Morningstar Market Insights: Central Banks, Inflation, and Patient Investing

A look at key market and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Central banks were the focus of investors’ attention last week. The Federal Reserve conformed with expectations, maintaining interest rates at their current level. In the accompanying press conference, Fed Chair Jerome Powell encouraged investors to expect three rate cuts this year, in line with current market expectations.

End of an Era in Japan

In contrast, the Bank of Japan ended its eight-year policy of negative interest rates. This represents a significant policy shift and reflects the recent strength in the economy, higher inflation, and wage settlements. Japanese equities have benefited from this growth, with the Morningstar Japan Index rising 47% over the last year. However, this return has been diluted for US investors by the sharp fall in the Japanese yen relative to the US dollar, providing a stark reminder that when investing overseas, we must take account of currency changes as well as the prospects for the companies in which we invest.

Equity Prices Continue to Rise

Despite a fall on Friday, US equity prices rose over the week, with the Morningstar US Market Index finishing 2.31% higher—and 9.65% higher for the year to date. A key contributor to this gain was Nvidia, which rose 7.35% as investors reacted positively to its developer conference. You can read our Morningstar Equity Analyst take on the Nvidia announcements here.

Diversification Means Diversification

As US asset prices continue to rise above Morningstar analysts’ estimate of fair value, it is natural to look for alternatives that appear more attractively priced. However, it is important to remember that the reason some investments appear attractive is that they are behaving differently from those that are rising quickly.

While choosing more attractively priced assets can deliver higher returns—and often appears smart in hindsight—such assets are likely to remain uncorrelated in the near term and create considerable regret as assets one has sold continue to rise in price, while those that have been bought languish or fall further. Such disappointment can lead to poor decisions. It is therefore vital that investors seeking better value holdings have the patience to overcome this regret and understand that market trends do not turn simply because one has changed one’s mind.

Inflation and Fed in the Spotlight Again This Week

In a busy week of economic data, investors are likely to focus on Personal Consumption Expenditure inflation data on Thursday. This is expected to show a slight fall in “core” PCE (which removes volatile food and energy prices) to 0.3% from 0.4%. Investors will also be listening for confirmatory remarks from the five Fed governors and chairs (including Powell) due to give speeches this week. Signs of growing concern about inflation would likely to have a negative impact on asset prices.

For the Trading Week Ended March 22

- The Morningstar US Market Index rose 2.29%.

- The best-performing sectors were communication services, up 3.41%, and industrials, up 2.99%.

- The worst-performing sector was real estate, down 0.15%.

- Yields on 10-year US Treasury notes fell to 4.22% from 4.31%.

- West Texas Intermediate crude prices fell 1.37% to $80.82 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 539, or 77%, were up, five were unchanged, and 160, or 23%, were down.

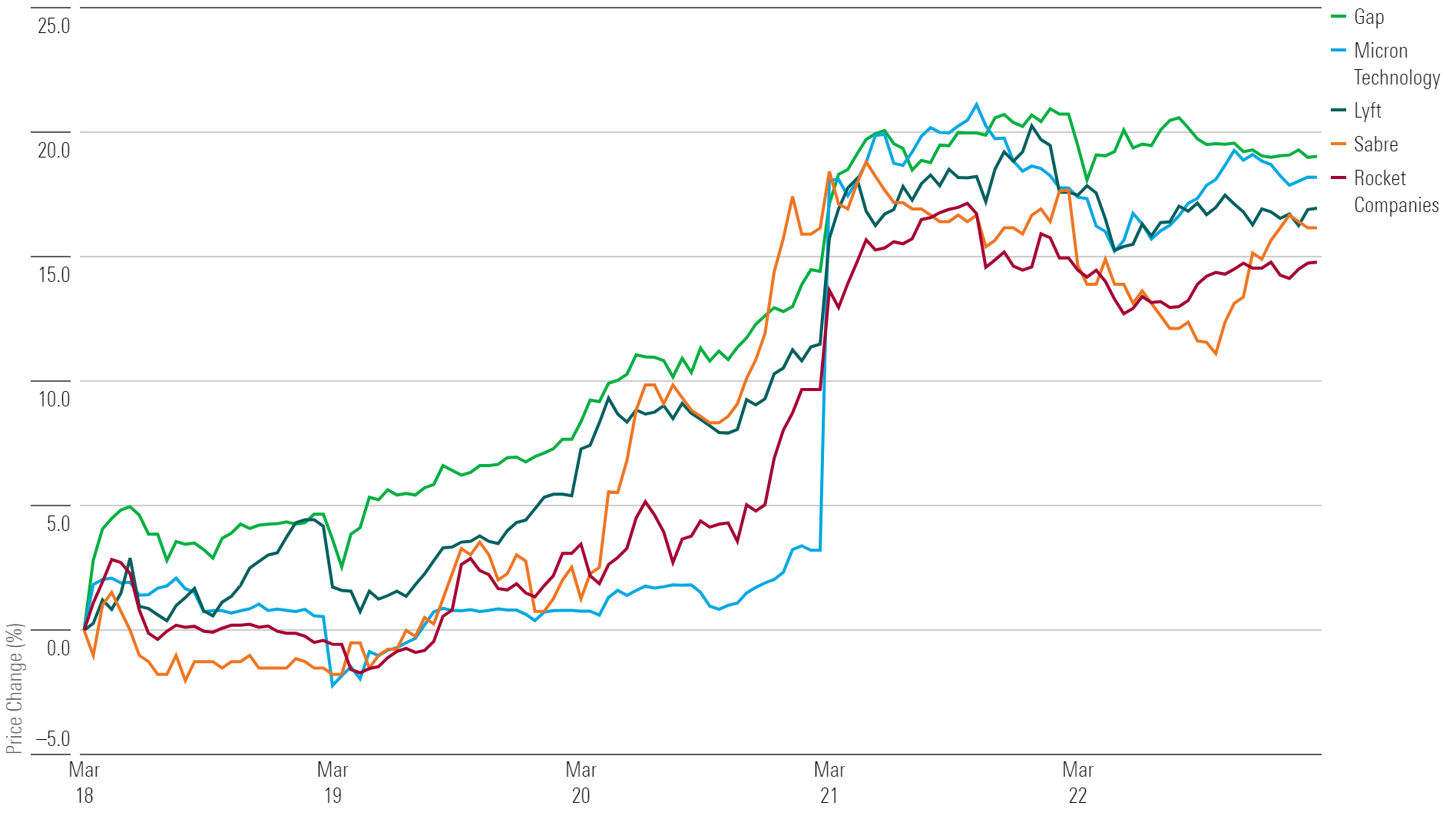

What Stocks Are Up?

Gap GPS, Micron Technology MU, Lyft LYFT, Sabre SABR, and Rocket Companies RKT.

Best-Performing Stocks of the Week

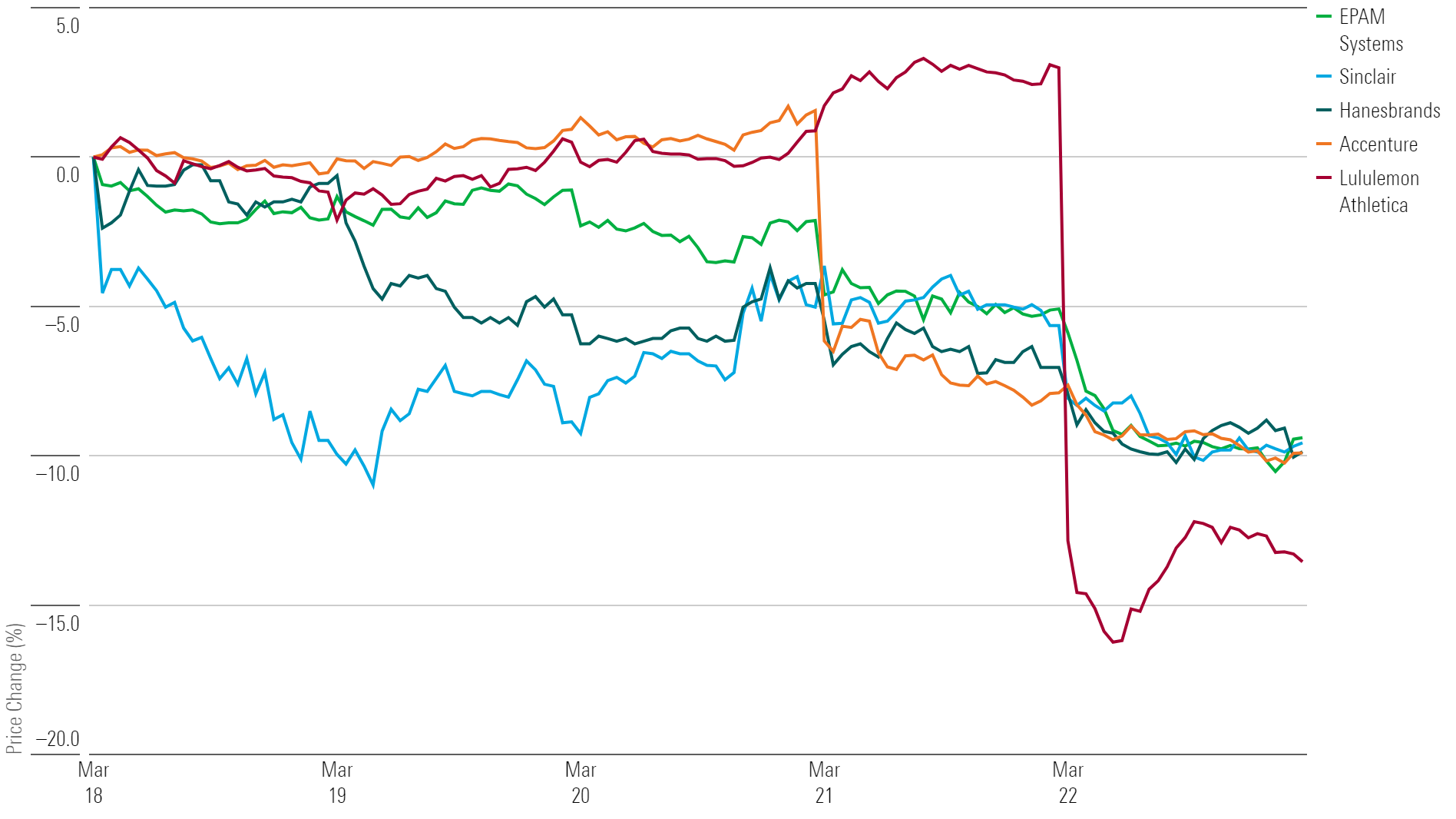

What Stocks Are Down?

Lululemon Athletica LULU, Accenture ACN, Hanesbrands HBI, Sinclair SBGI, and EPAM Systems EPAM.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)