Markets Brief: Has the Stock Market Hit Bottom? 3 Signs to Watch

In a down week for the market, Taylor Swift hits Live Nation stock, FTX ripples swamp Coinbase.

Heading into the final weeks of the year, the stock market has been showing signs of resilience despite a continued difficult economic backdrop.

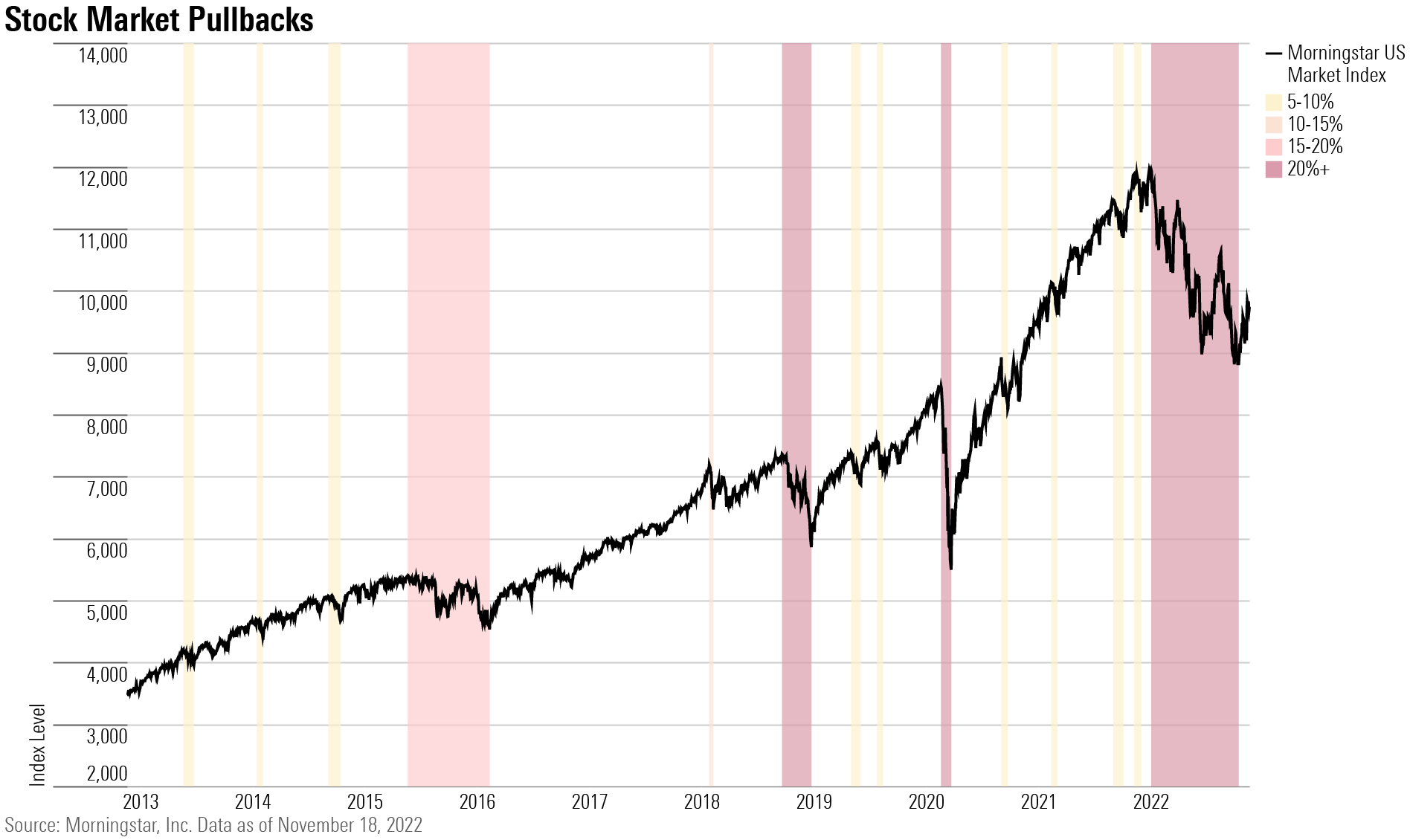

After hitting a new bear-market low on Oct. 14, the Morningstar US Market Index has bounced back 12%, thanks in large part to optimism that inflation has peaked. That’s leading to hopes that the Federal Reserve won’t have to raise interest rates as aggressively in coming months as has been the case up until now.

Also providing support for the stock market is a glass-half-full view of third-quarter earnings. While earnings reports overall were weak and the outlook for corporate profits has dimmed, Wall Street stock analysts thus far haven’t seen cause to take a significant ax to future earnings estimates.

Of course, stocks are still down 18% so far this year, which makes for the worst year-to-date performance through Nov. 18 in the U.S. Market Index since the 2008 global financial crisis. At the very least, from here, investors should be braced for volatility.

Unresolved is whether the worst of the selloff is over. Many strategists caution that the bounce seen in the past month is likely another bear-market rally that will run out of steam and take the broad market back to new lows.

Is This a Bear-Market Rally?

“When trying to figure out if we’ve seen the bottom of a bear market, the first thing to remember is that we’re going to see a number of false dawns,” says Chris Konstantinos, chief market strategist at RiverFront Investment Group.

Konstantinos notes that every bear market is different, but history suggests investors should expect four or five “false dawn” rallies. He notes that the 2008-09 bear market had a series of rallies topping 20% where in each case stocks went back to new lows.

The current rally marks the second bear-market bounce this year. The first started on June 16 and lasted through Aug. 16 and saw the market rise 18.1% before falling back to new lows.

The primary concern is that it is unclear just how far and fast inflation will decline. If inflation pressures remain high, the Federal Reserve has signaled it will continue to raise rates and keep them elevated until there are material signs of progress, even at the cost of slowing the economy.

Another major question mark is the toll that the Fed’s rate hikes will take on the economy. In the bond market, at least, a widely watched indicator is suggesting that a recession is very likely. And for stocks, while the earnings news has thus far been manageable, some analysts believe that the profit picture will deteriorate much more than is currently anticipated, in turn leading the market lower.

3 Rules of Thumb for Stock Market Trends

At RiverFront, Konstantinos points to three rules of thumb when weighing the question of the stock market’s near-term direction. “Our number-one rule in trying to understand the short-term trend for the market is ‘don’t fight the Fed.’”

While there’s been some optimism around the outlook for less aggressive interest-rate increases after the unprecedented series of four consecutive 0.75-percentage-point federal-funds rate hikes, the Fed is still very much in tightening mode, he notes. “The Fed is still actively trying to slow the economy and take liquidity out of the financial markets. The Fed is not on your side right here,” he says.

A second variable, Konstantinos says, is “don’t fight the trend.” For this, he looks to so-called market technicals based on price movements to determine the bias for the market as higher, lower, or sideways. For now, “the trend is a red flag but may be improving,” he says.

Lastly, the third rule of thumb is “beware the crowded extremes.” By this, Konstantinos refers to extremes in sentiment that could lead to sharp market reversals. RiverFront looks to a range of sentiment indicators that it has been watching for the better part of 25 years. “We’ve had some pretty serious pessimism … sentiment was very, very pessimistic for months,” he says. Recently, however, sentiment appears to have shifted back to more neutral. “Sentiment is starting to improve,” he says.

“The highest probability is that there is still more drama to go,” says Konstantinos. “There’s a decent likelihood we are in the thick of the bottoming process but may not have seen the ultimate lows.”

Events scheduled for the coming week include:

- Monday: Dell (DELL), Urban Outfitters (URBN), and Zoom (ZM) report earnings.

- Tuesday: Best Buy (BBY), Nordstrom (JWN), and Warner Music Group (WMG) report earnings.

- Wednesday: Deere & Co (DE) reports earnings.

- Thursday: Markets closed.

- Friday: Stock market closes at 1 p.m. EST. Bond market closes at 2 p.m. EST.

For the trading week ended Nov. 18:

- The Morningstar US Market Index fell 0.92%.

- The best-performing sector was consumer defensive, up 1.28%.

- The worst-performing sectors were consumer cyclical, down 2.72%, and energy, down 2.33%.

- Yields on the U.S. 10-year Treasury ticked lower to 3.81% from 3.82%.

- West Texas Intermediate crude oil prices fell 9.98% to $80.08 per barrel.

- Of the 843 U.S.-listed companies covered by Morningstar, 325, or 39%, were up, and 518, or 61%, declined.

What stocks are up?

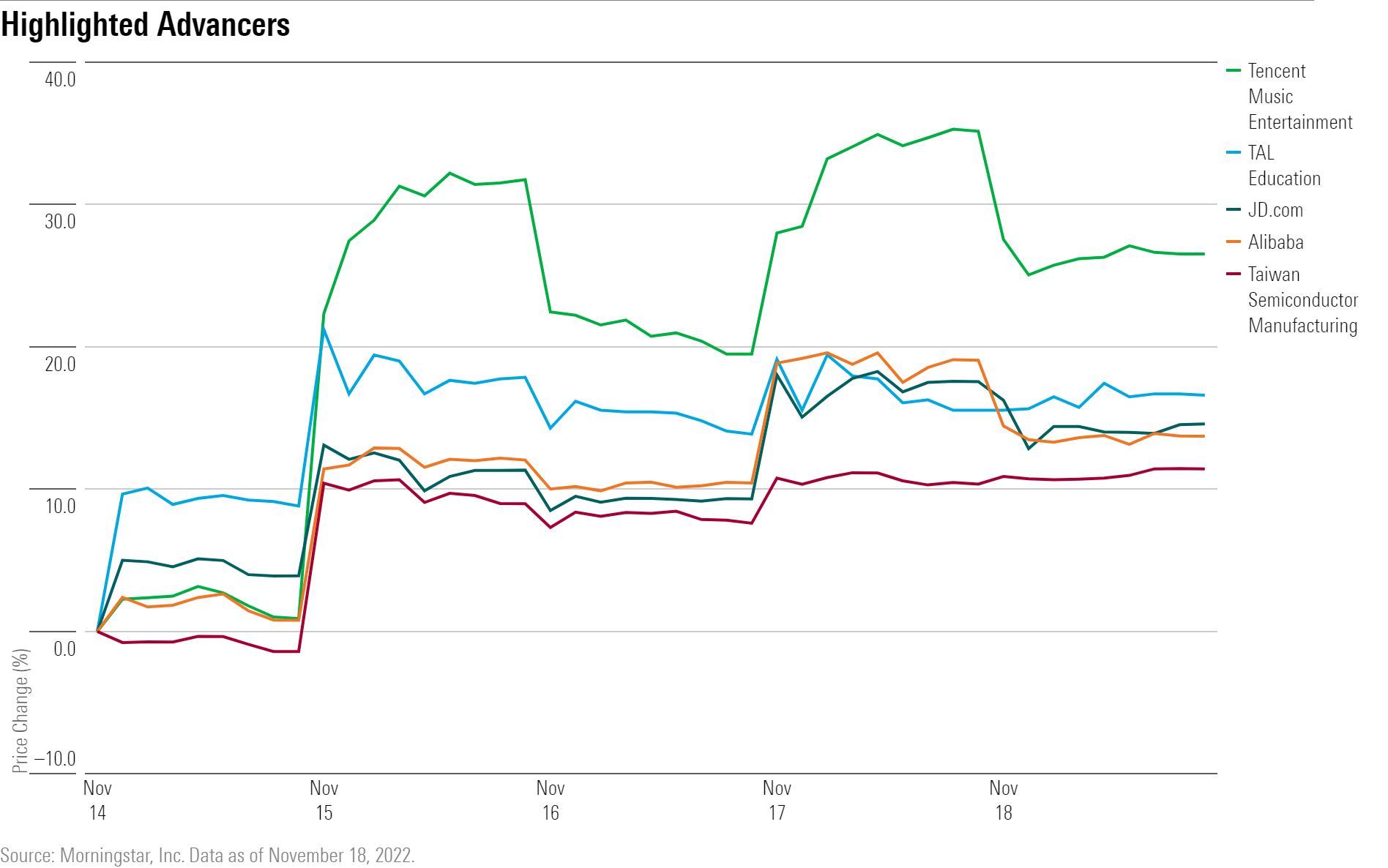

Chinese stocks made some of the biggest gains among stocks covered by Morningstar last week following news the country’s government was beginning to ease its zero-COVID-19 rules. Chinese multinational technology and entertainment giant Tencent (TME) rose last week, and e-commerce giants JD.com (JD) and Alibaba (BABA) each posted double-digit percentage gains. Chinese tutoring firms TAL Education Group (TAL) and New Oriental Education & Technology (EDU) also rallied.

China stocks have been extremely volatile for months, and the recent gains mark a reversal from big losses that had followed the announcement of a political reshuffle in China’s ruling party.

Microchip company Taiwan Semiconductor’s (TSM) shares rallied on news that Warren Buffett’s Berkshire Hathaway (BRK.B) took a $4.1 billion-dollar stake in the company to become its largest outside shareholder.

What stocks are down?

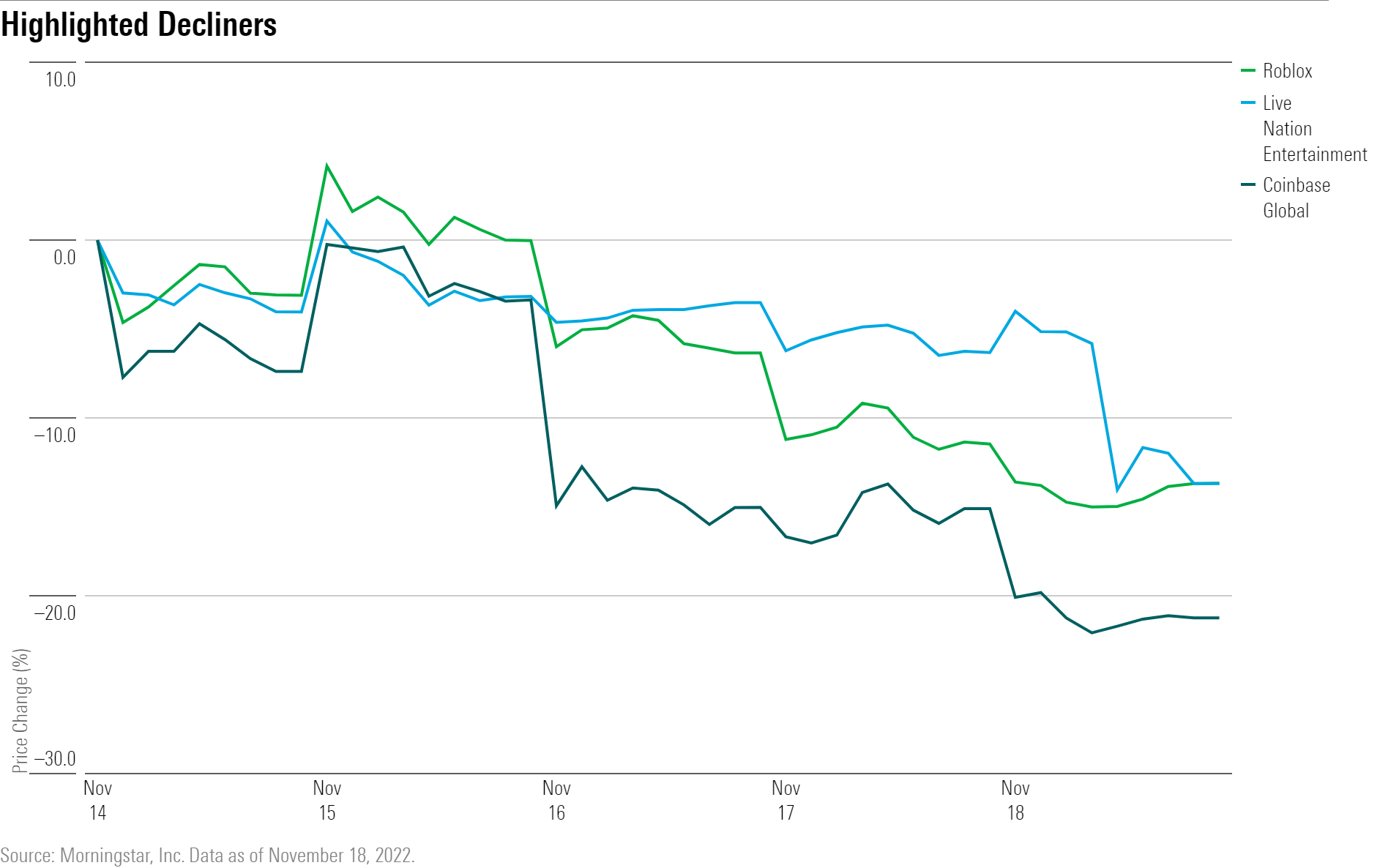

Coinbase (COIN) shares slumped amid news of cryptocurrency exchange FTX’s bankruptcy and surrounding controversy. “No-moat-rated Coinbase’s shares have experienced a spike in volatility in recent days as rival exchange FTX’s woes tore through the broader cryptocurrency ecosystem and sent cryptocurrency prices tumbling,” writes Michael Miller, equity analyst at Morningstar. Trust in cryptocurrency has eroded further, Miller says, and FTX’s large-scale failure “will likely have a chilling effect on investor interest in cryptocurrency.” On the flip side, FTX’s bankruptcy places Coinbase as the second-largest exchange in the world, he says.

Live Nation Entertainment (LYV) fell after news of a Department of Justice investigation around flawed sales of Taylor Swift tickets that left many fans unable to buy tickets.

Roblox (RBLX) stock also fell after reporting earnings earlier last week. Roblox reported mixed third-quarter results as users grew sequentially and bookings improved year over year, but the operating loss widened significantly versus a year ago, writes Morningstar’s senior equity analyst Neil Macker. Analysts lowered Roblox’s fair value estimate to $65 from $75 to account for slower margin expansion and currency headwinds. “Shares are trading at a significant discount to our updated fair value, providing some margin of safety,” Macker says, “but we expect the stock to remain highly volatile.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)