Active Equity Funds’ Triumphs and Trials Over the Past Year

We take a look back at stock funds’ successes and struggles during 2023.

Equity funds surged in 2023′s fourth quarter, with most equity Morningstar Category averages climbing by double-digit percentages. Funds emphasizing growth stocks, technology, or risk led the charge, while value-leaning or more conservatively positioned funds trailed. The worst performers were the China region and energy Morningstar Categories, which slid.

Those results harmonized with themes that endured for most of 2023, except for a third-quarter interruption. Most active stock funds, however, fell short of surpassing the broad U.S. market as it scaled to new all-time highs near the year’s end. Only around one third of U.S.-focused equity funds outdid their Morningstar Category Indexes.

The Significant Seven

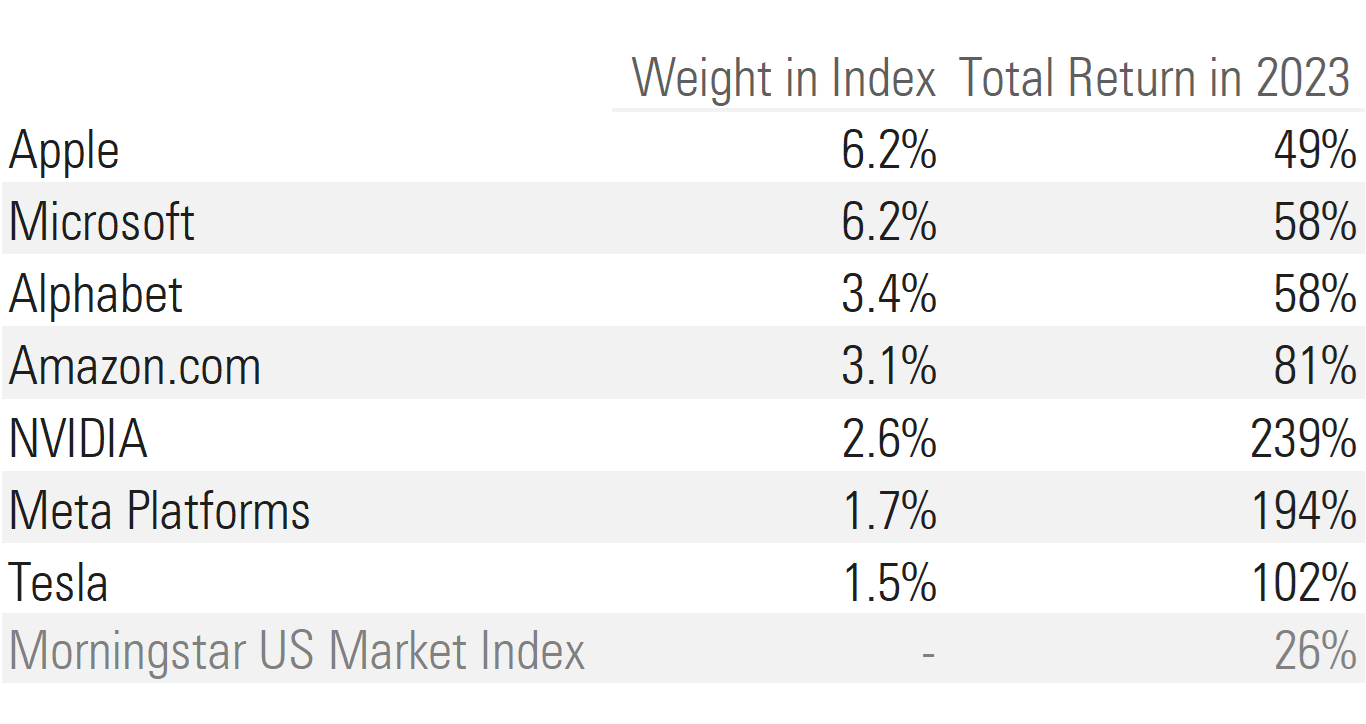

The story of the year was how the “Magnificent Seven”—Nvidia NVDA, Tesla TSLA, Meta Platforms META, Amazon.com AMZN, Alphabet GOOGL, Microsoft MSFT, and Apple AAPL—not only thrived but dominated. Each gained anywhere from around 50% to 240% and accounted for a huge portion of the Morningstar US Market Index’s 26% gain. The stocks’ stellar performance drastically swelled their share of the index to 25% from 17% over the year. Their share of the Morningstar US Large-Mid Cap Broad Growth Index climbed to 45% from 33%.

Giant Gains.

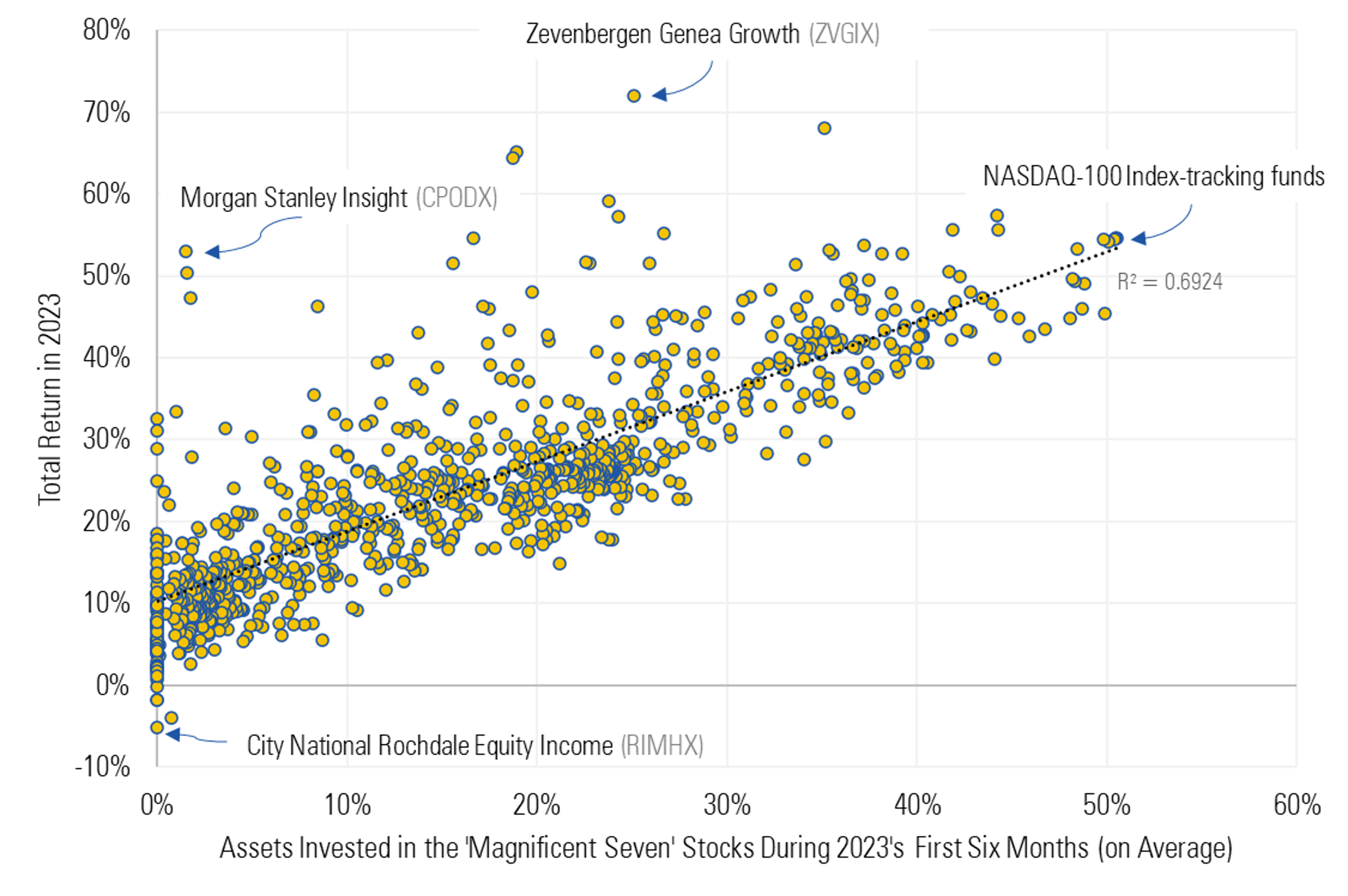

The first half of 2023 was crucial. Funds that had a larger share in these seven stocks than their respective indexes had a solid chance of outperforming them. But only around one fourth of U.S. large-cap funds did. The payoff was significant for those funds that did, with nearly 65% of them beating their indexes.

U.S. Stock Funds That Had a Lot in "Magnificent Seven" Stocks in 2023's First Half Did Well for the Full Year

The Indispensable Seven

Funds from Fidelity and T. Rowe Price were among the largest Magnificent Seven owners. T. Rowe Price Blue Chip Growth TRBCX emphasized Amazon, Alphabet, and Meta. Fidelity Blue Chip Growth FBGRX and Fidelity Growth Company FDGRX held gargantuan Nvidia stakes. Fidelity OTC FOCPX stashed one third of its assets in Microsoft, Apple, and Alphabet.

Those stakes helped them all rank in the top fourth of the large-growth Morningstar Category and trounce the Morningstar US Large-Mid Cap Broad Growth Index’s 40% gain.

The Magnificent Seven’s influence wasn’t limited to large-growth funds. Some value-oriented funds also benefited. For several years, Alphabet has been the concentrated Oakmark Select’s OAKLX top holding among fewer than 25 stocks. The fund’s 43% climb in 2023 earned it a top spot among large-value funds, which gained an average of around 12%. Alphabet was also among the largest holdings of large-value fund Dodge & Cox Stock DODGX, which also owned Microsoft, Amazon, and Meta and gained around 17% for the year.

The Unavoidable Seven

On the flip side, funds with less Magnificent Seven exposure than their indexes struggled to keep pace. Only 20% of them outperformed. There were notable exceptions. Morgan Stanley Institutional Growth MSEQX soared 50% even without much in the Magnificent Seven because it owned other aggressive-growth stocks that also were in favor, such as Uber UBER, Shopify SHOP, and Affirm Holdings AFRM.

By contrast, funds emphasizing stocks with high dividend yields or low stock-price volatility, such as Vanguard Dividend Appreciation ETF VYM and Jensen Quality Growth JENSX, tended to be among their categories’ worst performers in 2023.

What Happened With Small Caps?

Actively managed small-blend and -growth funds fell short of the 17% and 19% of their respective category indexes, rising only about 16% each. Such underwhelming results aren’t unusual in a bull market. Most actively managed U.S. small-cap funds position themselves more conservatively than their benchmarks, which helps cushion losses during drawdowns but hampers results during upswings.

Small-cap funds with adventurous risk/reward profiles soared. For instance, Morgan Stanley Institutional Inception MSSMX leapt 54%, mostly thanks to the strong performance of its highly volatile technology stock picks. On the flip side, Invesco S&P SmallCap Low Volatility ETF XSLV delivered a negligible gain. Boston Trust Walden Small Cap BOSOX, which also favors low-volatility stocks, rose 10% but fell well short of the large-blend average.

International Funds

Stock-picking success was mixed among global and international funds. Actively managed funds in the global large-stock blend and global large-stock growth categories struggled to beat their stylistically relevant indexes. Only around 20% managed to do so. Few were overweight technology—by far the best-performing sector—or in consumer cyclicals and communication services, the two next-best performing sectors. Instead, most funds had overweightings in industrials and healthcare, which lagged. The funds’ underperformance notwithstanding, they posted excellent absolute returns: The average global large-stock blend and growth fund gained 18% and 25%, respectively.

Some global large-cap funds thrived. With its big helpings of semiconductors and software stocks, PGIM Jennison Global Opportunities PRJZX climbed more than 40%, among the global large-stock growth category’s best results. Vanguard Global Equity’s VHGEX strong stock picks, including Meta, Shopify, and Uber, helped it gain 24%.

Most actively managed funds in the foreign large value, large blend, and foreign large growth categories beat their indexes with average gains of 16%-17%. What they had in common was an ability to avoid some of their markets’ worst-performing sectors: Most of the funds held below-index weights in communication services, real estate, and utilities.

The 12% average return of diversified emerging-markets funds in 2023 was rather good compared with their passively managed rivals. Two thirds of the category’s active managers beat their benchmarks. They did well by holding much lower stakes in Chinese stocks, whose losses of more than 10% made the market among the globe’s worst performing. GQG Partners Emerging Markets Equity’s GQGRX held relatively little in China. It instead held a huge stake in India, which proved an advantage as stocks within that market delivered double-digit-percentage returns, on average. The fund’s nearly 30% gain was extraordinary. On the other hand, Emerging Markets Growth EMRGX, Fidelity Advisor Focused Emerging Markets FIMKX, and T. Rowe Price Emerging Markets Stock PRMSX allocated heavily to China, lightly to India, and underperformed, climbing by only single-digit percentages.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)