Can Floating-Rate Funds Offset the Risks From Rising Interest Rates?

While these loans pay out more to investors when rates rise, their chances of going into default increase during a recession.

Rising interest rates are generally bad news for bond fund investors. As rates rise, bond prices fall.

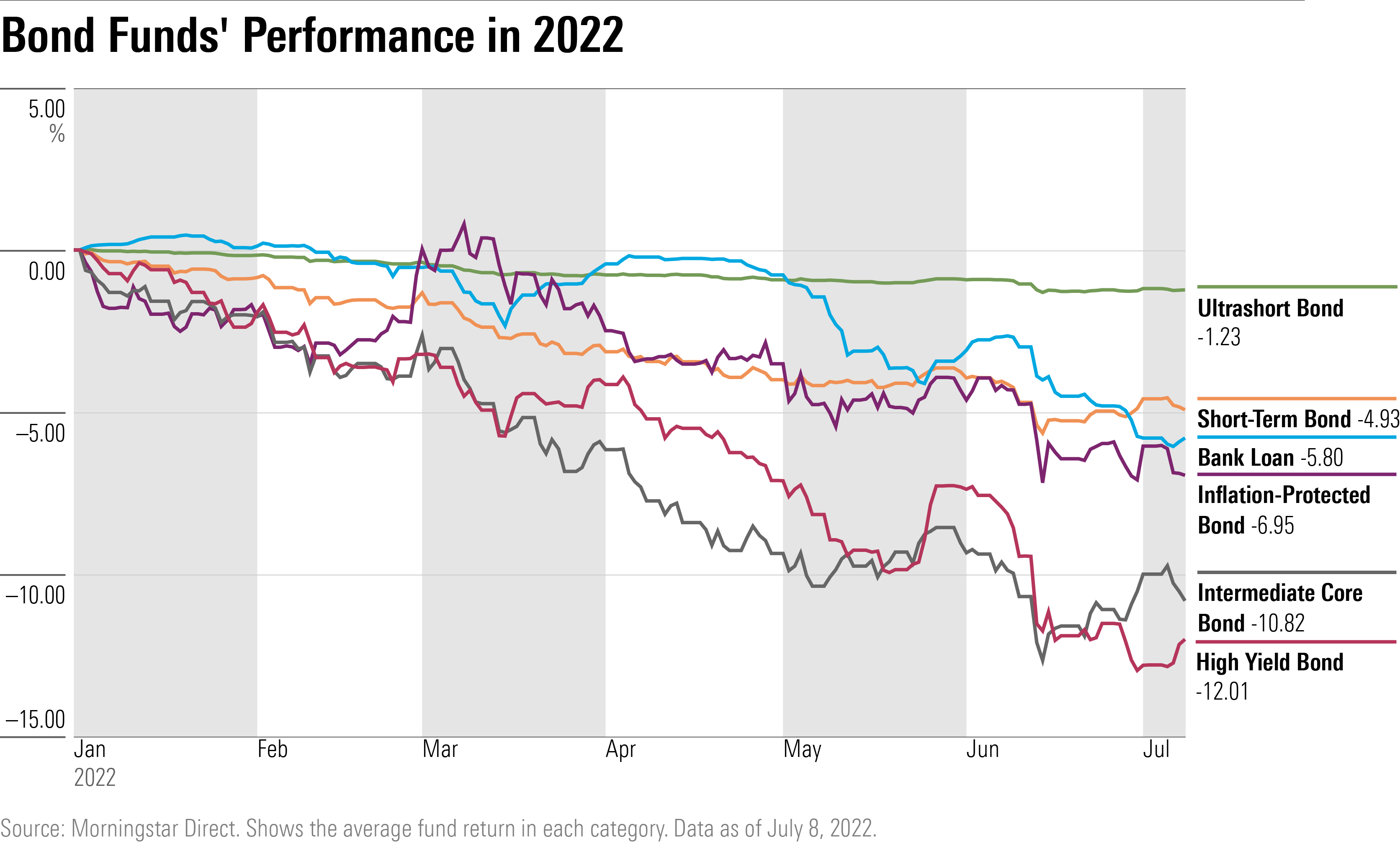

This year that dynamic played out in dramatic fashion, delivering some of the worst losses on record to bond investors.

But there is one area where rising rates can work in investors' favor: floating-rate funds.

Most floating-rate funds invest in bank loans that come with adjustable interest rates, which rise and fall with other short-term rates. Morningstar categorizes these funds together in the bank loan category.

That mechanism cushions these funds from the price declines seen on bonds with fixed interest rates. The result: This year, the average bank loan fund is down 5.8%, while the average core bond fund has dropped 10.8%.

With their reputation as an attractive investment in times of rising interest rates, investors have rushed in and poured more than $20 billion into the category this year.

However, it’s important for investors to understand that these are not a safe-haven investment, like an ultrashort bond fund or staying in cash.

The loans that floating-rate funds purchase are below investment grade, making them risky if the U.S. enters a recession and corporations begin to default. Investors should think of them as they would high-yield bond funds. Among bond funds, floating-rate funds are definitely at the complicated end of the spectrum.

“Many investors don’t understand bank loan funds,” says Morningstar senior manager research analyst Paul Olmsted.

What Are Floating-Rate Funds?

Floating-rate funds are attractive when interest rates are rising because what they pay investors rises or falls when those rates change. This year, as the Federal Reserve raises interest rates, the Secured Overnight Financing Rate or SOFR, which helps set the benchmark for many bank loans, has risen to 1.44% from 0.05%. Bank loans typically yield SOFR plus an additional amount to compensate for their credit risk. Unlike bonds that come with a fixed rate, floating-rate bonds carry minimal interest-rate risk.

The risk is that floating-rate funds are more of a credit risk since they are exposed to corporations that may struggle financially if the economy deteriorates. And as recession fears build this year, credit-sensitive strategies have stumbled.

As bond investors face some of their worst losses in years, floating-rate funds have outperformed. Morningstar chief market strategist Dave Sekera says the increase in yields from bank loans has helped offset their price declines. And since bank loans are higher up in the capital structure, meaning they are in line to get paid back first in the event of a default, they have suffered less than high-yield bonds, he says.

The average bank loan fund is down 5.8% this year compared with the 10.8% average decline for intermediate core bond funds and a 7.0% drop in inflation-protected bond funds.

Among taxable bond funds, only the ultrashort and short government bond funds have outperformed bank loans. These bond funds have done better since they are less credit-sensitive, as part of their portfolios are invested in government-backed securities. At the same time, they are less affected by rising interest rates because of their shorter durations.

The outlook for floating-rate funds hinges on the outlook for the broader economy. If economic conditions worsen, that would mean an increase in bank loan defaults, hurting performance for these funds. Defaults for bank loans remain below their historical averages right now, Morningstar's Olmsted says. That would change if the U.S. enters a recession.

Who Should Invest in a Floating-Rate Bank Loan Fund?

Because of their credit sensitivity, bank loan funds aren't a strong investment for those looking to find higher yields on their safe money. Morningstar's Christine Benz doesn't recommend them for anyone's safe assets. She puts them in an equity risk category, which is where investors with a long time horizon put their money.

Since bank loan funds invest in below-investment-grade debt, they can be used as an alternative to a high-yield bond fund. In times when investors are concerned about defaults they may move into funds, which invest in bank loans.

What Are the Best Floating-Rate Funds?

Morningstar analysts stress the importance of active managers when picking out a floating-rate fund. Olmsted says it’s important to look for experienced managers with large credit research teams that can dig through the bank loan market.

Passively managed funds often track indexes composed of only the most liquid bank loans, meaning these funds aren’t finding pockets of value, Morningstar associate manager research analyst Lan Anh Tran says.

Only two funds are medalists in the bank loan category.

T. Rowe Price Floating Rate PRFRX is rated Gold. Olmsted writes that the fund has a deep credit research team that complements its selective risk-aware approach. The fund has largely avoided defaults, with a historical annualized default rate of 0.1% for the strategy since inception, compared with 2.4% for its benchmark during the same period.

Eaton Vance Floating Rate EIBLX is also a medalist. Its cheaper share classes earn Morningstar Analyst Ratings of Silver and Bronze, while its more expensive shares are rated Neutral. The team applies its disciplined investment process consistently, allocating to loans across different risk levels and typically avoiding smaller and highly leveraged issuers, as it believes they do not pay enough income to offset their higher default rates, writes Olmsted.

Invesco Senior Loan ETF BKLN and Highland/iBoxx Senior Loan ETF SNLN are the only two passively managed bank loan funds. Invesco Senior Loan ETF is rated Neutral, and Morningstar's Tran writes that by virtue of following a simple rules-based index, the fund cannot leverage fundamental credit research for security selection. By limiting itself to the largest issuers for liquidity’s sake, the fund can miss out on attractive investment opportunities.

There are some floating-rate funds that invest in investment-grade credit or government floating-rate U.S. Treasury bonds. These funds fall into Morningstar’s ultrashort category and include the iShares Floating Rate Bond ETF FLOT and WisdomTree Floating Rate Bond ETF USFR. Investors have poured over $2 billion into both funds this year.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)