How to Create a Custom Benchmark

Learn how Morningstar analysts build blended benchmarks.

Certain funds defy easy comparison to broad equity or fixed-income indexes, such as the S&P 500 or Bloomberg U.S. Aggregate Bond Index. For example, it would be inappropriate to compare a balanced fund composed of individual stocks and bonds to a pure equity or pure fixed-income index. A blended benchmark combining equity and fixed-income indexes would be more applicable.

You can create such a blended benchmark with Morningstar Direct’s Portfolio Management module. To illustrate, let’s look at the popular American Funds American Balanced (ABALX) and its benchmark.

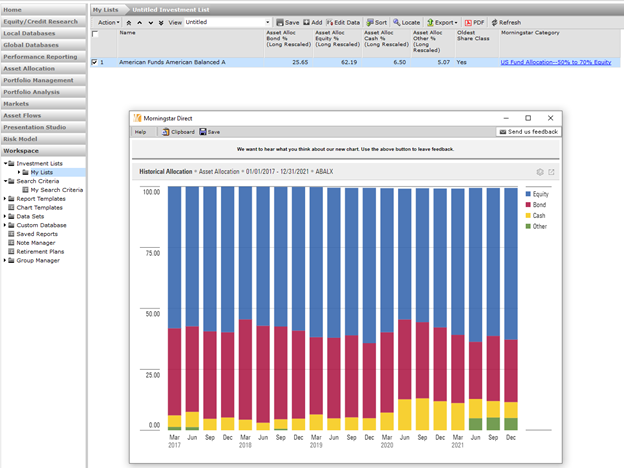

American Balanced is in the allocation--50% to 70% equity Morningstar Category and uses a blend of 60% S&P 500 index and 40% Bloomberg U.S. Aggregate Bond Index as its primary prospectus index. To make sure this mix is most appropriate, we can also create a quick historical allocation chart.

To make this chart, bring the fund into workspace in a new investment list. Once you add the fund, highlight it, and go to the Action button in the top left corner. Select Interactive Charts – Historical Allocation in this dropdown menu. The default will automatically pull up the asset-allocation breakdown. Use the gear settings icon in the top right corner to further customize the chart; however, the chart clearly shows this fund has had a roughly 60% equity exposure for some time.

So, a 60% S&P 500 index and 40% Bloomberg Aggregate Index combination seems most appropriate.

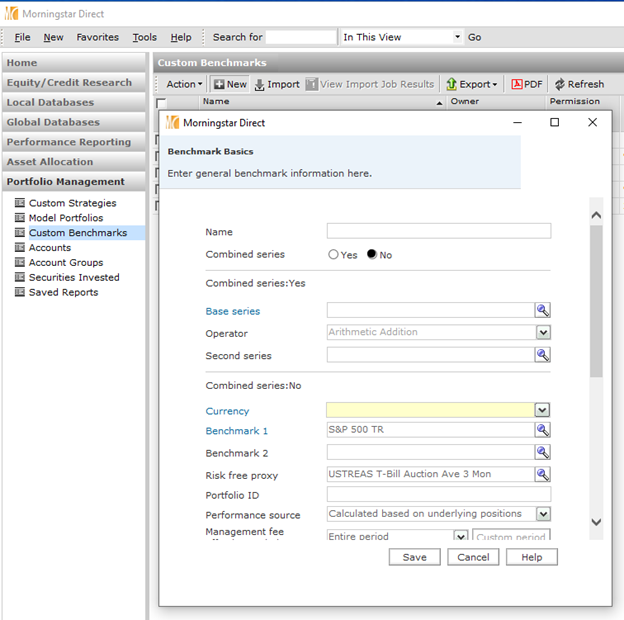

To create the blended benchmark, use the Custom Benchmark section of the Portfolio Management module. Once there, select the New button at the top of the screen. This will open a pop-up window to customize the custom benchmark settings.

While there are a lot of options on this screen, only a few settings are applicable for building a blended benchmark. After entering a name, skip over the Combined Series section and leave it checked as “No.” After that, select the correct currency but skip over the benchmarks and risk-free proxy settings.

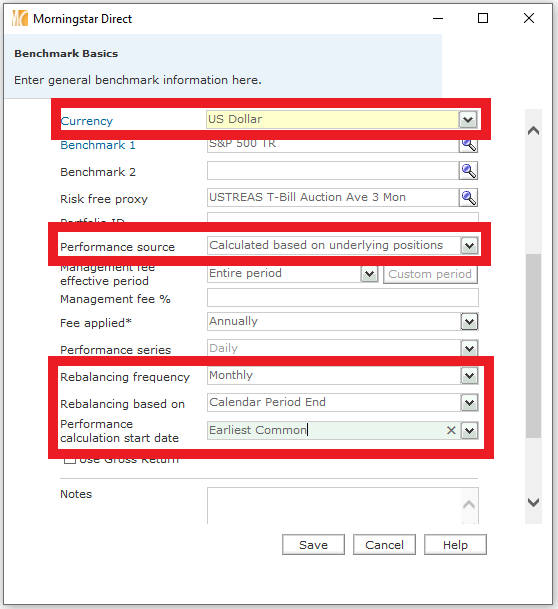

The most important setting selections remain at the bottom. For the benchmark to work, set the Performance Source option to “Calculated based on underlying positions.” Then for simplicity, skip the fee section.

Rebalancing options are next. Set the frequency to monthly and the rebalancing to occur on the "Calendar Period End" or, in this case, the end of the month. This rebalancing follows what American Funds states on its website as well as the methodology for the Morningstar Category Average.

Finally, set the Performance Calculation Start Date to Earliest Common, as this means that performance will begin once every constituent has been incepted. See the highlighted settings picture below for a quick summation:

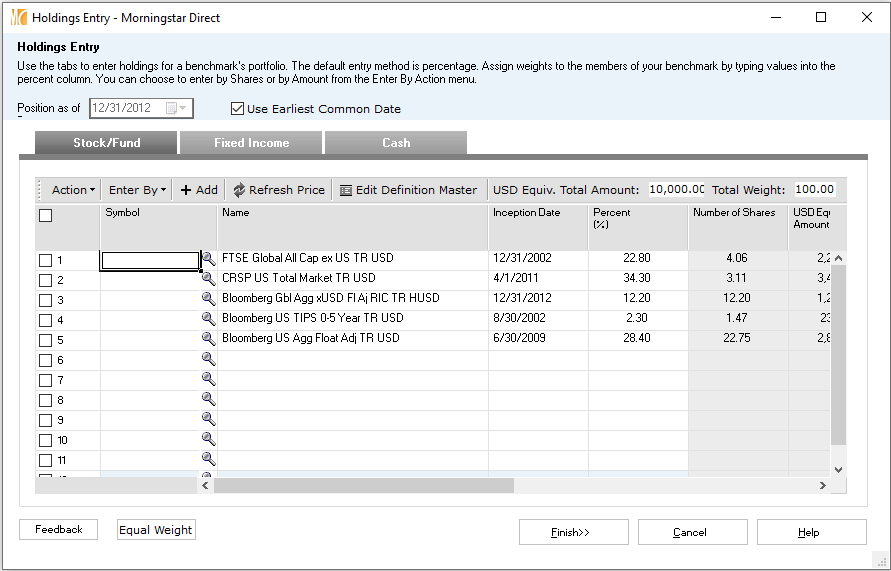

Once you input all the settings, click Save, and a new pop-up will open. Here, enter the indexes for the blended benchmark and their appropriate weights. By using the magnifying glass, you can find and add the market indexes. Then, using the Percent column, you can add the appropriate weights.

📷

Clicking the “Finish>>” button creates the blended benchmark. Now the index can be brought into just about any module in Direct and we can properly compare American Funds American Balanced. For example, I brought the blended benchmark into Workspace as an Investment List to compare returns below:

📷

Note: When bringing the benchmark into Workspace, the benchmark may take a while to load and will show up with a green arrow while the data is calculating. This is normal and should only take a few seconds, but it can take longer depending upon the data set and the number of constituents in the benchmark.

📷

While the 60/40 blend may be rudimentary, much more complicated blended benchmarks can also be created. For instance, Vanguard Target Retirement 2025 (VTTVX) uses a unique blend of five indexes for its primary prospectus benchmark.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2TT3THVKOJAKBFGHCCRTVPNEQ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)