7 Charts on Where Investors Are Putting Their Money in 2022

Despite a bear market in stocks and brutal start to the year in bonds, fund investors are hanging tight.

Despite big losses across stock and bond markets, Morningstar's mutual fund flows data show investors have for the most part stayed the course so far in 2022.

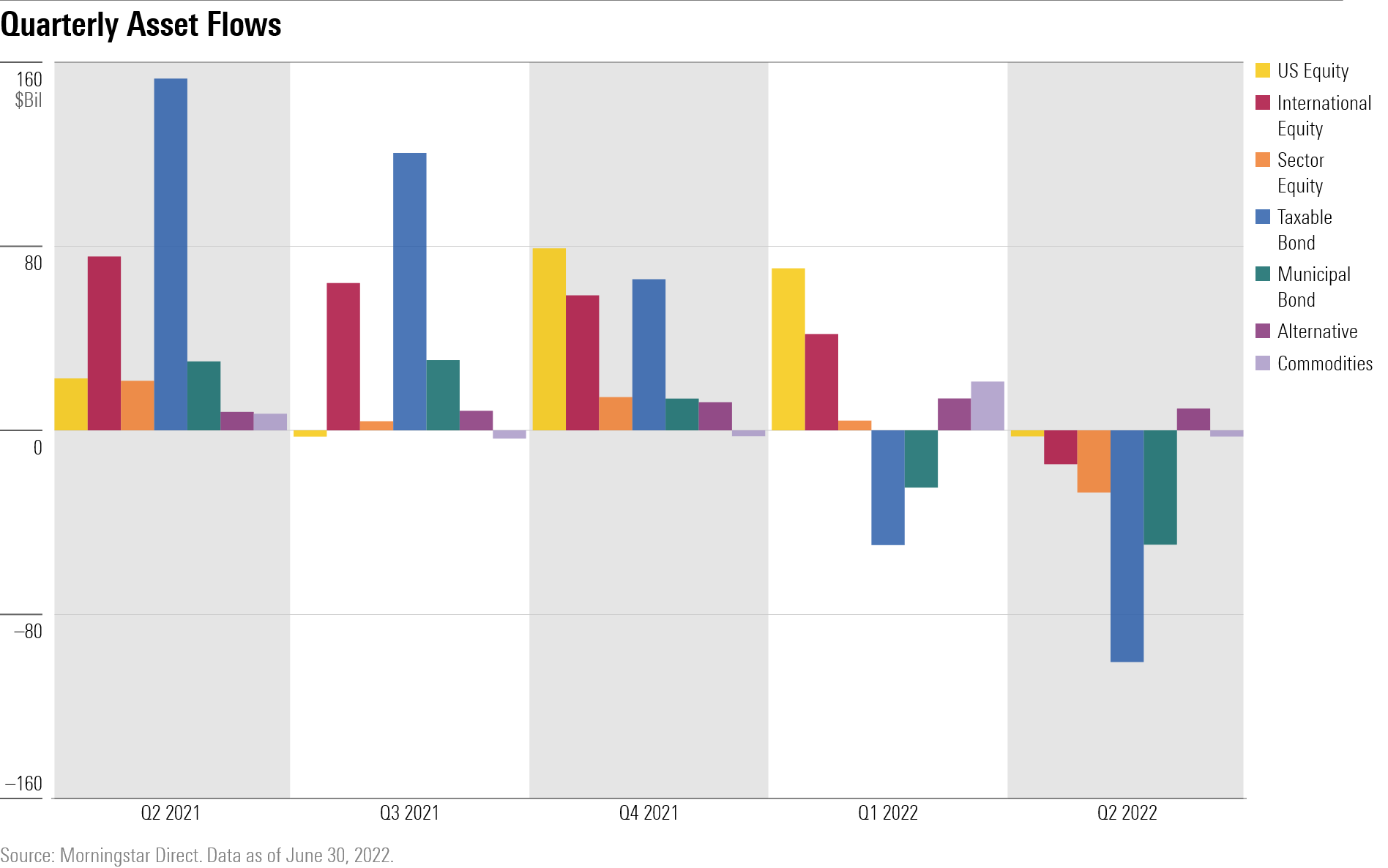

At the midyear point investors:

- Moved $66.8 billion into U.S. stock funds, though all the inflows took place in the first quarter. Investors overall made modest withdrawals in the second quarter.

- Pulled $150.2 billion from taxable bond funds. But that's just 2.7% of the money invested in bond funds as of the start of the year and follows a record $529.6 billion moved into the group in 2021.

- Shifted money into U.S. large value stock funds while pulling money from growth categories across the board.

- Withdrew roughly 7% of money invested in municipal bond funds.

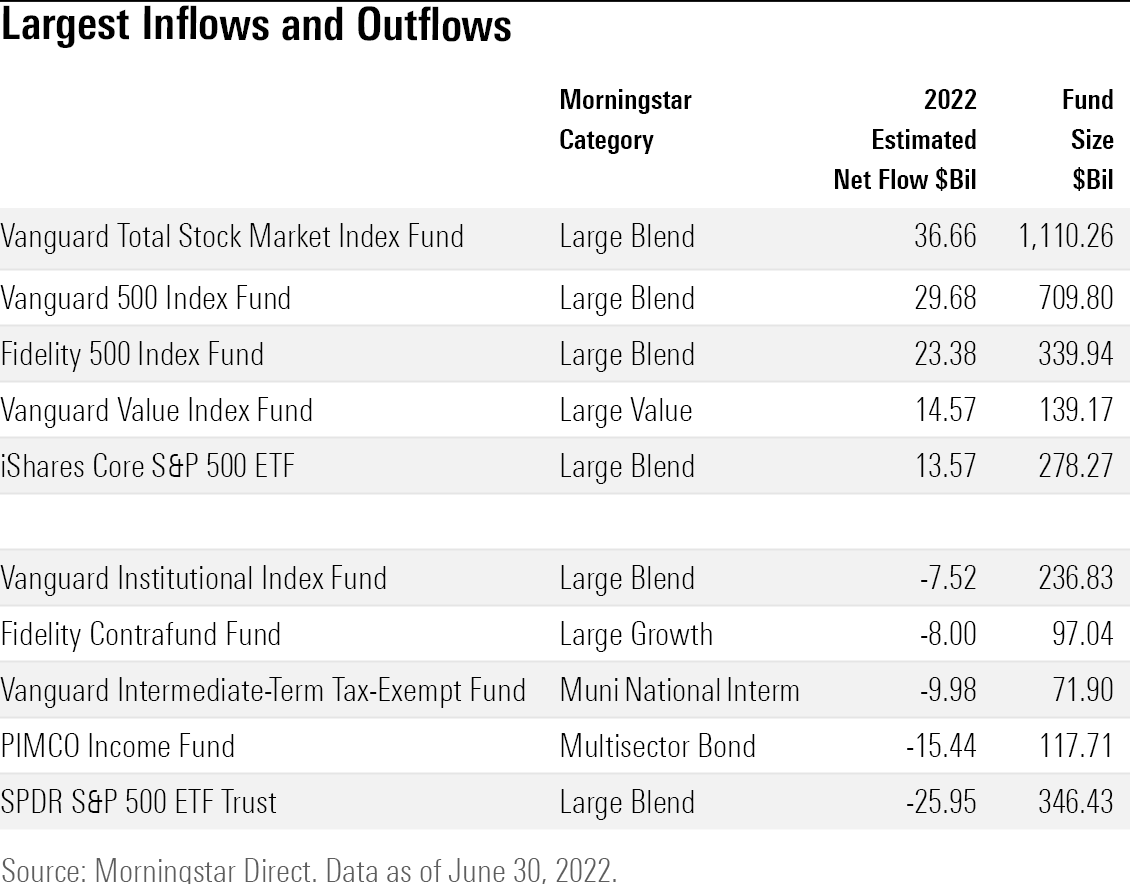

- Made the Vanguard Total Stock Market Index VTSMX the top fund for inflows at $36 billion, while Pimco Income Fund PIMIX saw the largest outflows among bond funds at $15.4 billion.

- Pumped cash into alternative-strategy and commodity funds amid turmoil in the stock and bond market.

- Exited technology and financial sector funds but shifted into energy and natural resource strategies.

Investors Stay the Course With Stock Funds

Even as stocks fell into their second bear market in a little over two years, U.S. investors largely held tight when it came to equity funds. The first half’s $66.8 billion of inflows came as investors moved $70.1 billion into U.S. stock funds in the first quarter, but pulled a net $4.4 billion out in the second quarter. This follows $152.4 billion flowing into U.S. stock funds last year.

Bond Funds See Small Exodus

As investors hang tight with U.S. equity funds, they have been selling out of taxable bond funds amid the worst losses in history in parts of the bond market.

Investors have pulled a net $150.2 billion from taxable bond funds, equal to 2.7% of their assets under management at the start of the year. Withdrawals have heated up as the year has progressed, with roughly $50 billion in outflows in the first quarter and double that amount in the second quarter.

Municipal bond funds have seen more of an exodus compared with the amount of money invested in those strategies. Investors pulled $74.5 billion from the group in the first half. That’s equal to 7% of assets under management at the start of this year.

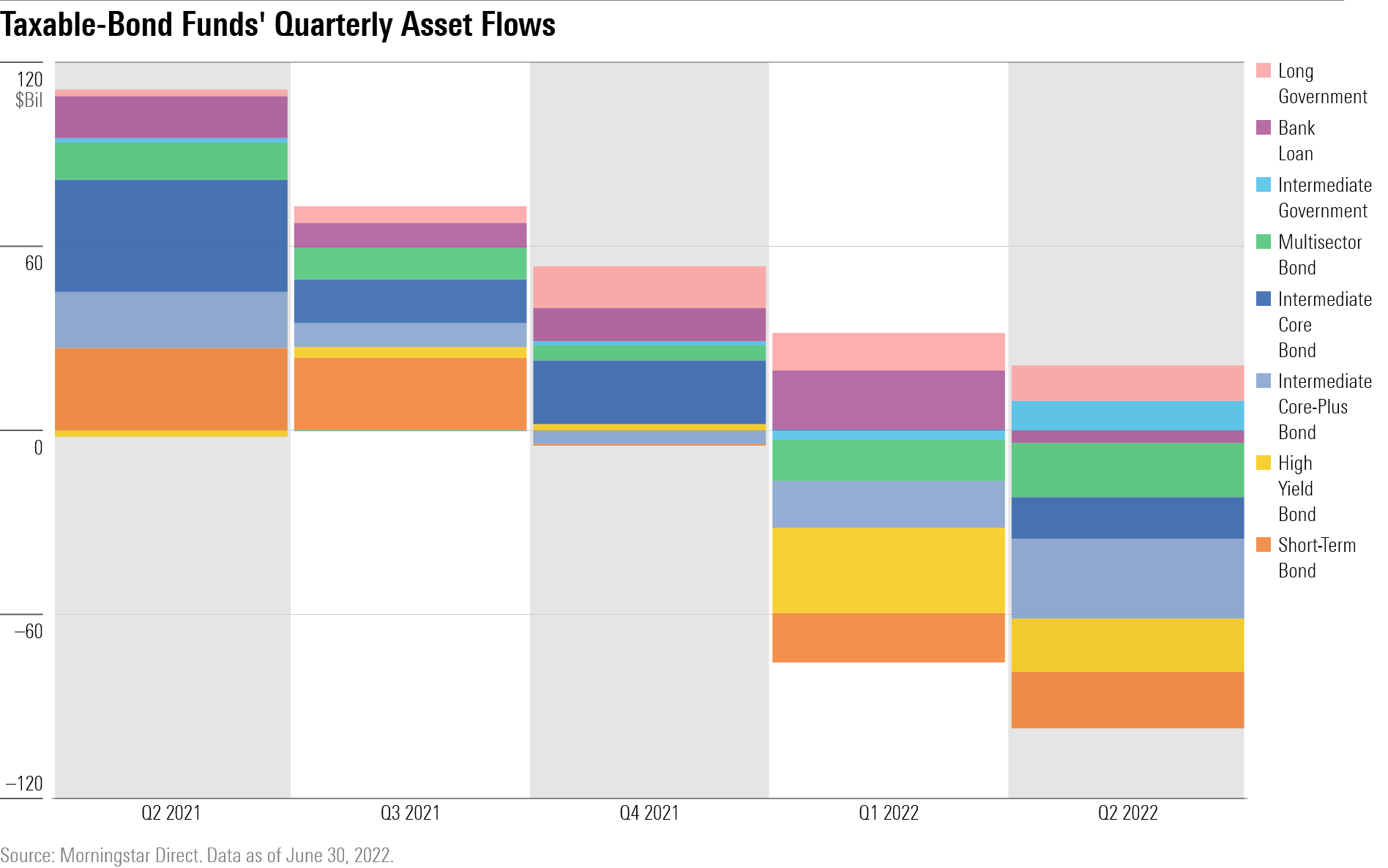

Within taxable bond funds, bank loan funds have attracted investors thanks to their ability to weather rising interest rates better than many other bond fund categories. Interest in inflation-protected bond funds dissipated. Long-government and intermediate-government funds also took in money despite their sensitivity to rising rates.

Investors pulled the most money from intermediate core-plus and high-yield bond funds, two areas that took in large amounts of money last year. PGIM Total Return Bond PDBAX had $6.9 billion exit, and the iShares iBoxx $ High Yield Corporate Bond ETF HYG saw withdrawals of $6.3 billion.

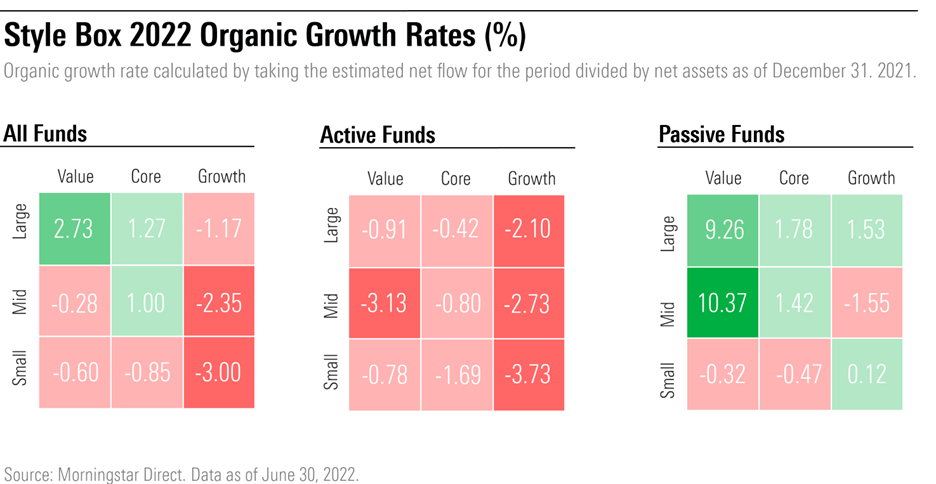

Value Funds Take In Money While Growth Investors Exit

Investors have also turned to value and dividend funds, which have held up better amid the broad market declined. The large value category took in $47.3 billion in the first six months of this year, equal to 2.7% of assets at the start of the year. The Vanguard Value Index VIVAX alone raked in $14.6 billion. The Schwab Dividend Equity ETF SCHD collected $7.4 billion, and Vanguard High Dividend Yield Index VHYAX gathered $6.4 billion.

At the same time, investors continue to flee battered large growth funds, with $32.8 billion in outflows. Small growth funds saw the greatest exodus based on organic growth rates, which measures money heading in and out of funds as a percentage of starting assets. Small growth funds saw $9.9 billion head out the door, leading to a decline in its organic growth rate of 3%.

Across U.S. stock funds, investors continued to exit actively managed funds no matter what category they fell into, while flows among index-tracking funds was mixed.

Among actively managed U.S. stock funds, investors pulled $7.9 billion from the $97 billion Fidelity Contrafund FCNTX and $5.4 billion from the $65.8 billion T. Rowe Price Blue Chip Growth Fund TRBCX.

Vanguard Funds Lead Inflows

More broadly, the Vanguard Total Stock Market Index saw the largest inflows of any mutual or exchange-traded fund with $26.7 billion in the first half. Broad index funds, including the Vanguard 500 Index Fund VFINX and Fidelity 500 Index Fund FXAIX, collected more than $20 billion.

SPDR S&P 500 ETF SPY saw the largest outflow with $26.0 billion exiting the $346 billion fund. The PIMCO Income Fund had the largest outflow of any bond fund with $15.4 billion in withdrawals. The Vanguard Intermediate-Term Tax-Exempt VWITX led outflows for municipal bonds with nearly $10 billion pulled from the $71.9 billion fund.

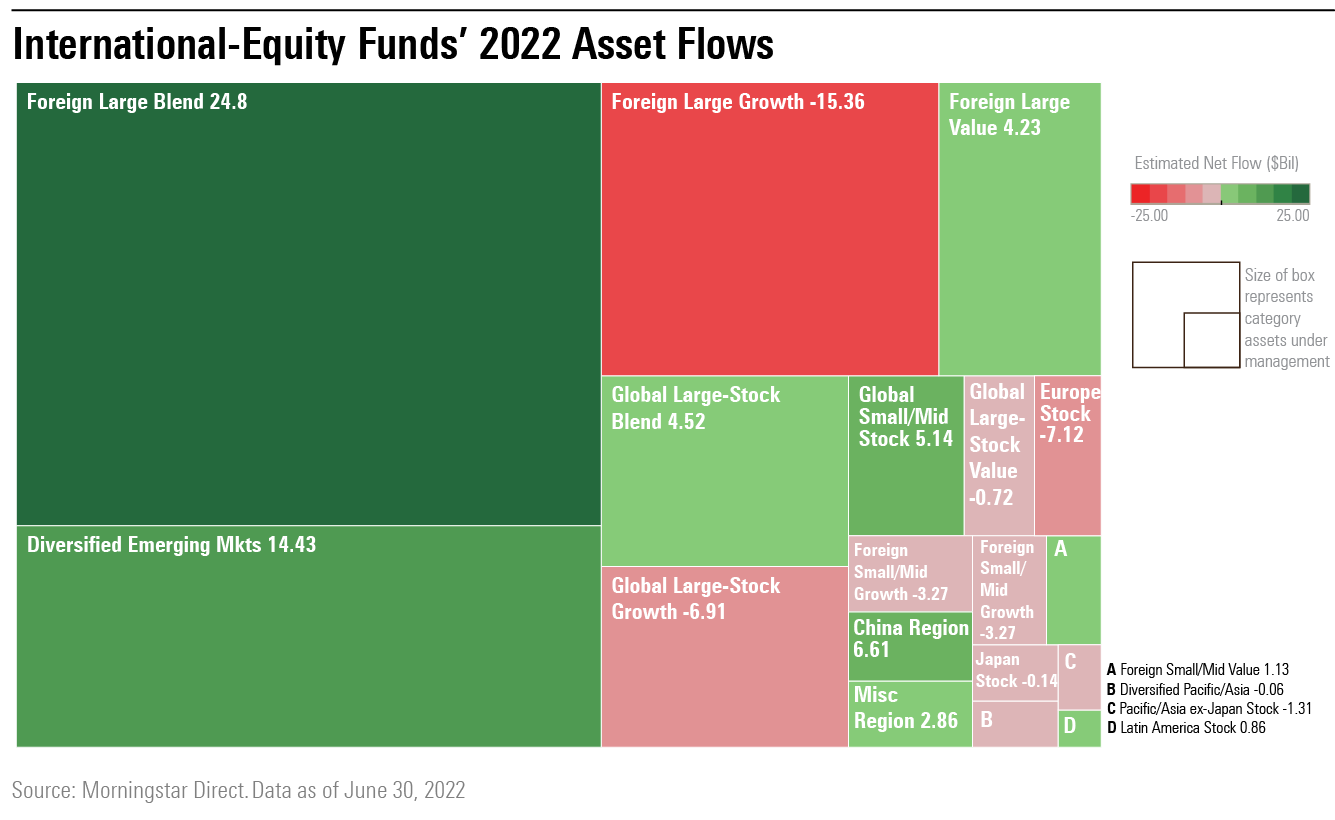

Inflows to International Funds Slow

International equity funds continued to draw investors, but at a slower pace than in 2021. In the first half of this year the group took in $27.7 billion, after recording inflows of $262.9 billion last year. Similar to U.S. equity funds, foreign large blend and value funds were most popular among the group, while growth-oriented funds recorded outflows.

Emerging market funds also saw inflows, with Vanguard Emerging Markets Stock Index VEMAX gathering $3.4 billion. Funds that invest in China collected $6.61 billion as the country's stock markets bounced back from a steep selloff, while European stock funds saw $7.1 billion of outflows.

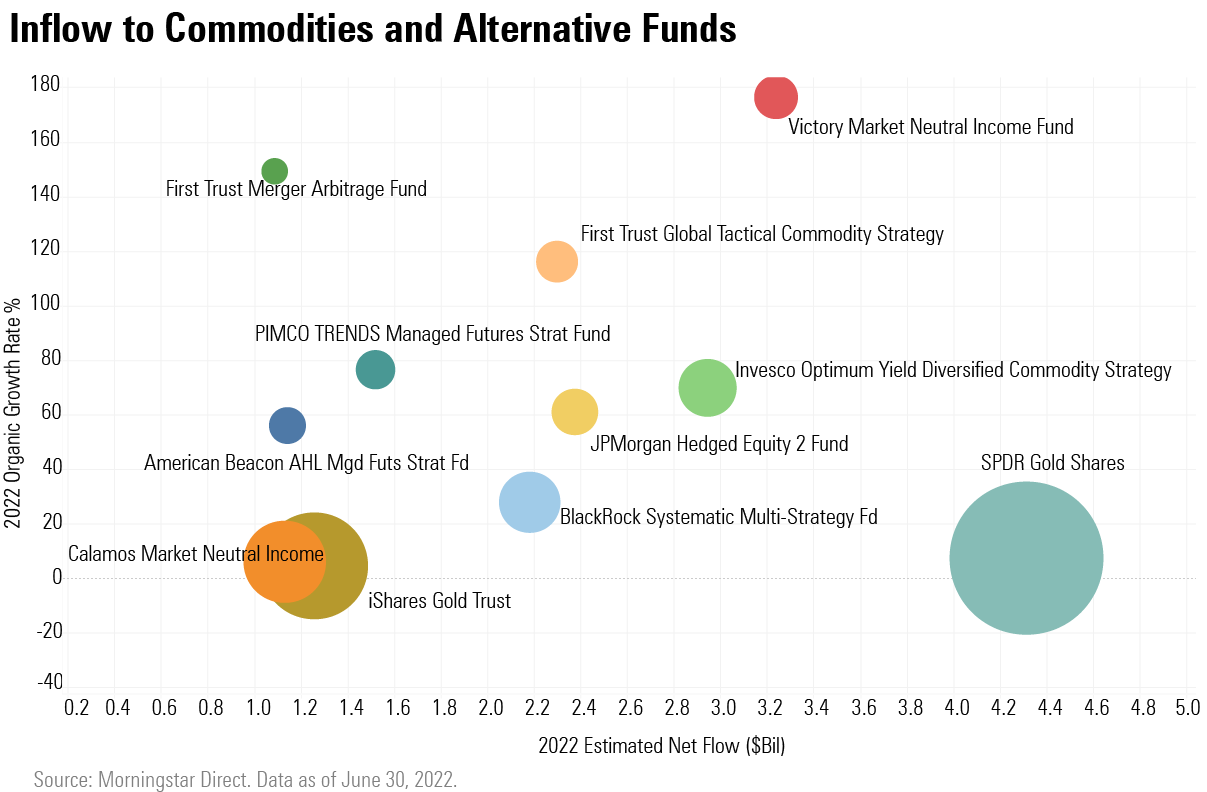

Investors Look to Alternatives and Commodities

With stock and bond funds getting hit hard, investors looked toward strategies that offer returns less correlated to those markets: alternatives and commodities.

SPDR Gold Shares GLD collected $4.3 billion and the iShares Gold Trust IAU brought in $1.3 billion. Funds that promise to hedge traditional market risks have also seen investor interest. Victory Market Neutral Income Fund CBHAX doubled in size and Calmos Market Neutral Income CMNIX collected $1.13 billion.

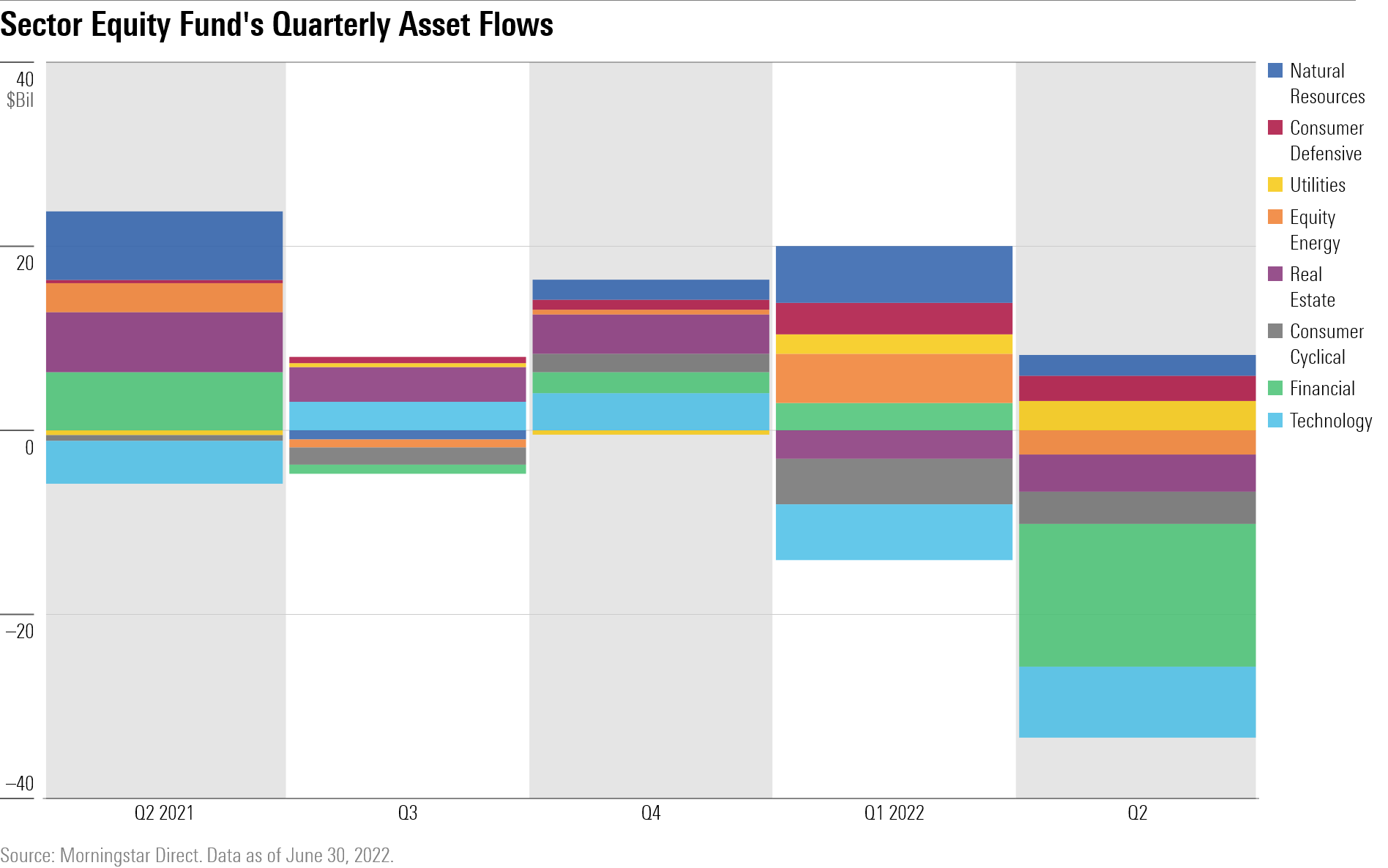

Investors Rotate Out of Financials and Tech

Investors reversed course on financial and technology funds, even though the dynamics of the two sectors differ.

Technology stocks have taken a hit as rising interest rates cut into rich valuations. Financials, meanwhile, can benefit from higher rates. However, investors on a net basis pulled money from both sectors in the first half, with $6.6 billion exiting the Financial Select Sector SPDR Fund XLF, and $2.2 billion from First Trust Dow Jones Internet Fund FDN.

Natural Resources and equity energy funds benefited from rising prices and the overall rally in commodity prices. First Trust Energy AlphaDEX FXN and First Trust Materials AlphaDEX FXZ have both doubled in size this year to about $1.5 billion each.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)