The Link Between Flows and Fund Ratings

Flows sometimes follow Morningstar’s upgrades and downgrades.

What happens after we downgrade a fund? Do scores of investors rush for the exits? What about upgrades?

We rolled out the Morningstar Analyst Rating in 2011, so by now we have a fair amount of data to answer those questions. We looked at both aggregate flows and growth rates, approaching the data from three angles. What was the total dollar value of flows after an upgrade or downgrade? How did a fund’s flows compare with peers’ over the ensuing periods? How did fund flows change following an upgrade or downgrade relative to their previous flows?

We ran these tests looking at a variety of slices of the fund world and watched flows over the following one-, three-, six-, 12-, 24-, and 36-month periods. One caution about this information: We tracked correlations of flows in relation to rating changes, but that doesn’t conclusively prove the rating change was the cause. We ran significance tests on the data, but remember that flows respond to many things besides our ratings, such as performance and fundamentals. Our study covered the 12-year period that ended in 2022 just before the Analyst Rating and Morningstar Quantitative Rating were merged into the newly minted Morningstar Medalist Rating.

To take a dive deep into the subject, read our research paper.

Where the Links Are Strongest and Weakest

When we look at all funds, we saw a slight uptick in flows relative to the peer group after an upgrade, but not much for flows relative to a fund’s prior months. For downgrades, the outflow pattern was stronger by both comparative measures of flows. That’s a theme we saw across the study.

Looking at flows in dollar terms for all funds with rating changes, we saw modest but not statistically significant moves. However, 24 and 36 months out, upgrades saw statistically significant amounts of inflows.

Active vs. Passive

This distinction proved to be one of the more revealing looks. We found there was a strong link between active fund rating changes and flows, but much less of a link with index fund rating changes.

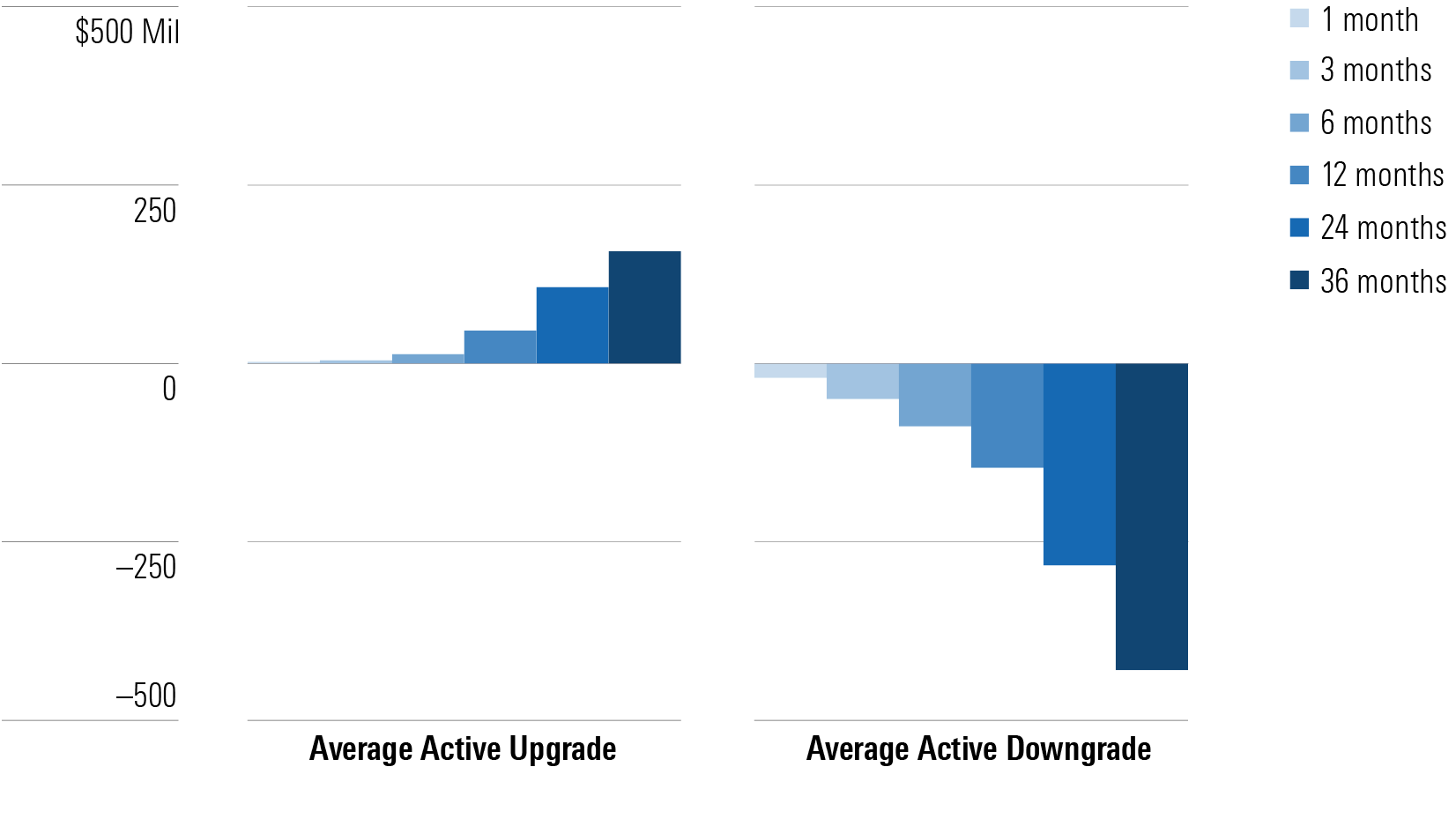

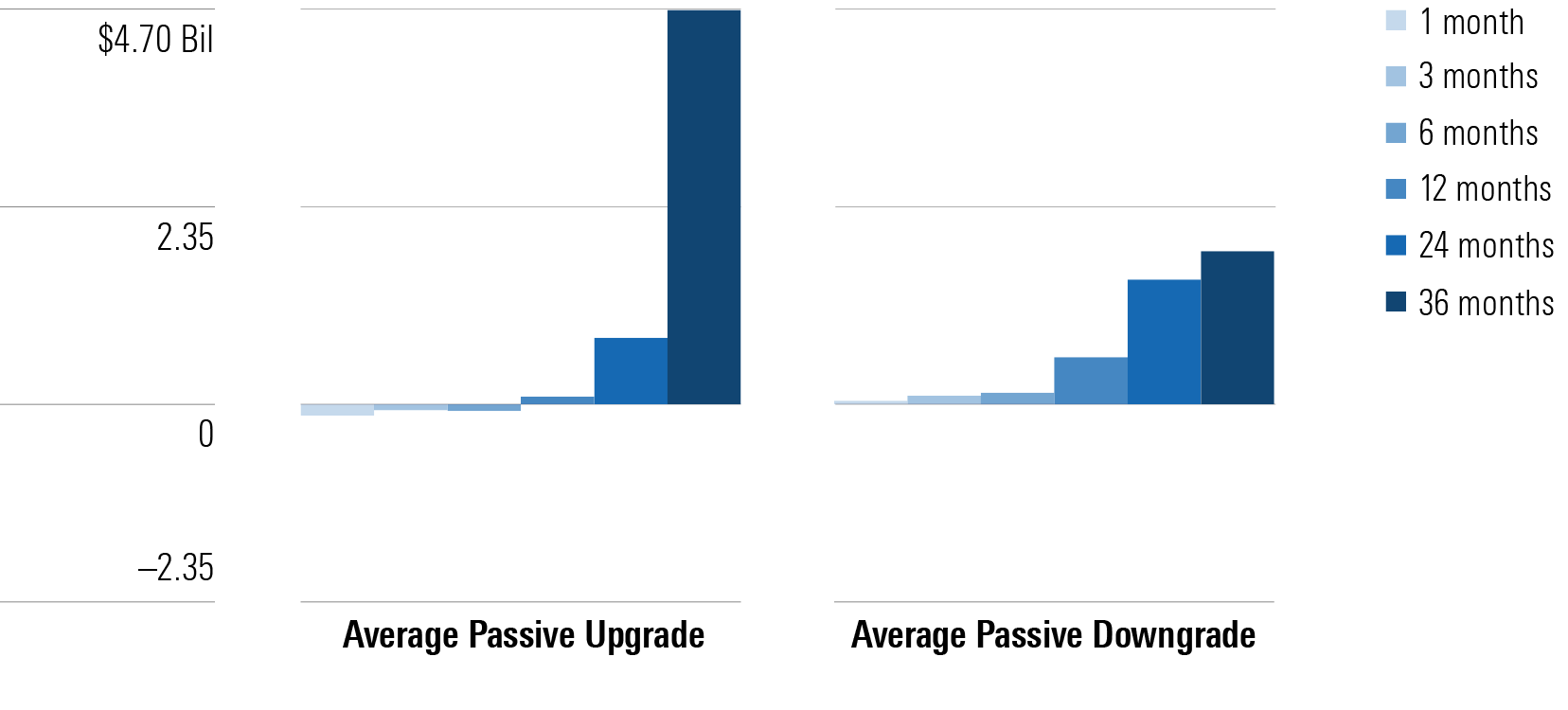

For all active funds with upgrades, inflows were about $2 million the first month on average, a cumulative $13 million after six months, $46 million after 12 months, and $157 million after 36 months. On the flip side, downgraded funds showed outflows of $20 million in the first month, $88 million in the sixth month, $146 million over 12 months, and $429 million in net outflows over the entire 36 months. For context, active funds collectively have been in outflows the past decade, and passive funds have been in inflows. Meanwhile, for passive funds, we saw steady inflows for both upgraded and downgraded funds albeit even more for upgrades.

Average Active Fund Flows Following a Rating Change

This data seem sensible as the fundamentals change more often at active funds than passive ones. Many passive rating changes are due to subtleties like slight changes in competitor fees. A fair number of passive exchange-traded funds change their benchmarks as they strive to find a basket of stocks that will draw investor money, but other than that, changes are few and far between.

Active funds have changes to managers and strategy, blowups, big short-term returns that alter the risk/reward profile, capacity constraints, and more. For certain, the goal of wise active investors is to choose funds where those elements are more stable than at the average fund, but such adjustments do happen across the thousands of funds we rate.

Average Passive Fund Flows Following a Rating Change

Fund Types

In our tests, we further spliced active strategies into equities, fixed-income, and allocation funds. This clarified that the link between ratings changes and flows is strongest with a subset of active funds. For equity funds, the pattern was strong from one to 36 months compared with peers. For bond funds, the pattern was pretty similar, though downgraded funds’ outflows were milder by the two- or three-year marks.

For allocation funds, the link was still there, but a little weaker than with fixed-income or equity funds.

We ran an additional test to see if funds going in and out of the Gold, Silver, and Bronze ratings territory led to any different flow patterns. Such changes could be a greater call to action since each medal level is tantamount to a recommendation, but Neutral and Negative ratings are not. For upgrades, the link was strong for equities, rather weak for bond funds, and weakest of all for allocation funds.

Downgrading of Gold, Silver, and Bronze funds to Neutral or Negative was another story. In this case, the outflows were strong for all three fund types.

Why would downgrades to Neutral and Negative show the strongest link? The likely reason is that such downgrades are more likely to be event-driven. Manager departures, strategy changes, and investing pitfalls are the sorts of things that spur downgrades and serve as clear calls to action. Upgrades, on the other hand, tend to result from more gradual improvements without a particular event to spur the change. Managers proving themselves over a few years is a gradual process, and each investor might have a different view on when they merit an upgrade. Or it could be a gradual uptick in performance or supporting staff buildup that spurs an upgrade.

What About Other Ratings?

The impacts of the Morningstar Rating, or star rating, are more widely examined, and most studies have found a sizable link between the star rating and flows. We found the same link, and it was stronger than the Analyst Rating link.

The star rating is a risk-adjusted return measure reflecting a fund’s performance relative to peers over the trailing three-, five-, and 10-year periods. It’s updated monthly, so the star rating is more responsive to performance than the Analyst Rating, and we know that performance has a strong impact on flows. Moreover, the star rating is still more widespread than the Analyst Rating even though we at Morningstar think the Analyst Rating (now Medalist Rating) is a better gauge of a fund’s prospects.

On the other hand, the Morningstar Quantitative Rating showed little link with flow patterns. This quantitative measure was updated monthly.

How Can You Apply This Information?

For fund investors, flows can be good, bad, or neutral. Generally, they don’t have much of an impact on performance. Rapid flows in either direction are a problem, however, especially for less liquid asset types like small-cap stocks or high-yield bonds.

The data suggest that there isn’t often a big move in flows after a rating change, so investors who buy after an upgrade or sell after a downgrade aren’t likely to be hurt by too many investors doing the same thing. But it is possible that a downgrade in a less liquid space could occur before a time of challenging outflows since greater reactions tended to follow downgrades.

In short, I wouldn’t worry too much about trading in reaction to Medalist Rating changes. Star rating changes are associated with greater flows, so trades based on star rating changes for funds trafficking in less liquid areas might cause more headwinds.

This article first appeared in the September 2023 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

3 Biggest Mutual Fund Downgrades of 2023

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)