Lessons for Investors From the Performance of AQR’s Funds

Liquid alternatives promise diversification—if investors can stay the course.

Editor’s Note: This article was temporarily unpublished from Morningstar.com while the piece was reviewed internally. It has been modified since its original publication to clarify that the author’s views are her own and not necessarily those of Morningstar and to clarify key takeaways for investors, including new information on performance data and an additional exhibit on flows.—Jeffrey Ptak, Chief Ratings Officer, Research.

AQR was founded in 1998 in the twilight of the hedge fund boom that made money managers like George Soros and Julian Robertson household names. It withstood early scrutiny for its founders’ rigorously researched but deeply contrarian opinions, riding standout performance to become one of the largest quantitatively driven hedge fund firms in existence.

Along with other quantitative managers, AQR stumbled in 2007 and 2008. In AQR’s case, investments in factors such as value and earnings quality were undone by the financial crisis unfolding in the credit and mortgage markets. But the firm regrouped, pivoting into a fast-growing new area: alternative mutual funds. Leveraging its reputation and marketing savvy, the firm quickly made inroads: Global AQR mutual fund assets climbed above $40 billion by 2018 behind strong inflows into strategies like AQR Diversified Risk Premia and AQR Managed Futures AQMIX.

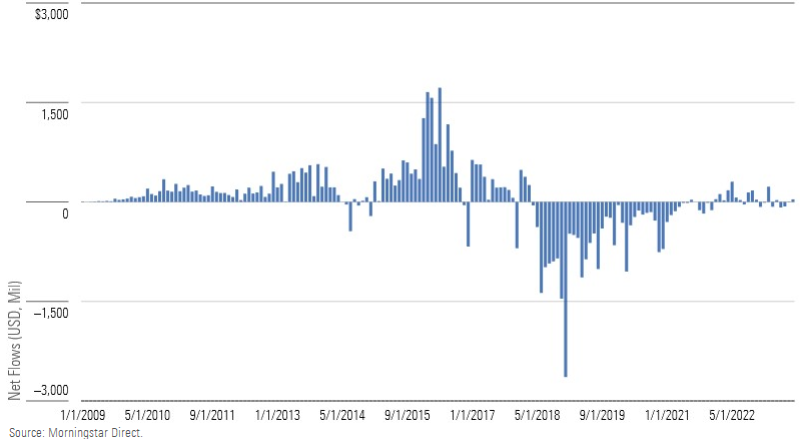

The past five years have not been without challenges for the firm, which has struggled with uneven performance and more than $25 billion in outflows from its mutual funds globally between January 2017 and August 2023. But outflows have moderated and performance has stabilized. Now the firm finds itself in the midst of a reboot. With it comes lessons for investors.

From Hedge Fund Agitator to Mutual Fund Titan

Right out of the gate, AQR made a name for itself with views that challenged consensus. In an unpublished but much-beloved paper called “Bubble Logic,” AQR’s founder Cliff Asness highlighted the deep chasm between reason and the ebullient valuations of dot-com stocks during the tech bubble. His firm invested accordingly, skirting technology exposure in favor of established factors like value and momentum.

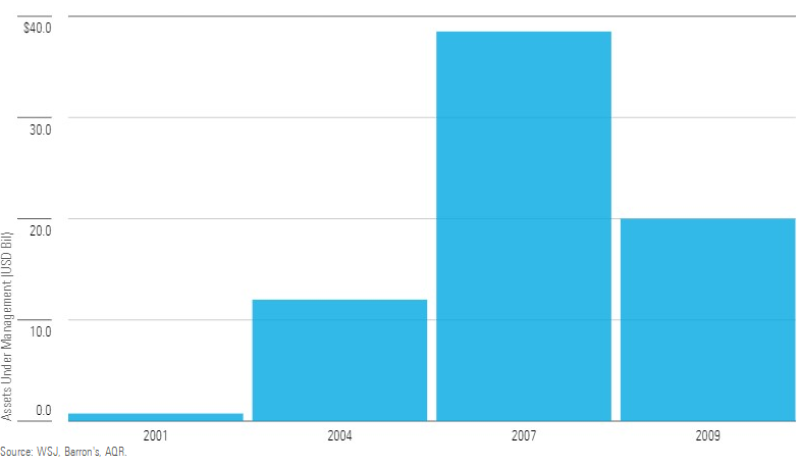

Although it took two years, the tech bubble did burst, making AQR’s concerns look prescient. Over the next several years, the firm was able to capitalize on its sterling reputation and strong institutional demand, amassing nearly $40 billion in firm assets by 2007. AQR, along with other quantitative managers, sustained heavy losses during the subsequent financial crisis. By 2009, the firm’s assets under management had been halved. That same year, AQR turned its attention to the mutual fund market.

AQR Assets Under Management, 2001-09

AQR offered a streamlined pitch to financial advisors and their retail clients. The firm did not attempt to use analyst judgment to identify specific companies that it expected to outperform. Instead, its investment process featured a systematic stock-selection process and academically substantiated factor exposures that were uncorrelated to each other and the market. From the firm’s first full year of calendar performance in 2010 through 2017, AQR’s investment approach drove strong risk-adjusted returns in the firm’s mutual funds, earning a 1.0 Sharpe ratio on average.

An Appealing Process, With Trade-Offs

At the time that AQR was entering the liquid alternatives mutual fund market in the early 2010s, it was still a niche space populated mostly by newer, largely unproven managers. AQR struck a very different profile, boasting a storied track record in the hedge fund space and exhibiting many appealing characteristics within its mutual funds. That includes transparent and repeatable investment processes and affordable products relative to other alternative strategies.

AQR stood out from other alternatives shops by emphasizing diversification and a rigorously quantitative approach to risk control. The firm invests in thousands of securities both long and short to get exposure to a range of equity market factors including value, quality, momentum, and sentiment. Some strategies offered exposure to just one factor, but most of AQR’s most popular mutual funds by flows from 2008-18, like AQR Long-Short Equity QLEIX and AQR Style Premia Alternative QSPIX, spread out across multiple factors so the effect of one would not overwhelm the others. That diversification and risk control contributed to strong performance uncorrelated to major asset classes, which in turn led to significant inflows relative to other alternative and nontraditional equity mutual funds.

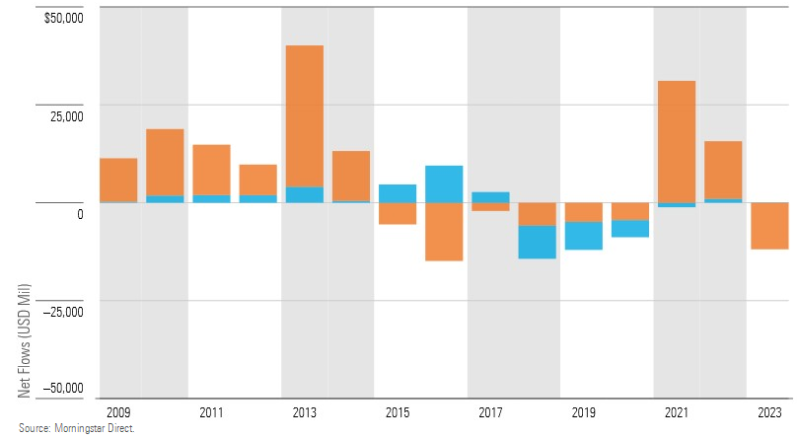

AQR U.S. Fund Flows Relative to Peers, 2009-23

Those merits notwithstanding, approaches like AQR’s entail trade-offs. While uncorrelated in the long run, factors can underperform together at times. AQR utilizes one systematic stock-picking model across many of its strategies, which means it was vulnerable to underperformance in many funds at the same time. Finally, in some strategies, the firm can opportunistically overweight factors based on relative valuation. That opens up the possibility of reducing the level of diversification, although AQR only does so rarely and typically in modest amounts. From 2009 through 2018, it hadn’t done so in a meaningful way in the mutual fund space before, which means that investors had limited opportunities to judge the impact of such investment decisions.

Reality Sets In

Those first two trade-offs became evident in 2018. That year was the first since 2000 that both the value and momentum factors were negative contributors in the same calendar year, and AQR’s stock-selection model struggled to add value. Many of the firm’s funds started to underperform in tandem.

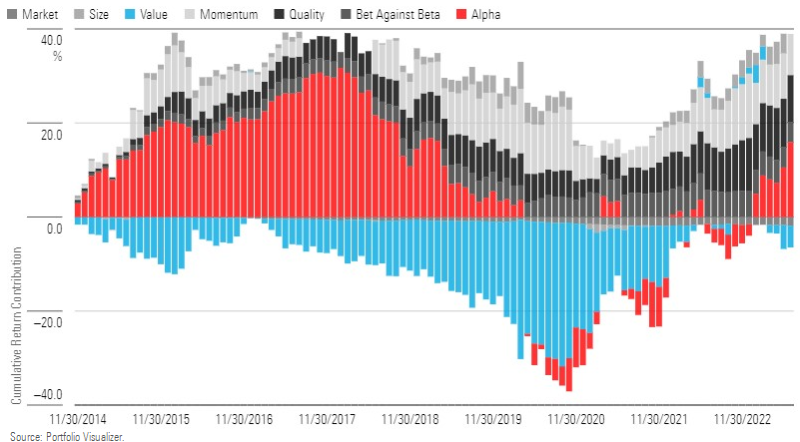

AQR Cumulative Alpha Contribution in Select Funds, 2014-18

While AQR is laudably transparent about its philosophy, like most quantitative managers not all of its factors or signals are publicly disclosed. Statistically, “alpha” is a catchall term for any performance that can’t be explained by regression analysis. That means that this regression does not entirely capture the impact of the firm’s proprietary factors and signals that it keeps under wraps.

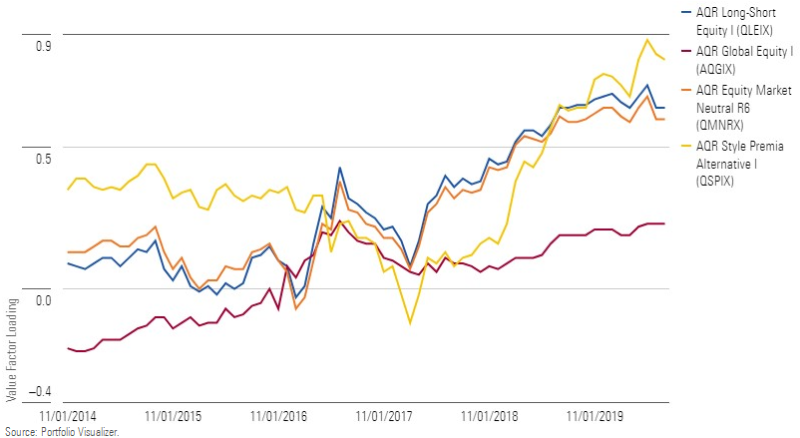

This is where the third trade-off comes in. After examining the events of 2018, AQR concluded that the value factor’s underperformance was a statistical anomaly and doubled down, opportunistically moving into value-based signals by up to 10 percentage points in some of its mutual fund strategies starting in 2019 and throughout 2020.

When value further underperformed, it intensified the firm’s pain. By December 2020, AQR Equity Market Neutral QMNIX had lost 38% of its value. Although AQR didn’t waver and value did eventually rebound, many investors had already bailed. Mutual fund assets plunged to $26.9 billion from a peak of $51.4 billion.

Return Decomposition for AQR Equity Market Neutral, 2014-23

The heavy outflows forced the firm to pare back. AQR changed portfolio managers on a substantial number of its strategies; at least 15 funds witnessed one or more named portfolio manager departures between January 2020 and September 2023. AQR pruned its lineup to refocus on the firm’s core strengths while exiting fledgling areas like fixed income.

Key Takeaways

The arc of AQR’s mutual funds offers several takeaways for investors.

1. The road to factor diversification can be bumpy at times.

AQR emphasizes diversification and rigorous risk controls during normal market environments, but its investment process has always allowed for a high-conviction active stance when valuation anomalies arise. A large value factor bet packed a big punch at a time when the typically diversifying characteristics of other factors had a muted impact on performance, even if value ultimately staged a comeback.

Rolling 36-Month Value Factor Loading in Select AQR Funds, 2014-23

2. Stock selection matters, too.

Either way, AQR’s struggles over the past five years can’t be boiled down to one single bet on value. After all, had AQR’s stock-selection model held up better, the value overweighting might not have led to such acute underperformance.

3. Complexity is hard to stick with.

Alternative strategies like the ones AQR runs are innately complex. While AQR has made every effort to be transparent and educate investors about the drivers of performance, retail fund investors can’t realistically have real-time access to all of the proprietary signals that AQR uses to compose its models, making it more difficult to pin down what a manager’s edge is. For investors, underperformance is not as large of an issue as unexplainable performance is. Investor informational gaps are still prevalent in liquid alternatives, which can lead to worse behavioral outcomes.

4. Resolve is needed to realize results.

AQR has shown enviable tenacity, retained a distinctive investment culture, and stuck to its guns. That’s reaped rewards; performance has improved markedly in recent years. But not all AQR fund investors have shown the same resolve by selling out before the rebound and consequently forgoing some of the gains that AQR’s discipline conferred.

AQR U.S. Alternative and Nontraditional Equity Mutual Fund Net Fund Flows, 2009-23

AQR’s mutual funds came out of the gate with a splash before performance stumbled and investors blinked. Returns have since bounced back, with 15 of the firm’s liquid alternative and nontraditional mutual funds posting top-quintile results over the three years through September 2023. AQR’s experience holds at least one crucial lesson for investors. Sometimes the best course to better outcomes is just that: staying the course.

The views expressed here are the author’s.

Clarification: This article was updated to clarify when text was discussing mutual funds from AQR, not other vehicles.

Clarification: This article was updated to clarify that AQR utilizes one systematic stock-picking model across many of its strategies, but not all of them.

Clarification: This article made previous reference to AQR Diversified Arbitrage ADAIX, a subadvised strategy.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)