Pumpkin Spice Lattes Could Be a Great Addition to a Plain-Vanilla Portfolio

A ‘basic’ Reddit index might actually provide a valuable investing lesson.

Working in finance, I’ve come across plenty of silly investment ideas and kitschy indexes in my day. (See VanEck Agribusiness ETF MOO or the KPOP and Korean Entertainment ETF KPOP).

None have hit so close to home as the one I recently stumbled across on Reddit: $BECKY, also known as the White Girl Index, a hypothetical basket of equally weighted stocks. (It’s important to note that it’s not an exchange-traded fund—yet.)

Each company on this list sells a major product or service that’s favored by people supposedly like me—white American women, who are sometimes characterized as “basic.” “Basic” people like popular, mainstream things, such as Starbucks’ SBUX pumpkin spice lattes, avocado toast for brunch, and leggings from Lululemon LULU.

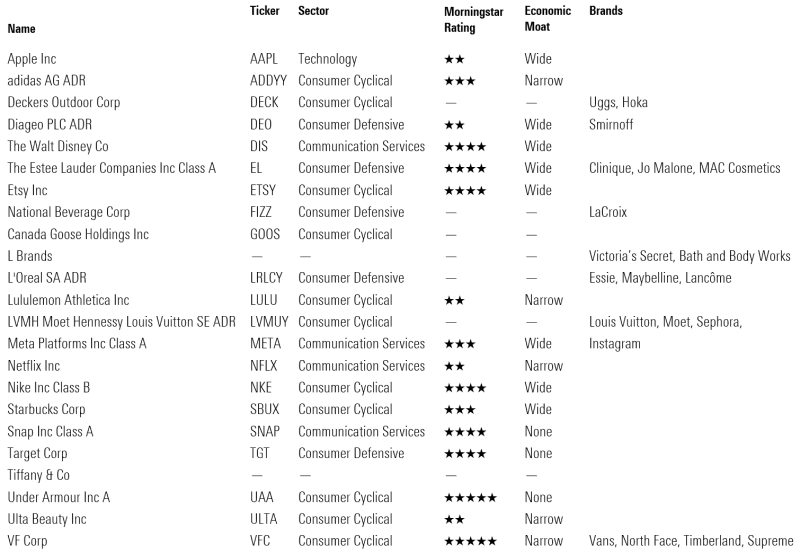

What Companies Are Listed on the Index?

'White Girl Index' Original Constituents

Some might find the idea of the list offensive. I certainly bristled a little bit when I first saw it.

For starters, Becky is my mother’s name. And while I do love the occasional Target TGT run, many of the other companies on this list don’t resonate with me. I drink my coffee black, not pumpkin-spiced, and I’ve never owned North Face clothing.

Everyone’s tastes are unique, and it can be uncomfortable when people draw on those tastes to make generalizations about your race and gender. Importantly, these products have gained widespread popularity because they resonate with people of many different backgrounds.

Still, I recognized that the point was to find a list of companies that had broad appeal among a specific demographic. So, I chalked it up to a lighthearted caricature and chose to focus on the meat and potatoes: the list itself.

Why The Index Continues to Resonate With Some Investors, Despite Its Flaws

The list may not be a suitable investment strategy for everyone. First, it’s a concentrated list, which means that outliers pack a big punch. Diversification is essential for long-term success in investing, and when it comes to putting together a portfolio, concentration is just the opposite.

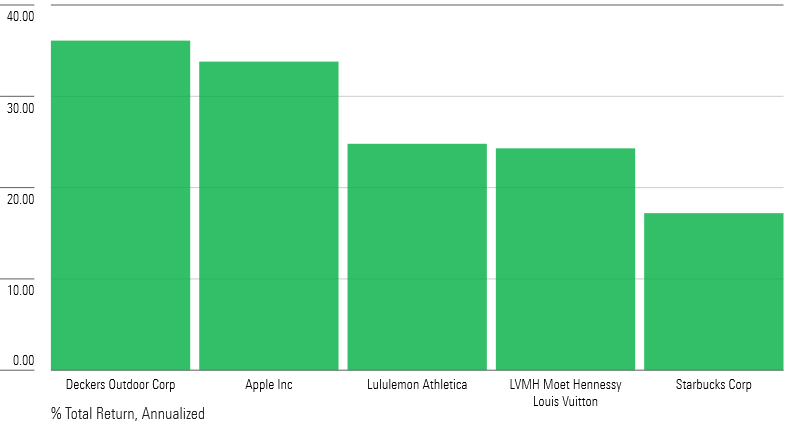

That said, I was struck by just how old this list was by social media’s standards. The original list dates back to 2018, and some companies on it don’t even trade publicly anymore. It has experienced enough staying power that the subreddit has periodically checked in to see how it’s performed since the idea was first conceived. Standouts include Deckers DECK, Apple AAPL, and Lululemon LULU.

Top 5 Performers

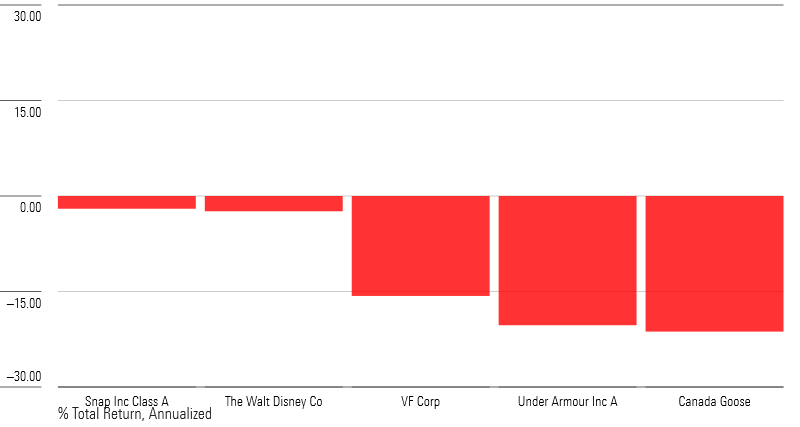

Laggards include Under Armour UAA and Canada Goose GOOS.

Bottom 5 Performers

I was impressed by the dedication to this index. While it is not my personal cup of tea, people seemed to care about it enough to revisit it years later and give it tune-ups. Given that trends on social media tend to travel at warp speed, that endurance is no small feat. And in my experience, as far as explicit references to women in investing communities go, the pickings are slim.

There is something notable about the subreddit’s commitment to this particular index, however silly it might seem. Sure, it’s a cobbled-together list that applies to a specific subset of women, but at least someone out there is trying.

I’d argue that it speaks to a deeper truth about investing, too. We all know by now that we’re supposed to go out into the market and shop around for quality businesses with competitive advantages at a discount. Sounds simple, right?

Unfortunately, for women it rarely is. It is well-known that women have lower confidence in their investing abilities than men and are more likely to feel discouraged from making investment decisions. This is aggravated by an appetite in the financial-services industry to make investments as complicated and esoteric as possible.

What if Getting Started With Investing Was as Simple as Buying a Pair of Well-Made Leggings?

So often investment professionals bandy about terms like a business’ consumers or its customer base when making the case for its potential growth. These terms sound professional to the casual listener but obscure reality. When we talk about the audiences that businesses sell their products to, ultimately, we’re just talking about regular people, with a limited amount of resources, deciding how best to distribute their money on the things that bring them joy. Like a fizzy seltzer water or a warm pair of boots. Those purchases might seem frivolous to some, but in aggregate, it’s serious business.

Every single one of us has a list of companies whose products we like and whose business models make sense to us; I can think of far worse starting points for an investing journey. Even if fur-lined slippers aren’t your comfy clothing item of choice, that’s OK. My list of businesses may look different from yours or $BECKY or my mom Becky’s.

It’s also possible that your list might look very similar to mine, or to your friends’ and neighbors’. That’s fine, too. It’s preferable to getting caught up chasing the flavor of the month and winding up as the proverbial hare. You want to look for businesses that are pumpkin-spiced, not candy-coated. Trends fade; well-made products endure.

I’ll admit, the index doesn’t have a perfect record on this front. Some companies, like Snap SNAP, lost their relevance long ago. Others, like L Brands, are already defunct. It’s important to look for companies that actively cultivate competitive advantages, like a food and beverage company with savvy brand development or a record label with prudent capital allocation.

Trust your instincts, and don’t overthink it. If you don’t get what’s going on with a stock, it’s going to be a lot harder to stick with your investment through the inevitable rough patches. If the whole thing seems too daunting, remember that index funds are called plain vanilla for a reason: They satisfy most people. When it comes to simplifying the dizzying array of choices we’re assailed with each and every day, that can be enough.

With investing, no matter who you are or what your goals are, sometimes it pays to keep it basic.

The views expressed here are the author’s.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)