Still Thinking of Giving This Holiday Season? A Donor-Advised Fund May Help

Comparing the top 10 providers.

We’ve written about donor-advised funds before, with a spotlight on heavyweights like Vanguard, Fidelity, and Schwab, which offer donor-advised funds alongside other advisory services. (Donor-advised funds allow individuals to donate money or investments to an account, keep that money invested, and distribute it to charities in a tax-efficient manner. For more information, see this explainer.) But the world of donor-advised funds stretches beyond the traditional asset managers; many different types of organizations offer them, from small community foundations to the titans of Wall Street. In this article, we will widen the aperture.

For simplicity’s sake, I’ll focus on the top 10 donor-advised fund providers by average assets under management over the past three fiscal years, excluding single-cause funds like hospitals and university systems.

Top 10 Donor-Advised Funds by AUM (Trailing Three Years, 2019-22)

We can group these donor-advised funds into four broad categories, each with its own distinct characteristics.

First, there are the investment managers. These firms offer donor-advised funds that integrate with their other investment offerings, allowing donors to thread their philanthropic giving into their overall financial goals.

Donor-Advised Funds Offered by Investment Managers

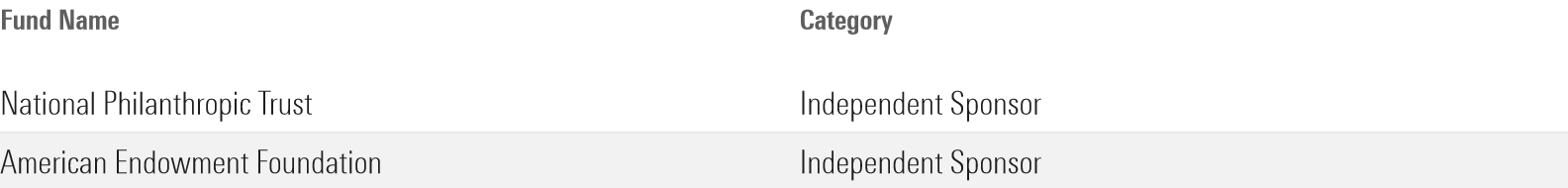

Independent donor-advised funds like the National Philanthropic Trust and American Endowment Foundation tend to have higher minimums and may require a financial advisor to set up the account. Relative to an investment manager, the main perk of an independent fund is that they are configured specifically so that their advisor can continue managing assets within the donor-advised fund according to their investment process. Independent donor-advised funds also offer broad flexibility in causes that individuals can support, which suits donors who know where they would like their money to go.

Donor-Advised Funds Offered by Independent Sponsors

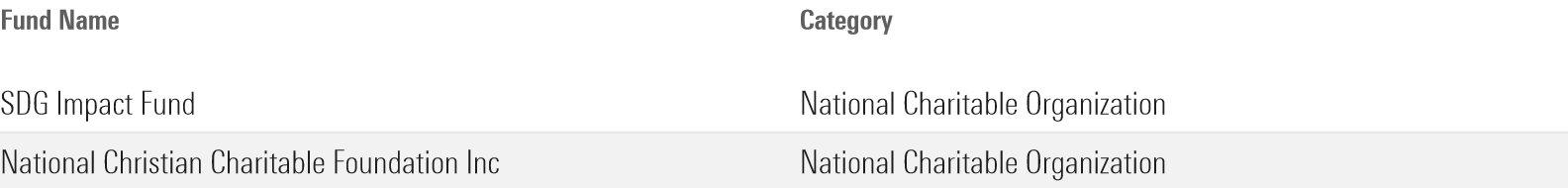

National charitable organizations, such as the National Christian Charitable Foundation and the Sustainable Development Goals Impact Fund, offer guidance on grantmaking according to specific philanthropic missions. That makes them ideal choices for donors passionate about particular causes but unsure about what specific charities to endow.

Donor-Advised Funds Offered by National Charitable Organizations

Finally, you have community funds, such as the Silicon Valley Community Foundation, which focus on serving donors within specific communities. These funds provide unique services tailored to local donor populations, usually in the form of grantmaking advice and often with a local perspective in mind.

Donor-Advised Funds Offered by Community Funds

The mission of the donor-advised fund provider can influence the selection of investment offerings.

For example, the Silicon Valley Community Foundation offers multi-asset environmental, social, and governance pools at three different risk tolerances, which may appeal to donors who want their investments to reflect their values but may be limiting for those who would prefer to follow more traditional investing strategies.

The National Christian Charitable Foundation provides multi-asset traditional or faith-based pools at five different risk tolerances, catering to donors with specific religious or ethical beliefs while also providing some optionality.

Asset and wealth managers tend to offer more choices, including traditional multi-asset pools at varying risk tolerances, along with single-fund multi-asset and single-fund single-asset-class options, providing a range of choices to suit different donor preferences.

Independent sponsors, in contrast, sometimes don’t even provide investment pools, leaving investment decisions entirely to the discretion of the advisor. This flexibility can be appealing to donors seeking a highly customized approach but is not suitable for do-it-yourself investors.

Investment Features of the Top 10 Donor-Advised Funds

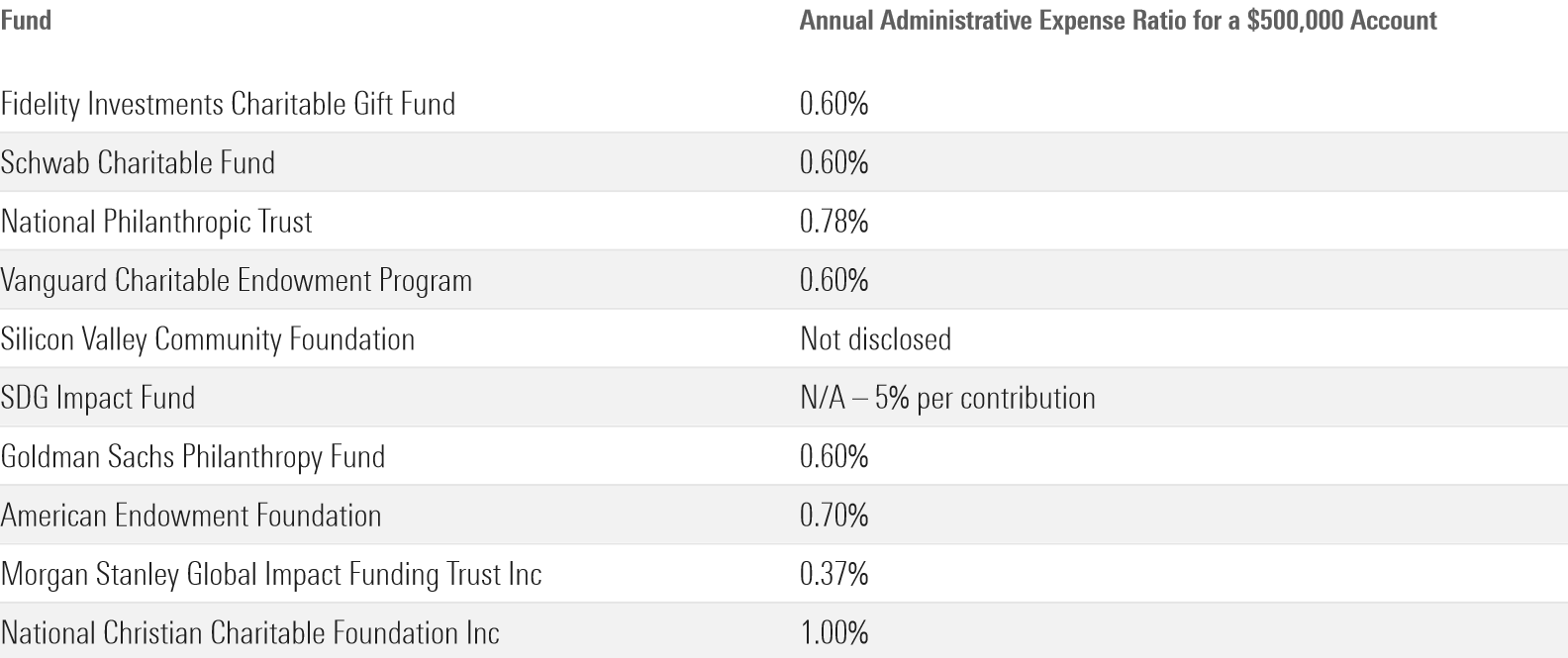

As with any financial endeavor, understanding the fees associated with donor-advised funds is crucial. Expenses are high relative to the administration of more traditional accounts, but these fees cover a range of costs unique to the management of charitable giving. Administrative costs include the expenses of processing donations, whether they are in the form of cash, marketable securities, or illiquid assets. Fees also cover the cost of maintaining relationships with multiple custodians. Philanthropic advisory services are often included in the fees, providing guidance to donors in their charitable endeavors.

Administrative Expense Ratios of the Top 10 Donor-Advised Funds

It’s important to note that donor-advised fund administrative fees do not cover investment expenses, which are assessed independently based on the investments selected.

Now, what do you get in return for the fees you pay? Donor-advised funds offer several benefits that might make them an attractive option for charitable giving:

- Donor-advised funds are faster to set up and cheaper to administer than private foundations.

- Donor-advised funds provide anonymity, which can be useful for donors who prefer to give discreetly within their local communities or for those who wish to keep their philanthropic endeavors private.

- For taxpayers who want to itemize their tax returns, donor-advised funds provide a streamlined way to donate to multiple charities and only have to keep one receipt—the initial donation to the donor-advised fund.

- Donor-advised funds offer a useful way to divest illiquid assets, allowing donors to charitably contribute assets like real estate or closely held stock without incurring taxes on capital gains.

Because donor-advised funds involve considerable administrative expenses, they are not for everyone. However, for investors who might otherwise have to suffer the expense and hassle of setting up a private foundation, or for those who need a lot of direction for their charitable giving, there may be benefits to considering a donor-advised fund. They allow an individual to align charitable giving with their values and objectives, ensuring their contributions make a meaningful impact.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)