Markets Brief: What Fewer Rate Cuts Could Mean for Stock Valuations

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Last week was characterized by strong economic data, weaker asset prices, and guidance from the Federal Reserve to investors that they should moderate expectations of near-term cuts in interest rates. Correspondingly, the estimated probability among investors of at least four quarter-point rate cuts by the close of 2024 has fallen from 49.7% a month ago to 21.4% at the end of last week, according to CME FedWatch. Investors can be slow to incorporate new information, so we may not see the impact of this change in expectations immediately, but it will likely act as a headwind to further rises in the valuation of stocks.

What Will Interest Rates Do?

As expectations of falling interest rates diminished, government bond yields continued to climb, with the 2-year Treasury yield rising to 4.76% by the end of the week. While the path of inflation and interest rates is naturally uncertain, for Morningstar’s view, check out senior US economist Preston Caldwell’s second-quarter outlook here.

QT Has Replaced QE

Alongside the management of interest rates, a key challenge for the Fed is unwinding the quantitative easing used to support asset prices and economic activity over the last 15 years—a process known as quantitative tightening. While many commentators believed easing was necessary, addressing its consequences could significantly impact asset prices. Morningstar Wealth’s Marta Norton devoted a recent column to the topic.

Energetic Stock Prices

Investors welcomed higher-than-expected employment growth on Friday. Another bright spot was the gain in the prices of energy companies, with the Morningstar US Energy Index up 3.69% over the week and 17.42% over the year to date. This places the index well ahead of the Morningstar US Technology and Communication Services Index (up 12.44% in the year to date), dominated by admired companies such as Microsoft MSFT, Apple AAPL, and Nvidia NVDA. This is an important reminder that the most popular companies do not always deliver the highest returns. Morningstar analysts continue to see attractive opportunities in this part of the market. Energy analyst Stephen Ellis provides his views here.

The Earnings Game Starts Again

There will likely be lots of news this week, with the Consumer Price Index report on Wednesday, comments by several Fed presidents toward the end, and the start of quarterly results reporting. Financial services companies take the stage first, with JPMorgan Chase JPM, Citigroup C, Wells Fargo WFC, State Street STT, and Blackrock BLK all reporting on the same day. As usual, companies will try to lower expectations before their reports to create “surprises” that boost their stock prices.

While this tedious game is what passes for entertainment on Wall Street, it has little to do with investing. Rather, reporting season lets investors compare the latest results with their long-term investment theses. For investors who lack a thesis, earnings season primarily provides an opportunity to make mistakes through overreaction.

This Week’s Key Market and Investing Events

- Wednesday, April 10: March Consumer Price Index report

- Thursday, April 11: March Producer Price Index report

- Friday, April 12: Q1 earnings season starts with reports from BlackRock, JPMorgan Chase, Wells Fargo, and Citigroup

Check out our weekly calendar of economic reports and corporate earnings.

Stats for the Trading Week Ended April 5

- The Morningstar US Market Index fell 1.04%.

- The best-performing sectors were energy, up 3.66%, and communication services, up 0.90%.

- The worst-performing sector was healthcare, down 3.03%.

- Yields on 10-year US Treasury notes rose to 4.39% from 4.20%.

- West Texas Intermediate crude prices rose 3.25% to $86.69 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 166, or 24%, were up, two were unchanged, and 536, or 76%, were down.

What Stocks Were Up?

Dell Technologies DELL, Newmont NEM, Sabre SABR, ChampionX CHX, and Liberty Energy LBRT.

Best-Performing Stocks of the Week

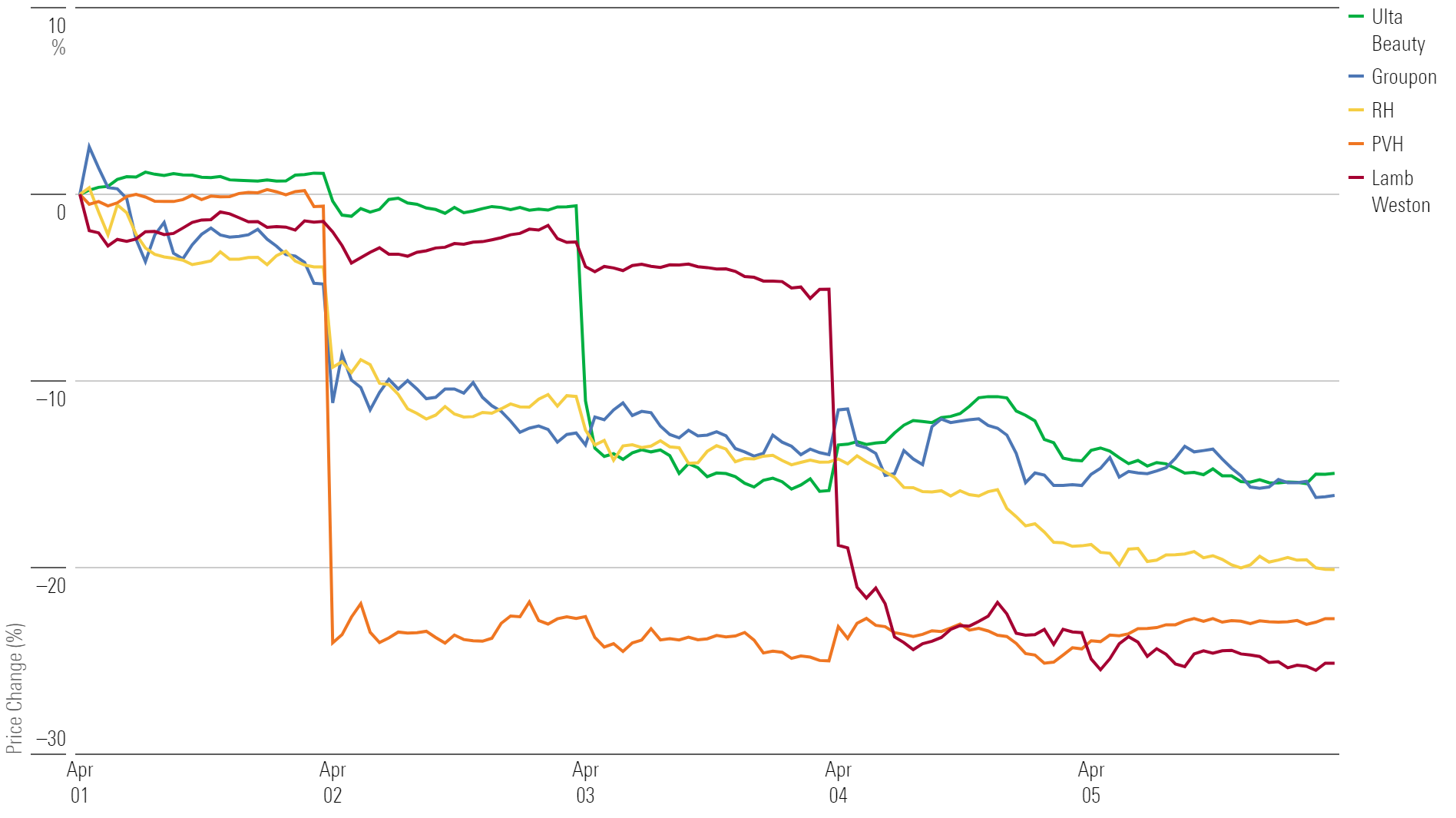

What Stocks Were Down?

Lamb Weston LW, PVH PVH, RH RH, Groupon GRPN, and Ulta Beauty ULTA.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)