Why We Upgraded 4 Baird Funds to Gold

A deep dive on these changes and other ratings highlights from February.

All the share classes of Baird Advisors’ four largest bond funds now have Morningstar Analyst Ratings of Gold. A recent People Pillar upgrade for the team that manages them raises the remaining funds’ share classes to Morningstar’s highest qualitative rating. Increased conviction in the quality of the squad running Baird Core Plus Bond BCOIX, Baird Aggregate Bond BAGIX, Baird Short-Term Bond BSBIX, and Baird Ultra Short Bond BUBIX boosted their People Pillar ratings, which, combined with their already High Process and Parent Pillar marks, resulted in the overall upgrades.

While other top-tier fixed income firms may have larger staffs, Baird’s seasoned leadership and tight-knit investing culture make it exemplary. Co-CIOs Warren Pierson and Mary Ellen Stanek, Morningstar’s 2022 Outstanding Portfolio Manager award winner, lead a diverse 10-person management team. Stanek, Pierson, Baird Advisors founder Charles Groeschell, and research director Jay Schwister make up the firm’s strategic leaders’ group, and each has more than 35 years of industry experience. The other six managers help lead the firm’s credit, securitized, municipal, and portfolio-construction and risk-monitoring teams and represent Baird’s next generation. Overall, the firm has 32 investment professionals that average nearly 10 years of firm and 20 years of industry experience as of January 2023.

The group tends to hang on to people, too. Since its early 2000 founding, only two managers have left the team, both to retire. Just two analysts have left since 2016.

It’s a team that knows its limitations. It eschews highly credit-sensitive or esoteric investments that would require resources beyond those it currently has. The managers also keep their funds’ interest-rate sensitivity close to that of their benchmarks. They focus on winning via security selection and sector rotation rather than big macro bets. That may limit the strategies’ potential upside at times in the short term, but they would rather post modest, but consistent performance rather than periodically spectacular results.

The funds’ disciplined, methodical approach and modest fees have worked well. All four ranked in the top third of their respective Morningstar Categories for the trailing three-, five-, and 10-year periods through year-end 2022 (institutional share class). Their outperformance has also been incredibly consistent: Each fund has also beaten its index and respective category median in at least seven of the past nine calendar years.

New to Coverage

AMG Yacktman Global YFSIX debuted with an Analyst Rating of Bronze last month. A trio of experienced and successful managers—Jason Subotky, Stephen Yacktman, and Adam Sues—run the strategy. The group has already built impressive records on Silver-rated AMG Yacktman YACKX and AMG Yacktman Focused YAFFX, but this fund is quite different. This strategy is more concentrated, holds more non-U.S. names, and has a greater stake in small- and mid-cap stocks. Launched in 2017, this fund has a short track record, but the managers have proved capable elsewhere.

Ratings Roundup

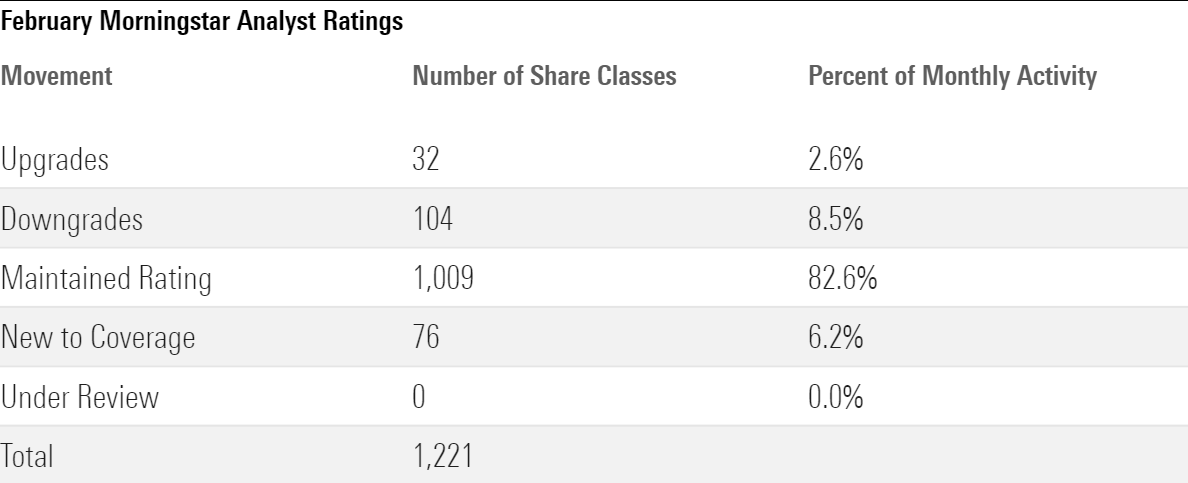

Morningstar updated the Analyst Ratings for 1,221 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios in February 2023. Of these, 1,009 retained their previous rating, 32 earned upgrades, 104 received downgrades, and 76 were new to coverage. Looking through share classes and vehicles to their underlying strategies, Morningstar issued 360 Analyst Ratings throughout February. Of these, only six were new to coverage, 13 received upgrades, and 67 received downgrades, but the majority (274) retained their previous ratings.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)