A Top Mutual Fund Manager Now Runs a Promising New Active ETF

Can David Giroux deliver the same impressive results with T. Rowe Price Capital Appreciation Equity ETF?

Investors now have a way to access one of the mutual fund industry’s best managers who had until now been mostly off-limits. In June 2023, T. Rowe Price launched a suite of five active equity exchange-traded funds, one of which is T. Rowe Price Capital Appreciation Equity ETF TCAF, managed by David Giroux.

Giroux, a two-time Morningstar Allocation Manager of the Year, has led T. Rowe Price Capital Appreciation PRWCX to a nearly unprecedented track record since taking the reins in mid-2006. Unfortunately for latecomers, that fund has been closed to new investors since 2014. The new ETF is the first opportunity to invest with Giroux outside of his flagship offering.

Giroux will utilize the same fundamental stock selection process for the ETF that he uses in the successful mutual fund, but with some notable changes to make the ETF more tax-efficient. Even so, the ETF and the mutual fund might not be as similar as you think. Here’s what you need to know:

Giroux’s Performance and Approach to Picking Stocks

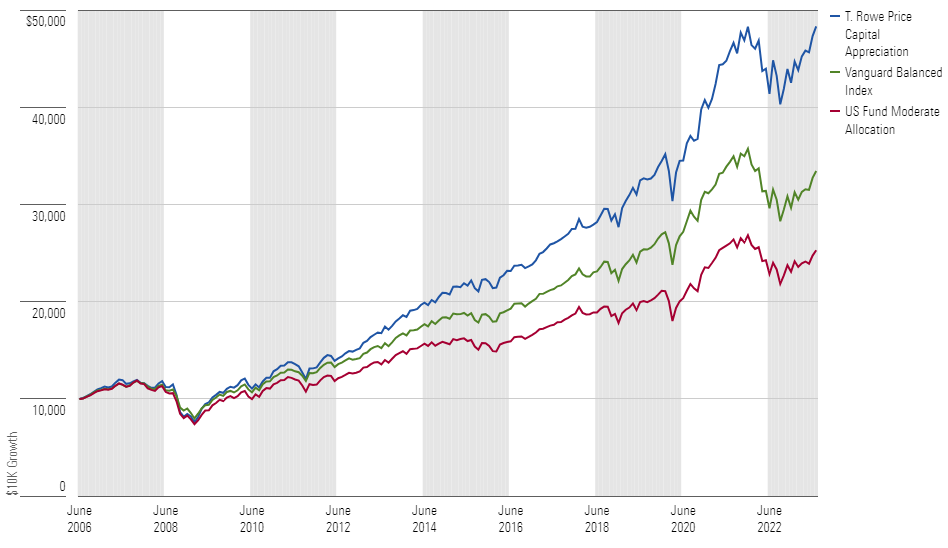

Giroux’s track record on T. Rowe Price Capital Appreciation has no rivals. The multi-asset fund managed to beat all moderate-allocation peers over his tenure through July 2023. The fund’s success can be attributed to several factors, but the reason the ETF is getting so much attention (it has grown to roughly $125 million in assets in just seven weeks) is that the mutual fund’s stock portfolio has consistently outpaced its S&P 500 benchmark (the same benchmark the ETF will seek to beat).

T. Rowe Price Capital Appreciation Over Giroux's Tenure

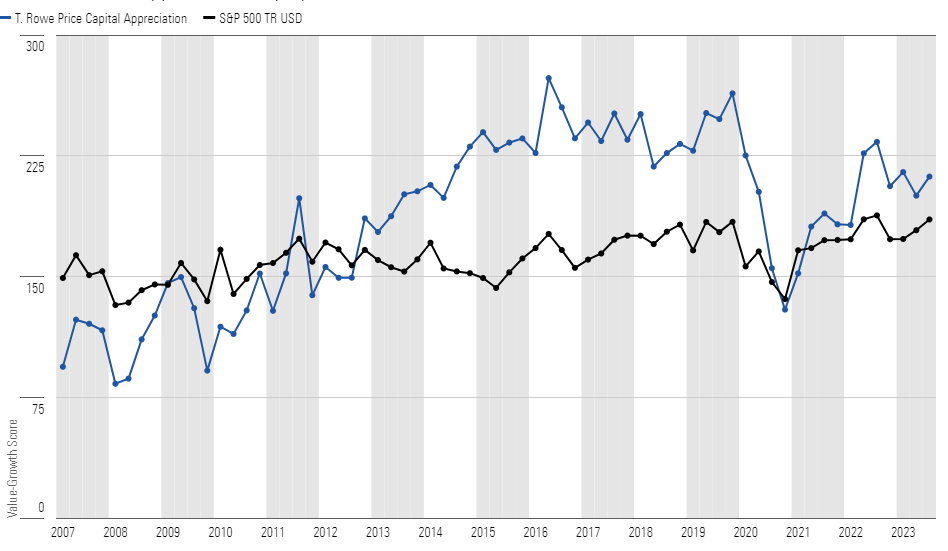

To pick stocks, Giroux cuts down the S&P 500 to roughly 125 companies, excluding those he believes have serious flaws such as excessive valuations, poor capital allocation, meager earnings growth, or poor management teams, among others. From there, he invests in the companies that he feels sit at the best valuations and hold the strongest risk-adjusted return profiles. That tends to fit the style of growth at a reasonable price, resulting in a portfolio that may oscillate between a value, blend, or growth orientation over time. Giroux has skillfully executed this approach within the mutual fund’s equity sleeve. We expect the same thoughtful, well-informed approach to stock selection in the ETF.

Giroux's Flexible Approach on Display

How the ETF Will Differ

Though the ETF will have the same investment philosophy as the mutual fund, they differ in meaningful ways that may limit the ETF’s upside. For starters, the ETF’s equity-only focus means Giroux’s ability to make swift and sizable moves across asset classes, an area where he’s captured meaningful value over short periods, isn’t applicable. And looking specifically at the equity sleeve of each fund, the ETF’s tax awareness leads to additional characteristics that set it apart from the mutual fund.

1) To reduce capital gains, the ETF is expected to trade in and out of names less often and have longer holding periods on average. The ETF’s annual turnover ratio is expected to be around 10%, significantly lower than the roughly 50% average for the mutual fund’s equity sleeve.

2) Further emphasizing tax efficiency, the ETF aims for a slightly lower dividend yield than the S&P 500 to help limit taxable income distributions.

3) The ETF will also be less concentrated. It held 100 individual companies at the end of June, and we expect that number to remain mostly consistent going forward. The mutual fund’s equity sleeve, meanwhile, tends to hold from 40 to upward of 50 companies. That said, only in rare cases would the mutual fund hold a company that’s not held in the ETF. The table below provides a snapshot of each fund’s stock portfolio as of June 30, 2023.

Portfolio Comparison—Top 10 Stock Holdings

One More Advantage

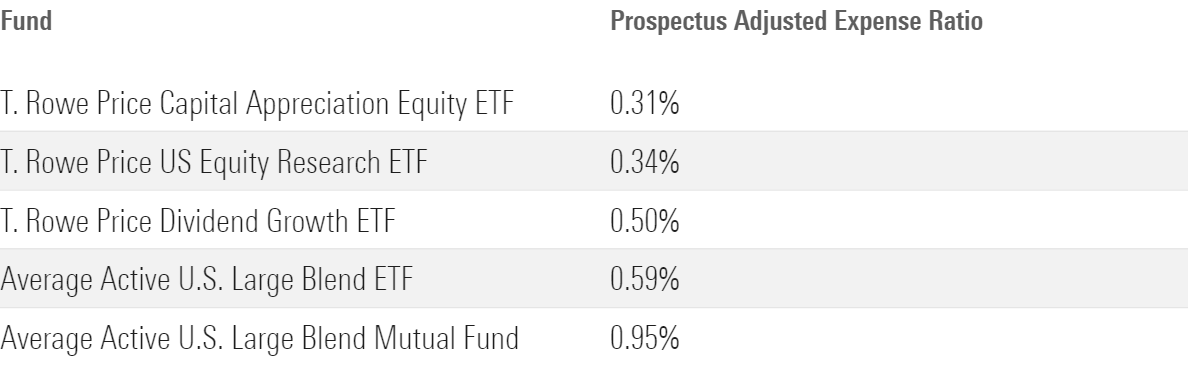

Not that Giroux needs any extra advantages versus peers, but the ETF’s low fee of 0.31% ranks very favorably compared with other actively managed U.S. large-cap blend peers, in both mutual funds and ETFs, and even compared with low-cost T. Rowe Price active ETFs.

T. Rowe Price Capital Appreciation Equity ETF Price Comparison

In an asset class with as small a success rate as U.S. large-cap stocks, every basis point of fees matters.

Should Investors Put This ETF on Their Watchlist?

The launch of TCAF offers a chance to invest with one of the best managers of the past 15 years. Giroux’s long-standing approach to stock selection, underpinning the fund’s more-focused portfolio than index-tracking alternatives, has merit, as is evident by Giroux’s impressive record on his flagship fund. However, it would behoove investors to set realistic expectations, as the ETF is by no means a clone of the equity sleeve of T. Rowe Price Capital Appreciation. For investors looking for active large-cap equity exposure, this strategy could make a lot of sense.

The ETF does not currently receive a Morningstar Medalist Rating given its recent June 14, 2023, launch; funds must have a minimum of one full month of performance to be rated. However, it should receive a rating in mid-August when performance as of July 31, 2023, is published. This fall, Morningstar plans to bring the fund under full analyst coverage.

For more information on T. Rowe Price Capital Appreciation, please see Morningstar’s October 2022 analysis. And for additional insights on Giroux’s stock selection in the newly launched ETF, check out 3 Cheap Stocks From a Great Money Manager.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)