January U.S. Fund Flows Were a Mixed Bag

Bond funds took in the most money; equity funds lagged.

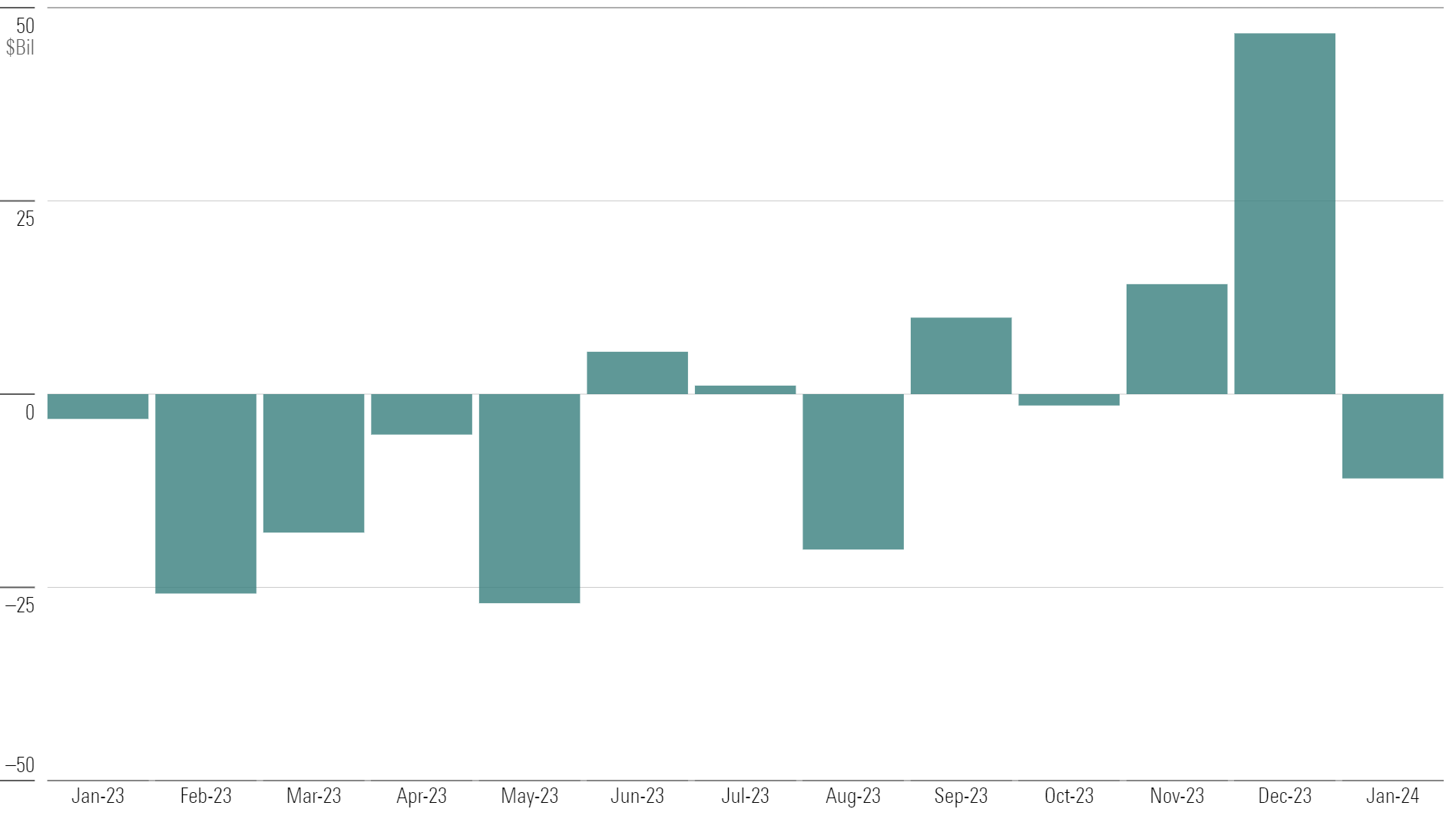

U.S. mutual funds and exchange-traded funds gathered $36 billion in January after wrapping up a weak 2023. Six of the 10 U.S. category groups took in net new money, including a handful that broke out of multimonth outflow skids. Bond funds took in the most money of any broad cohort. Equity fund flows were relatively weak.

Long-Term U.S. Fund Flows

U.S. Markets Keep Rallying—but Don’t Credit Fund Flows

Investors were net sellers of U.S. equity funds during 2023′s strong market, which continued into January 2024. U.S. equity funds shed $10.7 billion as the U.S. stock market closed January with strong gains after a choppy start. With mega-cap tech stocks delivering the goods yet again, large-value funds suffered the largest outflows, dropping $7.4 billion.

U.S. Equity Fund Flows

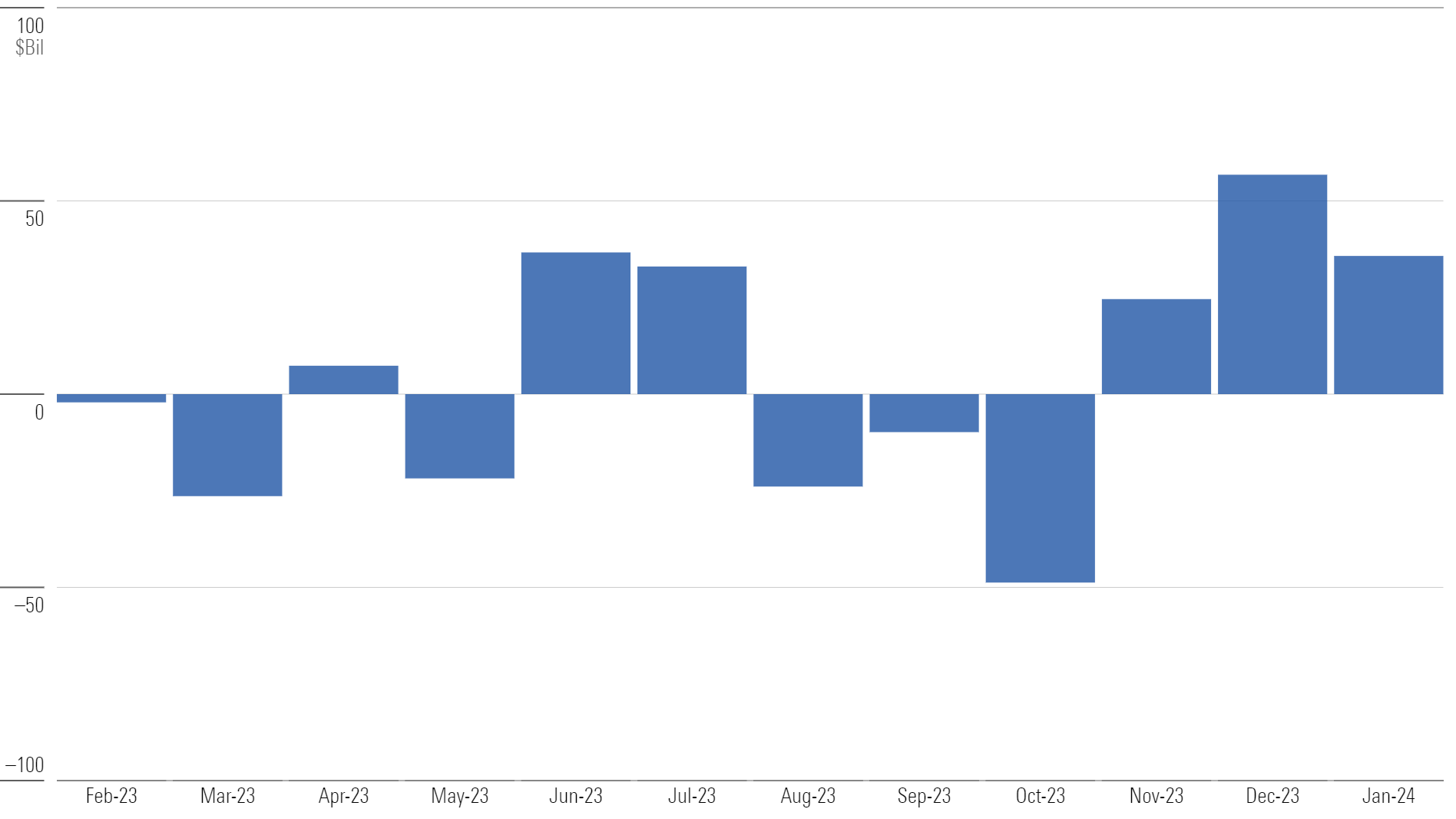

Taxable-Bond Funds Roar Back in January

Taxable-bond funds gathered just over $47 billion in January, their highest total since 2021 and equivalent to a 0.9% monthly organic growth rate. A host of categories collected healthy flows, including credit-sensitive ones like corporate bond and high-yield bond. Actively managed taxable-bond funds took in $25 billion of the $47 billion total, which was good for their best showing since 2021.

Taxable-Bond Organic Growth Rates

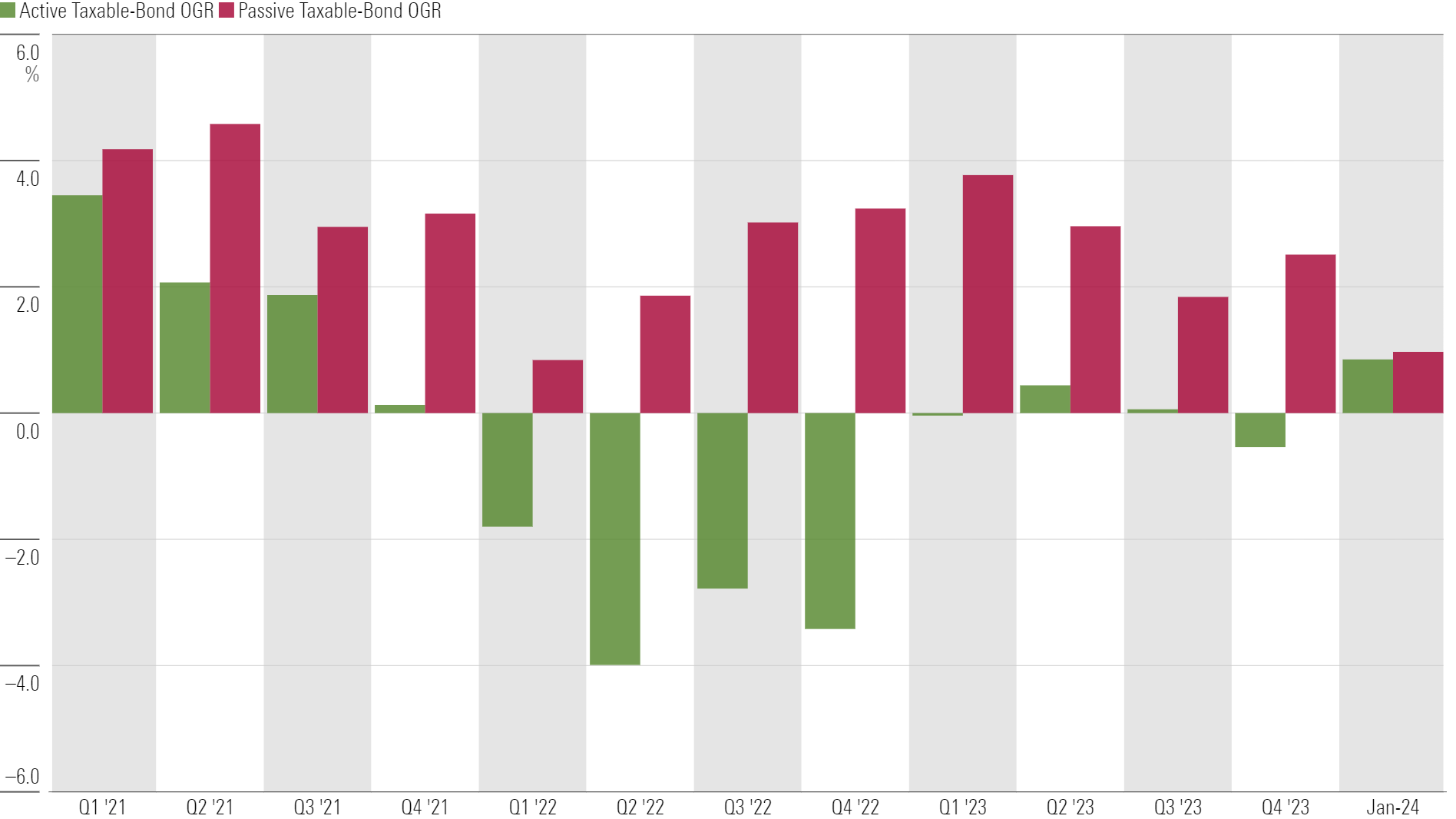

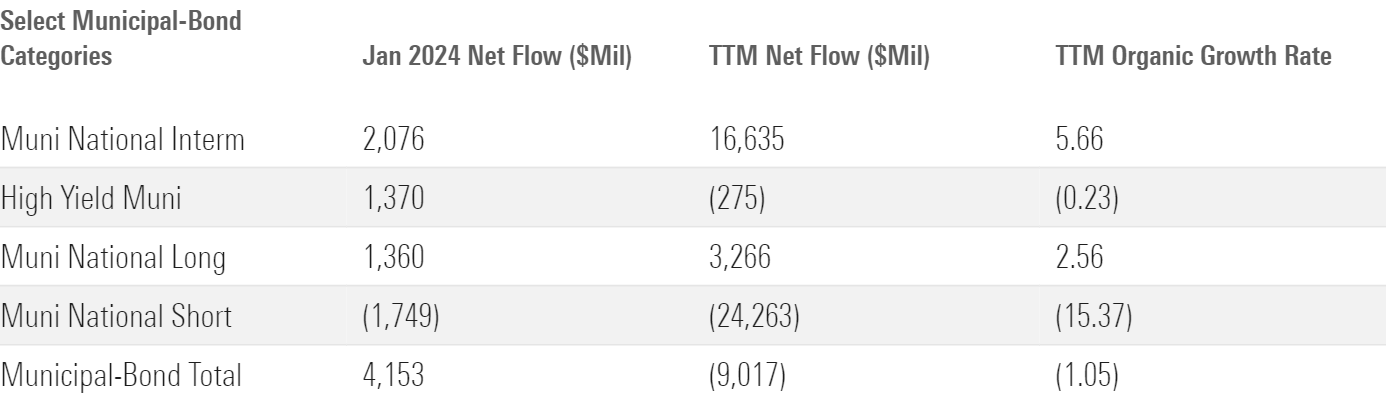

Municipal-Bond Funds See Strongest Flows in a Year

Over $4 billion streamed into municipal-bond funds in January, the most since January 2023. The municipal-bond fund universe skews toward shorter-duration offerings, which were out of favor last year, but flows into national intermediate, long, and high-yield categories offset another $1.7-billion outflow from the muni national short category.

Municipal-Bond Fund Flows

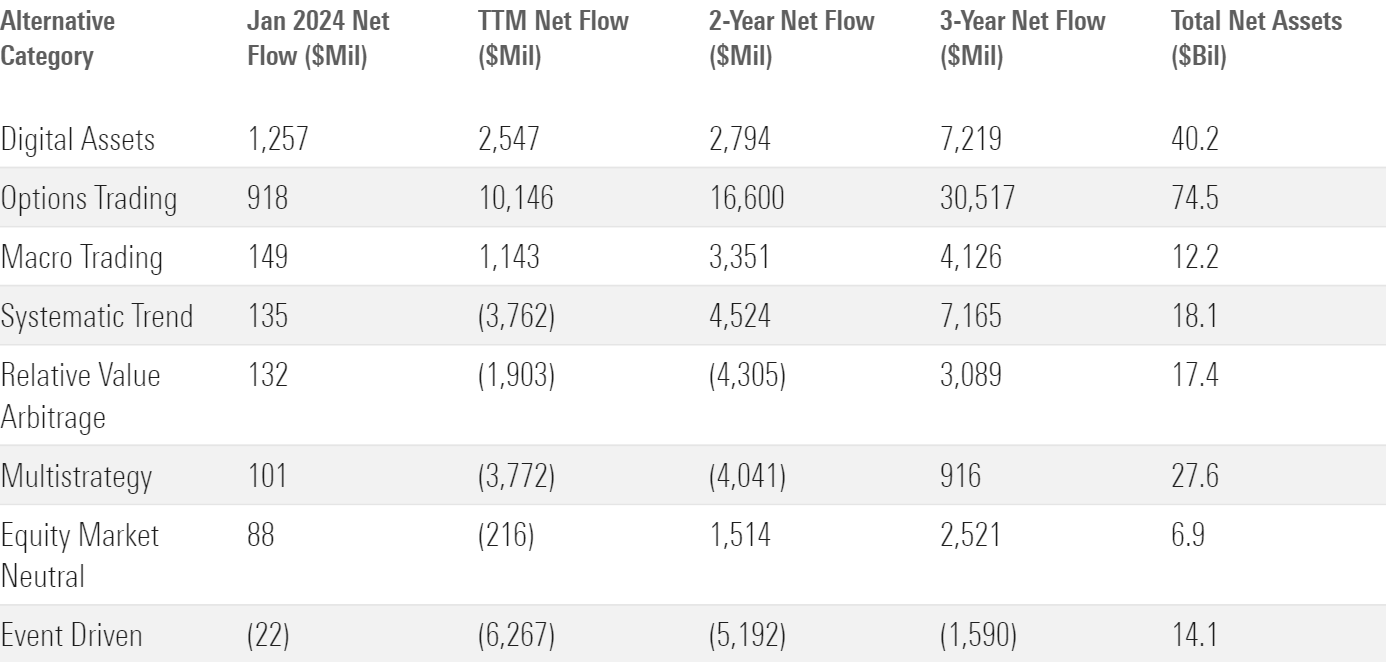

Bitcoin ETFs Lead an Alts Comeback

Alts were out of favor for much of 2023, but the SEC’s approval of bitcoin ETFs breathed new life into the asset class, which took in around $2.5 billion in January. Digital assets funds collected about $1.3 billion. But six of the seven other alternative categories also gathered positive flows, so the phenomenon wasn’t confined to cryptocurrency.

Alternative Fund Flows

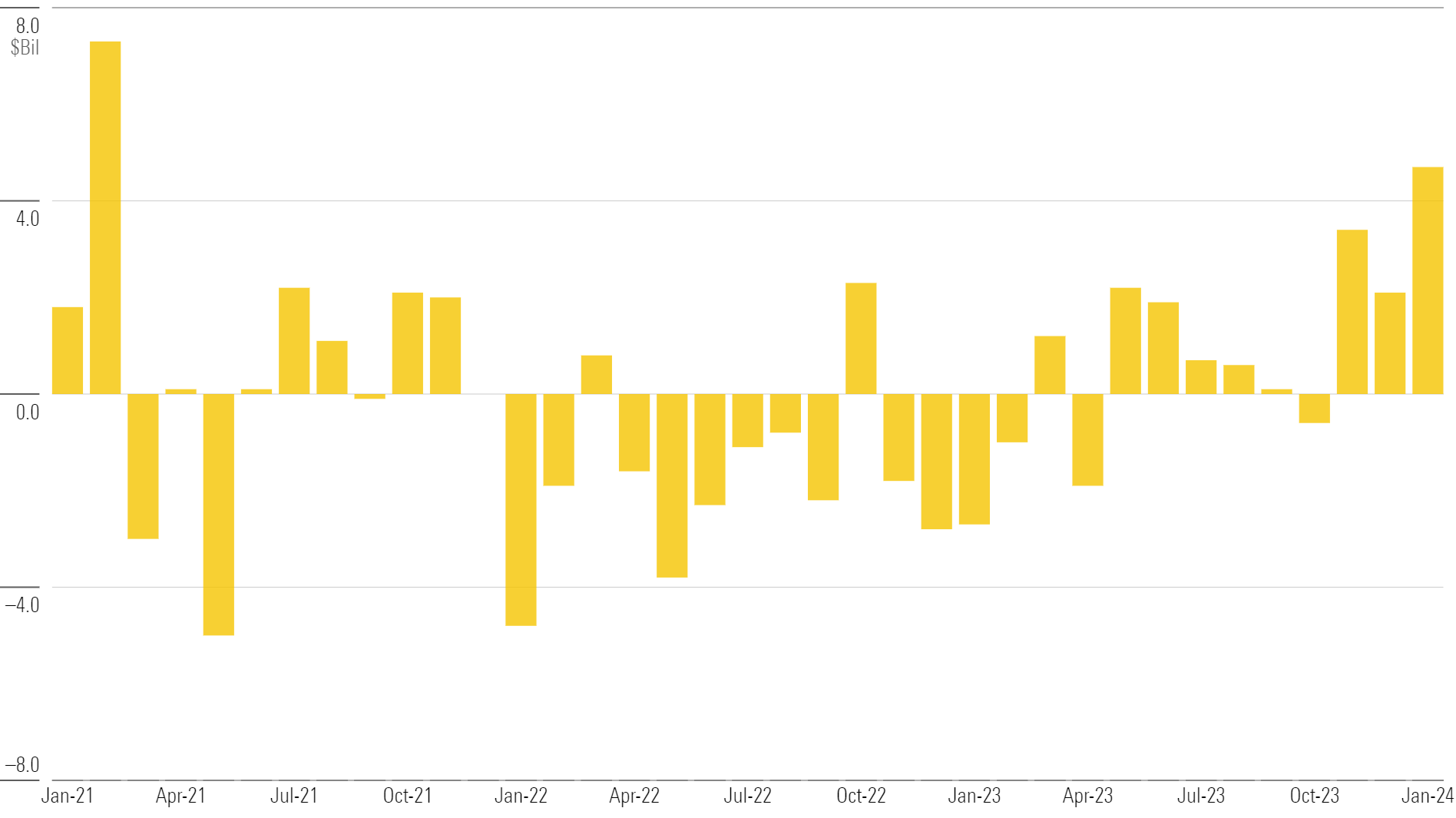

Technology Funds a Shot in the Arm for the Sector Equity Group

After outflows in five consecutive months (and 12 out of the last 13), sector-equity funds took in about $130 million in January. While that is a small sum, it belied a very strong month for technology funds, which collected $4.7 billion. That is their largest total since February 2021 during the tech heyday of the pandemic. Passive tech funds gathered nearly all the net inflows during the month.

Technology Fund Flows

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for January 2024. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)