Why We Expect the Job Market’s Slowdown to Renew in 2024

Our latest economic forecast for employment growth, wage growth, and labor force participation.

Summary

- The postpandemic excesses of the US job market are largely gone.

- We expect a slowing of job growth until late 2025 in response to falling gross domestic product growth. By 2026, the unemployment rate will rise around 1 percentage point compared with its 2023 average level.

- Wage growth is still slightly above levels consistent with 2% inflation, but it should return fully to normal as job growth slows.

- Job growth should recover from 2026 to 2028 in tandem with GDP growth. But the job market will remain in balance.

What’s Next for the Job Market?

The postpandemic excesses of the US job market have largely subsided.

The frantic search for workers has faded. The job openings rate had soared to 7.2% in the first quarter of 2022 (up from a 4.5% average in 2019) but has averaged just 4.9% in the past three months. Likewise, rampant turnover and job hopping (which we dubbed “the Great Reshuffling”) is over. The quits rate is back to prepandemic levels.

Job growth is still fairly healthy, but this is as much a product of expansion in labor supply as it is labor demand. Thus, wage growth continues to slide downward, though it’s still slightly above the rate consistent with 2% inflation.

But before the job market converges to a stable long-run equilibrium, we do see one more speed bump ahead. We expect a renewed slowdown in job growth from now until the end of 2025, with a commensurate uptick in unemployment.

A job slowdown will be caused by (and self-reinforce) the slowdown in GDP growth that we expect over the same time period. In our latest Economic Outlook, we detail that we expect real gross domestic product growth to slow in 2024 and 2025 versus the solid 2.5% growth posted in 2023. We expect GDP growth to trough at 1.4% in 2025 on an annual average basis.

As GDP growth rebounds from 2026 to 2028, we expect job growth to rebound, though not returning to anything like the overheated state seen in 2021 and 2022.

How Is the Current US Job Market?

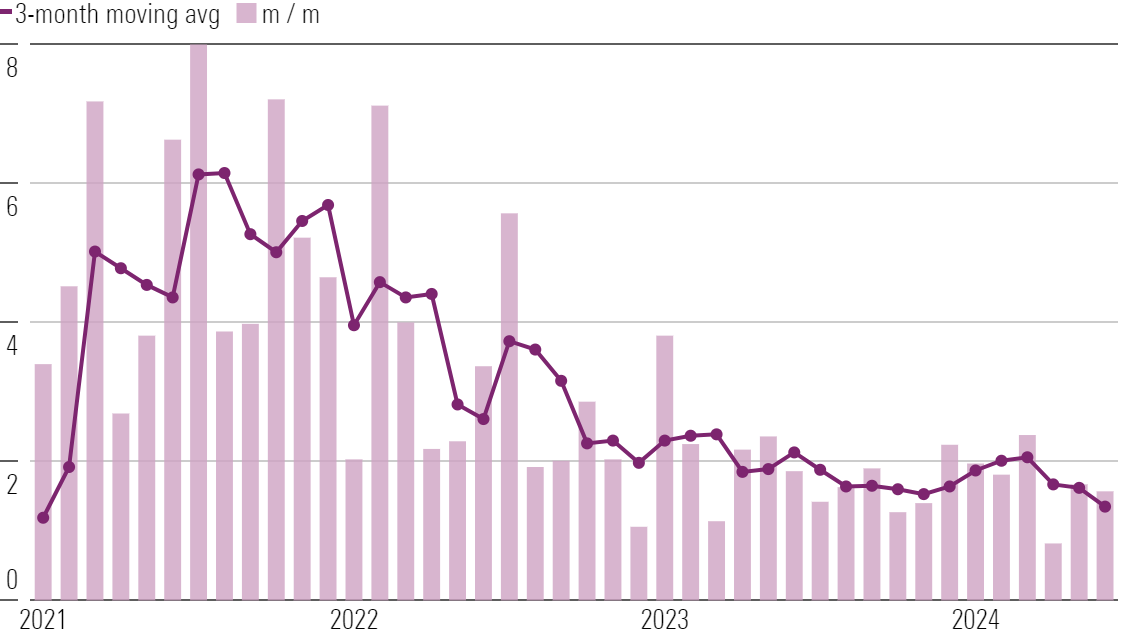

The latest jobs report presented somewhat of a bearish signal. Nonfarm payroll employment growth was 1.4% annualized in the three months ended in June 2024, down from 2.1% in the three months ended in April. That’s the slowest rate since January 2021. While June jobs gains beat expectations slightly, April and May jobs gains were revised down substantially.

Nonfarm Payroll Employment, % Growth (Annualized)

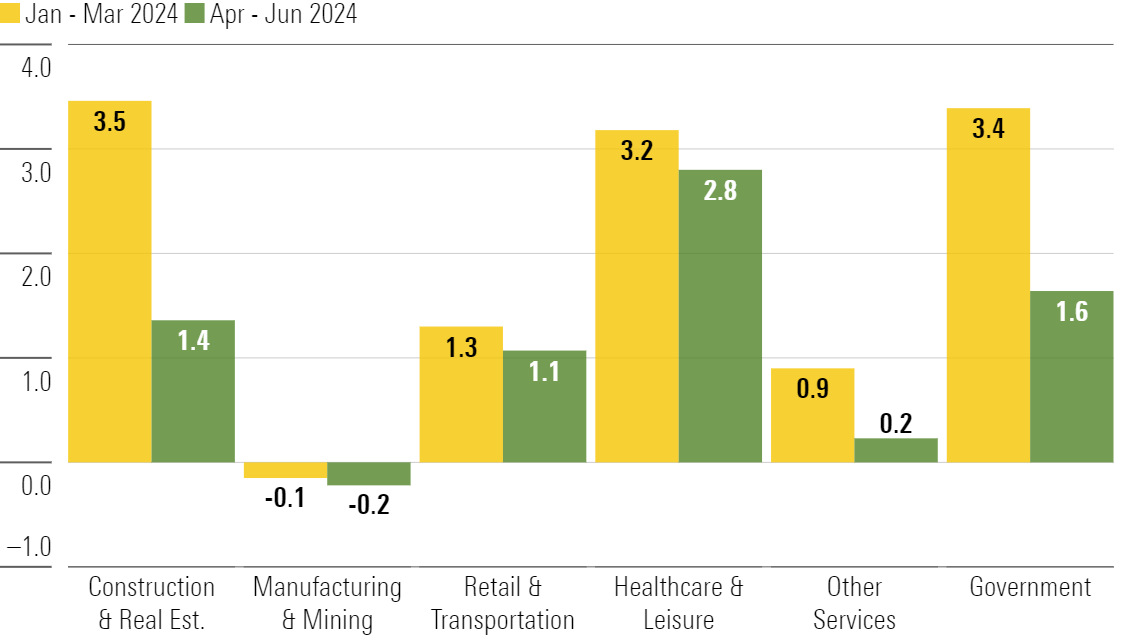

At the industry level, the slowdown in hiring in the past three months has been driven by government (slowing from 3.4% to 1.6% growth) as well as construction and real estate (slowing from 3.5% to 1.4%). It’s not surprising that construction job growth is slowing, as the strain of high interest rates is causing a renewed slowdown in housing and also beginning to weigh on nonresidential construction.

Employment by Industry Group, % Growth (Annualized)

Healthcare and leisure employment growth is still very strong. These industries shed their workforce during the pandemic but then struggled to rehire when consumer demand for these industries returned to normal over 2021-23. But employment in these industries is now well past prepandemic levels and has caught up to the recovery in consumer demand. So a slowdown in these industries should be coming.

What Is the Labor Market Outlook for 2024 and Beyond?

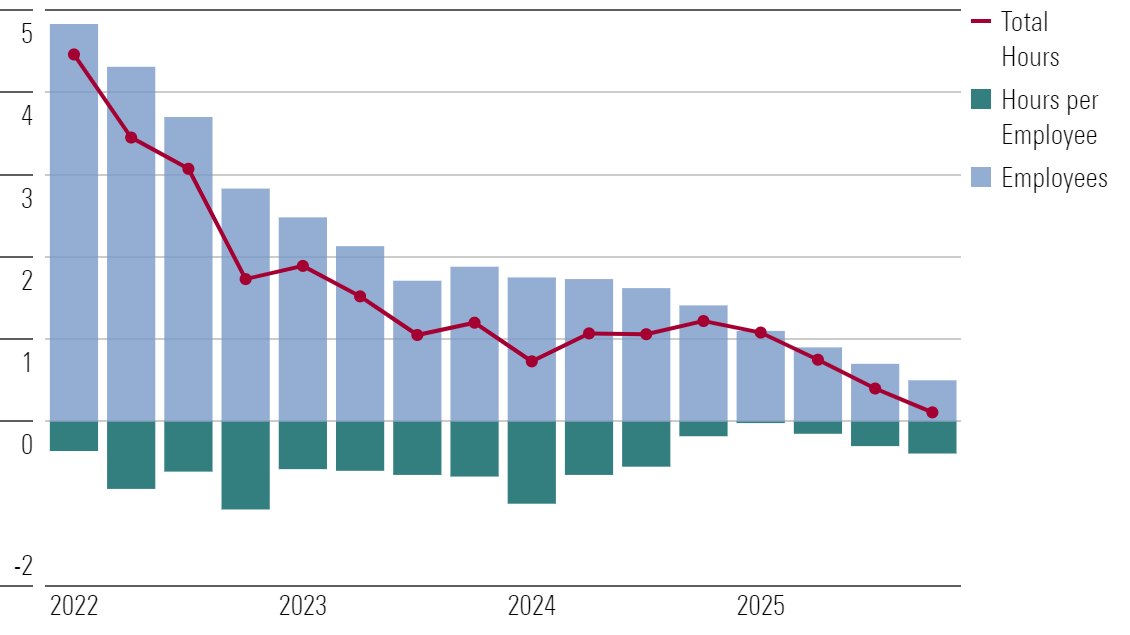

As of the first quarter of 2024, total hours worked were up 0.7% year over year. While employment was up 1.8% year over year, average weekly hours per employee was down 1%. Firms have been mitigating the growth in labor costs by cutting hours. But there’s little additional room to cut hours, so firms will have to resort to curbing growth in employment if they wish to reduce growth in labor costs in the near future.

Total Hours Worked, % Growth Year over Year

Indeed, we expect firms to move aggressively to slow growth in labor costs in response to slowing GDP growth over the next year. Thus, we expect employment growth to drop to 0.5% year over year by the fourth quarter of 2024.

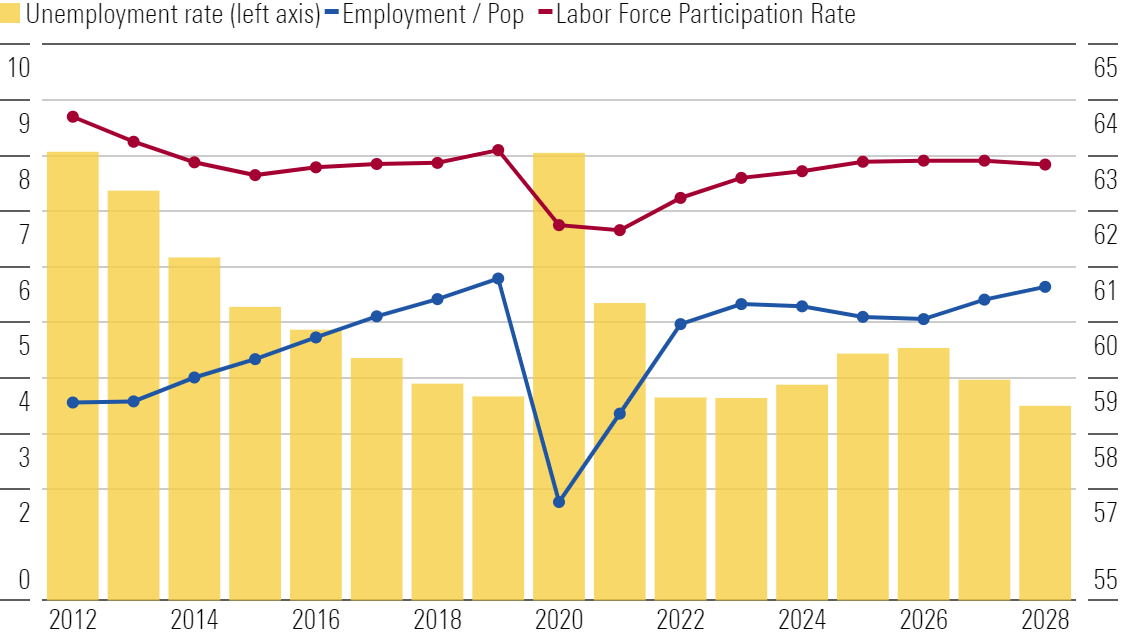

With labor supply continuing to expand briskly, that reduction in employment growth should compel a rise in unemployment. We expect the unemployment rate to rise from an average of 3.6% in 2023 to 3.9% in 2024, 4.4% in 2025, and 4.5% in 2026.

Labor Market Forecasts

As economic growth reaccelerates over the next couple of years, we expect the labor market recovery to resume, with the unemployment rate falling back.

We remain upbeat on labor force participation gains. Although the gains we expect after 2024 look modest, they’re actually quite optimistic when you consider aging demographics. All else held equal, aging demographics would be causing the labor force participation rate to gradually fall. But this should be more than offset by new entrants into the labor market.

We expect that widespread job availability will draw marginal participants back into the labor force. This process was already happening in the years before the pandemic.

We’re seeing early signs of this—for example, employers dropping unnecessary degree requirements from job postings and an increased willingness to train workers for skilled tasks. We see no reason that this trend won’t continue in the coming years.

What Do We Expect of Wage Growth in 2024?

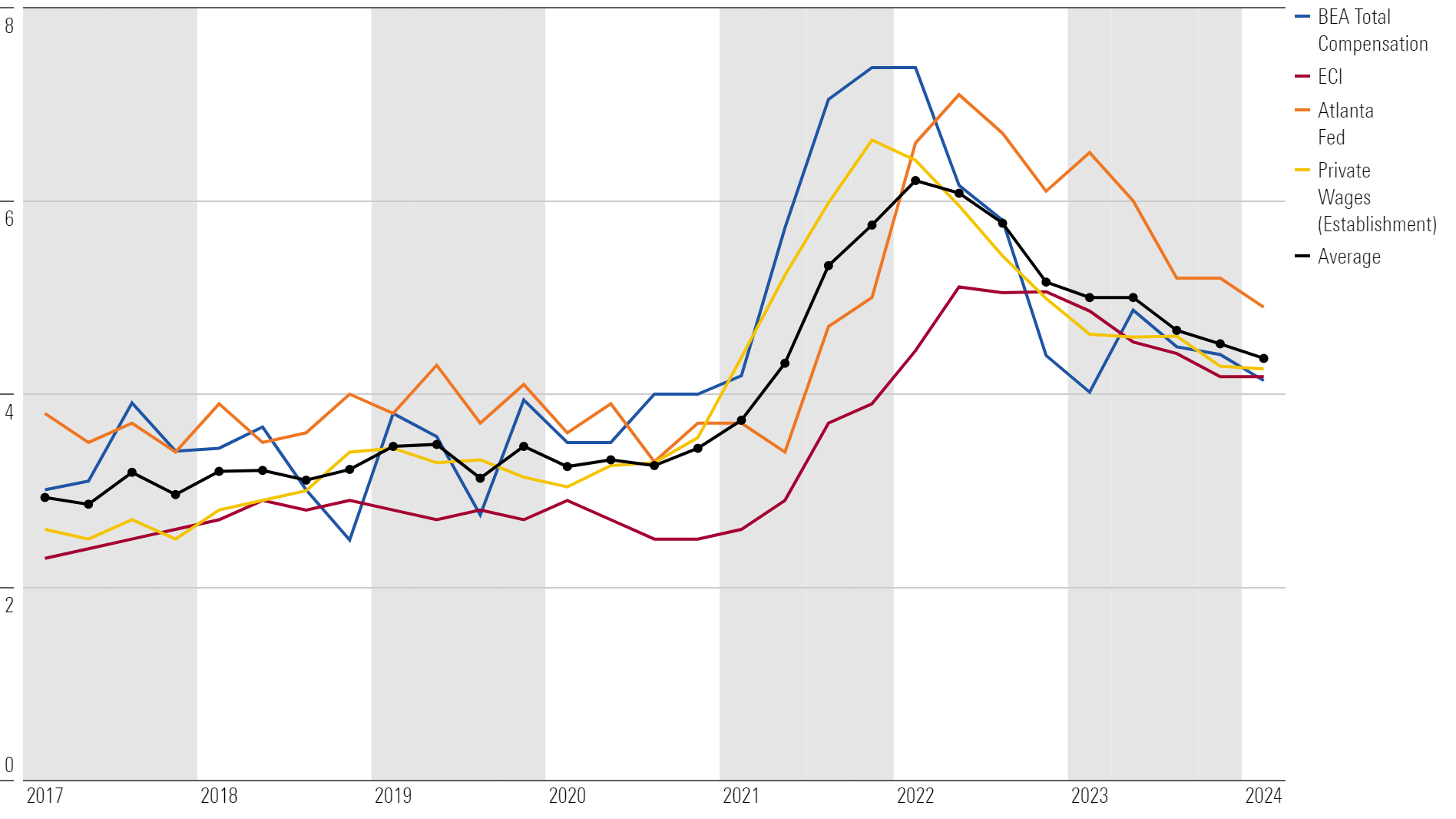

Our composite measure of wage growth still shows an overall downtrend, with growth at 4.4% as of first-quarter 2024, down from 5% a year ago and down 180 basis points from the peak in early 2022. Assuming productivity growth of 1.5% and a constant labor share of GDP, 4.4% wage growth is consistent with inflation running at 2.9%. That’s not too far above the Fed’s 2.0% target.

The labor market slowdown that we expect in later 2024 and 2025 should be sufficient to push wage growth fully back to normal, ensuring that inflation returns to 2%.

Wage Growth Measures, % Year Over Year

This article was compiled by Emelia Fredlick and Yuyang Zhang.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)