Markets Brief: There’s Good News for Investors in Rates Staying Higher for Longer

With the Fed believed to be readying another rate hike, bonds offer attractive yields even after inflation.

Check out our weekly markets recap at the bottom of this article, with a look at stocks making some of the past week’s biggest moves—including Wayfair and Tesla—as well as a calendar of the coming week’s economic and corporate news.

Friday’s June jobs report showed that the U.S. economy continues to hum along, cranking out new jobs at a solid pace.

With no sign of a recession in sight, bond traders believe the Federal Reserve will almost certainly increase the interest rate again at its meeting later this month. That’s a significant shift from a few months ago, when the bond market was anticipating rate cuts by the end of this quarter.

As always, it’s unclear exactly what path the economy and the Fed will be taking in the coming quarters. For now, at least, many in the markets say it’s looking more and more like investors will see interest rates stay high for a longer period.

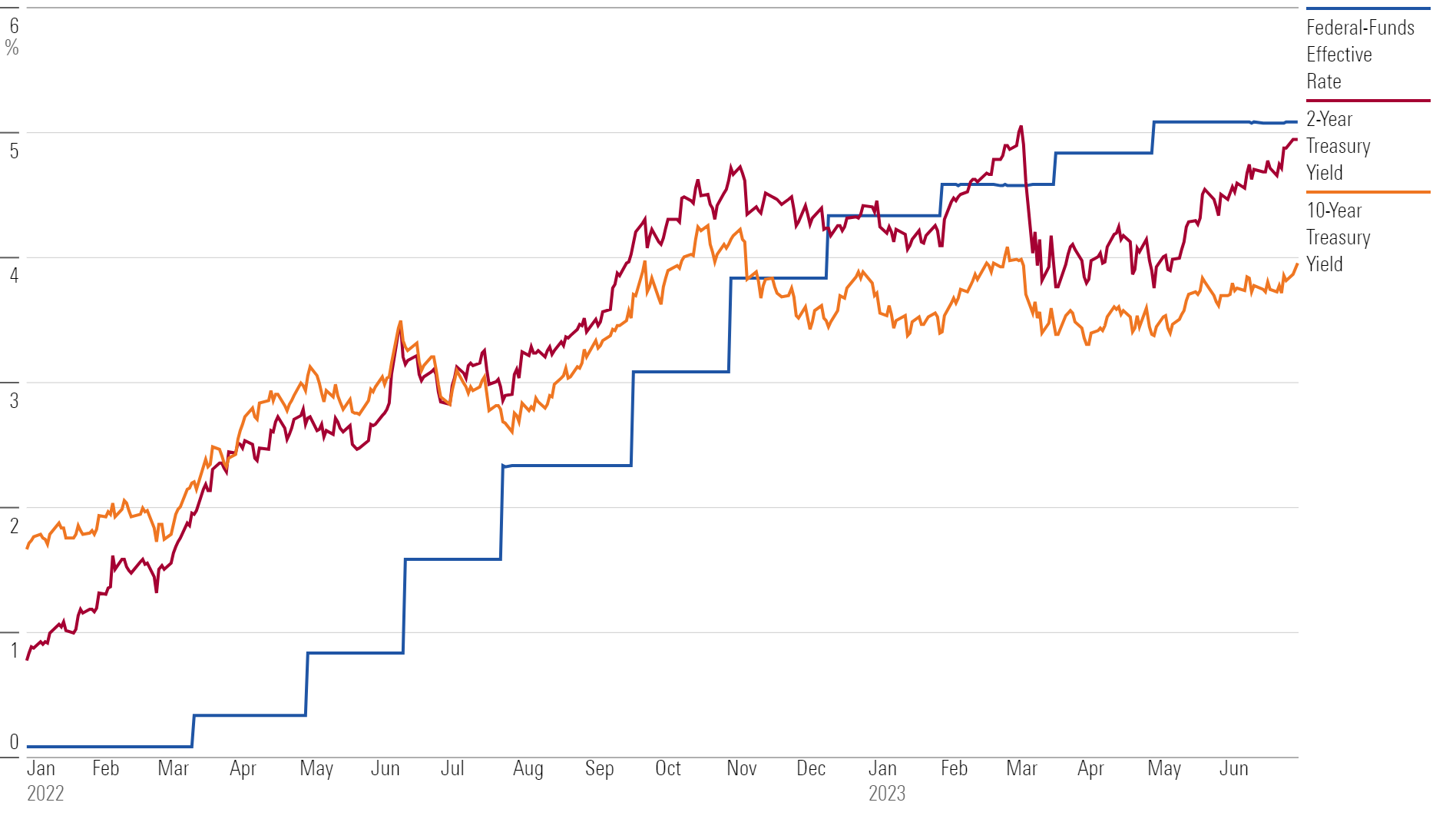

Treasury Yields and Federal Funds Rate

Not long ago, the prospect of the Fed tightening monetary policy was roiling both the bond and stock markets, but that dynamic has shifted. In fact, after 2022 brought some of the worst returns in history for bond investors, the current landscape seems to be cementing opportunities for them to lock in higher yields.

This sentiment was bolstered by Friday’s employment report, which showed that the economy added 209,000 new jobs during June—roughly in line with expectations for this hard-to-forecast report.

While the increase was smaller than some anticipated, “209,000 jobs is a perfectly healthy number,” says Joshua Jamner, investment strategy analyst at ClearBridge Investments. “Economic growth and activity seem to be slowing, but it’s still very healthy level.” He notes that from July 2018 through December 2019, when the unemployment rate was under 4%, the economy was averaging 155,000 new jobs a month.

Jamner says the Fed has “made it clear that they’re on a path toward raising rates in July, and there’s nothing I can see in this report that would say that they won’t move ahead with that.” From there, he thinks the Fed can position itself to evaluate whether it will raise rates again, either in September or at the meeting which concludes Nov. 1.

In the bond market, many strategists and money managers are saying a higher-for-longer landscape is offering a great opportunity for investors to add income to their portfolios.

U.S. Treasury two-year notes finished the week yielding roughly 4.95%. That’s just shy of their 2023 peak, but more impressively, two-year yields are holding at their highest levels since 2006, when they briefly crossed the 5% mark. One would have to look back to the 1990s to see a sustained time period when these notes last offered such yields.

Meanwhile, investors can earn an annualized yield north of 5% with three-month Treasury bills—levels last seen in 2006 and 2007.

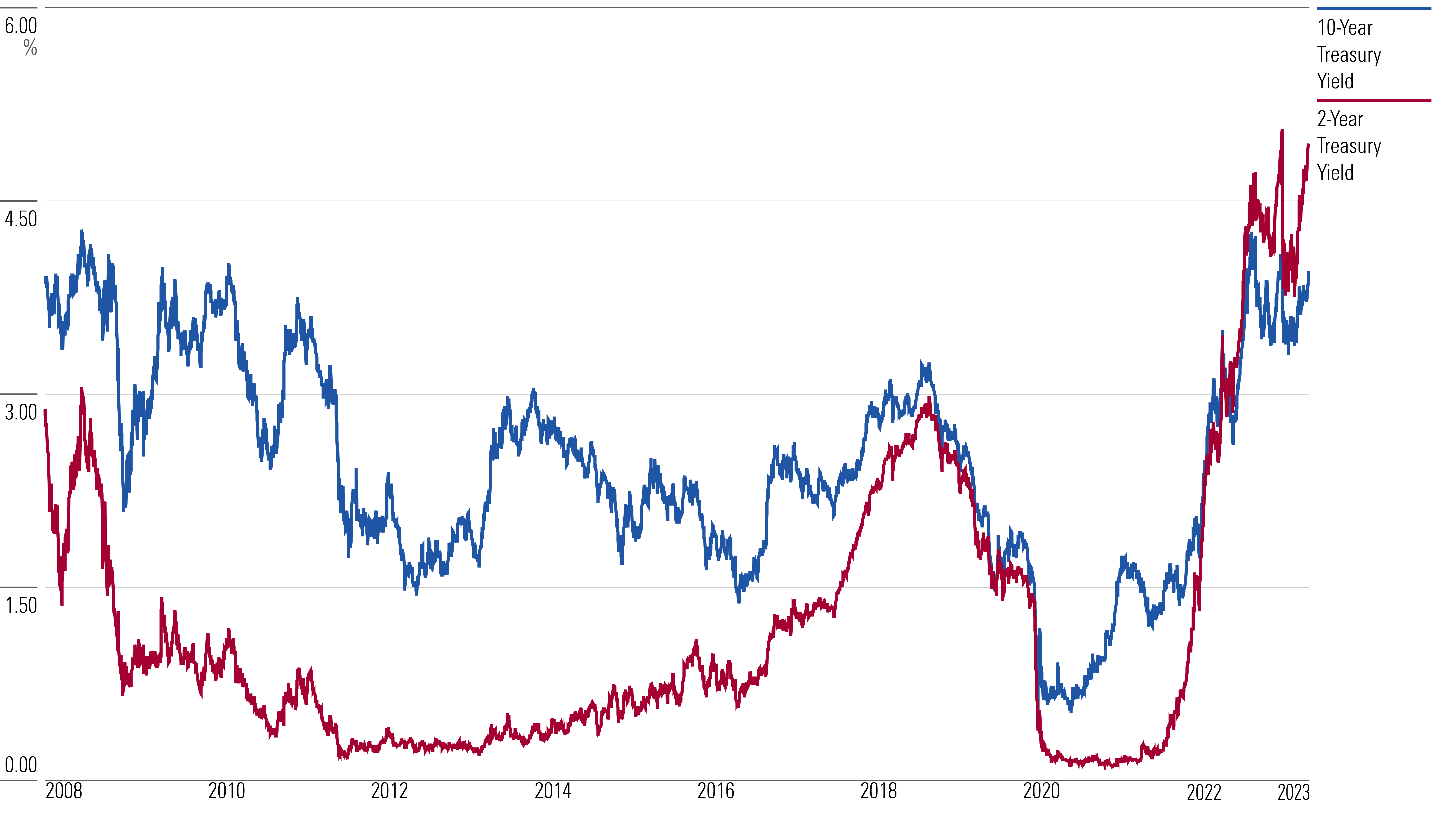

Treasury Yields

“Right now you’re getting good income out of fixed income,” says Katie Nixon, chief investment officer for wealth management at Northern Trust. Rates look attractive not just at an absolute level, but also on a “real” basis when comparing yields to expectations for inflation in coming years.

For example, inflation is expected to average 2.2% a year over the next five years, according to the five-year breakeven inflation rate. Meanwhile, an investor buying a U.S. Treasury five-year note would capture a 4.25% yield.

“Investors are getting compensated on a real basis after inflation in a positive way from their bond investments, and that hasn’t been the case for quite some time,” says Nixon.

The key for bond investors is that even if the Fed is seen raising rates a bit further, the end of the current cycle of increases is on the horizon unless there is a dramatic resurgence in inflation. While the Fed’s forecasts can easily change, it’s signaling that two more rate increases are on the horizon this year, along with modest rate cuts in 2024.

For investors who “have been avoiding fixed income because they’re afraid of rising rates, now is the time to revisit their fixed income portfolio,” says Nixon.

Candice Tse, global head of strategic advisory solutions at Goldman Sachs Asset Management, says that while yields on safe short-term bonds are “amazingly attractive,” investors should be looking to lock in current yields for longer time frames. “From our perspective, the way to look at fixed income right now is that investors should really be thinking about extending their durations,” she says.

“You’re going to find relatively secure yields as you look at longer-duration bonds,” Tse explains. “Especially in times when the Fed has finished their hiking cycle, that has been helpful for folks to think about.” In fact, she says that “being slightly early, before the end of the hiking cycle, helps generate more yield than waiting for the Fed to finish … so it’s better to start now.”

Tse’s base case has been for the Fed to raise interest rates one more time. “We’re looking for the Fed to continue to raise rates this month, probably by another 25 basis points,” she says. “Then after that, potentially holding and taking a pause” from additional rate increases.

Key Events Scheduled for the Coming Week

- Wednesday: June Consumer Price Index report. America Movil AMX reports earnings.

- Thursday: June Producer Price Index report. PepsiCo PEP, Conagra Brands CAG, Wipro WIT, Cintas CTAS, Delta Air Lines DAL, and Fastenal FAST report earnings.

- Friday: July Michigan Consumer Sentiment Index report. Telefonaktiebolaget L M Ericsson ERIC, BlackRock BLK, JPMorgan Chase JPM, UnitedHealth Group UNH, State Street STT, Wells Fargo WFC, and Citigroup C report earnings.

For the Trading Week Ended July 7

- The Morningstar US Market Index fell 0.6%.

- The best-performing sectors were energy and communication services, both up 0.4%.

- The worst-performing sectors were healthcare, down 2.4%, and basic materials, down 1.3%.

- Yields on 10-year U.S. Treasuries increased to 4.05% from 3.81%.

- West Texas Intermediate crude prices rose to $73.86 per barrel from $70.64 per barrel.

- Of the 848 U.S.-listed companies covered by Morningstar, 290, or 34%, were up, and 558, or 66%, were down.

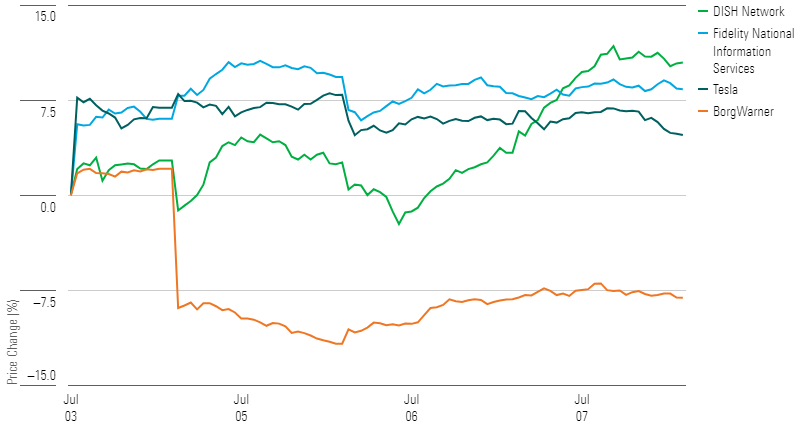

What Stocks Are Up?

Dish Network DISH stock increased following news about a potential merger with satellite communication services provider EchoStar SATS. Semafor reported that Charlie Ergen, who is the chair of both companies, wants to combine them, 15 years after EchoStar had spun out of the television provider. The move would steer Dish away from declining business as investors have been concerned about the firm filing for bankruptcy.

Fidelity National Information Services FIS stock moved higher after the company announced plans to sell a 55% stake in merchant acquirer Worldpay. The private equity firm GTCR will acquire the financial technology firm’s stake with an upfront value of $17.5 billion and an opportunity to another $1 billion later based on GTRC’s returns. In exchange, Fidelity will receive $11.7 billion in proceeds upfront, and the firm anticipates using it to reduce leverage to 2.5 times debt.

Tesla TSLA stock jumped after the company released data on second-quarter vehicle production and deliveries ahead of its earnings announcement on July 19. The automotive company achieved a new delivery record high of 466,140 vehicles, up more than 80% from the same period last year. Morningstar strategist Seth Goldstein notes that Tesla is on track to meet his 2023 annual deliveries forecast.

BorgWarner BWA stock rose after the automotive supplier completed the spinoff of its fuel system and aftermarket segments. The separation was initiated in 2021 when the company announced a plan to focus on electrification, which would involve disposing between $3 billion and $4 billion in combustion-related revenue by 2025. The two segments became Phinia PHIN, a single entity that made its public debut on July 5, gaining 22.3%.

Highlighted Advancers

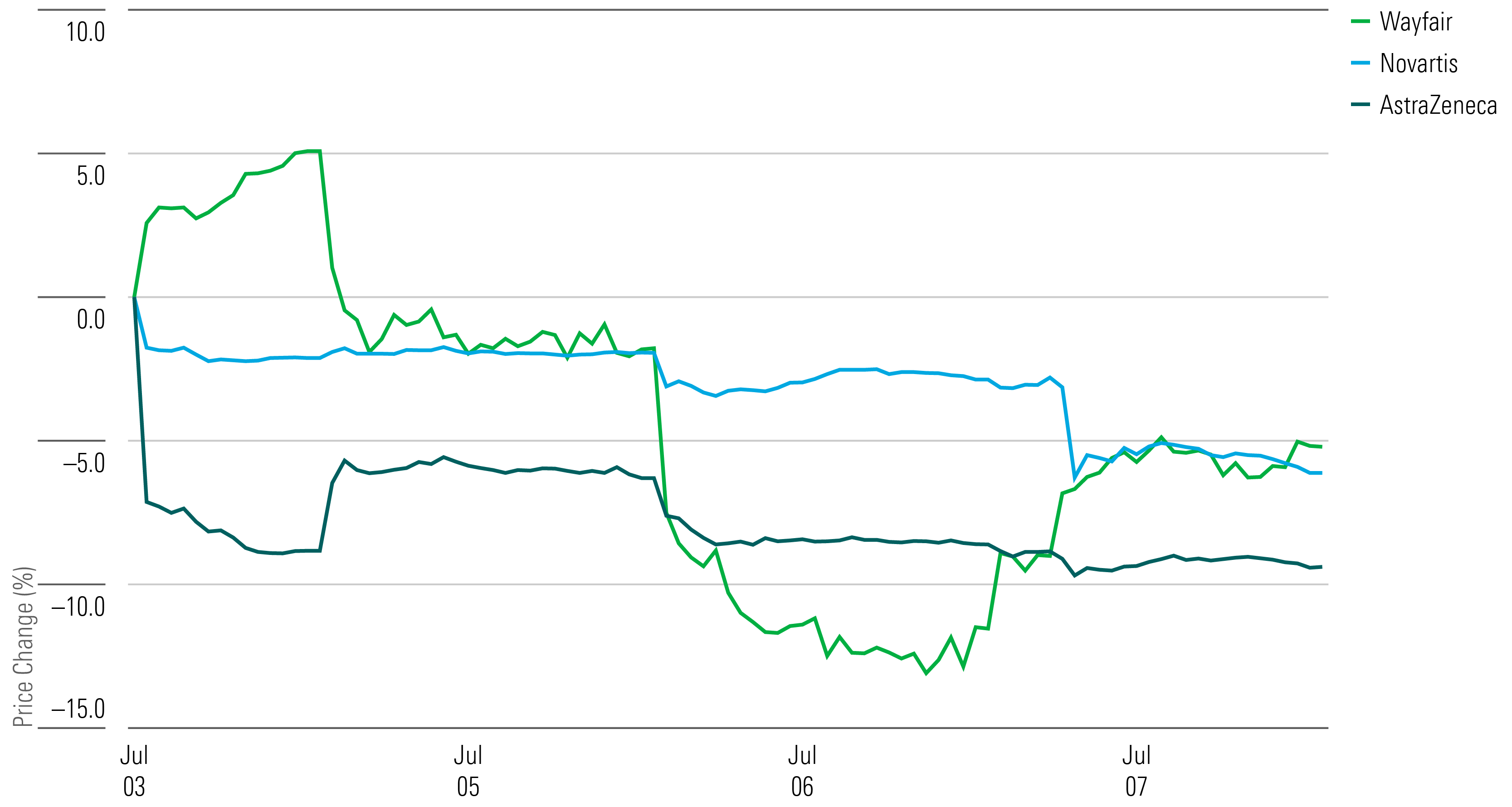

What Stocks Are Down?

Wayfair W stock fell after several executives—including the co-chair, chief financial officer, and chief operating officer—disclosed selling their shares in the company. Although Wayfair has taken measures to improve its profits and reduce costs, Morningstar senior equity analyst Jaime M. Katz says the company struggles against competitors who are pushing for faster delivery: “Given Wayfair’s lifecycle position, with significant growth potential but also corresponding expenses to achieve market share gains, we expect returns on invested capital to be volatile.”

AstraZeneca AZN stock declined in reaction to the mixed results of the pharmaceutical company’s lung cancer treatment research. The data showed the firm’s treatment fared better than chemotherapy in progression-free survival, but it did not show an overall survival benefit. “The lack of an overall survival benefit and potentially some unclear side effects mentioned by the firm are likely causing pressure on the stock,” says Damien Conover, director of healthcare equity research at Morningstar. “However, given our more moderate outlook for the drug, we see the market reaction as overdone.”

Shares of the Switzerland-based pharmaceutical company Novartis NVS declined after it lost a U.S. patent case for the heart failure Entresto. Novartis said the drug produced the second-largest number of sales for the company in 2022 and accounted for $1.4 billion in revenue in the first quarter of 2023. The firm sought to prevent other companies from producing a generic version.

Highlighted Decliners

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)