Markets Rallied at the End of 2023. How Do They Look Today?

6 trends from the final quarter of 2023.

After briefly falling in the third quarter, both equity and fixed-income markets closed out 2023 on a high note. We look back at the fourth quarter and where markets stand today.

Every quarter, Morningstar’s research team reviews the most recent U.S. market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights. (Morningstar Direct and Office clients can download the report here.)

Here are some of the findings from our latest quarterly market review.

Equity and Bond Markets Bounce Back

Developed-markets stocks remain the winners of the last 12 months, with U.S. stocks firmly leading the way. Emerging-markets equities, while participating in the strong fourth-quarter rally, lagged for the 12-month period despite strong absolute returns. U.S. bonds’ strong fourth-quarter rally spurred a crossover into positive territory for the 12-month period as rate-cut bets took hold. Commodities bucked the positive trend, with weak one-year returns despite rising tensions in the Middle East.

Trailing 12-Month Performance of Major Asset Classes

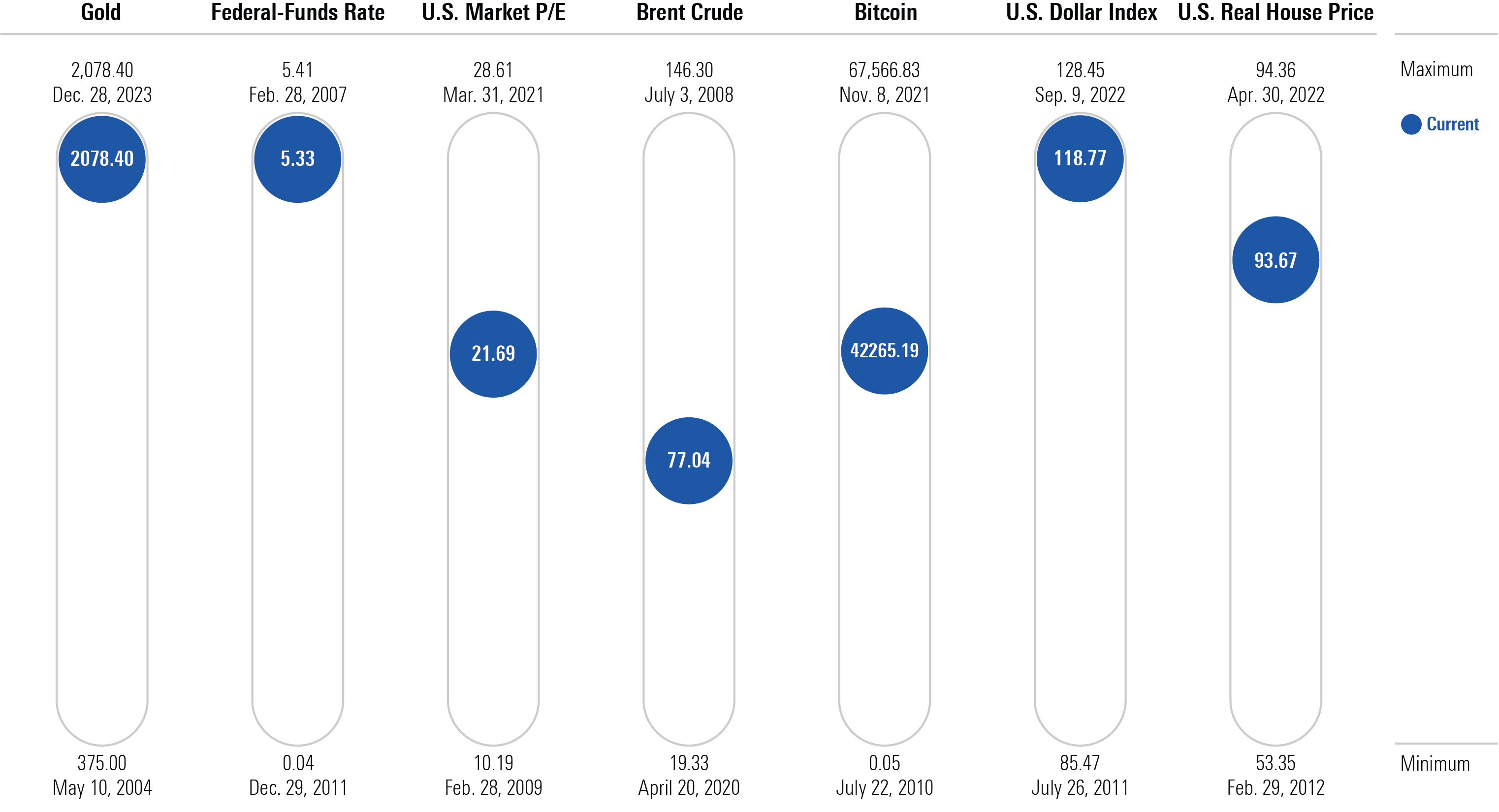

Where Markets Stand

Markets sit in a unique position as we enter 2024. Inflation has decelerated, but recent readings suggest a bit of a stall, even as rate-cut expectations took hold during the fourth quarter of 2023. Increased tensions in the Middle East helped contribute to firm gold prices (and the U.S. dollar), but oil weakened as demand concerns and fears of oversupply outweighed tensions. The chart below displays where each indicator sits relative to its maximum and minimum of the past 20 years.

Market Thermometer

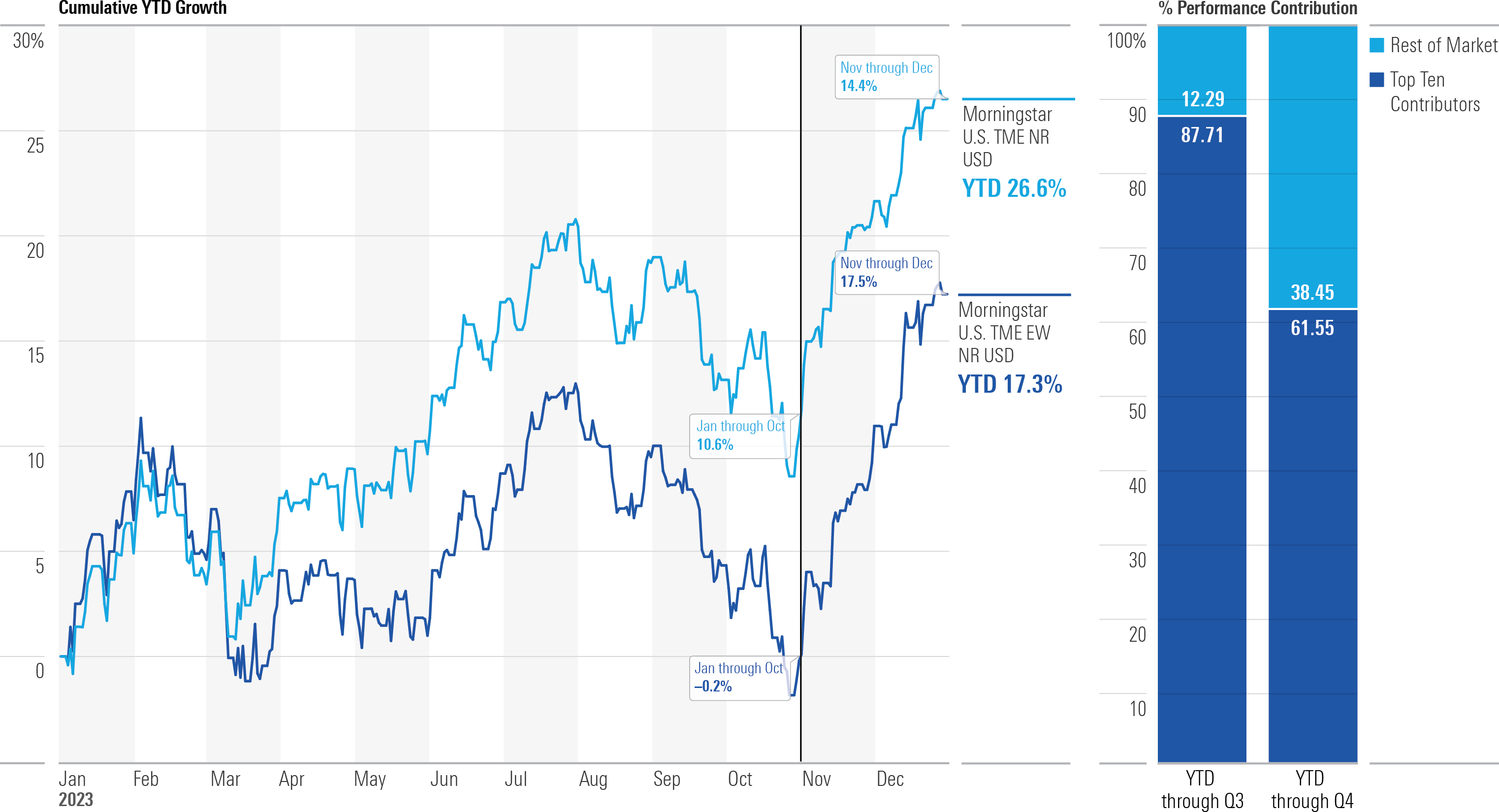

A ‘Breadth’ of Fresh Air

Last year was a narrow market in U.S. equities through the third quarter; top 10 returners contributed almost 88% of index returns. Over that period, the Morningstar US Target Market Exposure Equal Weighted Index badly lagged its market-cap-weighted counterpart, the Morningstar US Target Market Exposure NR Index. The fourth quarter represented a welcomed broadening: The Morningstar US Target Market Exposure Equal Weighted Index returned 17.5%, outperforming the market-cap-weighted index, which returned 14.4%.

Q4 2023 Ushers In Broader Participation in the US Bull Run

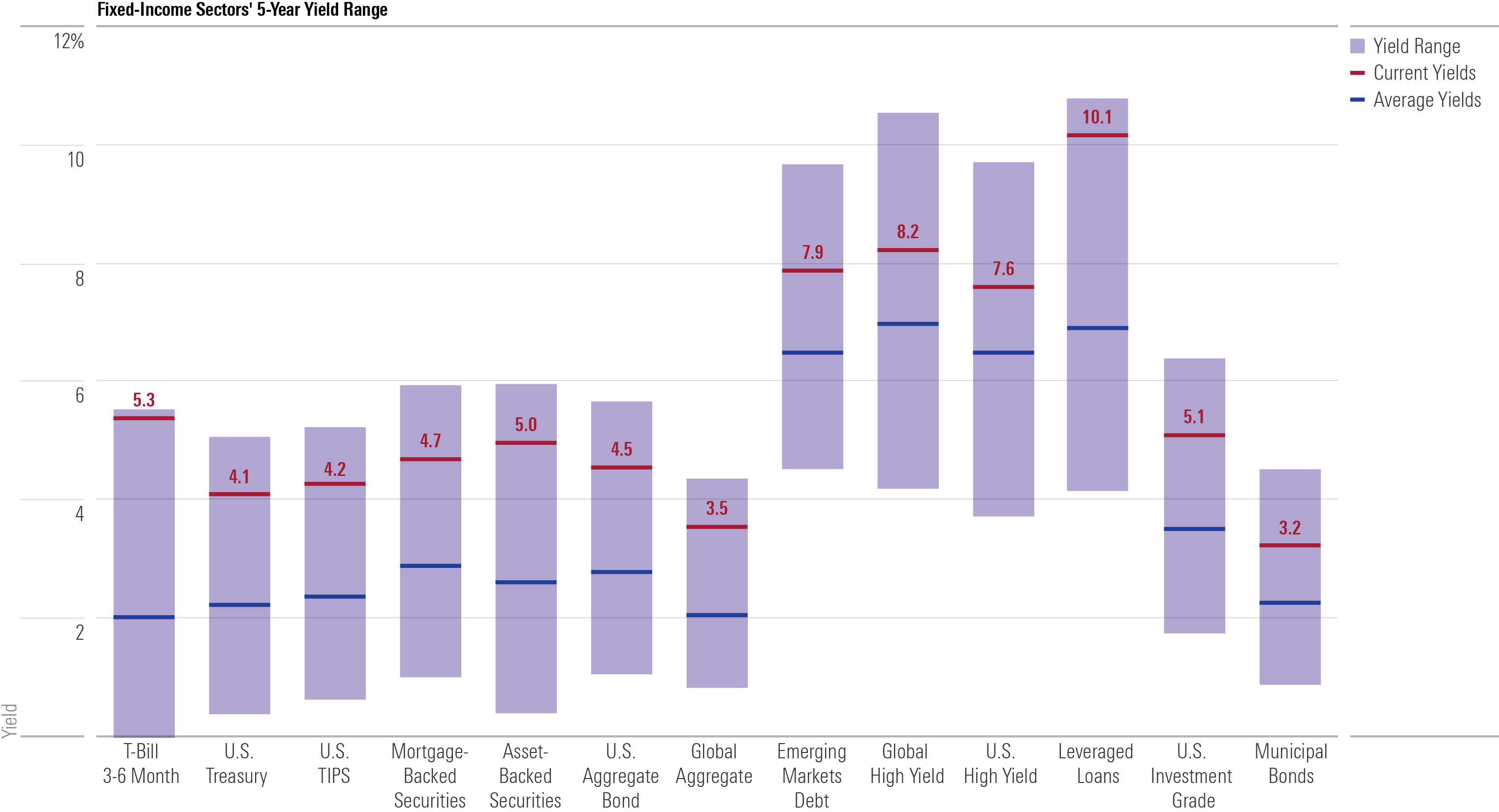

Yields Remain High

Yields climbed higher during 2023′s first 10 months as the Federal Reserve reinforced “higher for longer” messaging in order to tame inflation. The tone shifted in the fourth quarter, though, and bond yields plunged during the year’s final quarter as market observers received additional clarity on a path for rate cuts in 2024. However, yields across all major fixed-income sectors remain above their five-year average.

Yields Across Fixed-Income Still Remain High

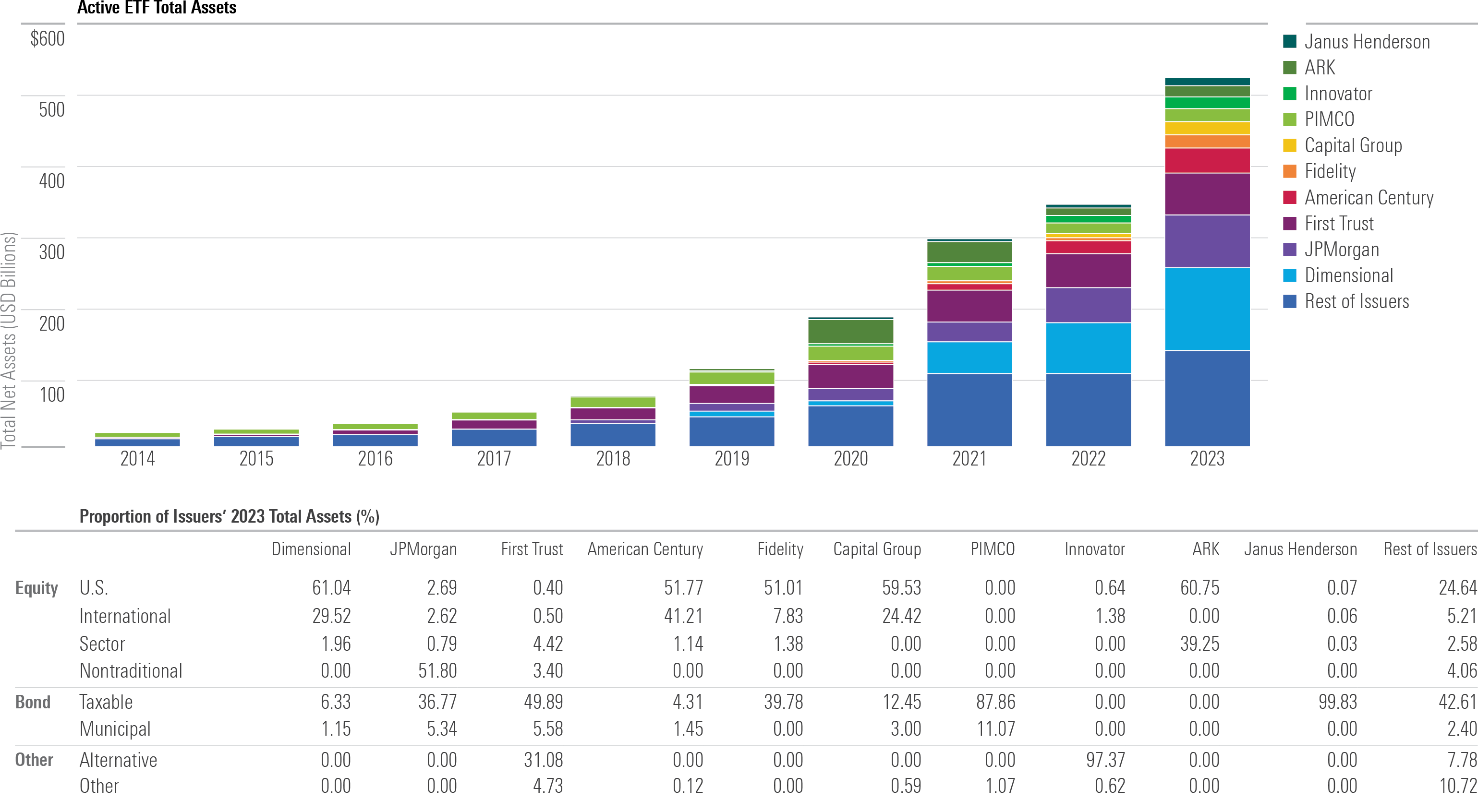

Active ETFs Keep Growing

The rapid ascent of actively managed exchange-traded funds has brought legacy mutual fund companies into the space. Firms like Capital Group, Fidelity, and others have found quick success replicating existing mutual fund strategies, leveraging their extensive asset-class expertise. None measure up to Dimensional Fund Advisors, though. Few have embraced active ETFs like Dimensional, and it has set the stage for their continued growth.

Active ETFs Gain Steam

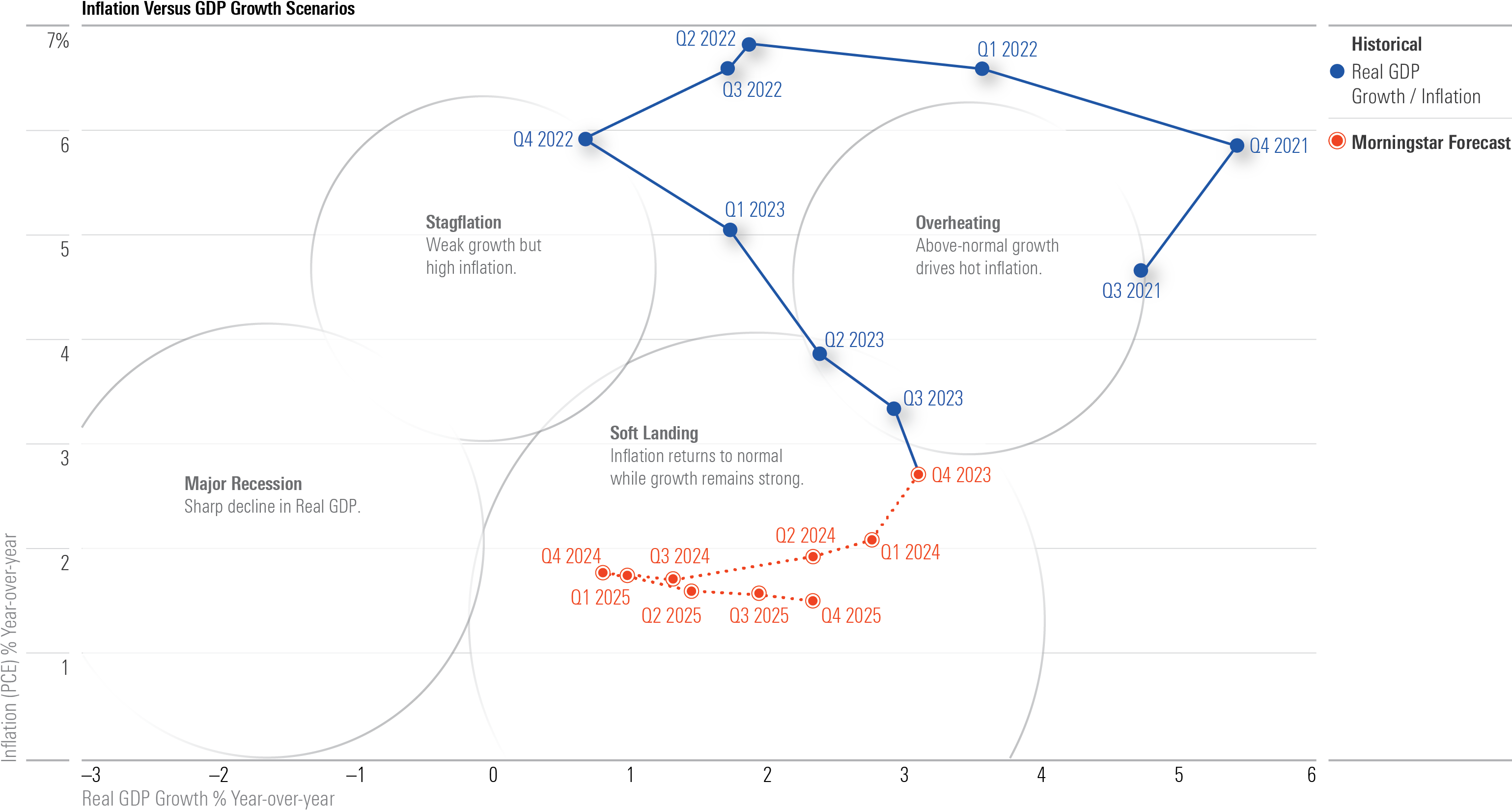

Soft Landing Is Mostly Likely Scenario for U.S., but Overheating Is a Risk

The dramatic reduction in U.S. inflation over the past year, in spite of an acceleration in gross domestic product growth, has invalidated the stagflation thesis. Resolution of supply constraints has allowed a much more painless disinflation than historical examples had suggested. We expect this process to continue, enabling a soft landing. The overheating scenario is the biggest risk to our view (see the hot fourth-quarter GDP numbers), but we think growth will soften as the effects of rate hikes continue to play out.

Where Is the U.S. Economy Heading?

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)