Fed Seen On Track to Raise Rates After Solid June Jobs Report

Despite some moderation of hiring, the labor market is tighter than the regulator would like.

The jobs market remained solid heading into midyear, as hiring continued at a healthy clip in June. As a result, the Federal Reserve is believed to be on track to announce another interest-rate increase this month.

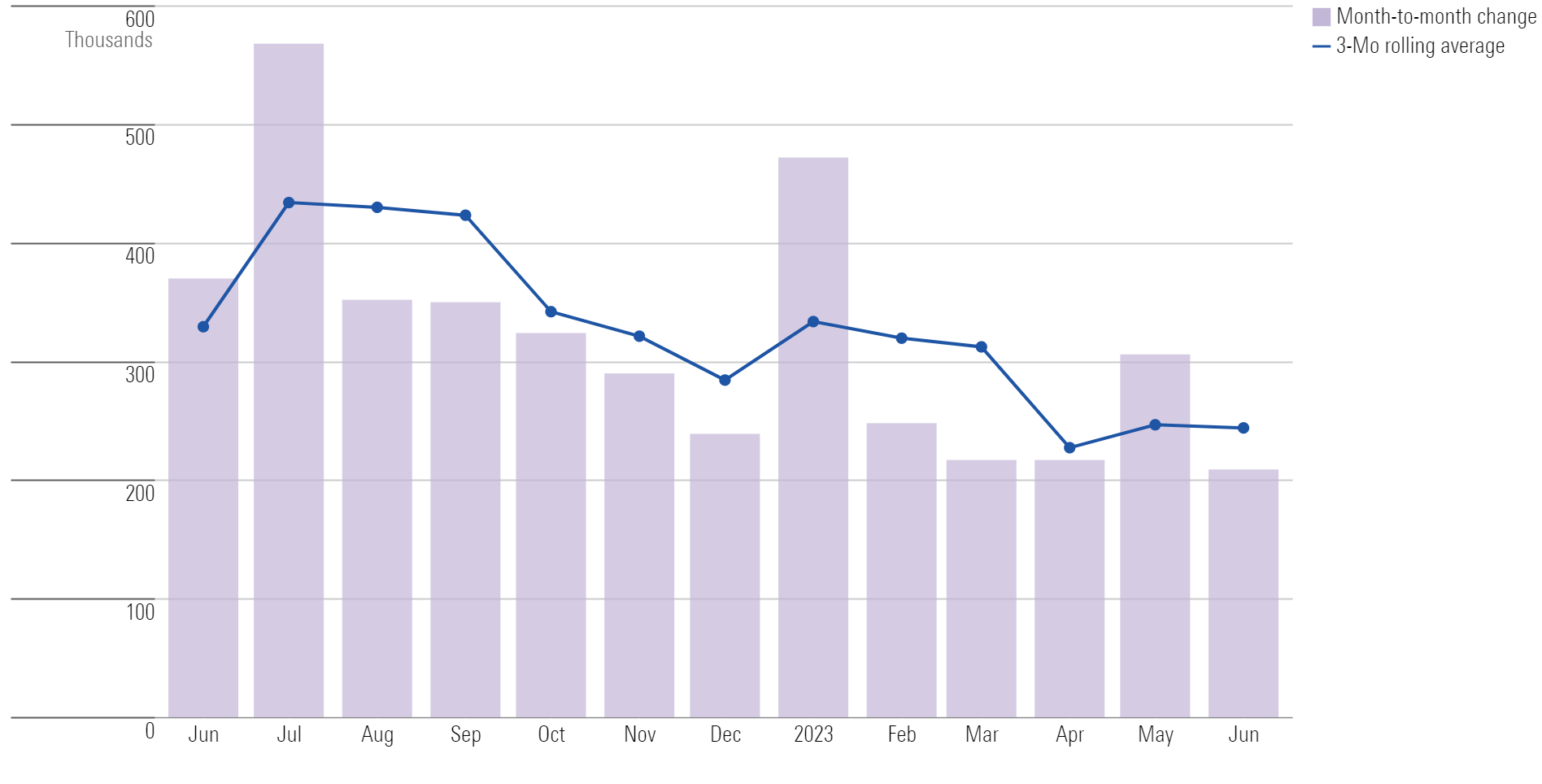

While the government’s report revised down estimates for new job creation in April and May, the pace of hiring through 2023 has been remarkably stable, with the unemployment rate at historically low levels and upward pressure on wages continuing to reflect a tight job market.

Against this backdrop, it is expected that when the Fed meets on July 25-26, it will raise its federal-funds rate target by another quarter of a percent. The regulator previously paused rate hikes at its June meeting.

The June jobs report from the Bureau of Labor Statistics showed that total nonfarm payrolls rose by 209,000, roughly in line with economists’ expectations.

“Job growth does appear to be inching downwards, but it’s still higher than the Fed is targeting,” says Morningstar chief U.S. economist Preston Caldwell. “Today’s report provides no reason to dissuade the Fed from hiking the federal-funds rate.”

June Jobs Report Key Stats

- Total nonfarm payrolls rose by 209,000, versus a revised 306,000 in May.

- The unemployment rate edged down to 3.6% from 3.7% in May.

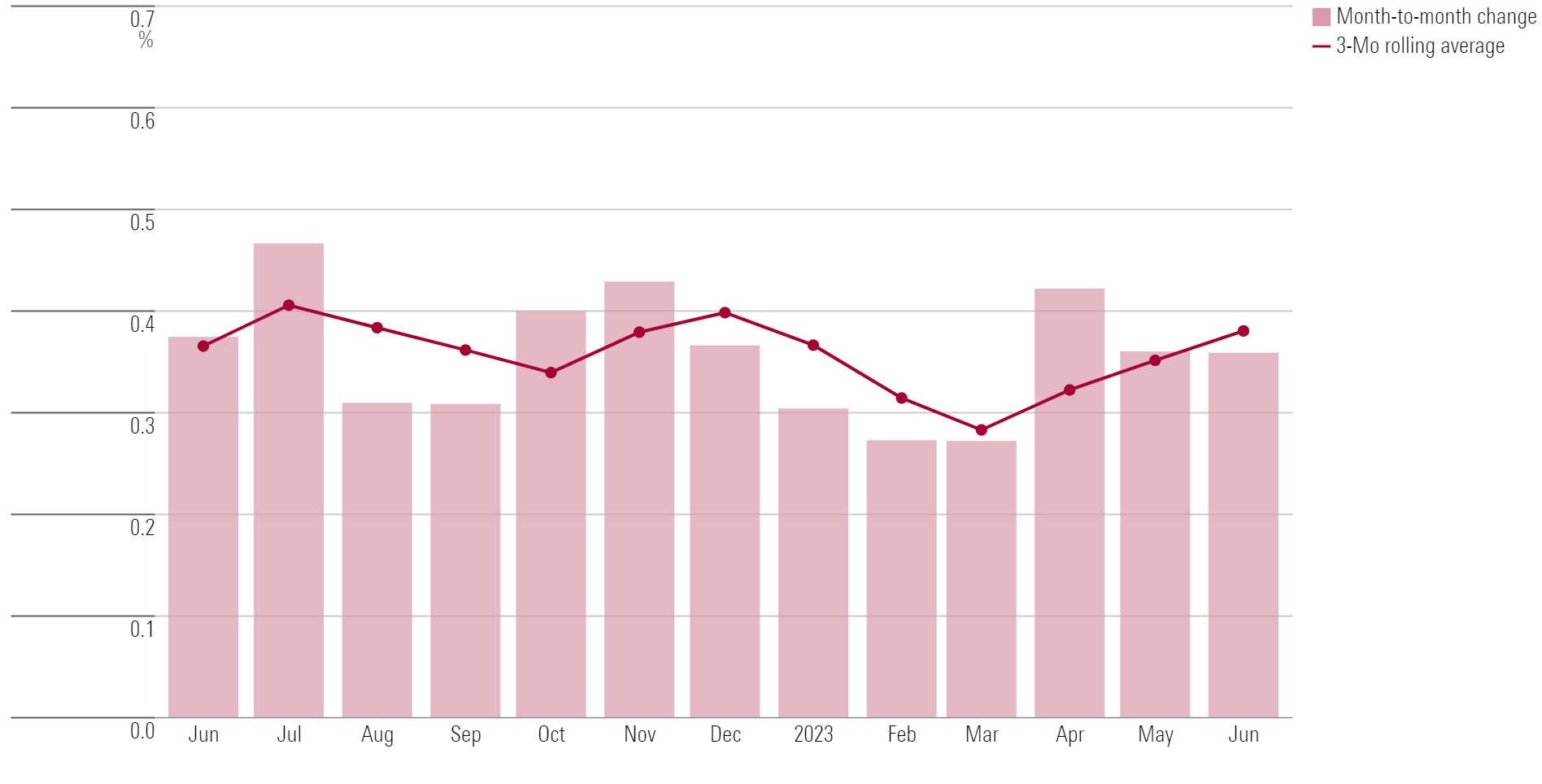

- Average hourly wages grew by 0.4% to $33.58 after rising 0.4% in May.

“June brought a solid increase in nonfarm payroll employment of 209,000 jobs, albeit with downward revisions to gains in April and May by a combined 110,000 jobs compared to data reported last month,” Caldwell says. All together, nonfarm payroll employment has increased by 1.9% annualized in the past three months, by his measure. That’s slightly lower than the 2.2% growth rate reported last month, Caldwell says, “and it’s also slightly lower than the 2.4% rate seen in the first three months of 2023.”

Caldwell says it’s possible that job growth will eventually be further revised down slightly. He explains: “According to the Philadelphia Fed, data from the Quarterly Census of Employment and Wages suggests an eventual downward revision to nonfarm payroll levels of around 0.5%. If that proves correct, it will be incorporated into revised nonfarm payroll figures released in February 2024.” Eventual downward revisions to job growth are not unusual when the economy is slowing, Caldwell says, mainly because the number of firms going out of business turns out to be greater than the BLS initially estimates.

Monthly Payroll Change

Wages Rise

In June, average hourly wages ticked up 0.4% to $33.58. Over the past 12 months, average hourly earnings have risen by 4.4%. The average workweek for all employees on private nonfarm payrolls rose slightly to 34.4 hours in June, up from 34.3 in May.

Caldwell notes that after showing some moderation earlier in the year, wage growth rebounded with the June report, with average hourly earnings posting a 4.7% annualized increase in the last three months, up from 3.4% in the prior three months. But the Fed’s source is “quite noisy, and remains lower than other measures of wage growth,” he says.

Monthly Wage Growth

Unemployment Rate Falls, For Now

In June, the unemployment rate fell 0.1 percentage points to 3.6%. The unemployment rate has ranged between 3.4% and 3.7% since March 2022.

“We continue to expect businesses to curtail their hiring sharply over the next year,” Caldwell says. “Employers are currently hiring too fast compared to the rate at which output is growing (productivity growth has been around zero or negative), which will eventually cut into profits if they don’t cut back on hiring.” And with banking credit contracting and consumers likely to get more conservative over the next year, in his view, “there’s still much more weakening in economic activity in the pipeline.”

Unemployment Rate

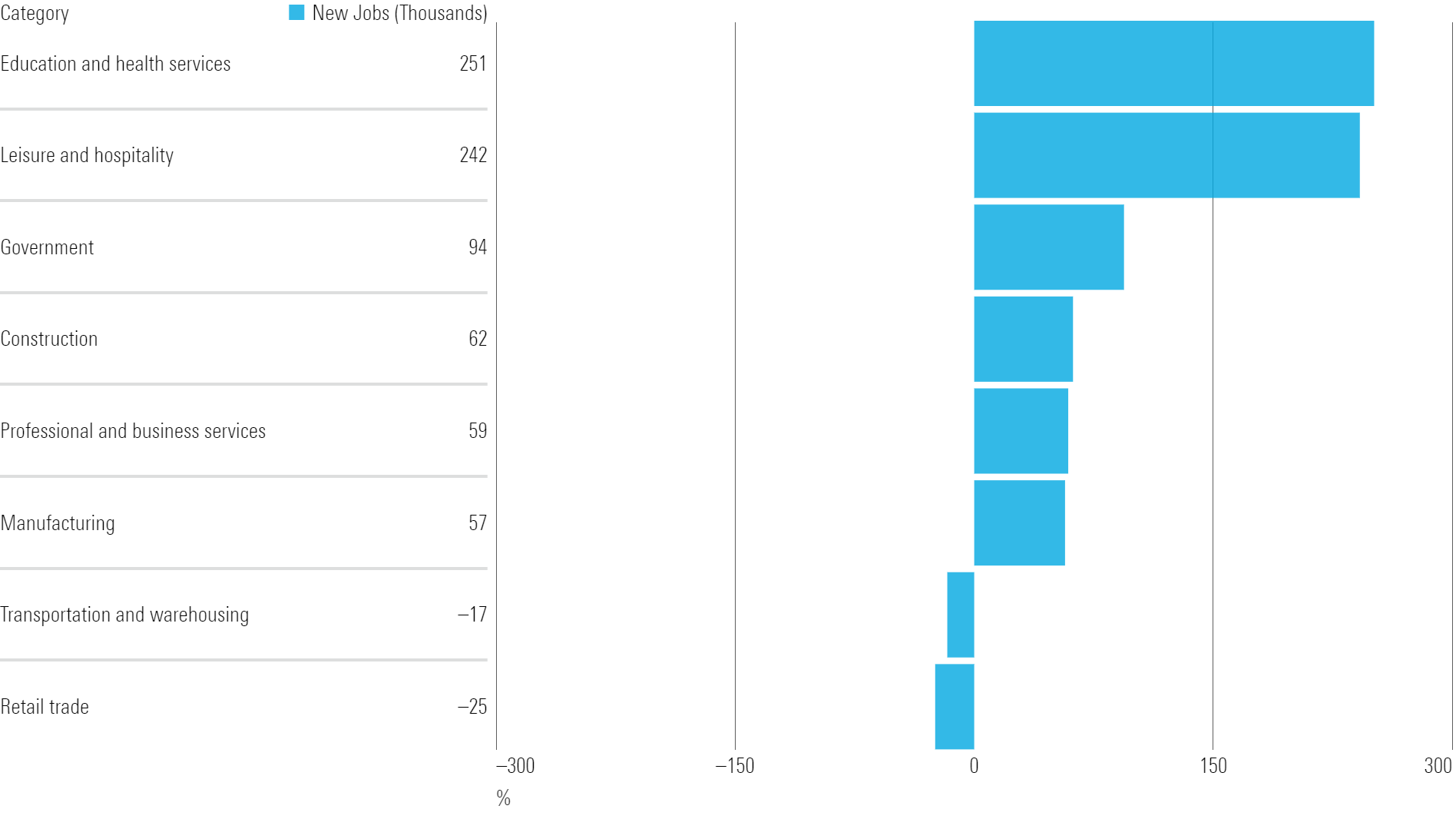

Industry-Level Employment Growth

At the industry level, employment growth in construction and real estate rebounded to a 2.7% annualized increase over April-June, up from 1.2% in January-March, according to Caldwell. “That appears to be driven by the jump in nonresidential construction—particularly the factory building boom for green energy and semiconductors—along with a rebound in housing.”

Employment growth in professional services, tech, and finance has accelerated in recent months, by Caldwell’s measure. Growth in healthcare and leisure has decelerated to a 2.7% rate in the last three months compared to 4.0% in the prior three months, matching the downtrend in consumer services spending growth as the return to normal from the COVID-19 pandemic has largely wrapped up.

Within the June report, government jobs rose by 60,000, in line with the average of 63,000 jobs per month through the first half of 2023 and more than double the average of 23,000 per month in 2022. Employment in healthcare rose by 41,000 over the month, driven by job growth in hospitals, nursing, and residential care facilities. Construction jobs rose by 23,000 in June, above the 2023 average thus far of 15,000 new jobs per month.

Selected Payroll Categories

June Jobs Report Shows Strength In the Economy

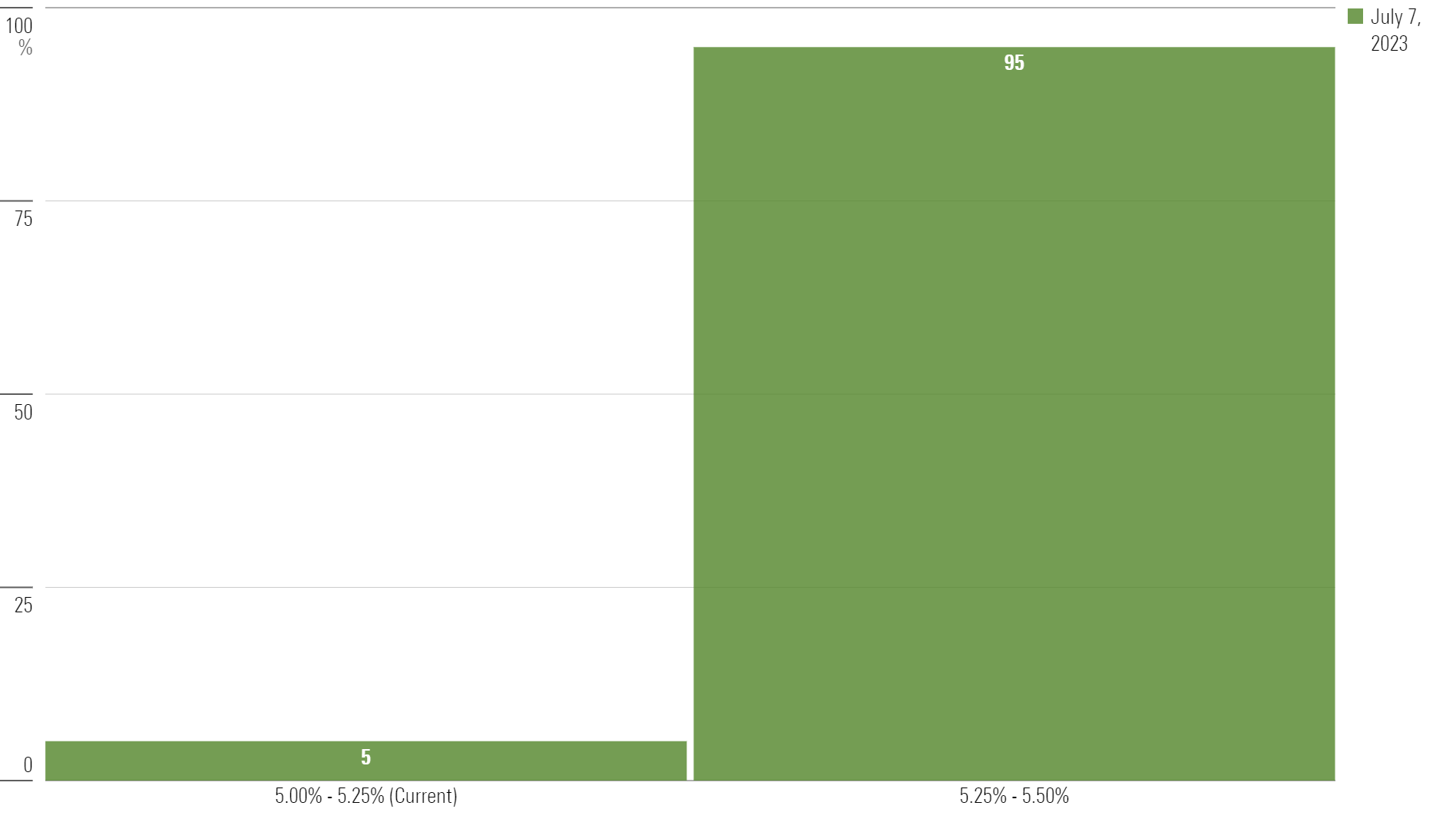

In the wake of the jobs report, the bond market near-unanimously expects a rate increase from the Fed. According to the CME FedWatch Tool, which tracks bets made by traders on the direction of interest rates, 95% of participants foresee the federal-funds rate rising a quarter of a point to a range of 5.25%-5.50%. Only 5% expect the Fed to hold rates steady, as it did in June.

Expectations for the Federal Reserve Meeting on July 26, 2023

A month ago expectations were more varied, with half of participants expecting a quarter-point rate hike in July and 35% expecting the Fed to hold rates steady at its current range of 5.00%-5.25% at both the June and July meetings. The remaining 14% expected a rise of 0.5 percentage points by July—a scenario that is now out of the picture.

“If job growth and other measures of economic activity remain at current rates and inflation proves stubbornly high, then another hike in September is possible,” Caldwell says.

“Employment is still expanding at a normal rate—about in line with the 1.7% average annual growth over 2015-19—but the Fed would prefer something closer to zero growth for a period of time to reduce excess wage growth and cool off the broader economy,” he continues. “However, we expect movement on both fronts to induce the Fed to pause in September and the rest of the year.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)