Size Concerns Downgrade 2 Fidelity Fund Ratings

Here are some ratings highlights from February.

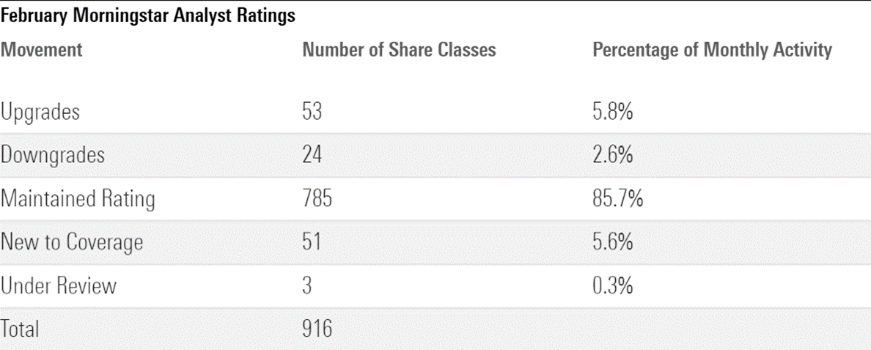

Morningstar updated the Analyst Ratings for 916 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in February 2022. Of these, 785 maintained their previous rating, 53 were upgraded, 24 were downgraded, 51 were added to coverage, and three came under review because of material changes such as manager departures.

Looking through share classes and vehicles to their underlying strategies, Morningstar issued 310 Analyst Ratings during February. Of these, 15 were new to coverage, and the remainder had at least one investment vehicle that had been previously covered by a Morningstar analyst.

Below are some of the highlights of the downgrades and upgrades from the month of February.

Upgrades

Increased faith in the talents of manager Vincent Montemaggiore led to Fidelity Overseas' FOSFX People rating upgrade to High from Above Average and a Morningstar Analyst Rating upgrade to Silver from Bronze. The unique insights and disciplined approach of Montemaggiore, who has been the fund's sole listed manager for roughly a decade, are essential to the strategy. He keeps journals of past mistakes and tracks his own investment theses to overcome behavioral biases. This self-aware, thoughtful, long-term approach has helped him navigate market volatility well. More than 50 international-equity analysts support Montemaggiore, but he still generates about half the portfolio's ideas himself.

Renewed confidence in Neuberger Berman International Equity's NBIIX management team upgraded its People rating to Above Average from Average and its Analyst Rating to Silver from Bronze for its institutional shares, R6 shares, and separately managed account. In early 2021, the strategy's People pillar dropped to Average from Above Average after longtime manager Benjamin Segal announced his decision to become a high school math teacher. Former comanager Elias Cohen, who became lead manager, had worked with Segal for nearly 20 years, but there was uncertainty because he lacked a public record as a lead manager. However, it's now clear that Cohen is continuing to implement the strategy's time-tested process. An experienced analyst team also remains.

Downgrades

Concerns about Fidelity Contrafund's FCNTX asset base warranted a Process rating downgrade to Average from Above Average and Analyst Rating reduction to Silver from Gold. Across all accounts, legendary manager Will Danoff steers roughly $250 billion, a hefty 0.65% of the S&P 500’s aggregate market value that limits Danoff's ability to nimbly trade or invest meaningfully in the small- and mid-cap companies he favors. Few other large-cap strategies have amassed as much--those that have saw significant degradation in their excess returns as their opportunity sets shrank and they became harder to maneuver. Danoff remains a great manager, but the strategy's asset base prevents him from running the portfolio with nearly as much flexibility as his peers.

Fidelity Advisor New Insights' FINSX Process rating dropped to Average from Above Average for similar reasons. The analyst ratings of its cheapest share classes dropped to Bronze from Silver, while its pricier shares fell to Neutral from Bronze. Danoff runs 80% of this fund nearly identically to Fidelity Contrafund, snugly tying their fates.

Changes to American Beacon Small Cap Value’s AVFIX subadvisor lineup prompted a downgrade of its People rating to Average from Above Average, resulting in an Analyst Rating downgrade to Neutral from Bronze for its cheapest shares while its pricier shares remained Neutral. On Jan. 31, 2022, American Beacon announced the terminations of subadvisors Foundry Partners and Hillcrest Asset Management. Combined, the two managed a little less than one fourth of the portfolio’s assets as of year-end 2021. American Beacon has tapped quality-focused manager DePrince, Race & Zollo as the replacement. While DRZ has an experienced investment team on its small-cap strategy, they aren’t nearly as well-known as other sleeve managers on the strategy, such as the Brandywine Global and the Hotchkis & Wiley teams.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)