Buffett’s Taiwan Semiconductor Stake Highlights Beaten-Down Semi Stocks

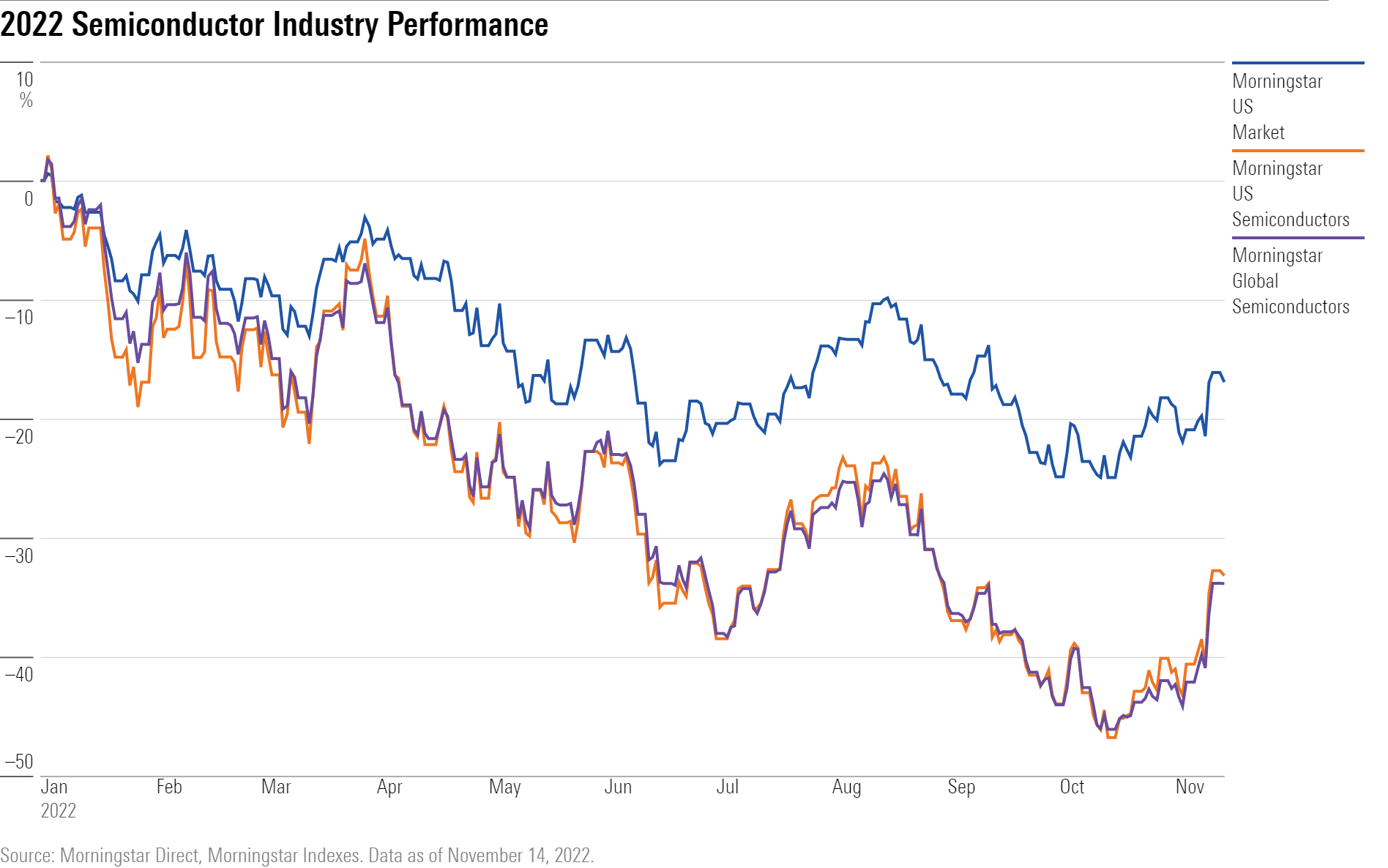

Morningstar analysts see 75% of semiconductor stocks as undervalued after a brutal selloff.

News that Warren Buffett’s Berkshire Hathaway (BRK.B) has taken a $4.1 billion stake in Taiwan Semiconductor Manufacturing shines a spotlight on one of the most beaten-down industries in the technology sector: Semiconductor stocks.

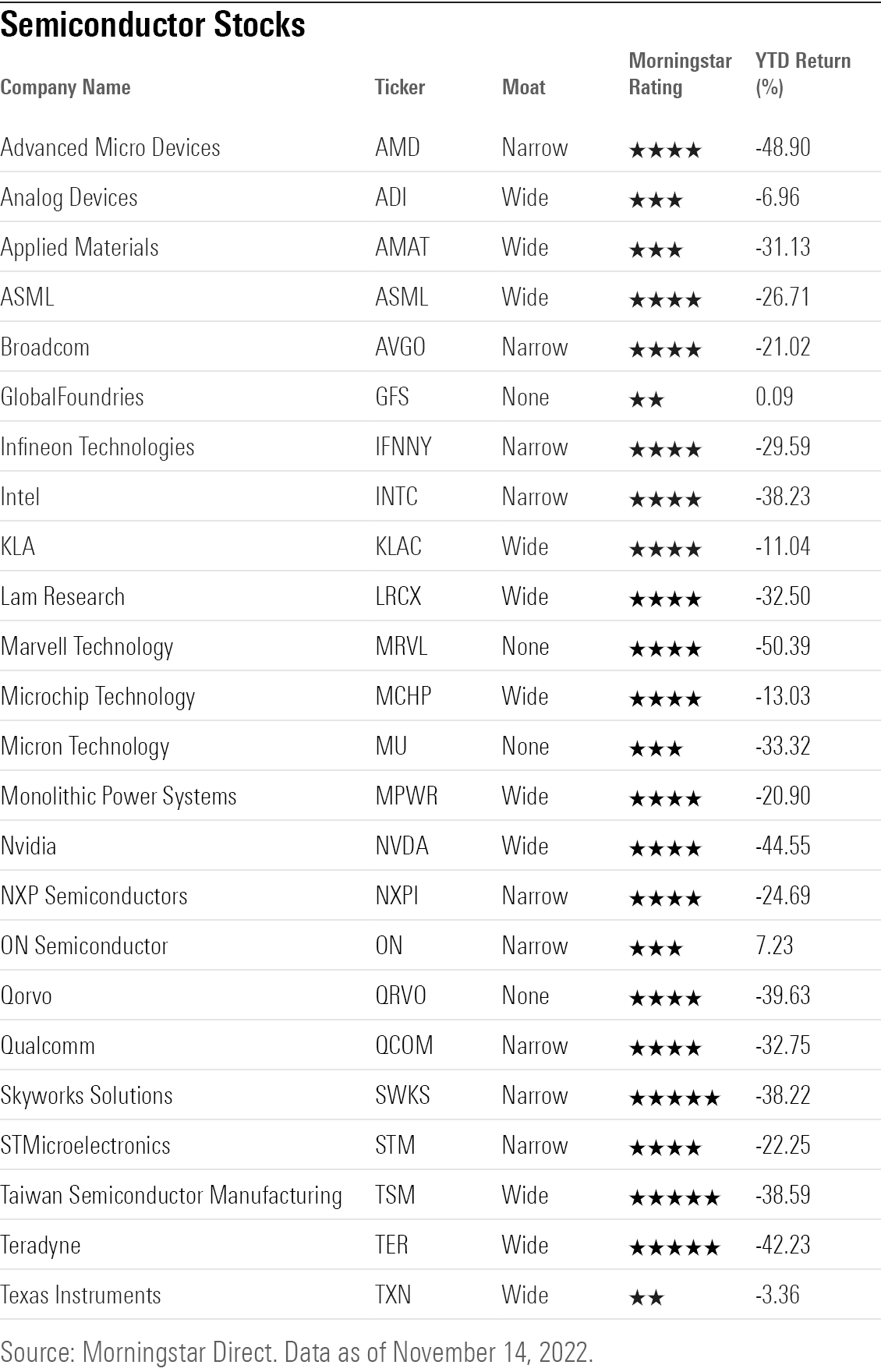

Semiconductors also happen to be an industry where Morningstar’s stock analysts see many undervalued names.

Out of the 24 semiconductor stocks covered by Morningstar analysts, 18 fall into undervalued territory with a Morningstar Rating of 4 or 5 stars. Most are in 4-star territory, but three are deemed significantly undervalued with a 5-star rating:

These low valuations come after a brutal stretch for semiconductor stocks.

Throughout 2022 the stocks of semiconductor companies, whose chips go into everything from computers to cars, were recording significant losses for the year on growing fears of a recession. While tech stocks in general have taken a bit of a hit this year, for semiconductors, the selloff came after a difficult two years when the pandemic, along with a fire at a major chip factory, reduced output.

Taking the situation from bad to worse, on Oct. 7, the U.S. Department of Commerce announced strict restrictions on the sale of semiconductors and equipment to China. These restrictions could cost some semiconductor companies hundreds of millions to billions of dollars in revenue.

Buffett is known for investing in household names, including consumer companies like Coca-Cola (KO), and financials such as American Express (AXP) and Bank of America (BAC). However, Morningstar analyst Greggory Warren notes he has invested in technology stocks before, including large stakes in IBM (IBM) and Intel (INTC). Berkshire’s current tech holdings include Apple (AAPL) and Activision Blizzard (ATVI).

Berkshire reported holding 60.1 million shares of Taiwan Semiconductor ADRs, which would make Buffett’s company the largest outside shareholder.

News of Berkshire’s investment, which was disclosed in a filing to the Securities and Exchange Commission, helped lift share prices across the semiconductor space. As of the close of trading on Nov. 15, Taiwan Semiconductor shares were up nearly 11%, and the SPDR S&P Semiconductor ETF (XSD) rallied by 3.56%. However, both are down substantially this year, with Taiwan Semiconductor having lost about one-third of its value and the SPDR ETF down roughly 24%.

Here’s a closer look at Morningstar’s take on five semiconductor stocks that are currently undervalued:

Nvidia (NVDA)

“Nvidia is the top designer of discrete graphics processing units that enhance the visual experience on computing platforms. The firm’s chips are used in a variety of end markets, including high-end PCs for gaming and data centers.”

“While Nvidia has historically generated most of its sales from gaming, its increasing data center presence for GPUs used in deep learning has helped propel the data center segment to a more equitable level.”

“We think the data center segment will rise at a 28% CAGR through fiscal 2027. We expect the firm to dominate the training portion of deep learning, but we anticipate more competition in the inference market. Gaming should continue to be a major source of revenue, though we think recent growth rates will be difficult to replicate due to saturation and lengthening replacement cycles of gaming GPUs and greater competition.”

“We think long-term investors should begin to find Nvidia attractive, as we think its data center business will prove relatively more resilient to macroeconomic challenges, though the developing situation with Chinese cloud customers is concerning.”

—Abhinav Davuluri, technology sector strategist

Taiwan Semiconductor Manufacturing

“We have cut our fair value estimate for Taiwan Semiconductor Manufacturing Co. to $133 per ADR as we bake in more conservative assumptions on high-performance computing demand in 2023 and 2024. We anticipate 2023 demand to be affected by sluggish PC demand and rebalancing of enterprise computing operations in light of fresh U.S. restrictions on doing business with Chinese customers. Nonetheless, we believe these do not change the long-term addressable market for HPC, and we still view TSMC’s shares as grossly undervalued.

“Having seen TSMC’s sequential decline in inventory days and management reducing capital expenditure by 10%, we foresee lower inventory dollars and a cautious 2023 capital expenditure budget (say flat year on year) as signs of the stock bottoming.”

—Phelix Lee, equity analyst

ASML (ASML)

“ASML reported third-quarter results better than our expectations and management’s guidance. The firm remains hamstrung by supply chain challenges, though these have been improving more recently.”

“Concerning the latest U.S. export control restrictions to China, management does not expect a material impact to ASML’s 2023 shipment plan, though it concedes there could be an indirect impact due to the inability of peers to ship their tools.”

``Should ASML be unable to ship to certain Chinese customers, we expect demand from other customers to make up for any lost sales. We are modestly raising our EUR- and USD-denominated fair value estimates to EUR 700 ($700) from EUR 696 ($696) as we incorporate stronger near-term expectations.”

“On Nov. 11, ASML hosted an investor day during which management outlined its outlook … management now expects 2025 revenue to be EUR 30 billion-EUR 40 billion, up from its EUR 24 billion-EUR 30 billion outlook presented at last year’s investor day.”

“While the shares are up more than 40% over the past month, we still believe they look undervalued at current levels, as we expect demand for ASML’s EUV tools will prove more resilient to a downturn in the semiconductor market in 2023.”

—Abhinav Davuluri, technology sector strategist

Broadcom (AVGO)

“Broadcom reported strong fiscal third-quarter results slightly ahead of our expectations. The firm’s results were buoyed by healthy networking demand led by cloud and enterprise data center spending. Despite slowing consumer demand, Broadcom’s networking, storage, and broadband business units have proved resilient, and the firm’s execution on its software acquisitions such as Symantec and CA Technologies is also admirable.”

“Fiscal fourth-quarter revenue is guided to be about $8.9 billion, which implies 25% year-over-year growth. Although we are impressed that Broadcom’s business is firing on all cylinders, led by stellar cloud and enterprise spending, we anticipate a slowdown in growth in 2023 as macroeconomic conditions likely deteriorate and the broader semiconductor market looks poised for a downturn. Additionally, we believe Broadcom’s wireless business will fare better than that of peers, due to its outsize exposure to Apple that we think will better handle smartphone demand headwinds.”

—Abhinav Davuluri, technology sector strategist

Texas Instruments (TXN)

“Texas Instruments reported solid third-quarter results but provided investors with a downbeat fourth-quarter forecast. We trim our fair value estimate for wide-moat TI down to $158 from $166 … we continue to view TI’s shares as fairly valued.

“Sluggish demand for chips going into personal electronics devices like PCs was well known, but we’re troubled by the weakness that TI is seeing within industrial, its largest end market. The chip shortage is effectively over in this end market, as TI saw customer cancellations and further weakness ahead; we would attribute such softness to macroeconomic factors. Automotive chip demand still exceeds supply, but industrial demand also used to be more than supply in prior quarters; but we now see a decoupling of these end markets.”

“For the December quarter, TI expects revenue to fall to the range of $4.40 billion-$4.80 billion. At the midpoint, sales would be down 5% year over year and 12% sequentially, although the fourth quarter often sees a normal seasonal dip in revenue. We estimate that TI’s guidance midpoint of $1.97 of EPS implies a further dip in gross margin to the 66%-67% range and operating margins down to the 47% range. Such results would still be spectacular when compared with historical levels, but they would indicate that business conditions have already peaked.”

—Brian Colello, technology sector director

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)