Which Funds Declined on the Plunge in Netflix Shares?

Funds investing in fast-growing stocks and those with a niche focus had the most exposure.

Several mutual and exchange-traded funds with holdings in Netflix NFLX declined Wednesday after shares in the streaming services giant fell 35% following the company's first quarterly decline in membership in more than a decade.

For the funds most widely held by investors the impact was minimal. The $400 billion SPDR S&P 500 ETF SPY fell just 0.06% on the day and has less than 0.50% of its portfolio in Netflix. The $286 billion Vanguard Total Stock Market Index VTSAX declined 0.11%, and Netflix represented 0.36% of its holdings as of March 31.

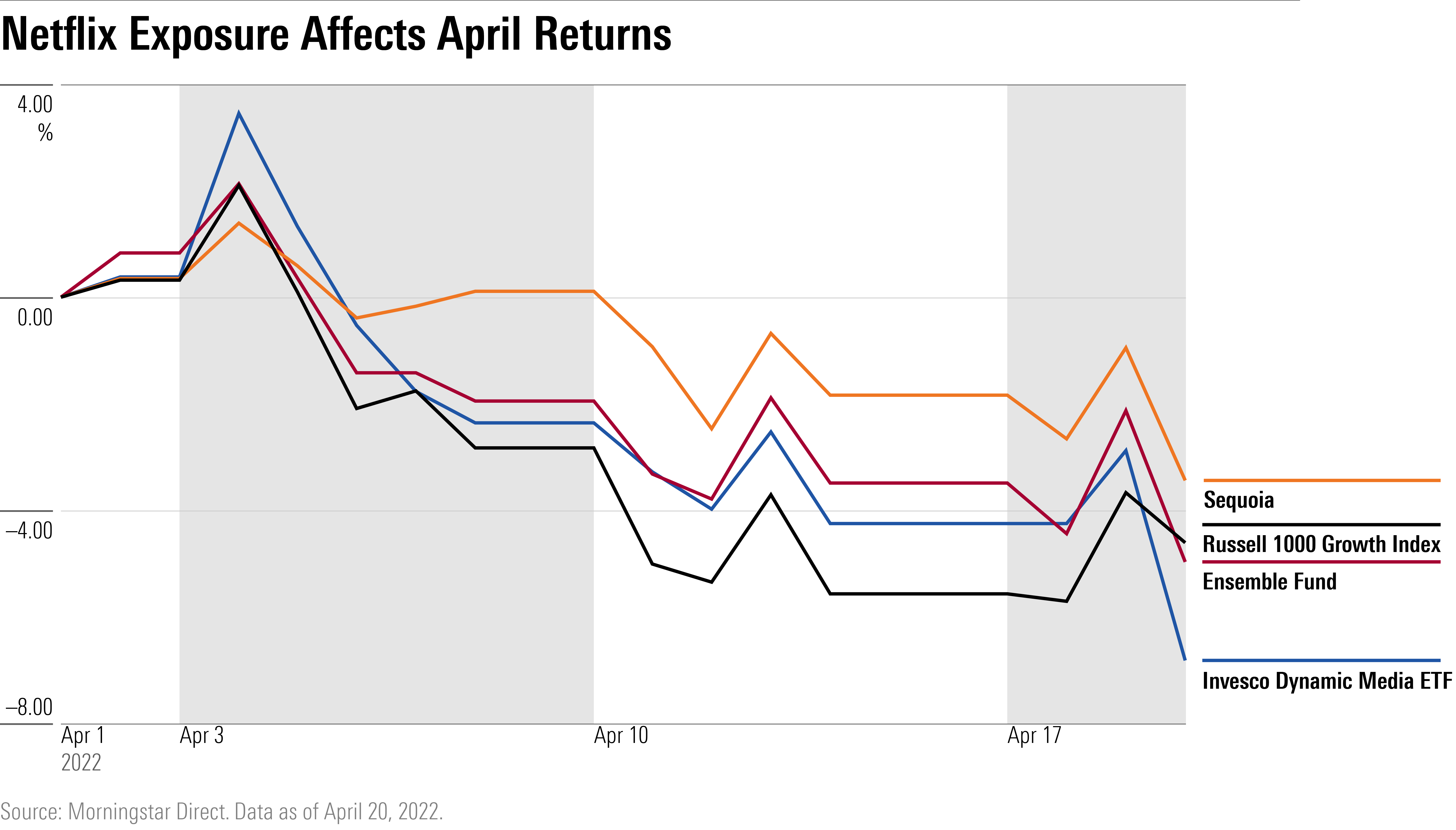

Netflix's 62% plunge this year has mostly affected large-growth funds that look to invest in the biggest and fastest-growing stocks in the United States. Many growth stocks have dropped sharply this year as interest rates rise, translating into lower valuations and higher borrowing costs.

For the Russell 1000 Growth Index, a commonly used benchmark by large-growth funds, Netflix represented 0.75% of the index as of March 31. It is down 13.2% this year. The $248 billion American Funds Growth Fund of America AGTHX had slightly more, with a weighting in Netflix of more than 1.90% at the end of last month.

Some managers had more invested in the company. Ensemble Fund's ENSBX second-largest holding was in Netflix at the end of last month with a 7.7% weighting. The fund slid 2.9% Wednesday and has dropped 19.8% this year. Portfolio manager Sean Stannard-Stockton outlined the firm's stance on Netflix in a January note.

Sequoia SEQUX had a 4.32% holding in Netflix at the end of March, one of only 24 companies it is invested in. Morningstar's Andrew Daniels wrote in a June note the fund invested in Netflix early last year following its purchase of Walt Disney DIS shares in the second quarter of 2020. The fund fell 2.5% on Wednesday and is down 15.6% in 2022.

It wasn't exclusively large-growth managers placing large bets on Netflix. In the large-value Morningstar Category, Oakmark Select OANLX had 4.32% of its assets under management in Netflix as of March 31. The team considers nontraditional value stocks, Morningstar director Katie Rushkewicz Reichart says.

Bill Nygren, manager of Oakmark OAKMX and Oakmark Select OAKLX, is still a believer in the company despite the disappointing first-quarter results.

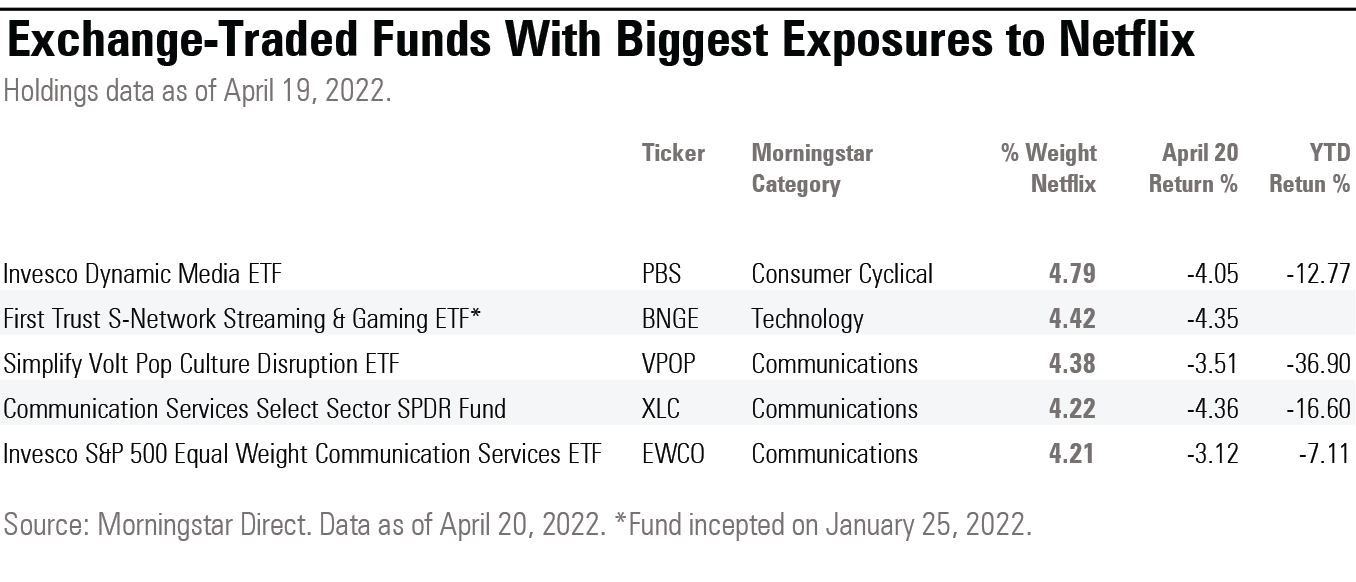

Among exchange-traded funds, it was those in niche categories that had the most exposure to Netflix.

Invesco Dynamic Media ETF PBS tracks an index that consists of 30 U.S. media companies. It had a 4.79% weighting in Netflix as of April 19 and is down 12.8% year to date.

First Trust S-Network Streaming & Gaming ETF BNGE launched on Jan. 25, 2022, and holds 4.42% in Netflix. The fund has $3.1 million in assets and is down 14.1% since its inception.

Simplify Volt Pop Culture Disruption ETF VPOP, is an actively managed ETF that invests in companies poised to dominate the new era of media, according to its prospectus, and also boosts its concentrated exposures with options. The fund launched in 2020 and has dropped 36.9% this year.

Of the sector funds with the largest Netflix exposure, Invesco S&P 500 Equal Weight Communication Services ETF EWCO has held up the best, losing 7.11% this year.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)