Contrarian Fund Picks for 2024

Large outflows may signal decent future returns for several Morningstar Categories.

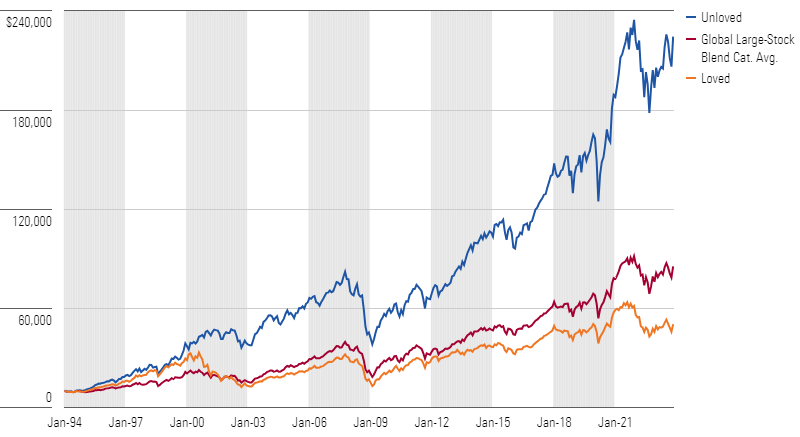

Stocks and bonds rebounded in 2023 after a brutal 2022. While many Morningstar Categories saw inflows, several continued to bleed. For 30 years, Morningstar’s Buy the Unloved has sifted among those shunned categories for potential opportunities. The contrarian investment approach entails picking funds from the Morningstar Categories with the most outflows in the previous year—the “unloved”—while avoiding strategies in the areas with the most inflows—the “loved.”

There are two versions of Buy the Unloved. The original iteration recommends investing equal sums in the three equity categories with the most outflows from the previous calendar year, holding them for three years, and then repeating the process. It excludes categories where flows are less useful indicators of investor sentiment, such as target-date, trading, and leveraged categories.

After 30 years of applying the original approach, the results have been quite impressive.

Version 1: Growth of 10K Chart (Since January 1994)

Version 1: Trailing Returns (%)

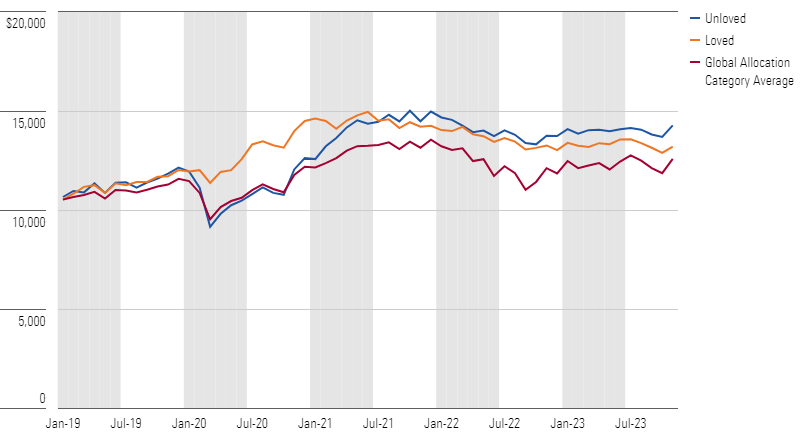

Launched in 2018, version 2 expands the universe of eligible categories to bond and allocation funds. In addition to categories’ absolute dollar flows, this version also considers fund groups’ percentage of net flows divided by total assets, as it helps capture smaller categories whose cash flows rarely crack the top or bottom three.

While version 2′s record is short, it has been decent so far.

Version 2: Growth of 10K Chart (Since January 2019)

Version 2: Trailing Returns (%)

Version 1′s Results

Based on open-end and exchange-traded fund net flows through November 2023, version 1′s most unloved equity categories are large value, large growth, and health. Large blend, foreign large blend, and Japan stock were the loved categories.

Here are some specific unloved ideas.

Large Value

Large value was among the loved each of the last two years but saw the greatest absolute dollar outflows of all Morningstar Categories in 2023. Gold-rated Dodge & Cox Stock DODGX is one of the best options here. The fund’s seven-member committee relies on the extensive, bottom-up research of the firm’s global industry analysts, who must defend their picks before the managers. The team focuses on stocks that look cheap relative to their competitive strength and growth prospects. The fund has had its ups and downs, but it has rewarded patient investors. Low fees also help.

For passive investors, Schwab Fundamental US Large Company SFLNX is an attractive option. The fund tracks the Russell RAFI US Large Company Index and weights its constituents by their fundamentals.

Large Growth

For the 22nd time this century, the large-growth Morningstar Category was one of the unloved categories. MFS Growth MFEGX remains a smart choice, even though comanager Paul Gordon retired in April 2023. MFS is a model for handling succession planning, so able hands remain at the helm, including longtime manager Eric Fischman and Brad Mak, a comanager since June 2021. They haven’t changed the fund’s patient, quality focused process that has delivered strong results since Fischman’s 2002 start.

Vanguard Growth Index’s VIGAX tight index tracking and thin fee make it a great choice for passive investors. The fund tracks the CRSP U.S. Large Cap Growth Index and uses market-cap weighting to size holdings.

Health

Healthcare funds have struggled over the last two years, but T. Rowe Price Health Sciences PRHSX is a solid option. Lead manager Ziad Bakri leads a team of nine global analysts, several of whom have advanced medical degrees. A former biotechnology analyst, Bakri favors biotech over large pharmaceuticals. His approach is also broader and more aggressive than most peers. Bakri will invest in all sized firms and even private companies. This has led to more volatility than peers, but it has also delivered higher returns.

Among the few passive healthcare options: Vanguard Health Care ETF VHT, which tracks the MSCI US IMI Health Care 25-50 Index, stands out.

Version 2′s Results

Three fixed-income, shorter-duration categories were the most unloved in version 2: bank loan, muni national short, and short-term bond. The most popular categories were long government, derivative income, and intermediate core bond.

Here are some specific unloved ideas.

Bank Loan

Before veteran manager Eric Mollenhauer took over Fidelity Floating Rate High Income FFRHX in 2013, it was one of the most cautious bank-loan offerings. But Mollenhauer and his team have bumped up the portfolio’s B rated debt, reduced cash, and sprinkled in some more-aggressive names. The fund has varied its helpings of these securities over time, but in recent years, the fund has floated to the category’s middle ground in terms of risk. This has helped the fund when bank loans have done well, including this past year.

Short-Term Bond

Mary Ellen Stanek, winner of Morningstar’s 2022 Outstanding Portfolio Manager award, and co-CIO Warren Pierson lead Baird Short-Term Bond’s BSBIX veteran 10-person management team. They match the Bloomberg U.S. Government/Credit 1-3 Year Index’s overall interest-rate sensitivity and then try to add value through security selection and sector allocation. The team shuns junk bonds, but this tamer approach hasn’t surrendered much over time. Its institutional shares have beaten the benchmark in nine of the past 10 calendar years.

IShares 1-5 Year Investment Grade Corporate Bond ETF’s IGSB broadly diversified portfolio of short-term investment-grade U.S. corporate bonds and low cost make it a fine passive option.

Muni National Short

Fidelity Limited Term Municipal Income’s FSTFX straightforward, risk-conscious approach makes it an exemplary choice. The fund has seen some manager turnover, but Cormac Cullen, Elizah McLaughlin, and Michael Maka still lead an experienced team. They use Fidelity’s proprietary tools to find mispriced muni bonds. The fund is often more sensitive to interest-rate changes than many of its peers, which can hurt when rates spike, as they did in 2022. But the team’s thoughtful credit and liquidity stance keeps the fund out of big trouble and provides a boost in rallies.

IShares Short-Term National Municipal Bond ETF SUB tracks the ICE Short Maturity AMT-Free US National Municipal Index. The ETF’s broad portfolio and affordable price tag make it a strong passive option.

Takeaways

Buy the Unloved can be a useful way to surface profitable contrarian ideas, but it’s a better complement, rather than core component, of a diversified portfolio. As the repeated appearance of large growth among version 1’s unloved shows, outflows don’t always point to areas with the lowest valuations. Heading in the opposite direction of flows, however, can turn up potential investments that the crowd has underestimated.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)