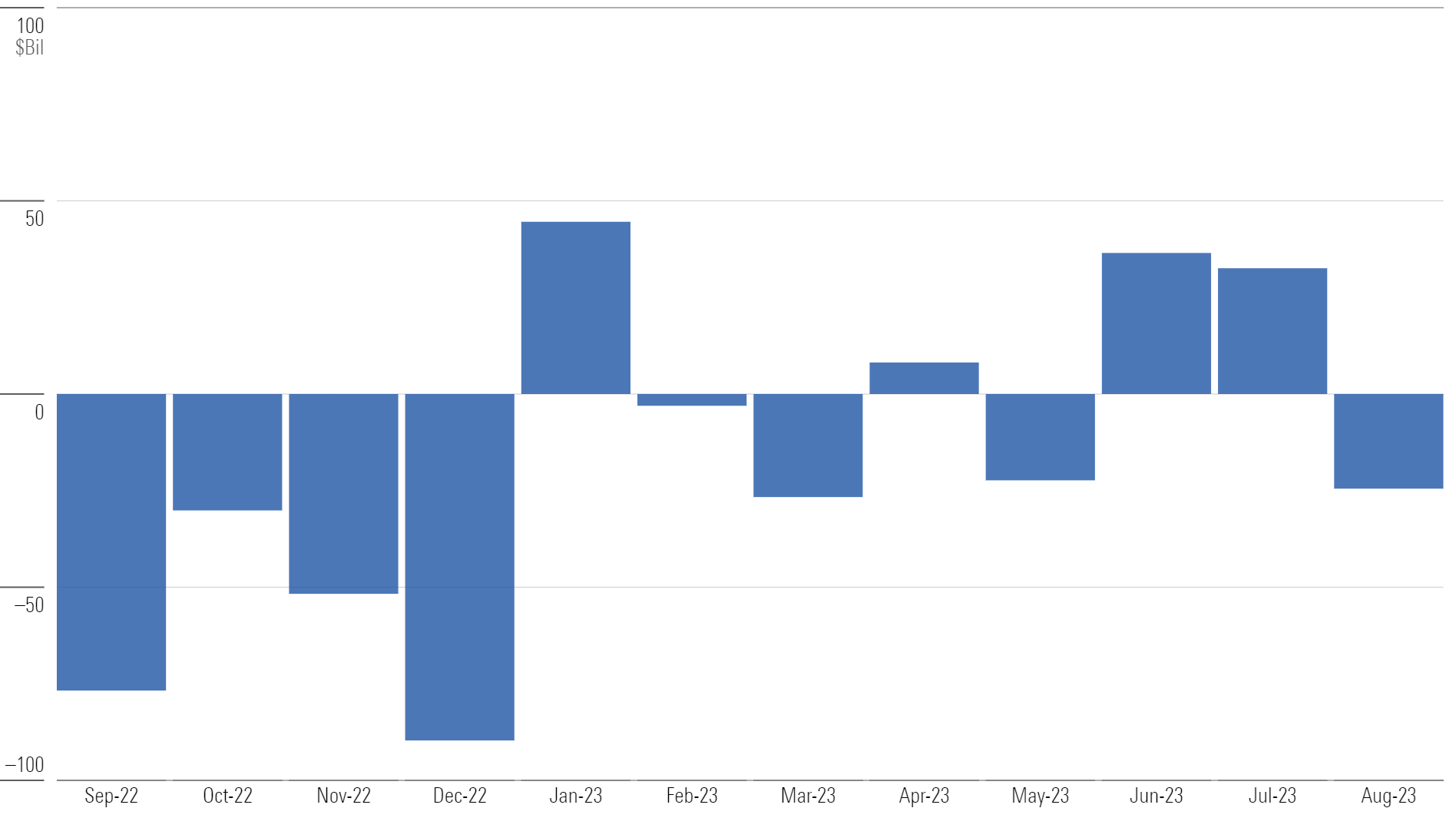

U.S. mutual funds and exchange-traded funds shed $24 billion in August, a small sum relative to their $25 trillion asset base. After four months of inflows and four months of outflows so far in 2023, long-term U.S. funds have collected a mild $45 billion for the year.

Monthly Long-Term U.S. Fund Flows

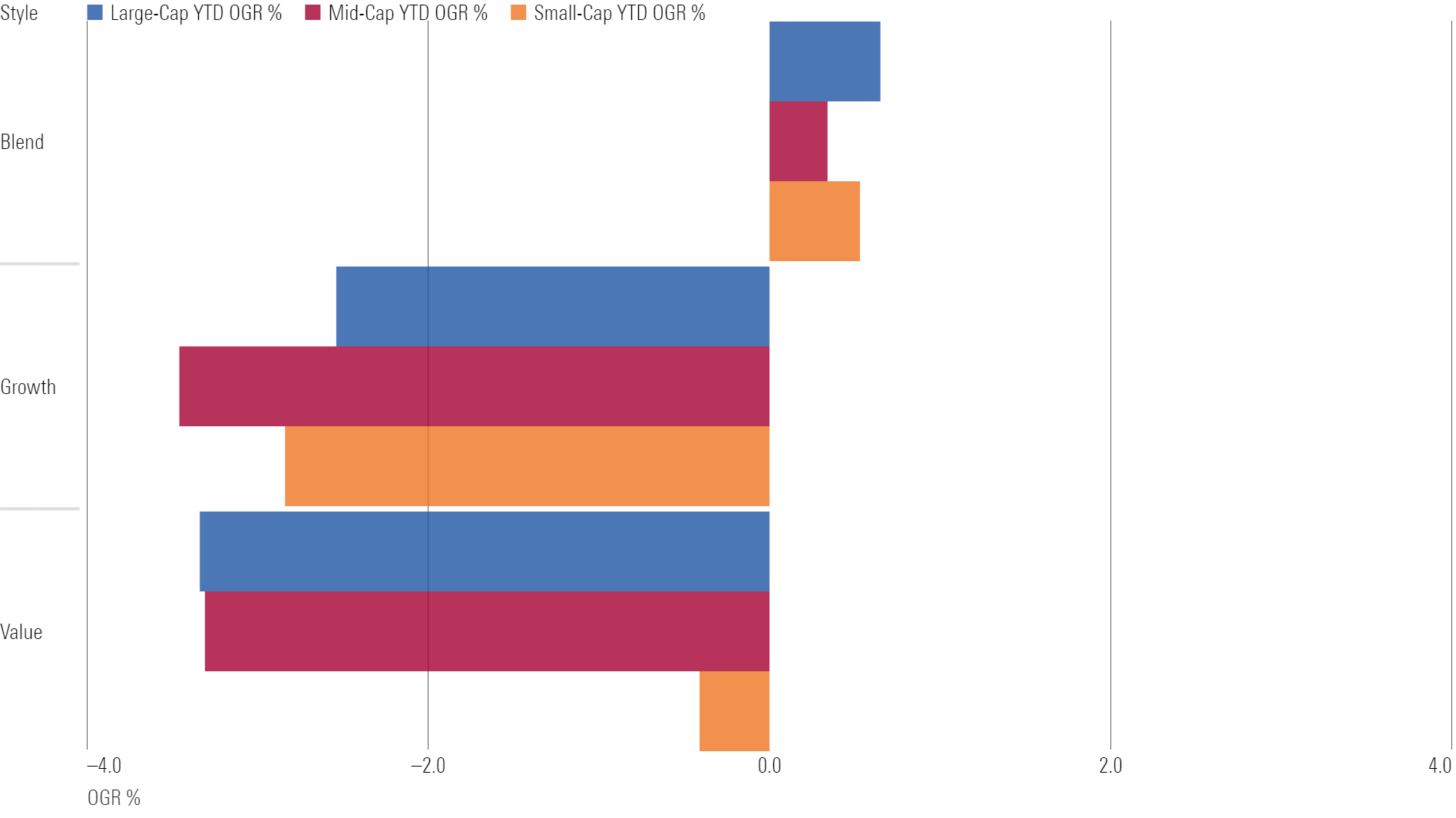

Style Investing Goes Out of Style

Investors have pulled more than $90 billion from U.S. stock funds so far in 2023. Money has flooded out of the value and growth sides of the spectrum. After shedding $6 billion in August, large-value funds are on pace for their worst calendar-year outflows on record. Large-growth funds bled $8 billion during the month and are likely headed for their 20th consecutive year of outflows.

U.S. Equity Year-to-Date Organic Growth Rates

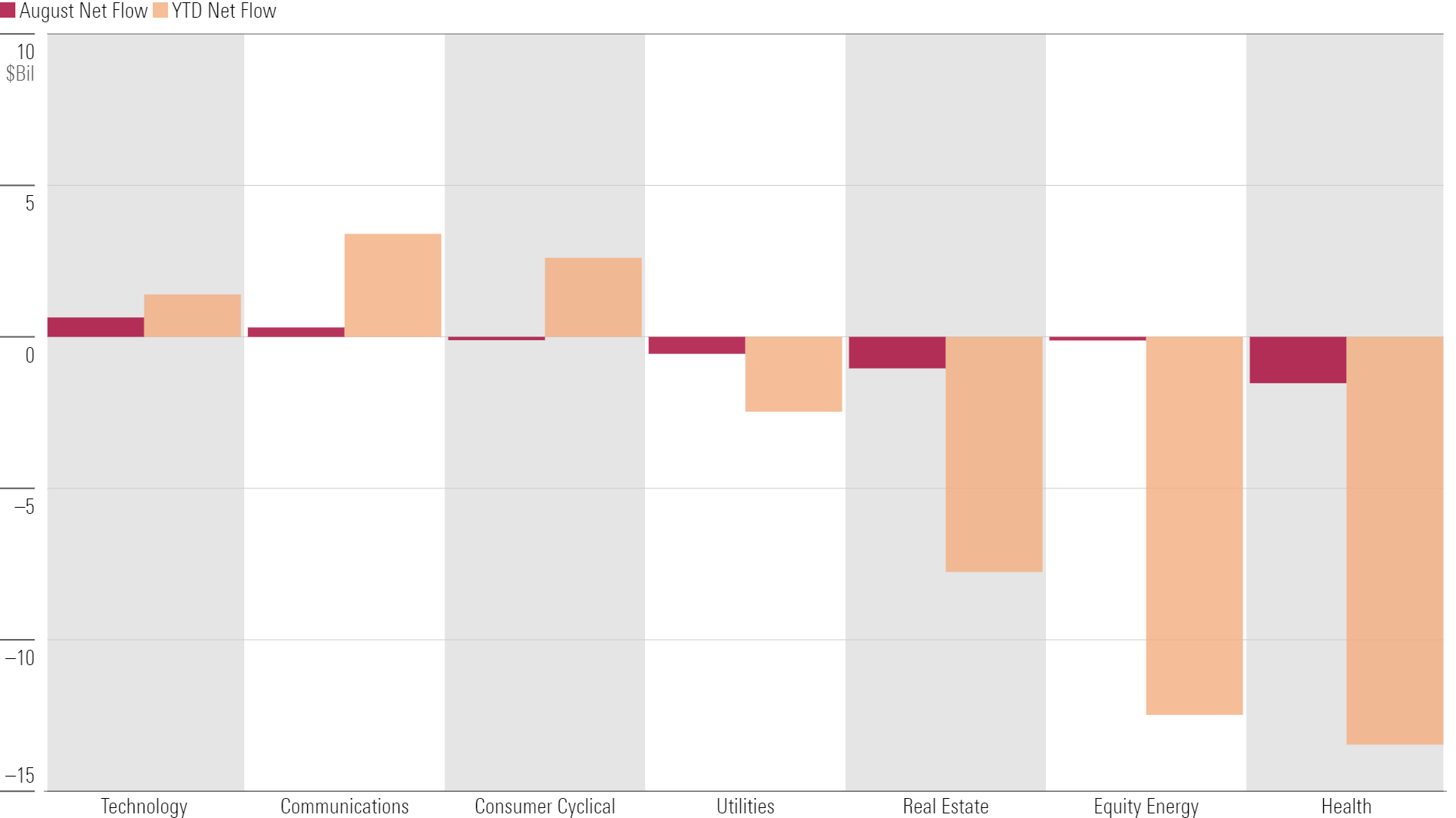

Sector-Equity Funds Return to Outflows

After snapping a seven-month outflow streak in July, niche sector funds saw $7 billion leave in August. Funds that track faster-growing sectors like technology held their own, but outflows from cheaper-sector funds (such as real estate) weighed on the broader cohort—a trend that has taken shape throughout 2023.

Sector-Equity Flows

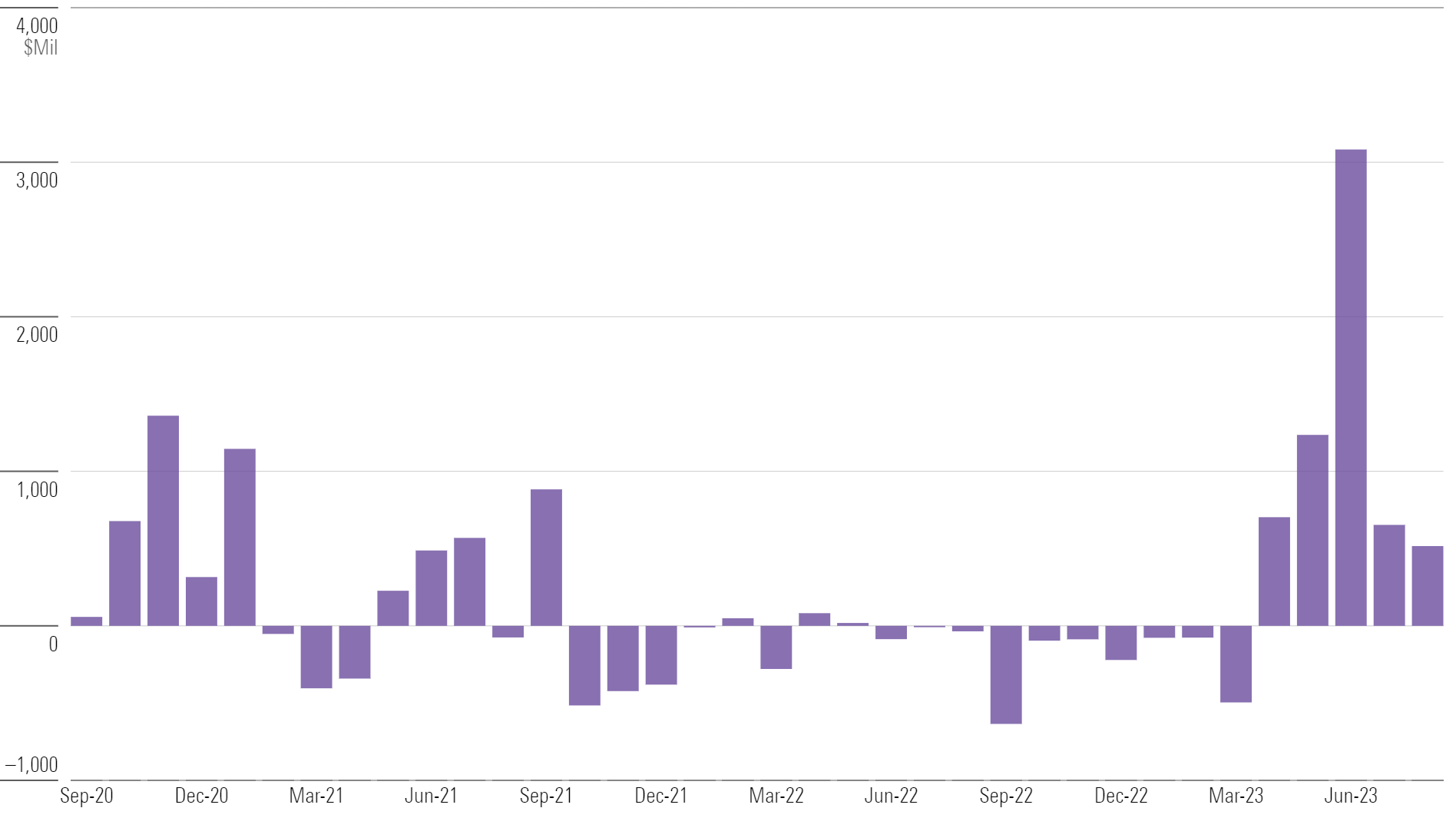

Japan-Stock Funds Stay on Investors’ Radar

A solid start to the year (and Warren Buffett’s endorsement) put a spotlight on Japanese equities and the funds that invest in them. The Japan-stock Morningstar Category collected $516 million in August, its fifth consecutive month of inflows. It was an otherwise quiet month for international-stock funds, though, with inflows totaling less than $1 billion.

Historical Japan-Stock Flows

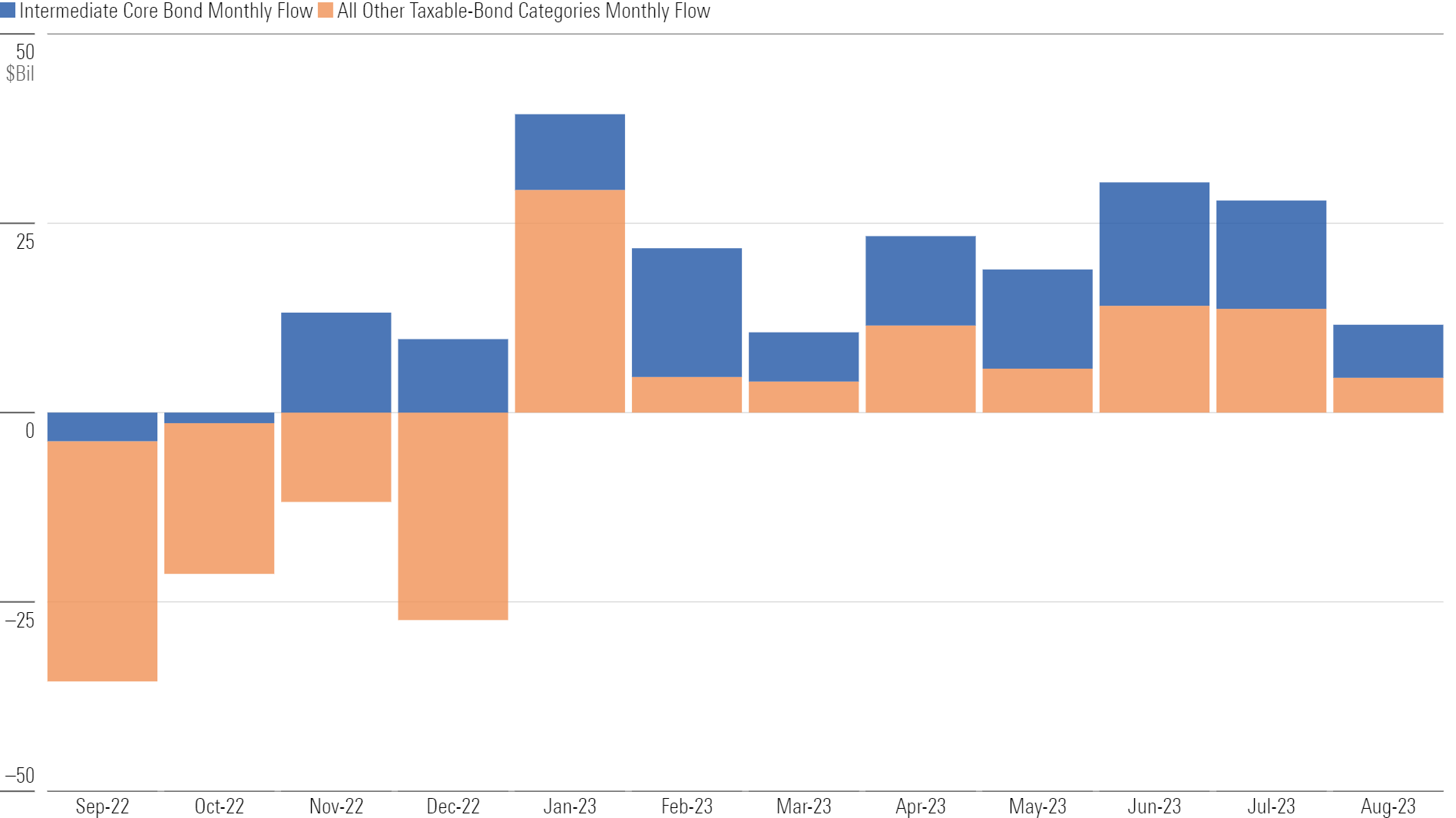

Intermediate-Core Bond Funds Lead the Taxable-Bond Rebound

Taxable-bond funds pulled in $11.6 billion in August, increasing their 2023 haul to $184 billion. Intermediate-core bond funds absorbed over half that money despite representing only one fifth of the taxable-bond cohort’s total assets. Strong flows into broad index funds have fueled that category group’s rebound from massive outflows in 2022.

Taxable-Bond Flows

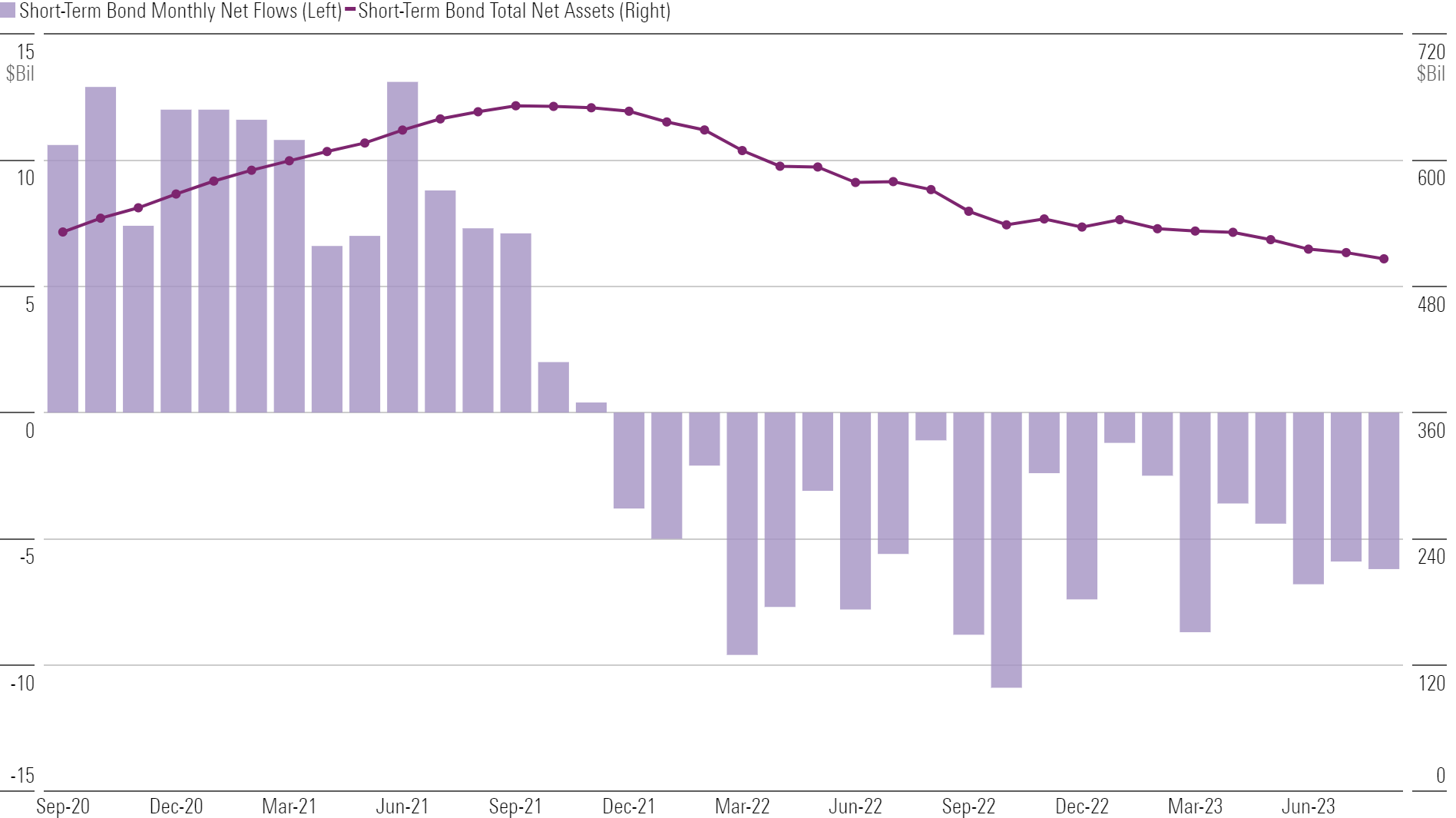

Short-Term Bond Funds Stuck in a Sour Spot

Short-term bond funds shed $6 billion in August, extending their record outflow streak to 21 months. Some investors flocked to the higher yields in money market or ultrashort bond funds. Others locked in rates with intermediate- or long-term offerings. This barbell strategy has left short-term bond funds, whose durations normally range from 1.0 to 4.0 years, out in the cold.

Short-Term Bond Flows

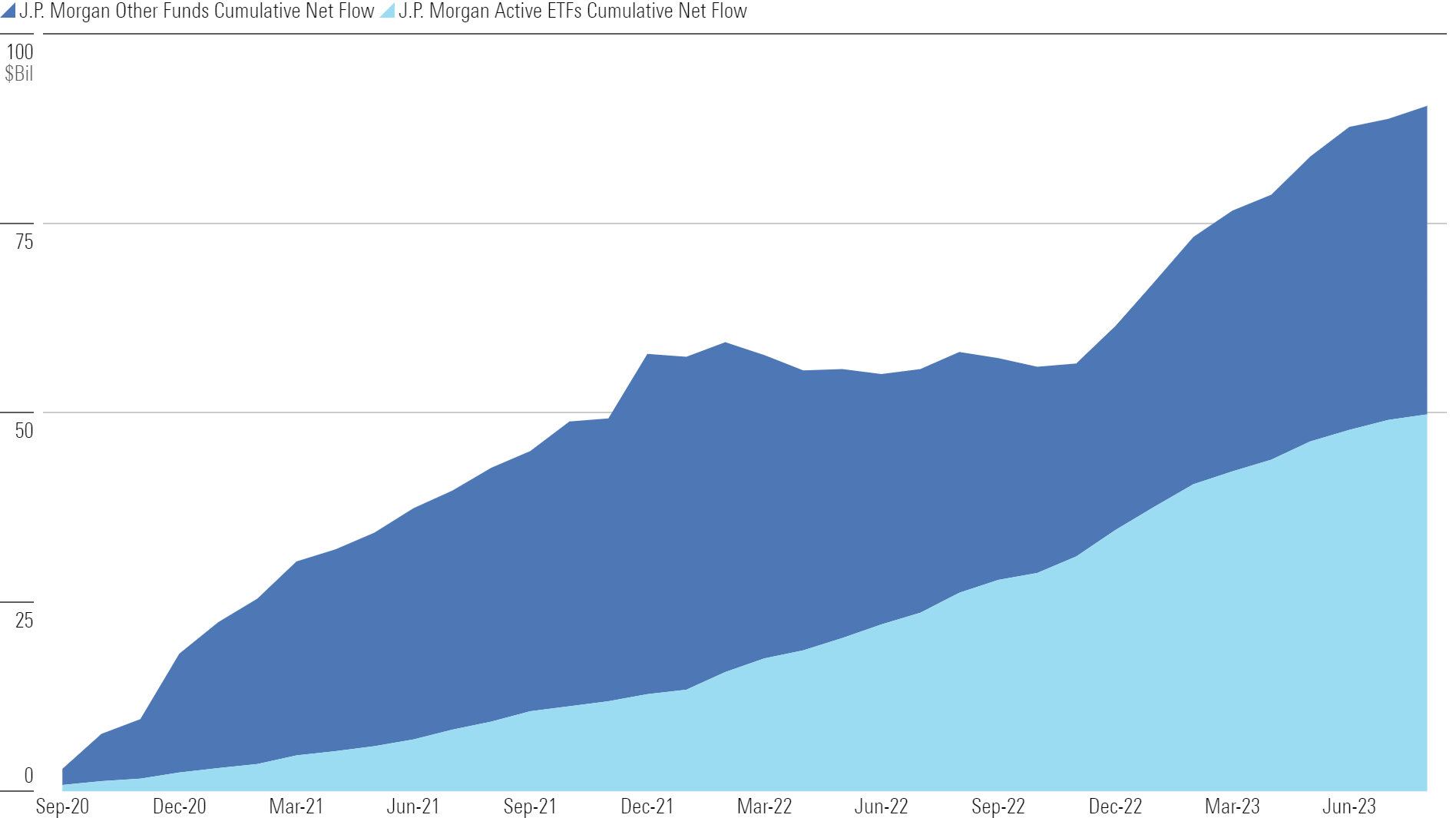

Active ETFs Power J.P. Morgan

Few firms have benefited from the rise of active ETFs like J.P. Morgan. Of the $90 billion the fund family reeled in over the past three years, $49.7 billion went into its active ETF roster. JPMorgan Equity Premium Income ETF JEPI started the momentum when it launched in 2020, and newer products like JPMorgan Nasdaq Equity Premium Income ETF JEPQ have helped sustain it.

J.P. Morgan Flows

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for August 2023. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)