Market Rallies Off Lows, but Expect Heightened Volatility to Persist

Steel yourself for more instability as economic headwinds and shifting monetary policy may continue to batter markets.

Stocks surged 8% in October, coming off their September lows. In our view, this rally was based on a combination of factors.

- First, according to our intrinsic valuations, stocks were trading at levels that placed them at rarely seen undervalued levels.

- Second, excluding a few high-profile misses among mega-caps, the rest of earnings season has not been as bad as feared.

- Third, during earnings conference calls, management teams were cautious regarding their outlook for the fourth quarter but generally did not make across-the-board cuts to guidance.

- Lastly, the broad base of the rally shows just how deep the broad undervaluation is across the market as the upswing had not been derailed by sharp selloffs among several mega-cap stocks.

Today’s Market Valuation

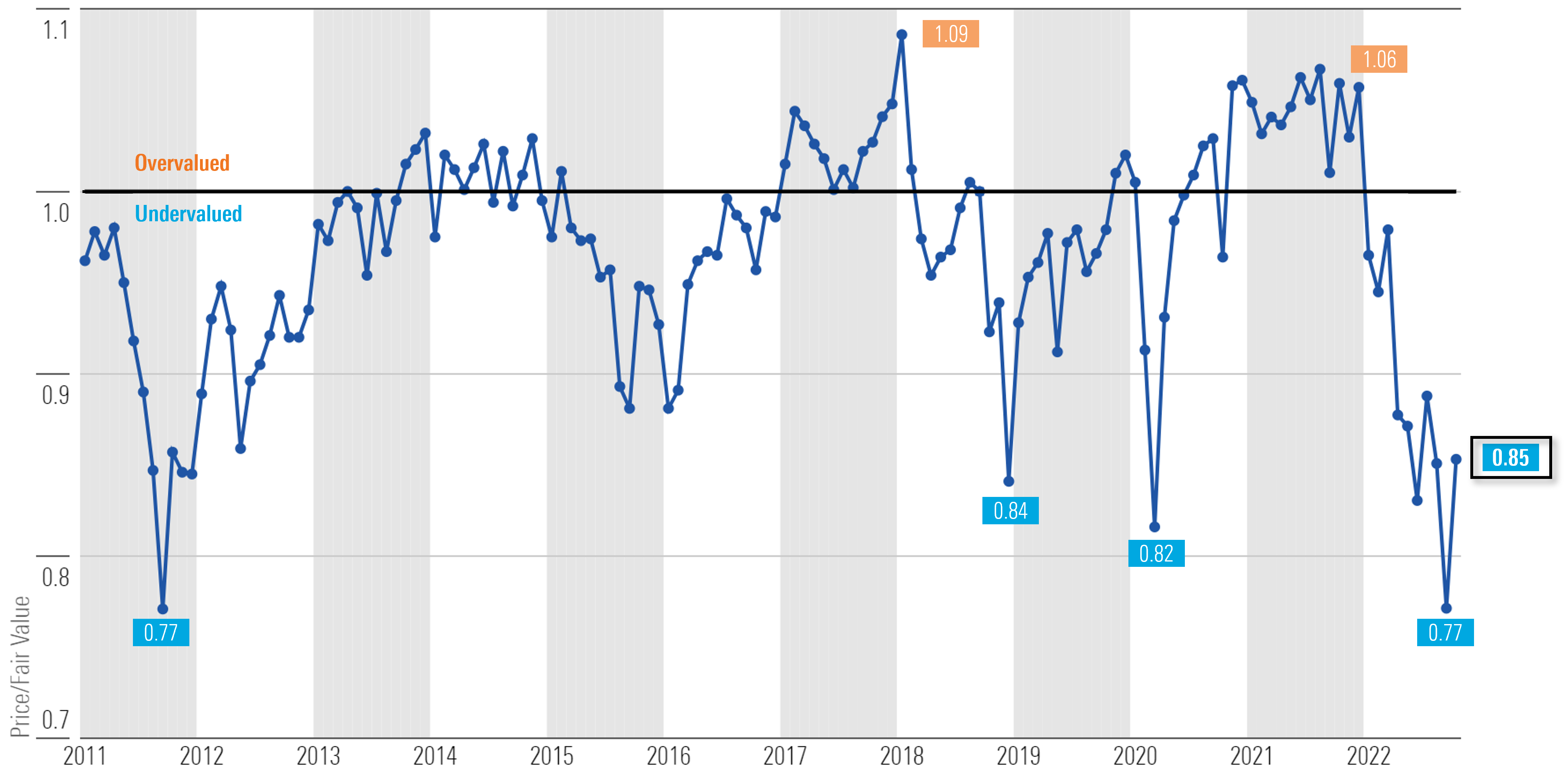

According to a composite of our equity coverage, as of Oct. 31, the broad U.S. stock market is trading at a 15% discount to our valuations. The reduction in this discount, which had been as low as a 23% discount in September, was mainly due to the rally across the stock market.

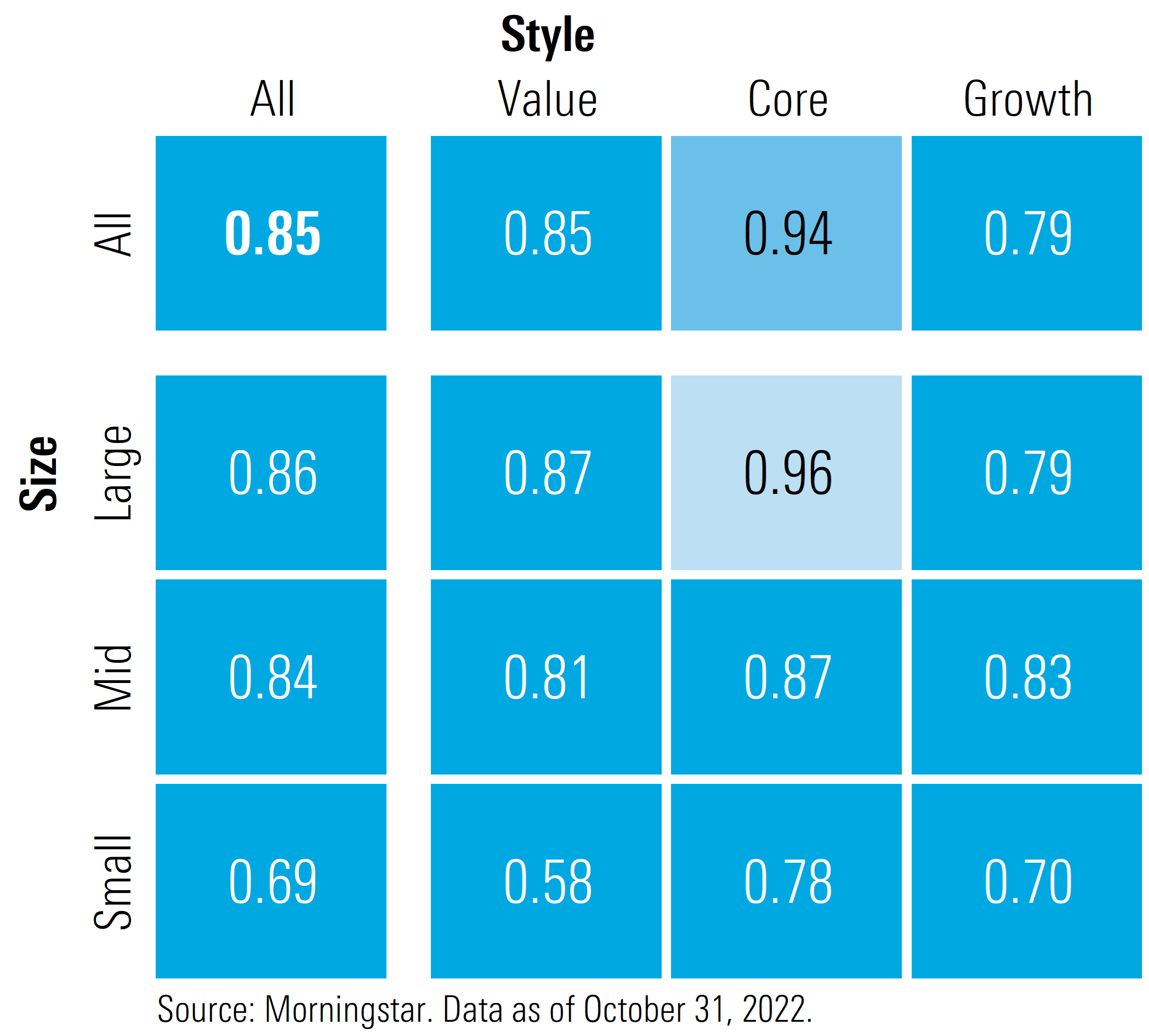

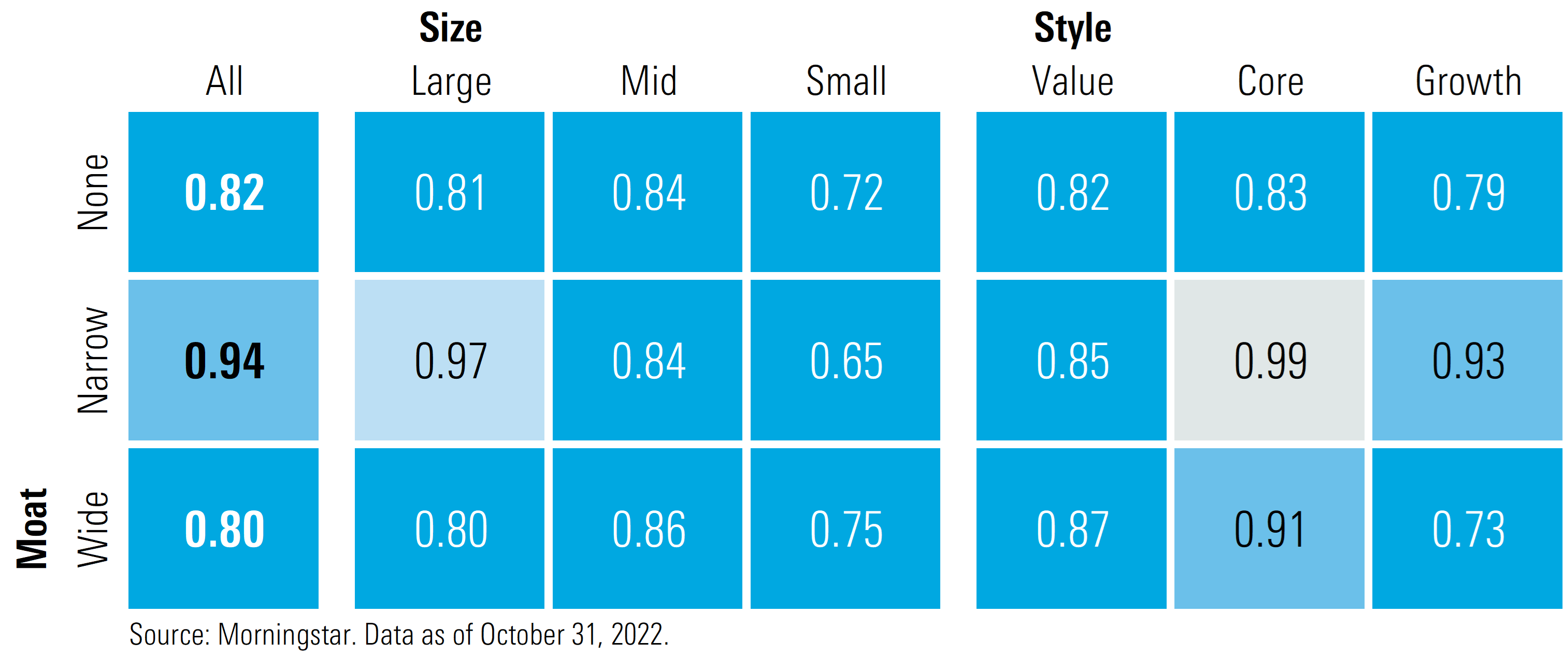

Breaking the valuations down by viewing through the Morningstar Style Box, investors appear best positioned with a barbell-shaped portfolio in which they overweight the growth and value categories and underweight the core/blend category. Both large-cap and mid-cap stocks remain near the broad market average, whereas small-cap stocks are significantly undervalued.

Even after the sharp October rally, stocks remain significantly undervalued. Since 2010, there have only been a few other instances in which stocks have traded at a similar discount to our intrinsic valuations as today.

Don’t Breathe a Sigh of Relief Just Yet—More Volatility on the Horizon

While we think equities remain undervalued, we expect more volatility over the foreseeable future. In order to establish a maintainable rally, the markets will be looking for indications that economic growth is reaccelerating and that inflation has peaked and is on a durable downward trajectory.

Looking forward, the four headwinds we identified at the beginning of the year are still constraints on the market. Over the foreseeable future, we expect that:

1) Gross domestic product will remain sluggish and won’t reaccelerate until the second half of 2023,

2) The Federal Reserve will conclude tightening policy in early 2023,

3) The preponderance of rising long-term rates has already occurred,

4) Inflation will moderate over the next few months and subside to 2.6% in 2023,

5) Earnings for U.S. companies with significant international exposure will see earnings hits from a strong dollar,

6) Liquidity will continue to be drained from the markets. The Federal Reserve is letting $95 billion of bonds roll off its balance sheet every month. As those bonds are refinanced in the public markets, it will drain investors’ cash that otherwise might have been allocated to other securities such as equities.

As long-term investors, we are not necessarily concerned whether a company beats or misses earnings any one quarter but are focused on shifts that may reflect a change in long-term business prospects or margin assumptions that impact intrinsic value. This quarter, we have seen a confluence of these factors begin to affect our valuations of even the largest mega-cap stocks. For example, we cut our fair values on Alphabet GOOGL, Amazon.com AMZN, Microsoft MSFT, and Meta Platforms META anywhere from 5% to 25% as our analyst team lowered their outlooks in response to the weakening economy.

The upshot to these factors is that we think they will provide the Fed room it will need to begin easing monetary policy in mid-2023. Our forecast for the federal-funds rate at year-end 2023 is 3.00%.

Where Do We See the Best Value?

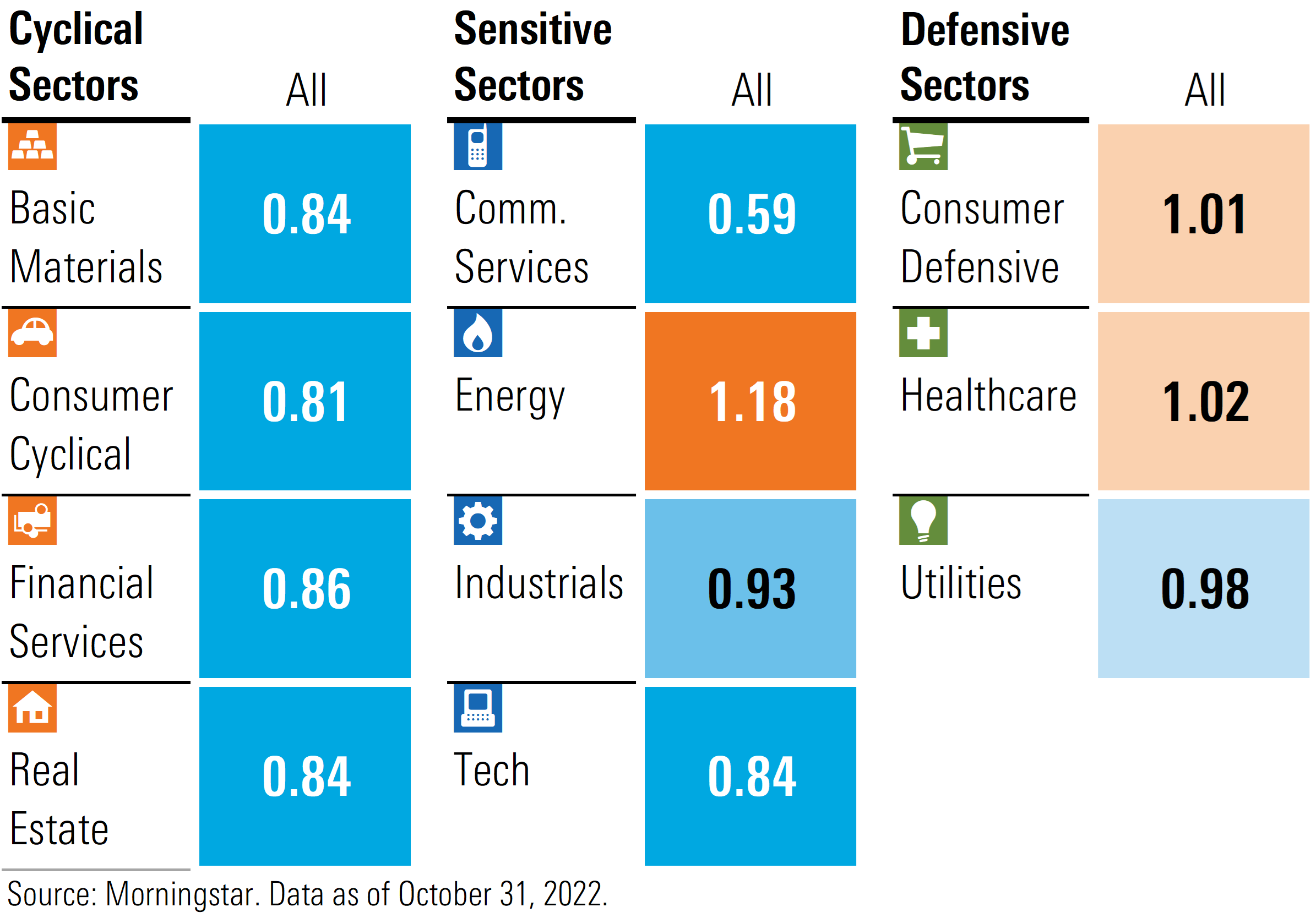

Communication is the most undervalued sector, but it should be noted that the sector valuation is skewed by our valuations on Meta Platforms and Alphabet. These two stocks, especially Meta, are two of our most differentiated calls versus the market, and they account for over half of the market capitalization of the sector.

Technology and the cyclical sectors have underperformed this year in response to the softening economy. These were some of the more overvalued sectors coming into the year, but at current levels, we think the market has overcorrected to the downside and that traders are incorporating the current earnings growth weakness too far into the future.

One area where we would exercise caution is the energy sector. In October, the energy sector shot up 24% and is up over 66% for the year to date. While energy was the most undervalued sector coming into the year, it is now trading well into overvalued territory. Among the defensive sectors, returns have all held up relatively well compared with the broad market selloff, and as such, they all remain near fair value.

Investment Strategy

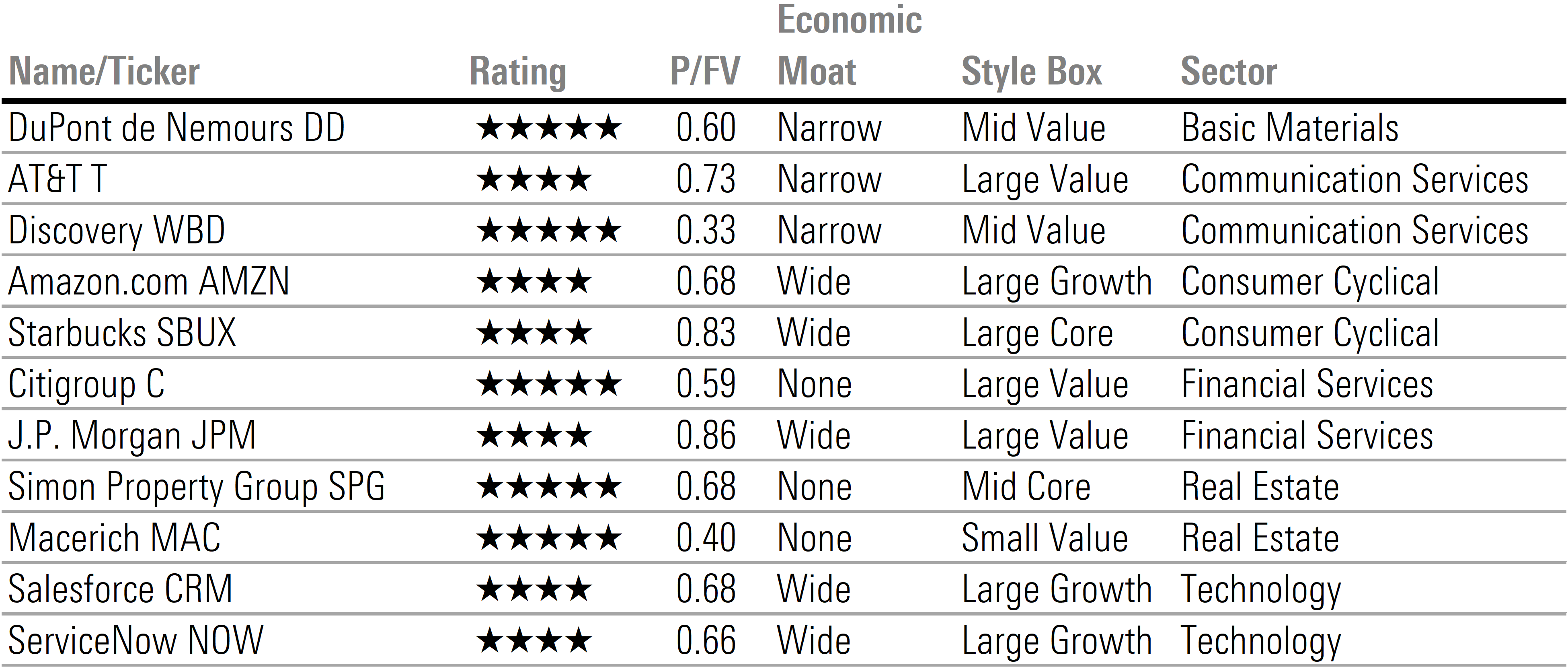

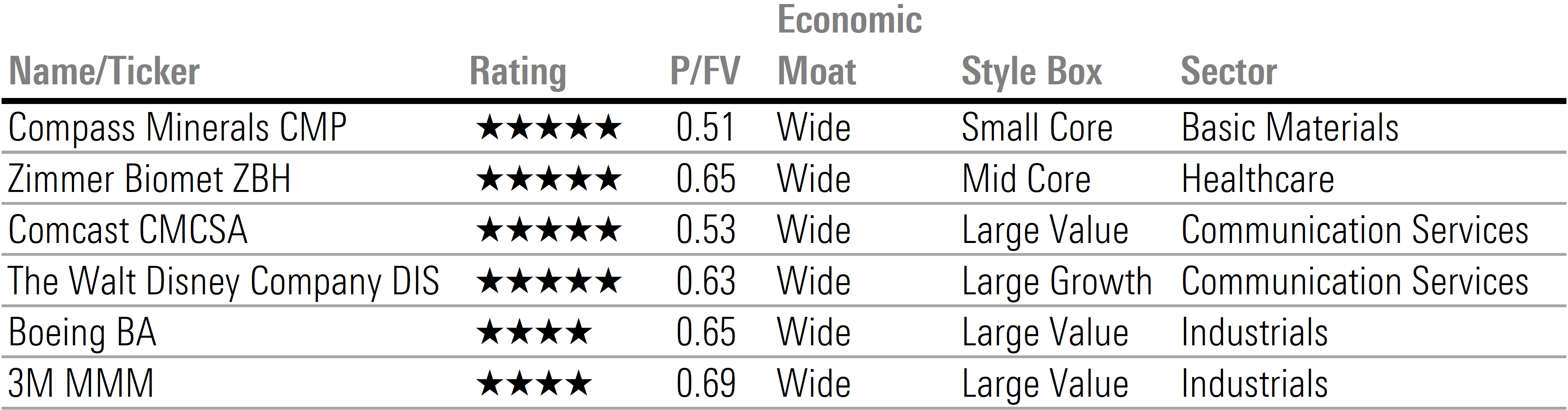

In an environment of heightened volatility, high inflation that has yet to turn down, and increasing probability for a recession, we think it becomes increasingly important to focus on investing in those companies with long-term, durable competitive advantages. In addition, we also focus on those companies that are leveraged to long-term secular growth themes.

Stocks of those companies that we give Morningstar Economic Moat Ratings of wide have suffered along with the broad market drawdown this year. At this point, a composite of wide-moat-rated stocks is trading at a greater discount to our intrinsic valuations than the broad market. We expect companies with a wide economic moat to be best positioned to weather an economic downturn and exhibit the strongest pricing power in an inflationary environment.

Two of the long-term secular growth themes we have highlighted over the past year include:

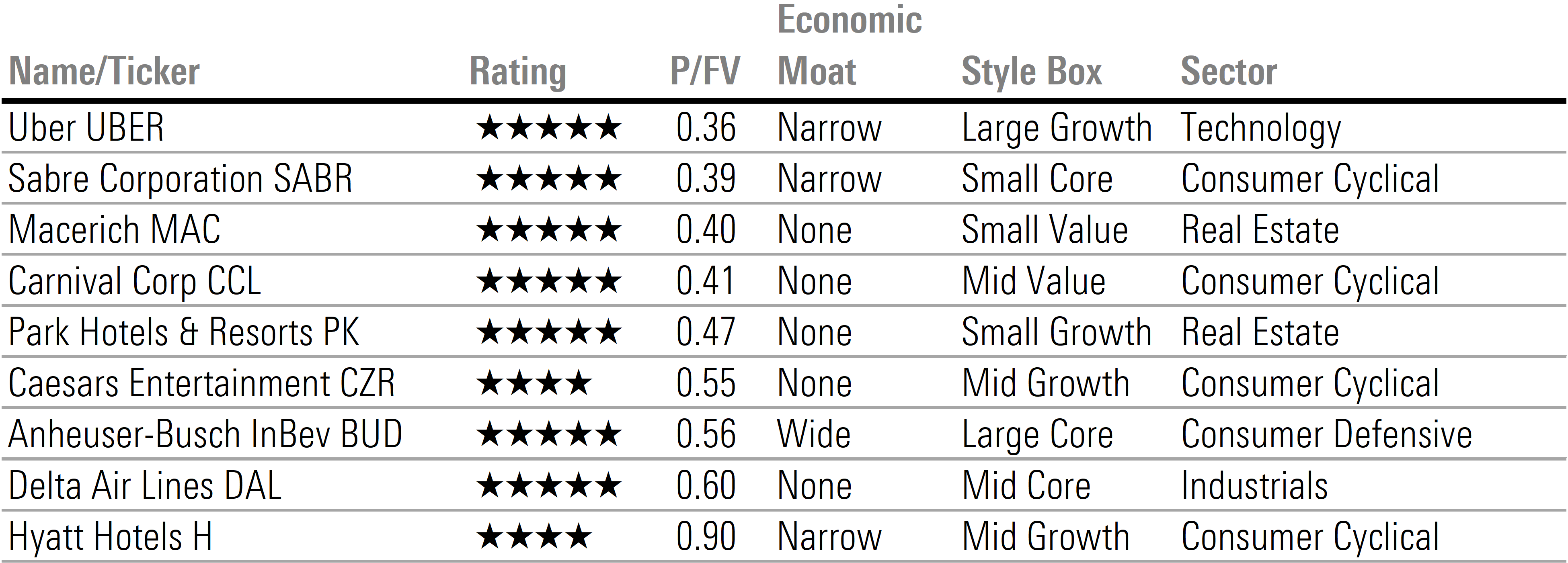

Consumer behavior normalization. As the coronavirus pandemic recedes and consumer behavior continues to normalize, we expect that spending will shift back into spending on services and away from goods. Companies that will benefit from this trend span the travel & leisure, transportation, food & beverage, and real estate industries.

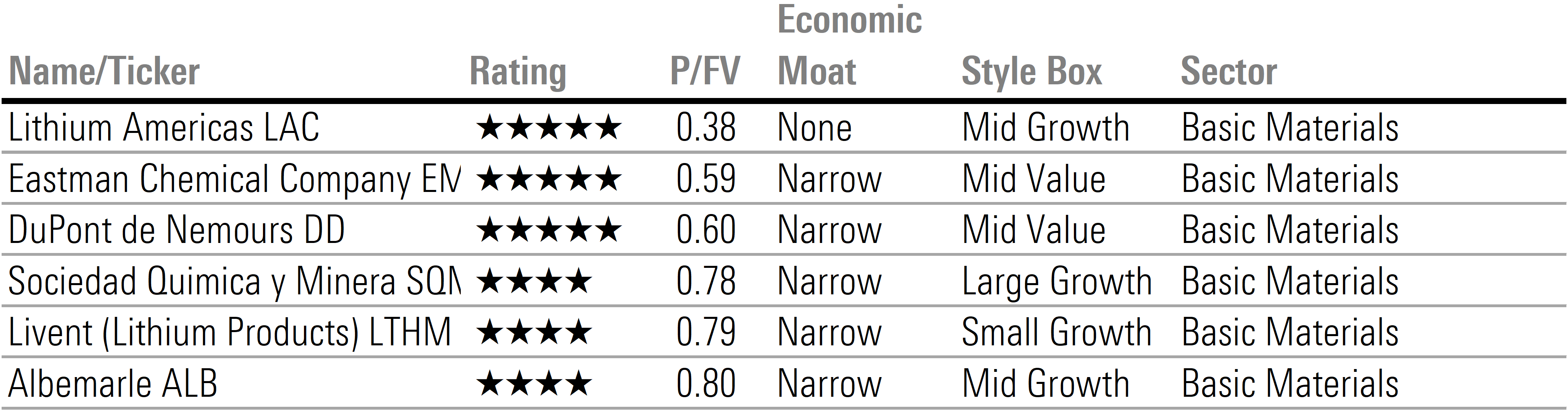

Growth in renewable energy, especially electric vehicles. As electric vehicles grow as a percentage of new auto sales, we project that the lithium required to make the batteries will remain undersupplied over the next decade. EVs also require between 2.5 times to 3 times more specialty chemicals for their production as compared with internal combustion engines.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)