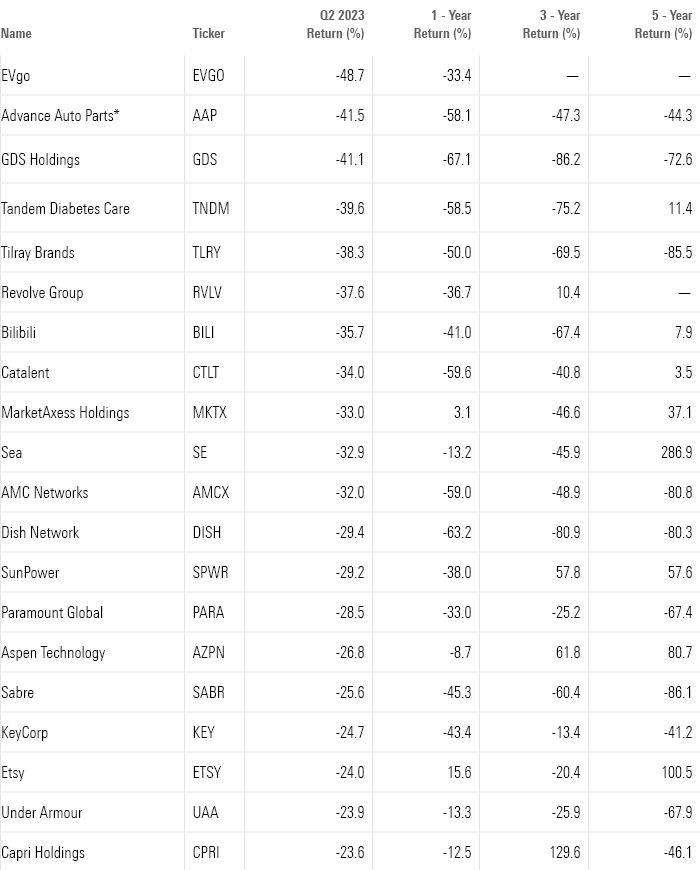

Worst-Performing Stocks of Q2 2023

EVgo, Advance Auto Parts, and Dish Network were among the biggest decliners during the second quarter.

This article is part of Morningstar’s Q2 market review and outlook.

Stocks in the consumer cyclical and communication services sectors led the list of the poorest performers in the second quarter of 2023, with most faring worse than they did in the first quarter.

The second quarter’s worst-performing stocks covered by Morningstar analysts include EVgo EVGO (down 48.7%), GDS Holdings GDS (down 41.1%), and Dish Network DISH (down 29.4%). Other notable losers include Advance Auto Parts AAP (down 41.5%) and Paramount Global PARA (down 28.5%).

Of the 862 U.S.-listed stocks covered by Morningstar analysts, 335 declined in the second quarter of 2023, with only 16 going above 25%. In contrast, 759 stocks declined during the same period in 2022.

Worst-Performing Consumer Cyclical Stocks

EVgo’s 48.7% plunge made it the worst performer. The firm was 8 percentage points away from reversing its gains from the first quarter, during which it rose 57%. The electric vehicle charging network provider’s stock declined after competitor Tesla TSLA announced collaborations with General Motors GM and Ford Motor F as both automobile manufacturers expand their offerings in the EV market. Morningstar equity analyst Brett Castelli expects the GM-Tesla collaboration to be a long-term negative for EVgo.

Morningstar dropped coverage of Advance Auto Parts on June 7, but the firm’s 41.5% loss was the second-worst performance among U.S.-listed stocks we covered this quarter. The stock plummeted 35% after the company reported its first-quarter results on May 31. Its earnings of $0.72 per share were significantly below FactSet’s mean estimate of $2.56.

Revolve Group RVLV recorded a second-quarter loss of 37.6%, reversing its first-quarter gain of 15.1% and exceeding its year-to-date loss of 26.3%. Inflation-wary consumers and macro pressures led the fashion retailer’s profits to wrinkle. The company’s first-quarter results were mixed, with sales falling short of Morningstar equity analyst Sean Dunlop’s estimate but with earnings per share surpassing his forecast.

Singapore-based internet retail company Sea’s SE 32.9% loss made it the 10th-worst performer. The outcome showcases the stock’s volatility, given how during the previous quarter its 66.1% gain ranked it 10th on our list of the best-performing stocks. The stock fell as a decline in gross merchandise value overshadowed those earlier signs of profitability.

Concern about slowing growth for future air bookings hit Sabre SABR following the release of its first-quarter results, as the company’s shares declined 25.6% in the second quarter. Assessing the travel technology provider, Morningstar senior equity analyst Dan Wasiolek writes that against a backdrop of persisting inflation, tightening credit availability, and a declining consumer saving rate of disposal income, “the risk of softer economic growth during the next year remains, and numerous nontravel consumer-related companies point to strained demand.”

With its second quarter down 24%, Etsy ETSY presented mixed results, with better-than-expected sales but lower-than-expected earnings per share. Additionally, as the e-commerce platform struggles with its apparel resale subsidiary Depop, it will not return to 20% operating margins for another three years—one year later than Dunlop expected.

Under Armour UAA continued to struggle, failing to gain the upper hand in the sportswear market with lackluster product performance. The apparel company has seen little change in sales figures while demand has dragged, leading its stock to fall 23.9% in the second quarter.

With a 23.6% second-quarter drop in its stock, luxury fashion group Capri Holdings CPRI continued its trend of declining sales from 2016 amid store closures, weakening categories, and reduced product distribution.

Worst-Performing Consumer Cyclical Stocks of Q2 2023

Worst-Performing Communication Services Stocks

Bilibili’s BILI 35.7% loss this time around made it the worst among the U.S.-listed communications services stocks covered by Morningstar analysts. Morningstar senior equity analyst Ivan Su writes that while the China-based video-sharing platform’s business model sets it up for growth and is ahead of relevant media-related markets, he is less confident about Bilibili’s outlook “due to weak competitive positioning, low barrier to entry, and numerous existing competitors.”

AMC Networks AMCX continued to grow its flagship cable television channel with the production of strong original content such as “Better Call Saul” and monetizing such programs for third-party streaming platforms. But the media holdings company’s library is not exclusive to its own streaming service. With richer competitors challenging the firm’s ability to thrive, AMC ended its second quarter down 32%.

Shares of Dish Network fell 29.4% as the television and mobile wireless service provider accrued debt and investors grew concerned about it potentially filing for bankruptcy. Dish co-founder and chair Charlie Ergen has opted to promote the firm’s “wireless capabilities to calm the debt market than undertaking a major financing transaction,” says Michael Hodel, director of communications services equity research at Morningstar. Still, the company lost 81,000 customers during its first quarter and reported a 3% decline in revenue per customer versus the previous year.

The catalyst for Paramount’s 28.5% loss in the second quarter was the results of its first quarter, during which the company had a net loss of $1.16 billion. With revenue and earnings per share expectations missed, revenue growth expected to slow, and competition from companies such as Roku ROKU and Netflix NFLX, the media conglomerate’s stock declined 28.4% on the date of release.

Worst-Performing Communication Services Stocks of Q2 2023

More of the Worst-Performing Stocks of Q2 2023

Other stocks that suffered major losses during the second quarter include GDS, Tandem Diabetes Care TNDM, and Tilray Brands TLRY. GDS’ 41.1% decline made it the third-worst performer among the U.S.-listed stocks covered by Morningstar analysts this quarter.

Despite the strong response to the introduction of Tandem’s insulin pump into the market, Morningstar senior equity analyst Debbie S. Wang says the medical device manufacturer still struggles to establish itself as a major competitor and become profitable. With the company’s misses in its first-quarter results, Tandem lost 39.6% in the second quarter.

Although Tilray ended the fourth quarter of its fiscal year in May, the pharmaceutical company lost 38.3% in the second quarter of the calendar year. The firm issued $150 million of 5.2% unsecured convertible senior notes and said it may also dispense an additional $22.5 million to cover over-allotments. Proceeds would be used in part to refinance the near-term maturities due this year and in 2024. But Morningstar ESG equity strategist Kirstoffer Inton says that “with the maturities nearing, the company left itself little time and could no longer wait to refinance the notes.” On the same day that Tilray announced the move, its stock plummeted 21%.

Another major decliner was Catalent CTLT, which delayed the release of its first-quarter results amid uncertainty and reduced guidance, leading the pharmaceutical company to lose 34% in the second quarter. And although it shared good news for its trading volume, MarketAxess Holdings’ MKTX lower-level credit transaction fees amid rising interest rates led the electronic trading platform’s stock to fall 33% by quarter’s end.

Q2 2023 Worst-Performing Stocks

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JYGMFDSZ6ZCJJKNOD2CMBUGOOM.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_4b82c3dc40354f6f812c5eab796cbf3e_name_file_960x540_1600_v4_.jpg)