U.S. Fund Flows: Momentum Stalls in February

Bond-fund flows stayed positive, but U.S. equity funds remained weak.

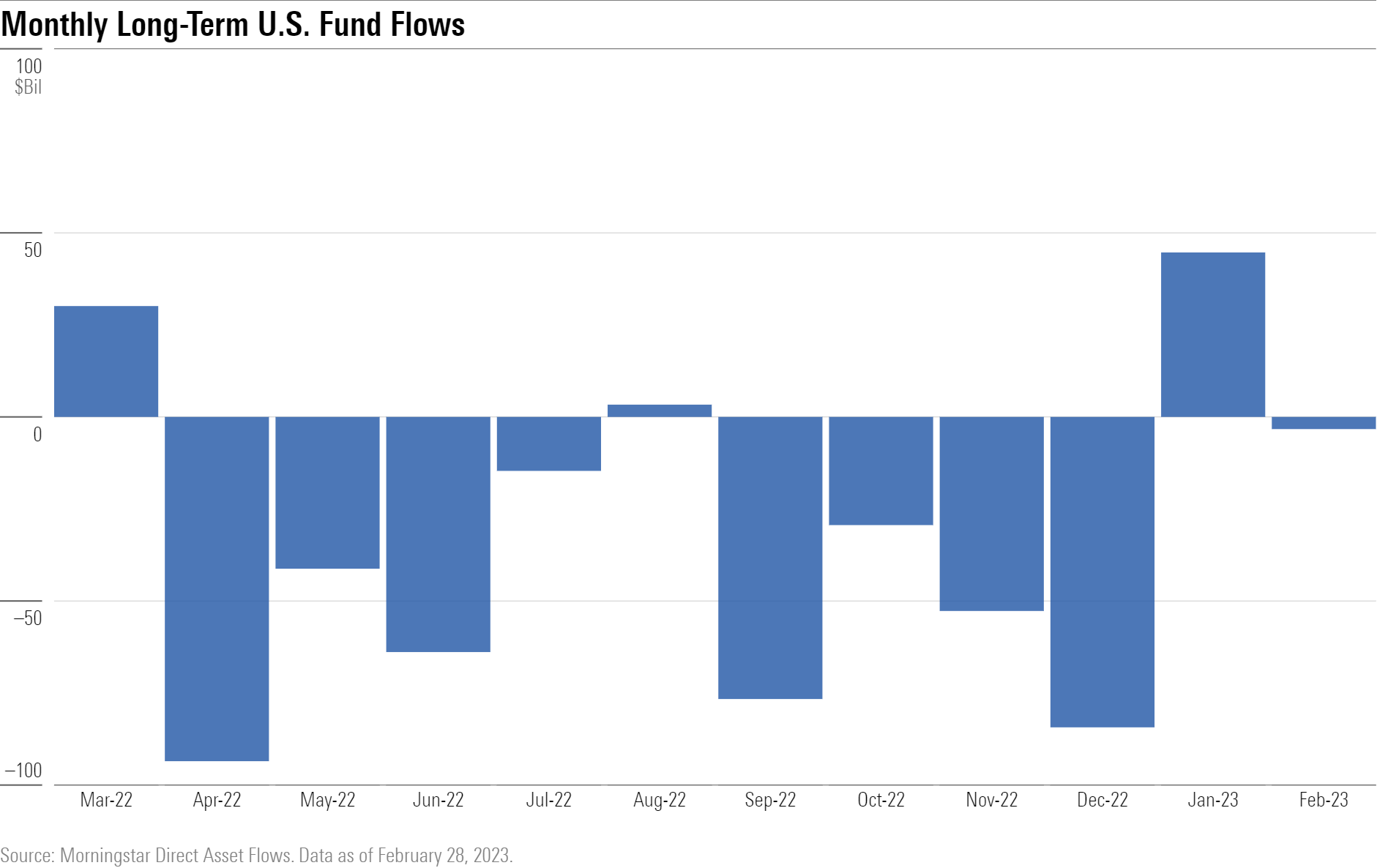

Hopes of a sustained rebound in investor demand dissipated in February 2023 as U.S. funds saw about $3 billion leave. The general flow trends across the 10 category groups rhymed with January’s, but inflows moderated while outflows picked up.

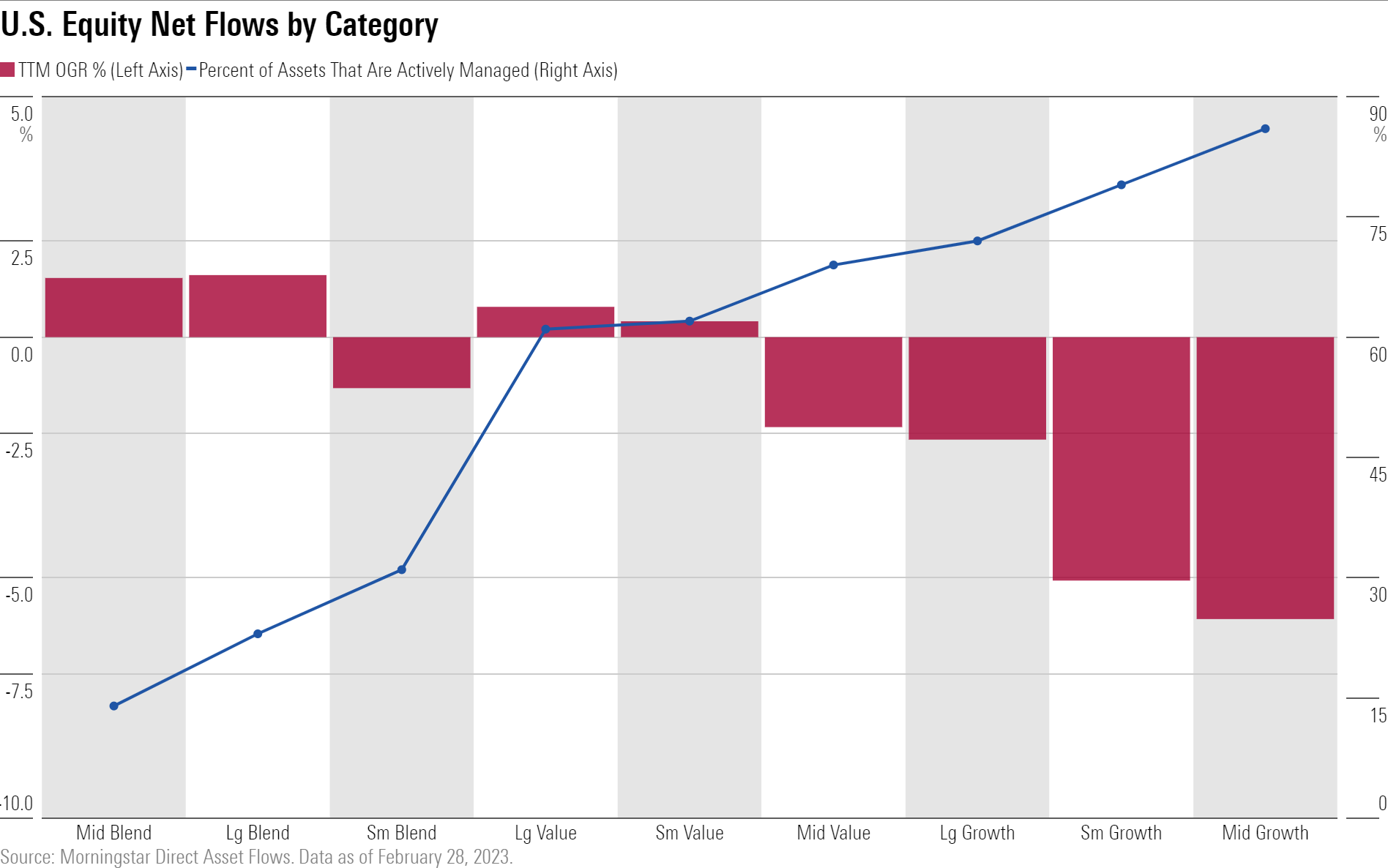

Active/Passive Divide Complicates U.S. Equity Flows

U.S. equity funds had modest outflows in January but saw larger ones in February. The category group dropped $25.4 billion during the month, driven by a $21.0 billion outflow from large-blend funds. The dispersion of flows within the broader group is likely linked to the relative prevalence of actively managed funds, which continue to struggle to attract inflows.

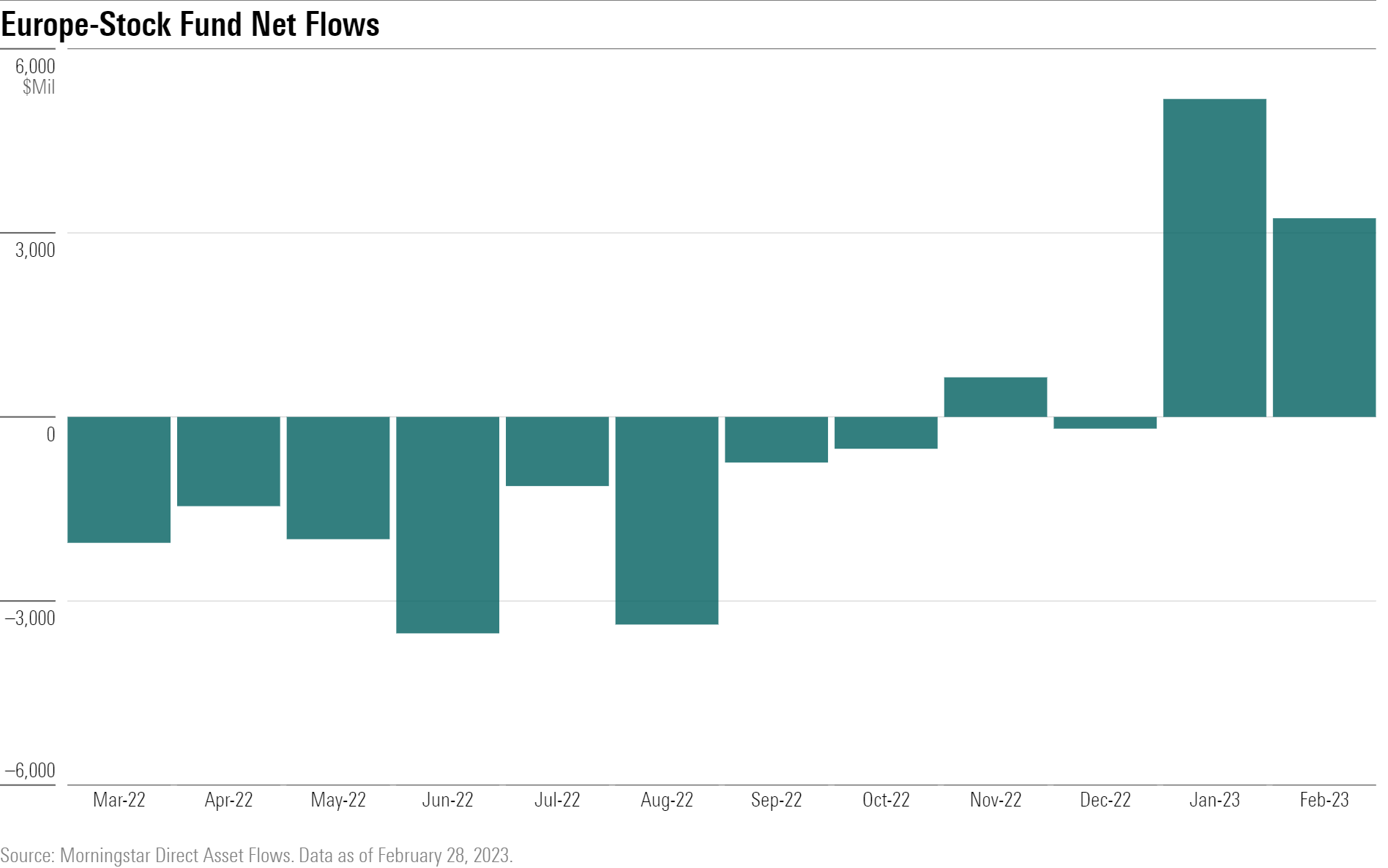

Investors Pivot to Europe

International-equity funds broke a five-month streak of outflows in January and built on that momentum in February with a $9 billion intake. Investors have most notably embraced Europe-stock funds so far in 2023, as they’ve collected over $8 billion through February—the most of any category in the group and good for an impressive 14% organic growth rate.

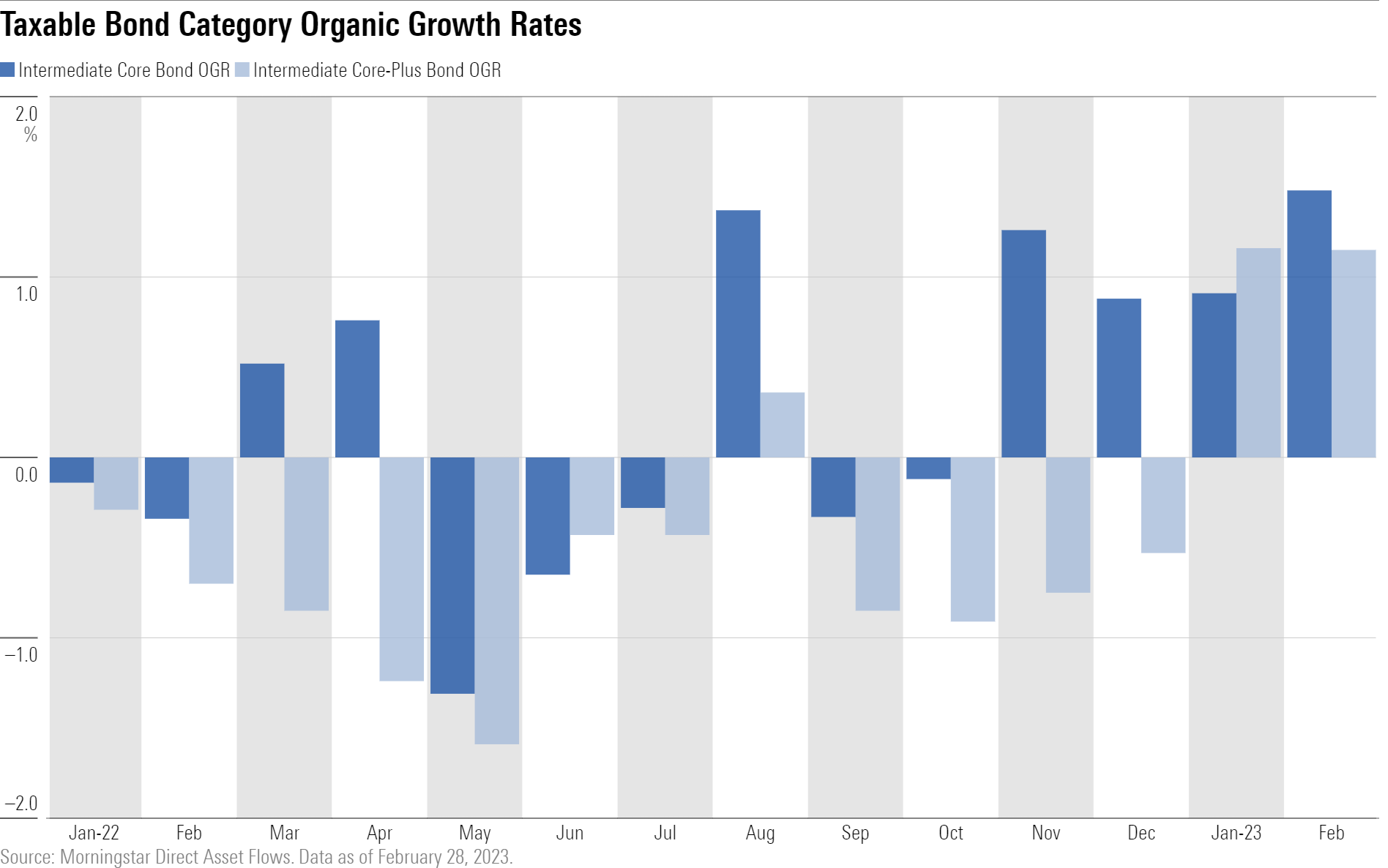

Taxable Bond’s Big Hitters Step Up

Taxable-bond funds reeled in nearly $21 billion in February behind strong inflows into the two largest bond categories. Intermediate core and intermediate core-plus funds led all Morningstar Categories with about $17 billion and $8 billion of inflows, respectively. That continued a hot start to 2023 after heavy outflows from both categories drove record taxable-bond outflows in 2022.

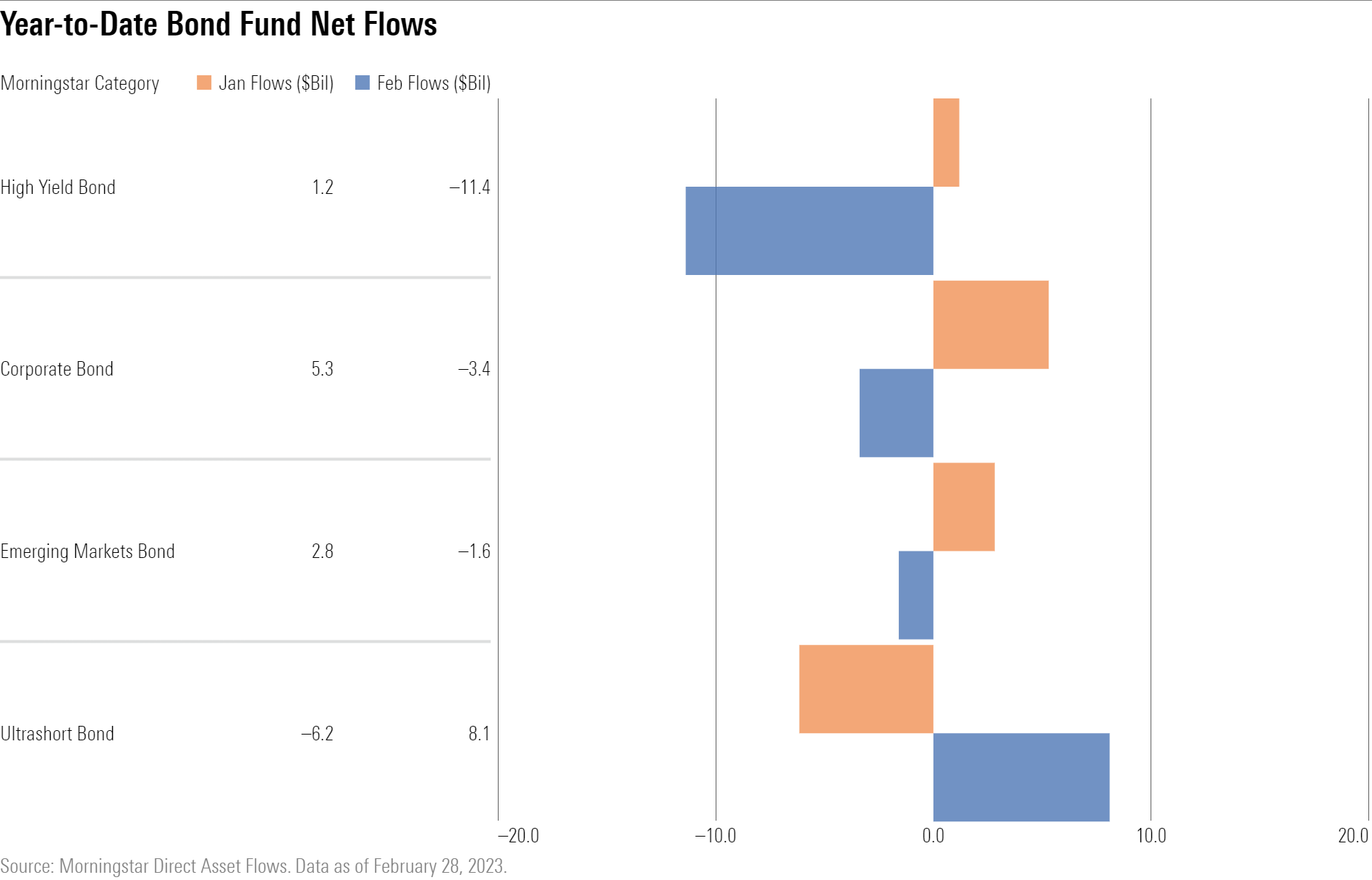

Bond Investors Reverse Course on Risk

After piling into riskier bond funds in January, investors moved to safer options in February. The reversal hit high-yield bond funds the hardest, as they suffered their worst outflows since January 2022. Cashlike ultrashort bond funds, on the other hand, welcomed over $8 billion of new money.

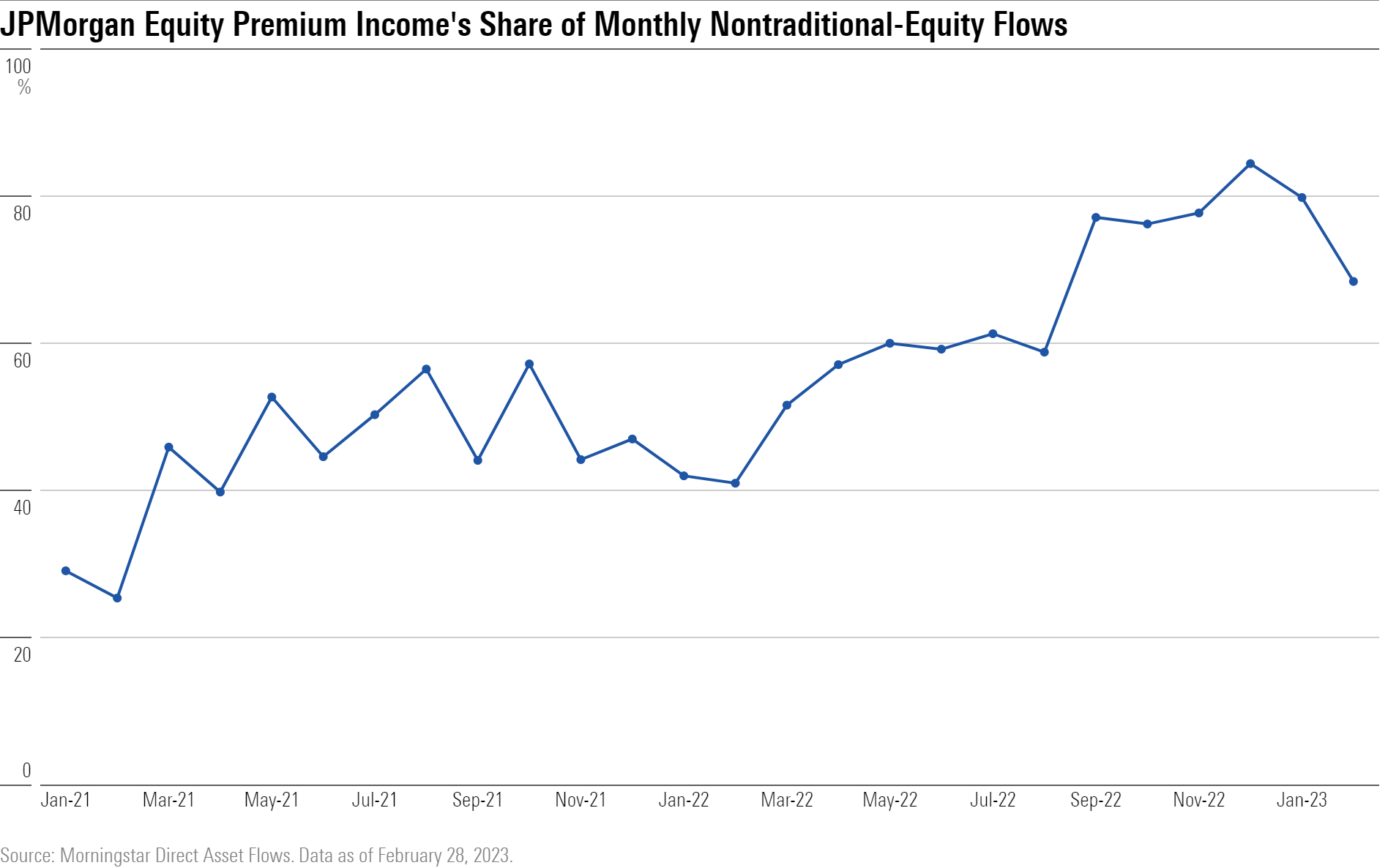

Nontraditional-Equity Funds Still on Fire

A February intake of $2.9 billion brought nontraditional-equity funds’ streak to 26 months of inflows. Over that stretch, they’ve collected nearly $48 billion. Much of the group’s success owes to a star strategy in JPMorgan Equity Premium Income, whose mutual fund (JEPIX) and ETF (JEPI) vehicles are responsible for roughly $28 billion of that total.

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for February 2023. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)