Markets Brief: 3 Takeaways From Third-Quarter Earnings

Amid weaker earnings results across the market, stocks that fell short took a bigger beating.

As earnings season winds down, investors are left with a landscape where the headwinds from rising interest rates and high inflation are just beginning to leave their mark.

Third-quarter earnings season started strong, with generally favorable results coming in from major banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Bank of America (BAC).

But the tide quickly turned with negative outlooks and weaker earnings reports.

While the last batch of third-quarter results are still coming in, approximately 80% of the 843 U.S.-listed companies covered by Morningstar analysts have reported results as of Nov. 10.

From the results so far, we see three major takeaways from third-quarter earnings.

- Bigger earnings misses, and fewer big beats.

- Investors punished stocks with poor earnings hard.

- Companies took an ax to future earnings growth estimates.

Here’s a closer look at these takeaways.

Fewer High-Margin Earnings Beats, More Severe Misses

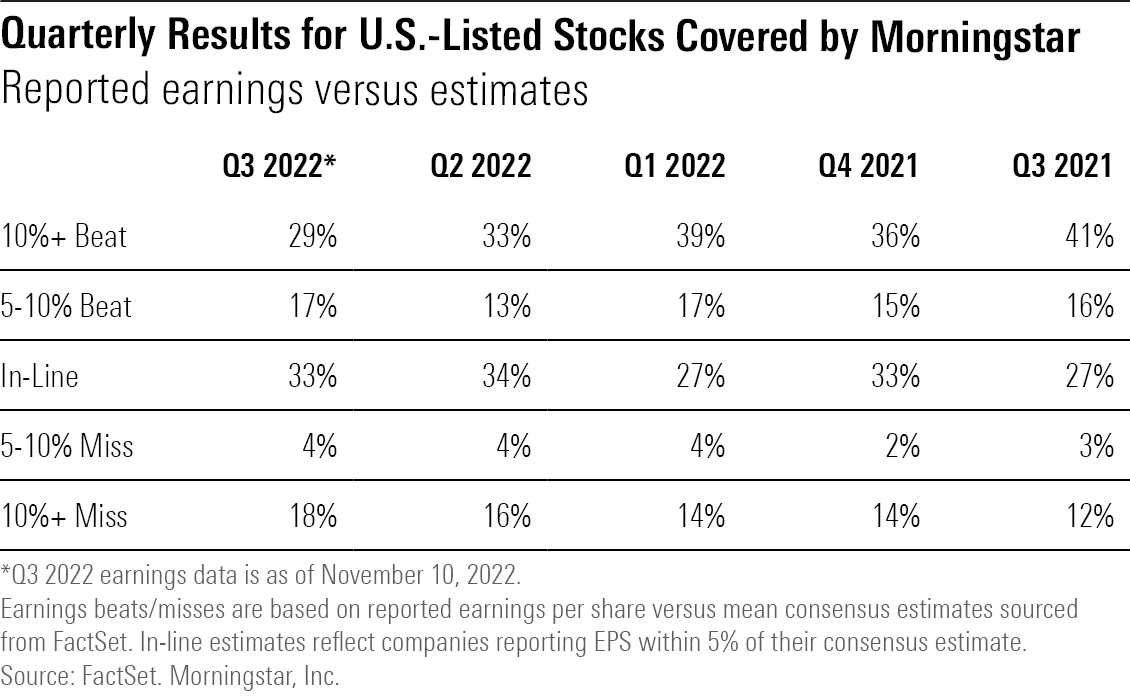

Third-quarter earnings results continued the recent trend of fewer large earnings beats. Among the 671 companies that have reported earnings out of the 843 U.S.-listed companies covered by Morningstar analysts, only 29% beat FactSet consensus estimates by 10% or more. That’s a 12-percentage-point drop from the 41% pace set a year ago, and a decline from 33% in the second quarter.

Meanwhile, the percentage of companies that missed earnings results inched up, with 18% of the companies that have reported results that missed estimates by 10% or more.

Although the number of companies that met earnings estimates for the third quarter is on par with the second quarter, at 33% versus 34%, third-quarter results were also rife with slowing growth and negative outlooks.

As seen with so-called Big Tech, company managements set earnings guidance ranges much lower than what the market was expecting for the fourth quarter. For instance, Amazon.com (AMZN) not only reported results that showed revenue growth at Amazon Web Services to be slowing, but also announced fourth-quarter revenue guidance of $140 billion to $148 billion, lower than the consensus estimates of $155 billion prior to results.

Amazon’s guidance news shook investors, as the fourth quarter would have been expected to be stronger due to holiday season sales. Microsoft (MSFT) and Alphabet (GOOGL) also reported similar woes, with the toughening macro environment serving as a major deterrence to growth for both themselves and their clients.

Punishing the Earnings Misses

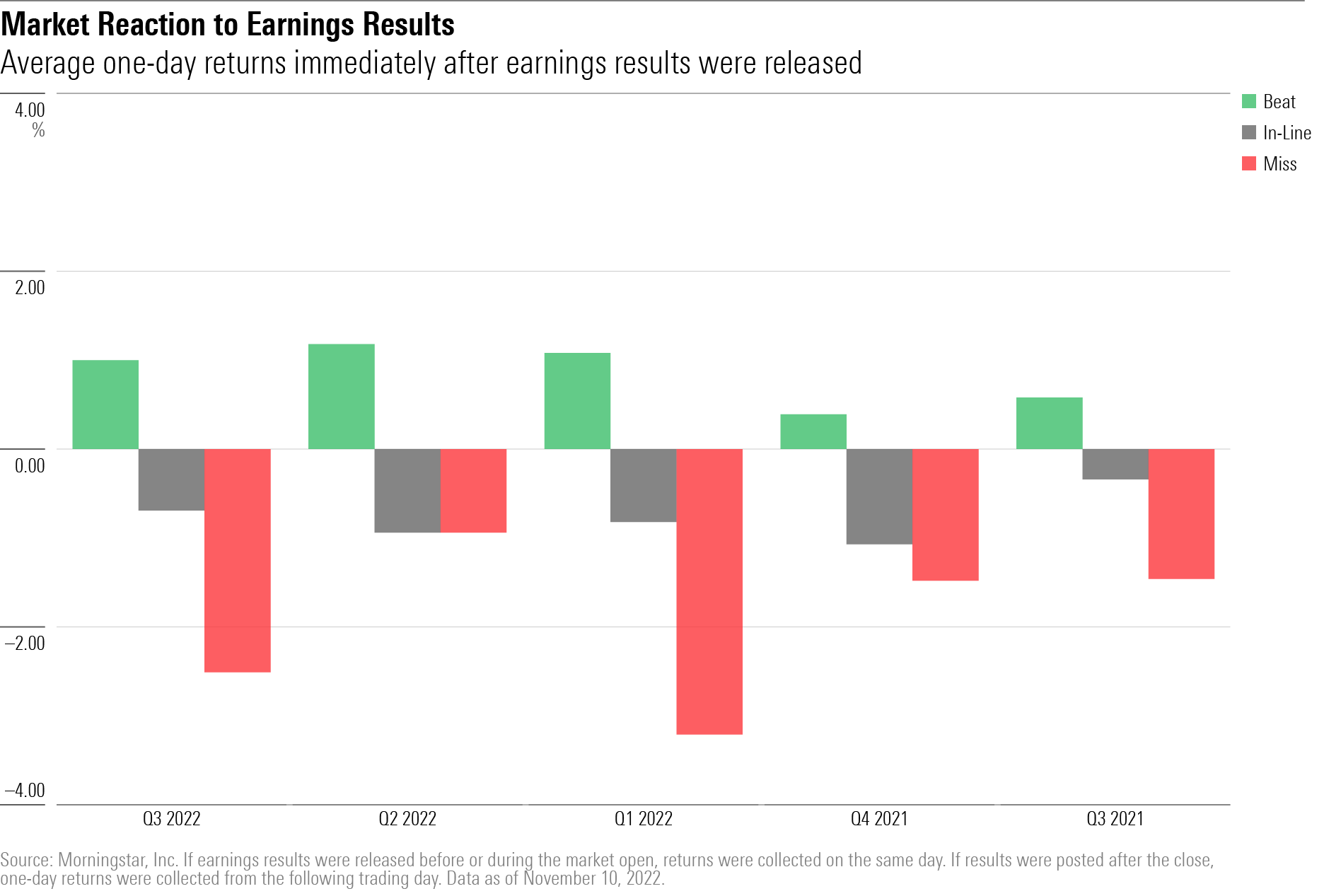

Back in the second quarter, investors largely cheered results that simply met expectations with a kind of glass is half full mindset, and had relatively muted reactions to the higher number of earnings misses. Not this quarter.

Earnings misses have been less well received than in the previous quarter. The average immediate reaction to earnings misses was a 2.51% decline in stock prices for the third quarter, compared to a 0.94% decline in the second quarter.

Stocks with the most severe reactions to earnings included Syneos Health (SYNH), whose shares plunged 46.25% during its one-day return immediately after the company posted earnings results. Syneos stock is now down 67.86% for the year.

Other major decliners in response to third-quarter news were DaVita (DVA), which fell 27.09% after earnings, and is down 39.83% year-to-date, and Roblox (RBLX), which fell 21% in response to earnings, and is down 67.30% for the year.

Forward Earnings Growth Has Tapered Off

Against the difficult economic backdrop, analysts have pared back their forecasts for earnings in the quarters ahead.

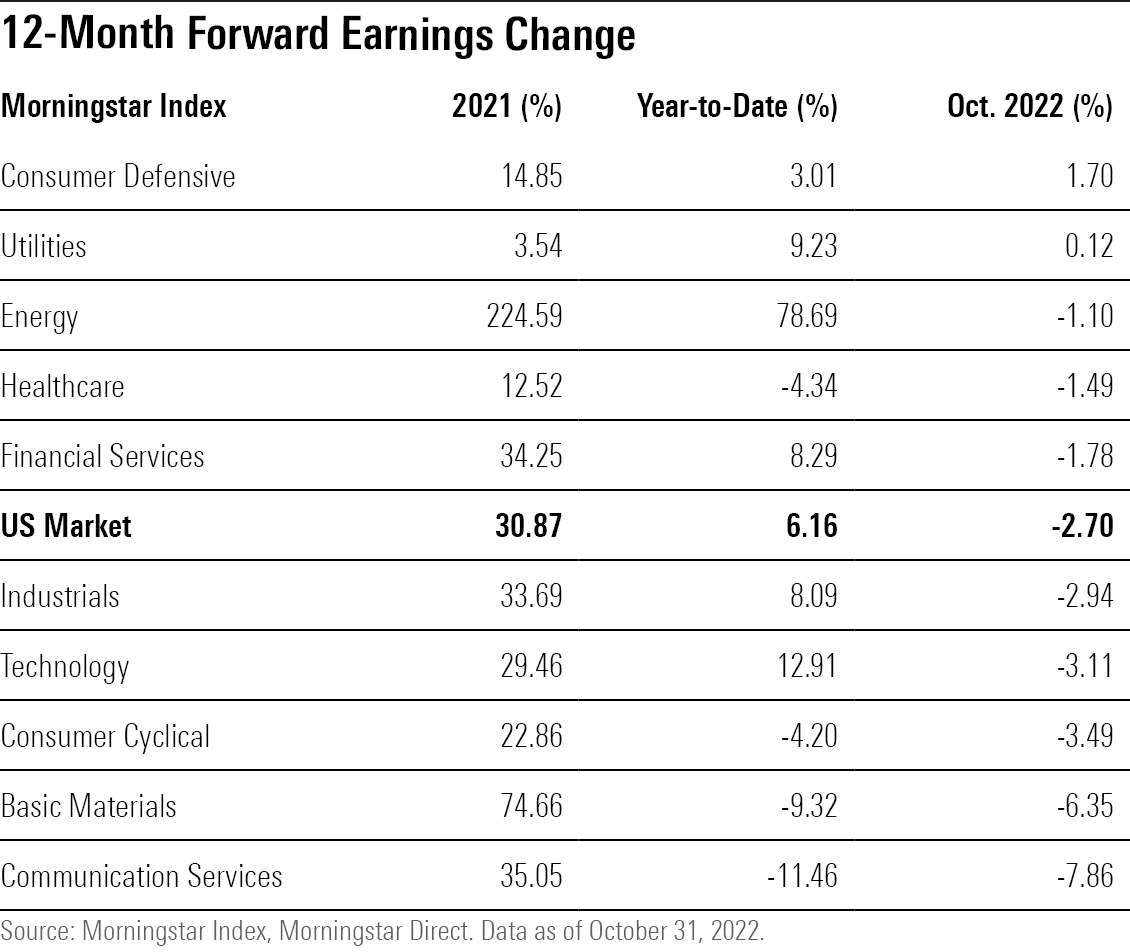

Expectations for forward earnings for the Morningstar US Market Index fell by 2.70% during October.

So far for 2022, expectations for earnings growth have increased 6.16% for the U.S. market index, but that’s down significantly from 30.87% in forward earnings in 2021.

At the sector level, nearly all but consumer defensive and utilities stocks saw expected earnings decline for the month as third-quarter results rolled in.

In fact, for many sectors, forward earnings are now below what they were at the end of 2021. Worst hit has been communication services, which saw an 11.46% decline in forward earnings for the year ending October.

Energy sector forward earnings growth has remained strong at 78.69%, but still fell off from 2021 levels of 224.59%. Consumer defensive was the only sector that had a notable improvement in forward earnings as third-quarter results came in, increasing by 1.7% in October, and 3.01% in the year.

Events scheduled for the coming week include:

- Tuesday: Producer Price Index report for October to be released. Walmart (WMT) and The Home Deport (HD) report earnings.

- Wednesday: Retail sales data for October to be released. Target (TGT) and Nvidia (NVDA) report earnings.

- Thursday: Macy’s (M) and Kohl’s (KSS) report earnings.

For the trading week ended Nov. 11:

- The Morningstar US Market Index rose 6.04%.

- All 11 industry sectors rose for the week, led by technology, up 10.66%, and communication services, which gained 9.18%.

- Yields on the U.S. 10-year Treasury fell to 3.84% from 4.16%.

- West Texas Intermediate crude oil prices fell 3.94% to $88.96 per barrel.

- Of the 843 U.S.-listed companies covered by Morningstar, 720, or 85%, were up, and 123, or 15%, declined.

What Stocks Are Up?

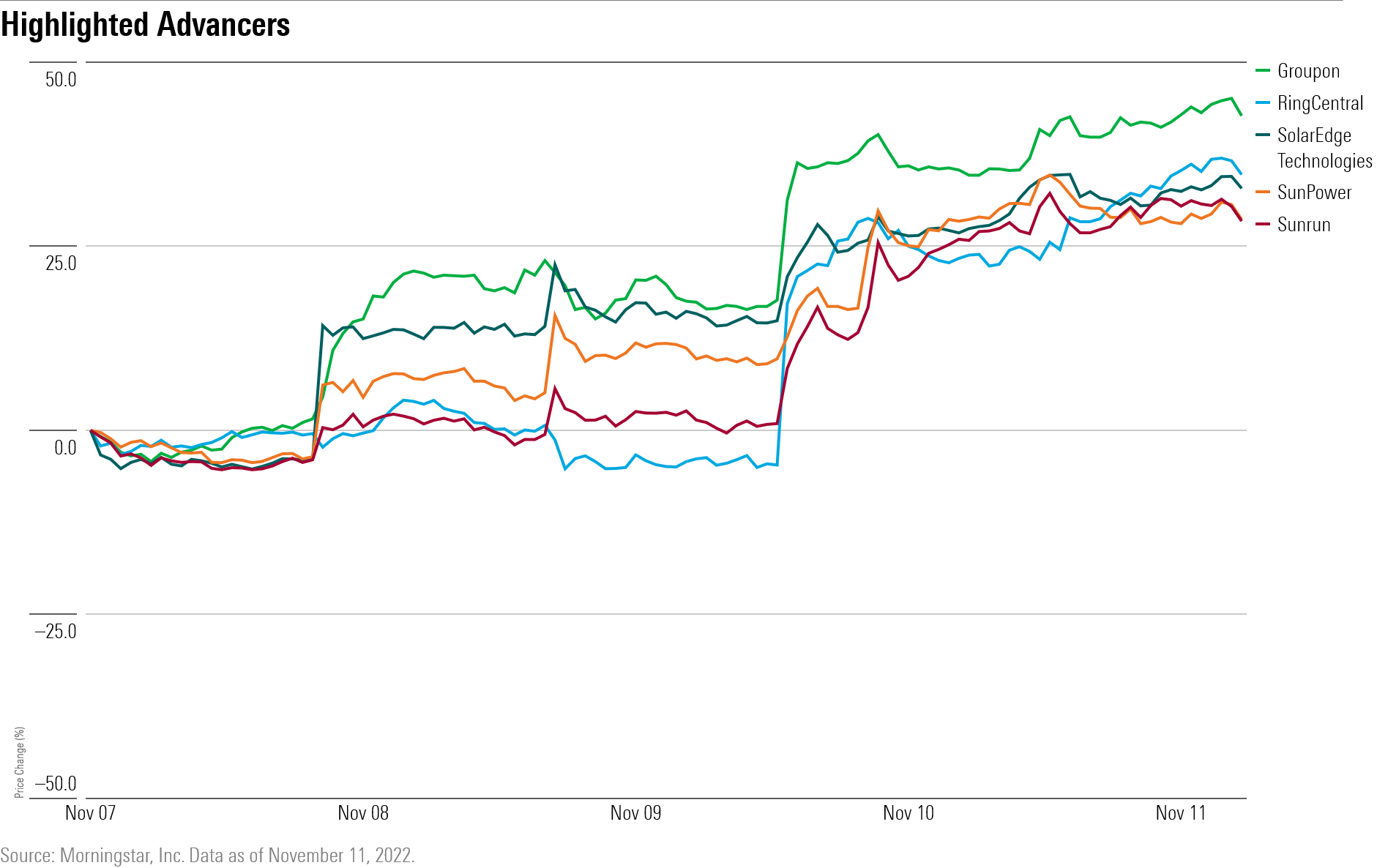

Solar stocks rallied this week after California regulators released a new decision regarding its net metering program. SolarEdge Technologies (SEDG), SunPower (SPWR), and Sunrun (RUN) all posted gains of more than 20%.

After missing earnings expectations Groupon (GRPN) rose to end the week up 42.86%.

``The couple of positive things from the third-quarter results and the earnings call was a deceleration in user loss in the international market and a slowdown in overall purchase frequency decline,” says Morningstar senior equity analyst Ali Mogharabi. ``Another positive was the possibility of the firm monetizing its 2.3% stake in the private U.K. company, SumUp, a provider of mobile card readers.”

Shares of the online marketplace company saw their fair value estimate reduced to $27 from $29.

RingCentral (RNG) shares rallied following strong third-quarter results. “No-moat RingCentral reported good third-quarter results that exceeded the high end of guidance and FactSet consensus for revenue and adjusted operating margin,” Morningstar senior equity analyst Dan Romanoff says. ``Relative to our model, fourth-quarter guidance was ahead on margins and light on revenue.”

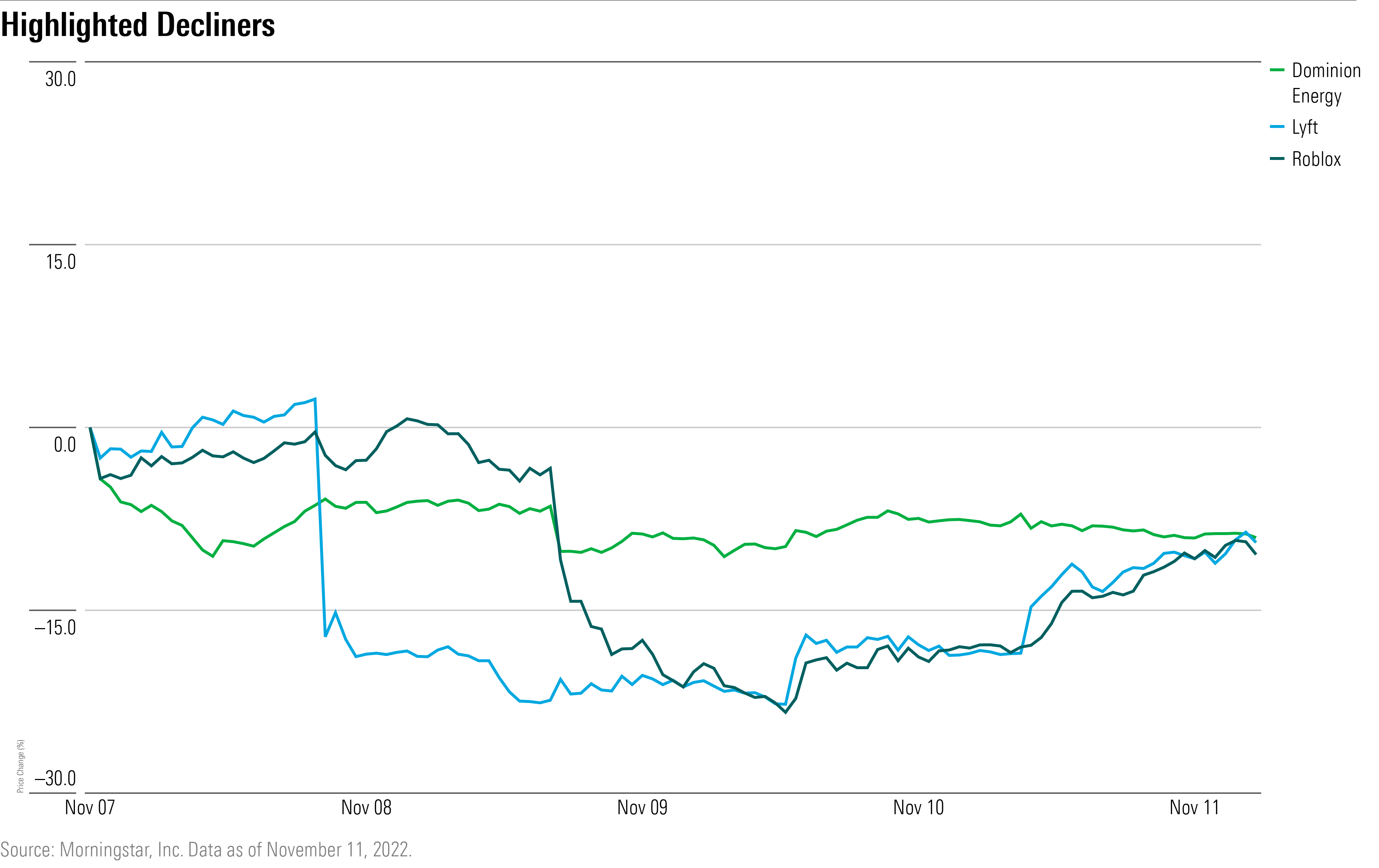

What Stocks Are Down?

Roblox shares fell 9.46% this week following mixed third-quarter results. “Users grew sequentially and bookings improved year over year, but the operating loss widened significantly versus a year ago,’' Morningstar senior equity analyst Neil Macker says. The online video game platform provider saw its fair value estimate lowered to $65 from $75. “Shares are trading at a significant discount to our updated fair value, providing some margin of safety, but we expect the stock to remain highly volatile.”

Lyft (LYFT) shares also declined following disappointing third-quarter results for the second-largest ride-sharing service in the U.S.

``While adjustments to our model result in a $55 fair value estimate, down from $65, we continue to view shares of this narrow-moat firm as deeply undervalued,” Mogharabi says.

Shares of Dominion Energy (D) fell 8.12% after the company announced a strategic review of its business.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)