Large-Growth Active Fund Managers Have Faced an Uphill Battle

Why they’ve failed to beat their benchmark’s huge gains over the long run.

Funds in the large-growth Morningstar Category went on a huge run after the global financial crisis. From the low on March 9, 2009, through 2021, a period that included many ups and downs but was mostly favorable for large growth, the category gained 18.6% annualized, more than any Morningstar Style Box category. Even in moments of panic, such as the early 2020 coronavirus drawdown, the category came out ahead, as stay-at-home trends benefited many technology firms that large-growth funds favored.

Yet, challenges loomed. Large-growth stocks crashed in 2022. The Russell 1000 Growth Index, often used to measure the success of active funds, became more top-heavy as the market’s biggest companies dominated. Index-beating performance, already hard for active funds, has seemed nearly unachievable over the past decade.

In “The Big Shortcoming,” we explore how the large-growth landscape has changed over the past decade and look at recent trends following 2022′s tough year for large-growth funds, including flows, tax consequences, and the emergence of active exchange-traded funds. We also hunt for the main culprits behind active managers’ failure to prove their worth.

A Lucrative Decade for Large Growth, but a Lost One for Active Managers

Large-growth stocks may have been lucrative over the past decade, but it was also the worst category for active portfolio managers. Only 6% of active large-growth funds around in 2013 outperformed the category benchmark through 2022. Many others folded, liquidated their portfolios, and stuck investors with unexpected tax bills.

One natural headwind to a fund’s success is its cost. As direct offsets to total returns, higher management fees and other expenses pose a higher hurdle to outperformance. But they were not a root cause of the typical large-growth fund’s lackluster results; its before-fee returns over the past decade also struggled.

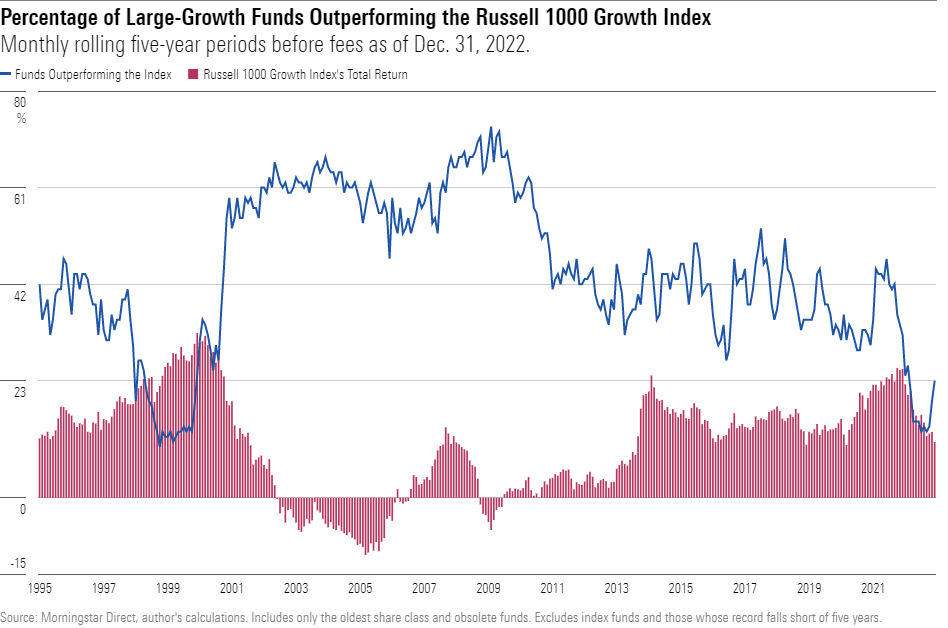

Large-growth portfolio managers used to be more successful. From 2000 to 2010, 60% or more of them often beat the index over a given five-year period. That figure reached new lows in 2022, when less than one fourth of active funds had beaten the index over the trailing half-decade.

The hurdles to success have gotten higher for all large-growth managers. Even top-quartile funds, which prior to 2012 had typically exceeded the index by 1 percentage point or more, have lagged the benchmark in recent years.

Some researchers say this reflects an increasingly competitive market. It is tempting to conclude that managers have become inept because of the slide in measures of outperformance and success, but arguably the opposite is true. Just as it has gotten harder for individual runners and swimmers to differentiate themselves from their rivals as the average speed and skill levels of athletes have increased, it has become more difficult for highly educated, experienced, diligent, and well-resourced managers to beat their similarly endowed, seasoned, and motivated rivals.

The Burden of a Bull Market?

The market’s rise over the past decade put stock-pickers at a disadvantage, say some active investing proponents. Since active managers tend to hold some cash in anticipation of fund-investor redemptions, a portion of the fund’s assets earn far less than stocks during a bull market. Advocates of active investing have often said that the funds’ relative results would instead thrive during bear markets, when active managers can showcase their ability to use cash or other means to mitigate risks that the index can’t avoid.

Active large-growth funds’ cash stakes do hinder their upside but do not fully explain why they lag the index over the long term. They typically hold less than 2% in cash. A hypothetical portfolio of a Russell 1000 Growth-tracking ETF and 4% cash rebalanced monthly would still have done better than the category average and with milder volatility.

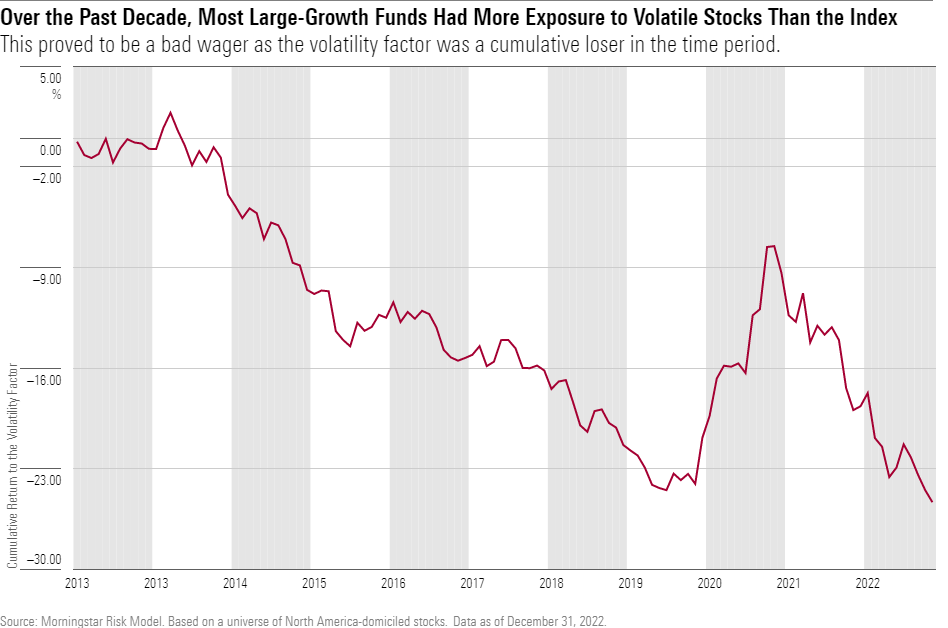

Large-growth managers also haven’t reliably provided downside protection or milder risk profiles. Most embraced more-volatile stocks that tend to fall harder in drawdowns. Such exposure hurt the funds’ results as volatile stocks underperformed the broad market during the decade.

This helps explain why large-growth funds’ risk-adjusted results look as bad as their absolute returns.

A Snag in Active Managers’ Style Being in Favor?

The relative success of large-growth stocks themselves also could have been a headwind. The recipe for stellar returns from 2013 to 2022 seems simple in hindsight: own U.S. large-cap growth stocks. Actively managed funds, however, tend not to be pure plays on their benchmark’s style. Active large-growth funds, for example, tend to own more stocks with lower earnings-growth expectations, cheaper valuations, smaller market-capitalizations, and greater international exposures than their benchmarks do. That can disadvantage active stock funds relative to their indexes when their style is in favor because the benchmarks tend to be unalloyed representations of the styles.

This defense of active large-cap growth managers suggests they may regain the upper hand when nonbenchmark stocks outperform. Except, the average large-growth fund hasn’t reliably outperformed the benchmark during the meaningful (albeit brief) environments when value stocks have beaten growth stocks.

After controlling for funds’ style and sector exposures, Morningstar’s risk model suggests that a hefty amount of the typical large-growth fund’s poor showing versus the benchmark owes to bad stock-picking.

The Burden of Benchmark Behemoths

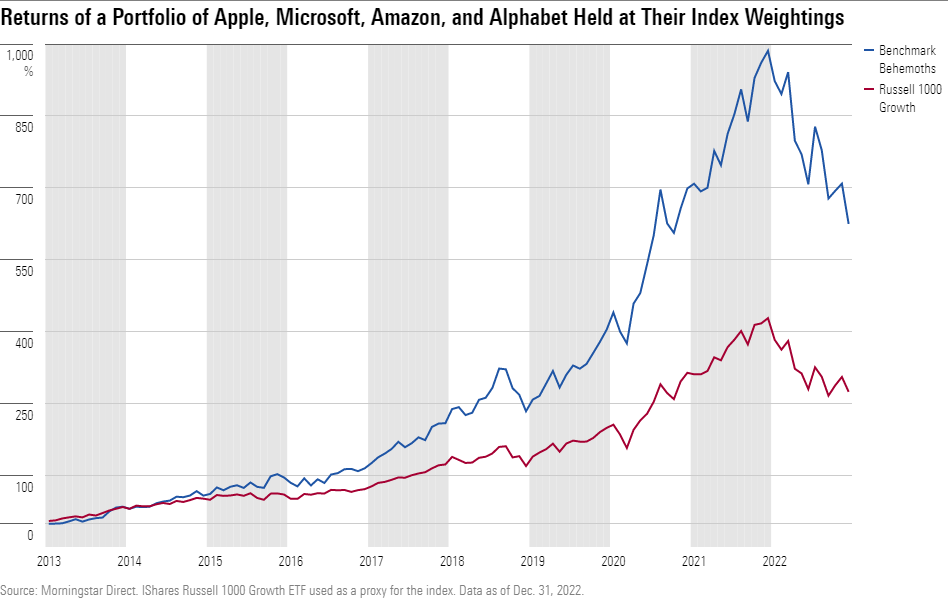

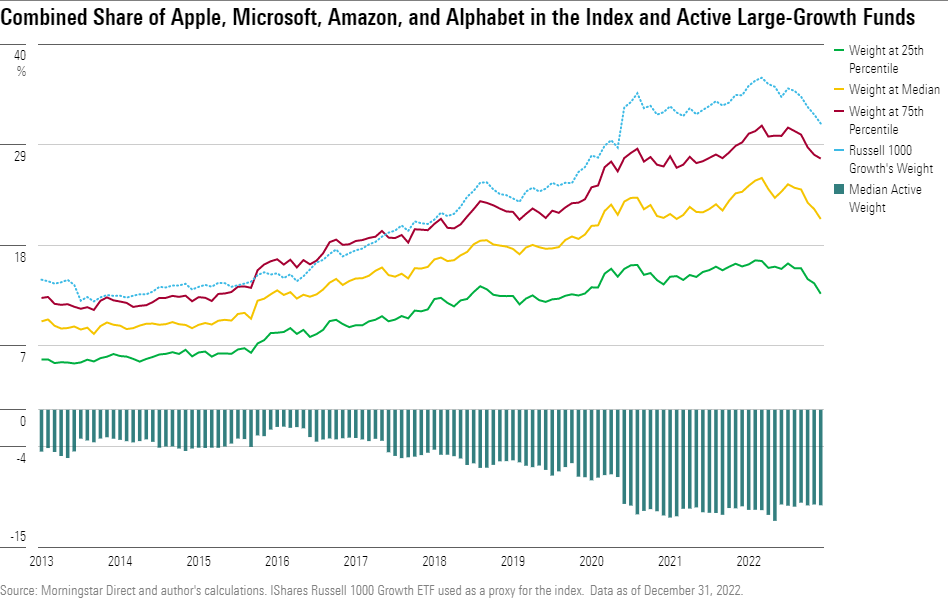

This postmortem so far has undercut arguments in favor of an active large-growth manager comeback. Now we arrive at a legitimate reason to cut them some slack: Four benchmark behemoths—Apple AAPL, Microsoft MSFT, Amazon.com AMZN, and Alphabet GOOG—accounted for a huge share of the index’s gain from 2013 to 2022 and left stock-pickers few ways to surpass it.

The stocks’ combined index weight more than doubled from 2013 to 2022, when its 35% peak marked a degree of company-specific concentration far above the previous highs of the late 1990s and early 2000s. Investing less than the index in those stocks early in the period, as the median active large-growth manager did, now looks like a mistake, since those companies went on to post spectacular, benchmark-bolstering growth and gains. In recent years, however, portfolio managers’ reluctance to own more of the behemoths than the index was arguably prudent or even a legal necessity.

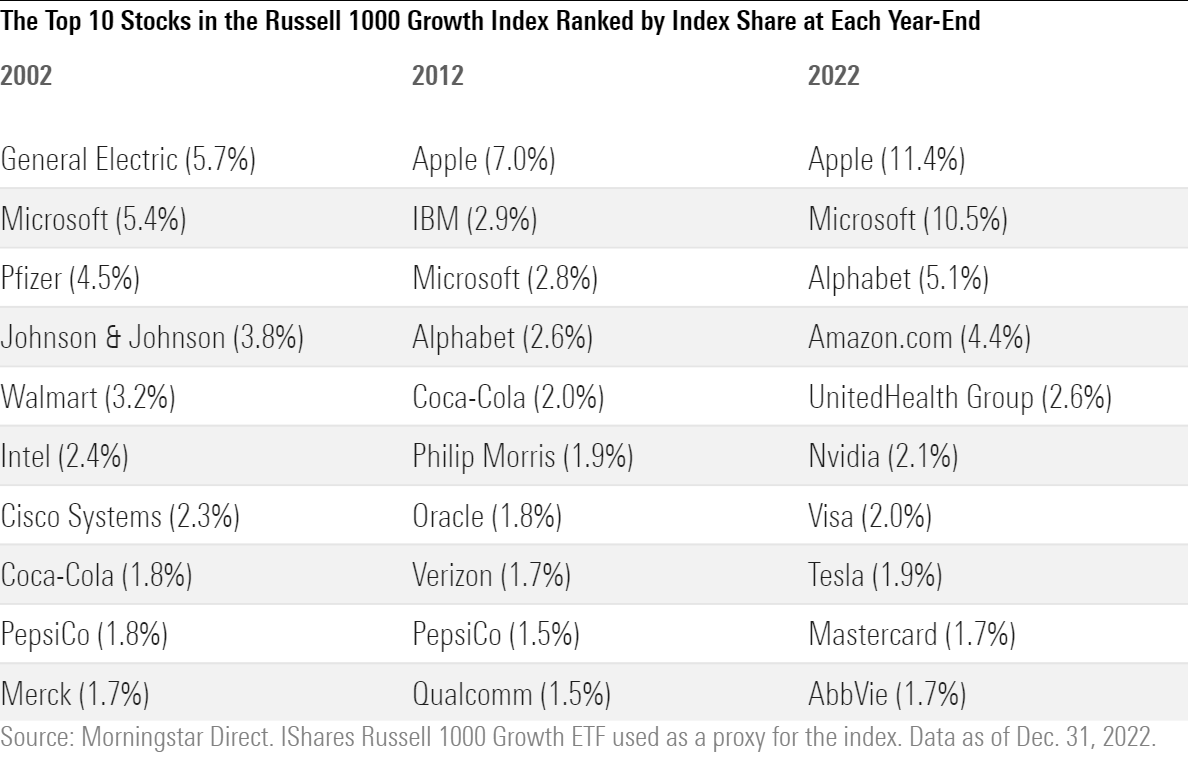

There are valid reasons not to chase the giants, though. Few managers are willing to stomach the degree of company-specific risk embedded in the index. And most companies that approach the size of the benchmark behemoths struggle to maintain their breakneck growth. Innovation slows, execution gets less nimble, and smaller competitors nip at incumbents’ heels. A company’s index dominance is often temporary. History was on the side of large-growth fund managers who, a decade ago, underestimated the staying power of the benchmark behemoths. Advancing to the top of the index has often presaged a retreat, as the table below shows.

Underweighting the behemoths helps diversified large-growth funds when the benchmark’s largest holdings perform poorly but hurts when the biggest stocks do well, as they did for many years before 2022.

Conclusion

Active managers’ lousy showing over the past decade sends a strong signal about the merits of cheap index-trackers. Indeed, with an index’s stock allocations determined by the wisdom of the crowd, market-cap-weighted passive investments are often excellent solutions. But history has shown that the madness of the crowd has also given large-growth-stock-pickers occasional opportunities to redeem themselves, and the unique concentration of the large-growth universe makes some of their underperformance in recent years forgivable. A top-heavy index is tough to beat when its largest constituents are also its best-performing ones. They may not be going forward.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)