How Large-Growth Funds Are Navigating Their Concentrated Universe

What does the rising number of nondiversified mutual funds mean for risk?

The wisdom of portfolio diversification seems ingrained in the Western psyche. Recommendations to not put all your eggs in one basket trace back hundreds of years; research in support of the proverb have earned Nobel Prizes.

It may then seem off-putting to some investors to notice their mutual funds officially describing themselves as nondiversified, as an increasing share of them have done. In 2021, T. Rowe Price started calling some of its large-growth funds that collectively manage more than $160 billion in assets as nondiversified in their prospectuses;[1] in 2023, Fidelity plans to do the same for a handful of its own large-growth funds, amounting to $120 billion.[2]

The new descriptions do not indicate these mutual funds have decided to get more aggressive, though. The diversification label—as legally defined by U.S. regulators—is not a particularly useful indicator of a fund’s audaciousness. And at strategies that try to stick closer to their benchmarks’ risk/reward profiles, adhering to the diversification rules can be a hindrance.

The Concentration Conundrum

The Investment Company Act of 1940 implies that an allocation of 5% or more to a single security is uncomfortably large; to earn the diversified status, a mutual fund must limit the aggregate share of such positions to 25% of its assets.[3]

The limits make some sense. Concentration courts volatility. To be sure, there have been many nondiversified funds whose top stocks have immensely helped or hurt their returns. One recent example is Baron Partners BPTIX, whose gargantuan stake in Tesla TSLA—recently more than half the portfolio’s assets—powered its extraordinary results from 2020-21 but sapped them in 2022 when the electric vehicle maker plunged by two thirds. Sequoia SEQUX suffered an infamous blowup from 2015-16 as the market value of its biggest holding, then known as Valeant Pharmaceuticals, collapsed and never recovered.

But knowing whether a fund is above or below that threshold does little to help understand its ability to withstand drawdowns and mitigate volatility—two key advantages diversification can provide. What may matter more is the riskiness of the fund’s largest positions or the degree to which the fund emphasizes stocks of one variety or another, among other things. An officially diversified fund such as Morgan Stanley Institutional Inception MSSGX, for example, can experience adrenaline-pumping undulations in performance that aren’t tethered to the results of its top holdings. Its exposure to stocks with high price/earnings ratios, volatility, and expected earnings growth explains most of its poor 2022 showing. That cohort posted some of the market’s steepest declines during the year. A fund with big individual country or industry bets also can experience big swings.

Nondiversified but Defensible

Not all nondiversified funds carry above-average risks. By avoiding companies with paltry earnings and hard-to-predict fortunes, Jensen Quality Growth’s JENSX compact portfolio of about 30 stocks, as of late 2022, has provided downside protection. Akre Focus AKRIX (20 holdings) and FMI Large Cap Investor FMIHX (32 holdings) also tend to provide steadier total returns than most peers. Each of these relatively mild-mannered funds is nondiversified.

But resilience and reliability may not be every investor’s topmost priority; some investors care more about a fund’s ability to outpace its benchmark’s total returns. One way to do that is to own funds that deliberately try to look and behave differently than their indexes by, among other things, building concentrated or focused portfolios.

The Disadvantages of Diversification

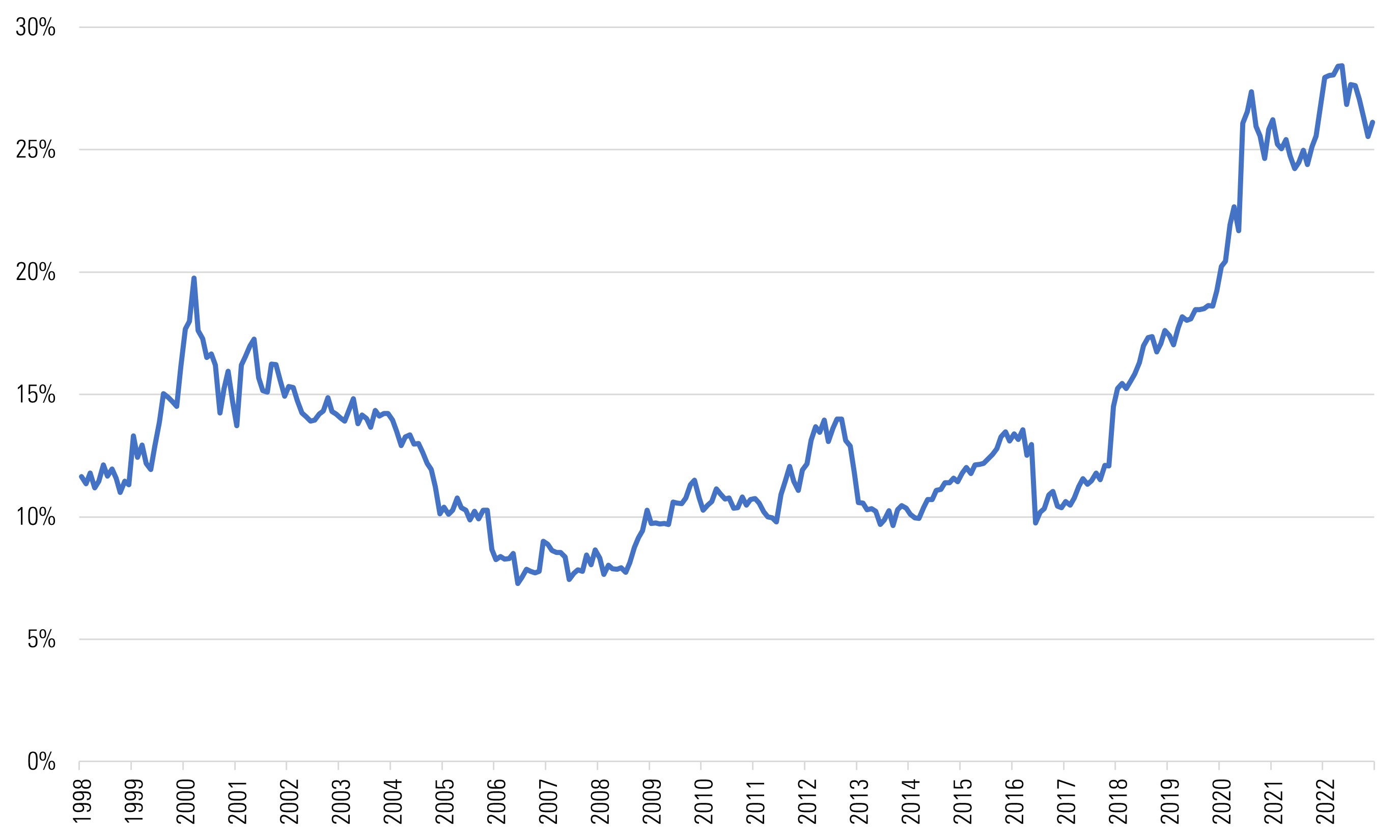

When a top-heavy index’s largest constituents are also its best-performing ones, bet on it to beat diversified funds benchmarked to it. Nowhere has this dynamic been more evident than the large-growth Morningstar Category. The Morningstar US Large-Mid Cap Broad Growth Index, a relevant benchmark for the group, has over the past three years reached levels of company-specific concentration not seen since the early 2000s.

Exhibit 1: The Combined Share of the Morningstar US Large-Mid Cap Broad Growth’s Largest Three Constituents

Since in recent months four stocks (Alphabet GOOG, Amazon.com AMZN, Apple AAPL, and Microsoft MSFT) each accounted for 5% or more of large-growth indexes and together consumed up to 35% of their aggregate market capitalization, they have complicated diversified managers’ jobs. Someone running a diversified large-growth fund who was bullish on each of those stocks couldn’t overweight any of them without underweighting another.

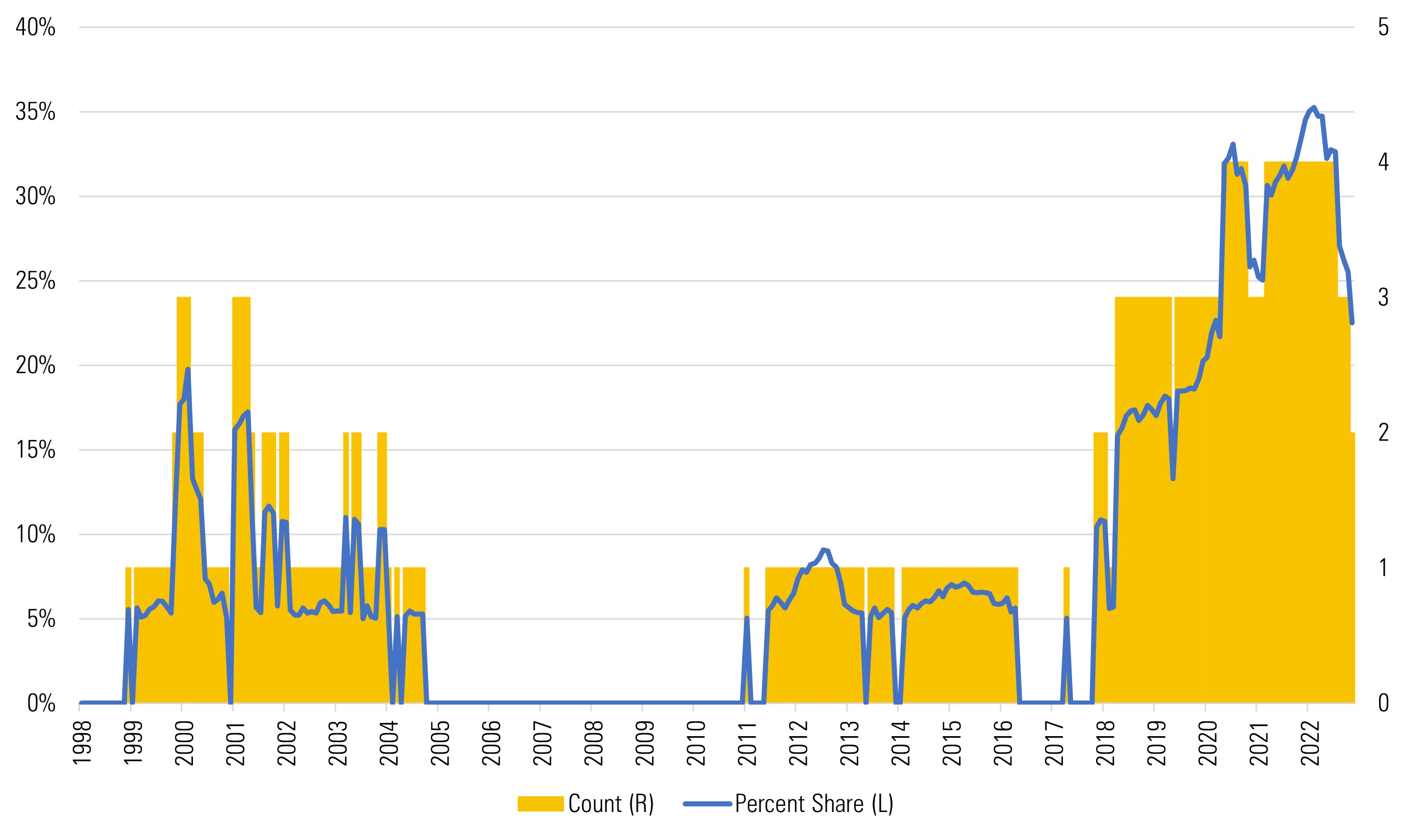

Exhibit 2: The Count and Combined Share of Stocks Within the Morningstar US Large-Mid Cap Broad Growth Index Exceeding 5% of the Index

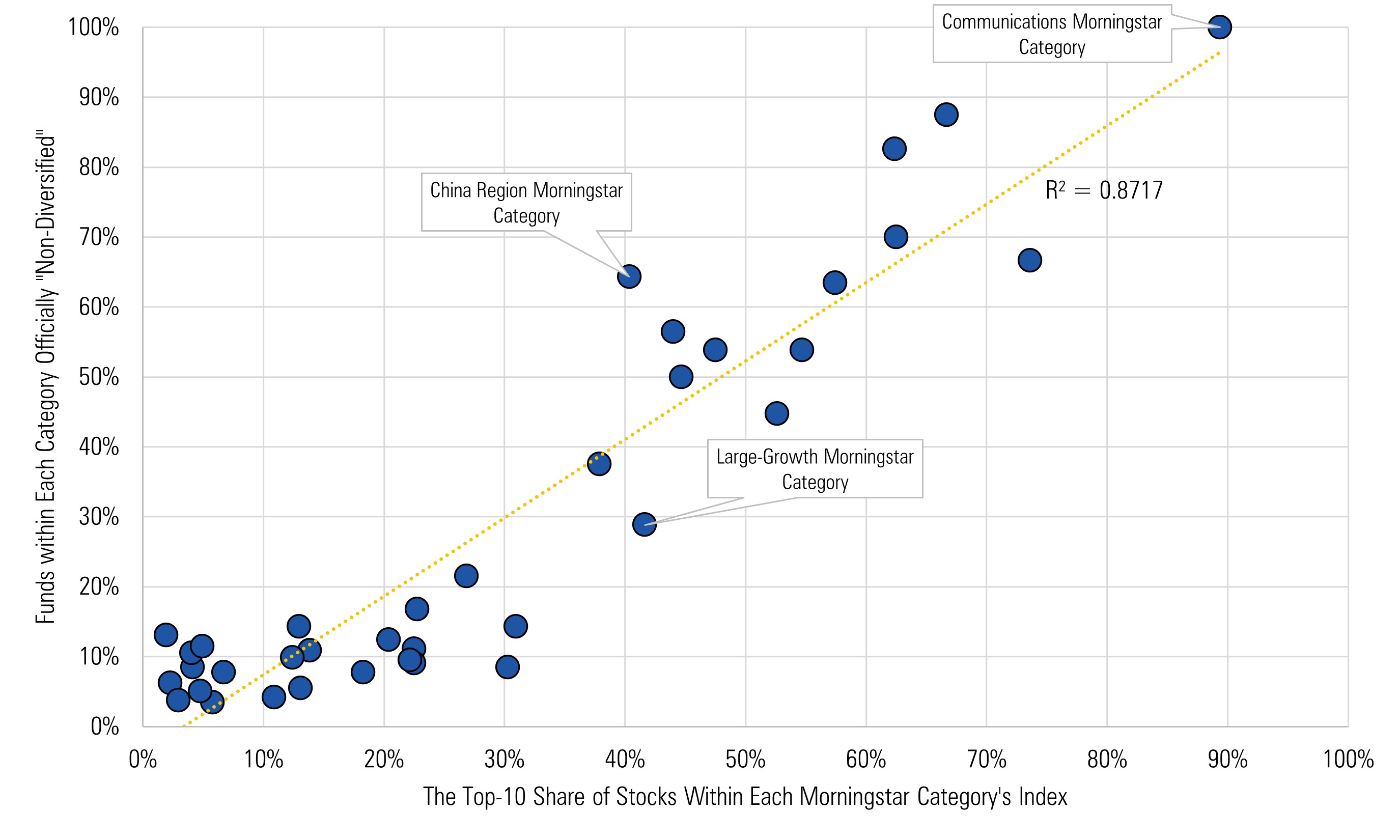

This forced underweighting helps diversified large-growth funds when the benchmark’s largest holdings perform poorly, but it hurts them when the biggest stocks do well, as they did for many years before 2022. This helps explain why a fund is likelier to be nondiversified as its investable universe becomes more concentrated.

Exhibit 3: Strong Relationship Between the Concentration of Each Morningstar Category’s Index and the Percentage of the Category’s Open-End Funds That Are ‘Nondiversified’

Look Beyond the ‘Diversified’ Label

So, a mutual fund is not necessarily acting imprudent or overhauling its investment process when it relabels itself as nondiversified. Nondiversified funds can still thrive during stressed market environments and avoid company-specific blowups by careful stock-picking and portfolio construction. And diversified funds can still court risk in other ways, such as through sector, industry, or country exposures.

There are more gauges of fund diversification and concentration, investor, than are dreamt of in the SEC’s current regulations.

End Notes

[1] T. Rowe Price Blue Chip Growth; T. Rowe Price Blue Chip Growth ETF TCHP; T. Rowe Price Growth Stock PRGFX; T. Rowe Price Growth Stock ETF TGRW

[2] Fidelity Blue Chip Growth FBGRX; Fidelity Blue Chip Growth ETF FBCG; Fidelity Blue Chip Growth K6 FBCGX; Fidelity Large Cap Growth Enhanced Index FLGEX; Fidelity Trend FTRNX; Fidelity Growth Company FDGRX; Fidelity Growth Company K6 FGKFX; Fidelity Growth Discovery FDSVX; Fidelity Advisor Equity Growth EPGAX

[3] In fact, a mutual fund may be able to maintain its “diversified” status while holding more than 25% of its assets in securities larger than 5% if it was their strong performance that caused their share to swell beyond that threshold.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)