How the Largest U.S. Equity Funds Performed in Q2

While growth funds powered ahead, value funds made paltry gains.

Among the most widely held stock funds, strategies with a strong growth tilt outperformed in the second quarter as big technology stocks led equities out of a bear market.

Growth funds posted double-digit gains for the second consecutive quarter following one of their worst years ever. The most concentrated and tech-heavy funds made the largest gains.

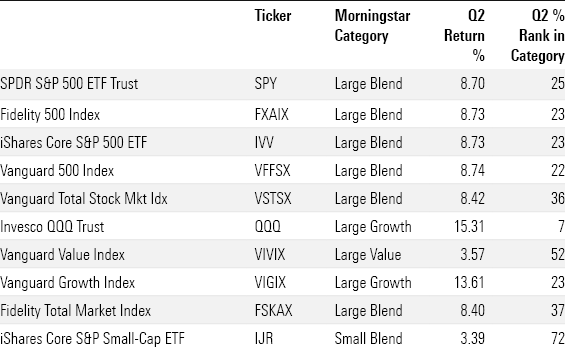

Q2 Largest Stock Index Fund Performance

Invesco QQQ QQQ gained 15.3%, adding to its 20.7% return from the first quarter and bringing year-to-date gains to 39.2%. This puts the $202 billion fund on track for its best year since 2020, when it gained 48.6%.

The passive ETF tracks an index composed of the 100 largest non-financial stocks traded on the Nasdaq stock exchange. It’s benefited from the strong performance of technology stocks this year

The largest U.S. passive fund, the $422.7 billion SPDR S&P 500 ETF SPY, gained 8.7% during the quarter. The broader $310.5 billion Vanguard Total Stock Market Index VTSMX gained slightly less, advancing 8.4%.

While growth funds powered ahead, value funds made paltry gains. The $99.6 billion Vanguard Value Index VIVIX gained only 3.6% as the fund, along with other large-value funds, was hit with big investor redemptions. Vanguard Value Index saw net withdrawals of $5.4 billion in the second quarter.

Small-cap stocks also lagged amid concerns about the potential for a recession. The $69 billion iShares Core S&P Small-Cap ETF IJR gained 3.4% in the second quarter, landing in the bottom half of the small blend category this year.

“The portfolio leans value and small relative to its typical peer, so it’s been hurt more than most in the small blend category,” says associate analyst Zach Evens.

Largest Passive Equity Funds Q2 2023 Performance

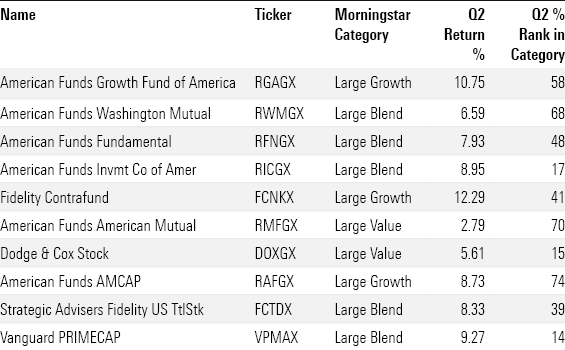

Q2 Largest Active Stock Fund Performance

Among the largest active stock funds, Fidelity Contrafund FCNKX posted the best results. The $102.5 fund billion gained 12.3%, which put it in the top half of large-growth funds.

“The biggest contributor to Fidelity Contrafund’s results was its huge stake in Meta Platforms META, its top holding at around 10% of the fund’s assets as of its most recent regulatory filings,” says strategist Robby Greengold. Meta stock advanced 35.4% in the second quarter.

“Another top-five position, Amazon AMZN, gained 25%. Nvidia NVDA, a roughly 3% position in the fund, also helped lift the fund by gaining around 50%,” Greengold adds.

In the large-blend category, the $62.2 billion Vanguard Primecap VPMAX posted a strong quarter relative to its peers, gaining 9.3% against the average gain of 7.3%. “Much of its strong second-quarter performance is owed to its top holding, Eli Lilly LLY, which rose by one-third,” says Greengold.

“Within the healthcare sector, the fund also beat the S&P 500 in part by avoiding AbbVie ABBV and Pfizer PFE, which declined by double-digit percentages. Another contributor was its above-index exposure to airlines, which gained around 20%, on average,” he adds.

Among the largest-value funds, $89.9 billion American Funds American Mutual RMFGX lagged with a gain of 2.9%, while $87 billion Dodge & Cox Stock DOXGX outperformed with a gain of 5.6%. (For these and other funds in this article, performance is based on the lowest-cost share class for each fund. As a result, returns will be lower for higher-cost share classes.)

“For a strategy that’s been noted for its financials, healthcare, and energy exposure in recent years, Dodge & Cox Stock has benefited from a rebound in some technology and communication services holdings, such as Microsoft, Alphabet, and Meta,” says associate director Tony Thomas. He explains that Dodge & Cox Stock seeks undervalued companies, and those tech and communications stocks were arguably undervalued coming into this year after a tough 2022.

Largest Active Equity Funds Q2 2023 Performance

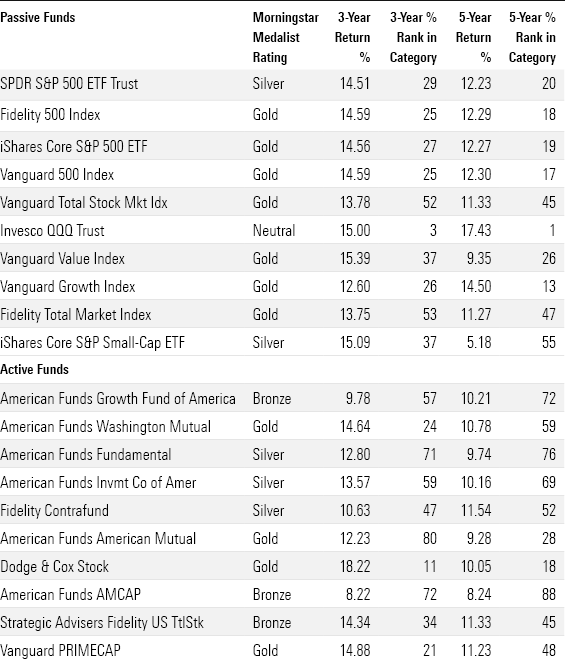

Over the past three years, Dodge & Cox Stock has gained the most among the largest U.S. stock funds. It’s up 18.2% on an annualized basis since July 2020.

Over the past five years, Fidelity Contrafund is up the most with a gain of 11.5% among active funds, though Invesco QQQ outshines it with a gain of 17.4% on an annualized basis since July 2018.

Largest Equity Funds Long-Term Performance

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)