Energy Stocks: OPEC’s Failure to Defend Oil Prices Has Created a Supply Glut, Hurting Performance

Our top picks in the energy sector are Schlumberger, TC Energy, and APA.

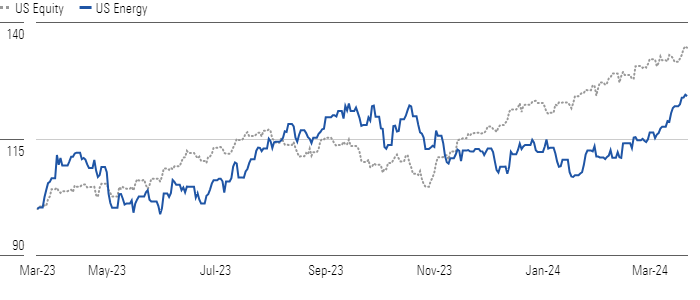

The near-term outlook for oil and gas remains weak amid soft pricing and declining rig activity. Consequently, we’re not surprised that energy stocks have underperformed the broader US market over the trailing 12 months. That said, the industry’s M&A outlook remains generally positive. The recent Diamondback-Endeavor deal consolidates more top-tier acreage within fewer key operators. It also allows Diamondback to once again implement its successful playbook of cutting costs and returning excess cash to shareholders.

Energy Underperforms Amid Oil Price Weakness

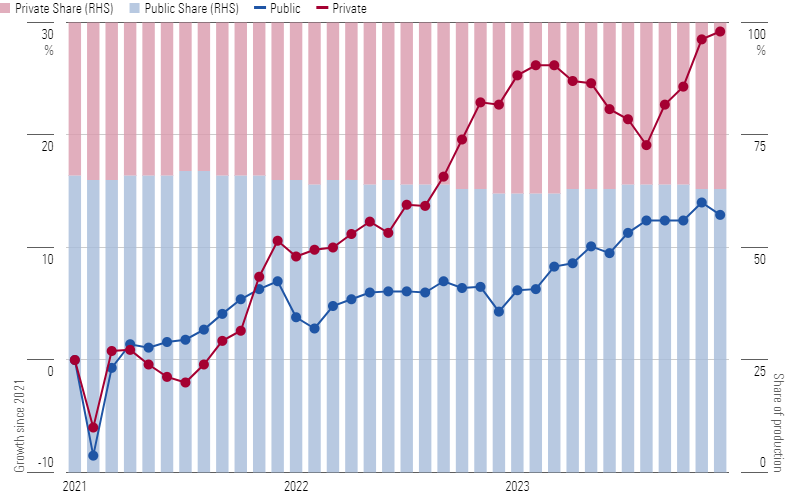

We think OPEC has failed to protect oil prices through supply cuts. The organization will likely have to extend and deepen voluntary cuts through 2024, more than it initially indicated. US mergers and acquisitions activity within the Permian, as well as associated production cuts, remain the most positive news for OPEC, since public producers are sharply cutting combined rig counts from growth-oriented private producers.

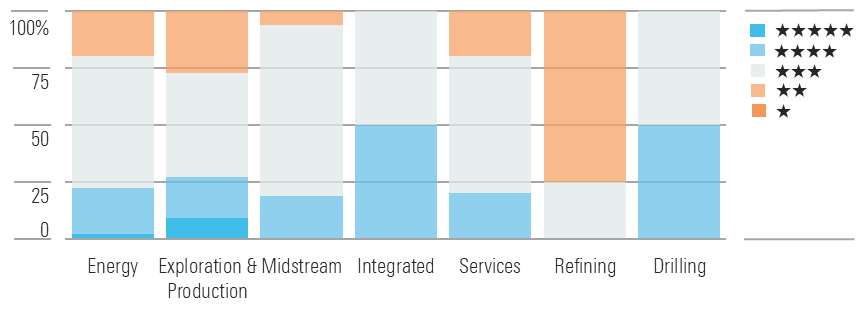

Integrated and Oil Services Have the Most Bargains In Energy

ExxonMobil recently delayed its Golden Pass terminal to 2025. We therefore don’t expect any material new US liquefied natural gas, or LNG, export terminals will enter service in 2024, which will delay demand from the Gulf Coast into 2025. Even so, the Biden administration’s pause on new LNG terminal approvals won’t affect under-construction terminals. In fact, we think LNG terminals will still double US LNG exports over the new few years. However, Asian and European LNG customers questioning US LNG export reliability will likely curtail prices.

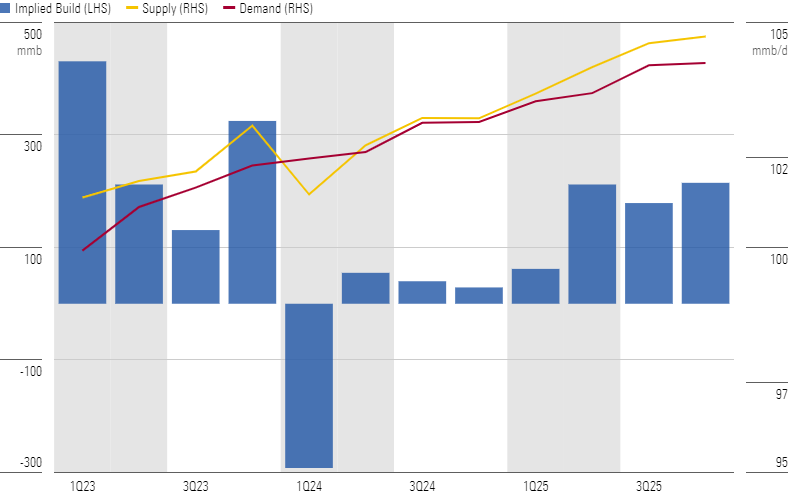

Private-Public M&A Flattens US Oil and Gas Production and Curtails Growth

The biggest takeaway from M&A activity is that the US production growth curve will flatten further. Public firms are largely seeking to maximize returning cash to shareholders, in sharp contrast to private entities, which were far more focused on growth. In 2023, US oil production increased by about 850,000 barrels per day. 2024 estimates are already falling rapidly, with 2024 growth of 150,000-400,000 barrels per day. For the rest of 2024, modest inventory builds support ongoing weakness in the oil market. Even with the extension of cuts from OPEC, it’s clear that they’re barely supporting a somewhat balanced oil market versus pushing deeply into undersupply territory and supporting prices closer to $100/bbl.

The Market Swings Back to Oversupply Amid Expected Inventory Builds

Top Energy Sector Picks

Schlumberger

- Fair Value Estimate: $60.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

High demand for oilfield services lends service firms a good deal of pricing power, which we expect will support margin expansion over the next few quarters. Schlumberger’s SLB leading-edge technological advancements continue to distinguish the firm from peers. Its myriad innovations consistently add value for customers, preserving its ability to command premium pricing over and above the currently favorable operating environment.

TC Energy

- Fair Value Estimate: $47.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

TC Energy TRP is dealing with multiple investor concerns: too-high debt, lingering worries over future impacts from the Coastal GasLink overruns, and skepticism over the planned 2024 liquids spinoff. In contrast, we think the completed CAD 5 billion-plus in asset sales, plus another CAD 3 billion in additional sales and CAD 1 billion in extravert optimization opportunities, provide plenty of capital to reduce debt. The liquids spinoff should be capitalized at 5 times debt/EBITDA, suggesting more leverage to be moved off TC Energy’s balance sheet. We believe the liquids spinoff will highlight the quality and growth opportunities available in the gas and power portfolios, including carbon capture and hydrogen.

APA

- Fair Value Estimate: $65.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

APA APA is hoping for a game changer with its exploration assets in Suriname. The firm has announced a string of promising discoveries, and it may have a final investment decision in 2024. We think the project will move forward and the market isn’t giving enough credit. Our fair value estimate assumes three production vehicles with 180 mb/d capacity. That pegs Suriname at a sizable percentage of APA’s equity, so we like the upside as a catalyst-driven name that might outperform in a challenging oil and gas price environment.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)