Growth Funds Faced a Third Quarter Reversal of Fortune

Most laggards from the year’s first half became the leaders of the third quarter.

The mutual and exchange-traded fund shining stars of 2023′s first half dimmed in the third quarter, while previously dormant assets climbed.

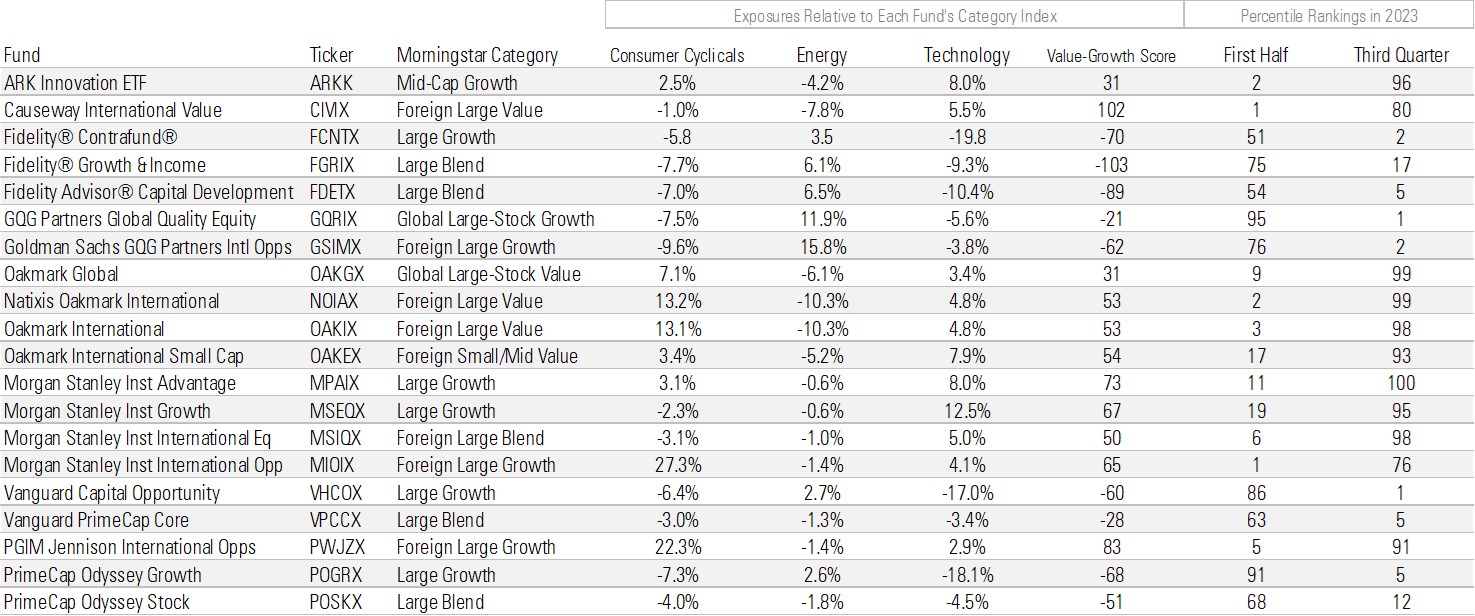

Investors’ seemingly insatiable appetite for risk fueled the stock market rally in 2023′s first six months. The digital assets Morningstar Category—consisting of funds of risky investments like cryptocurrencies and nonfungible tokens—surged by 50%. The best-performing equity funds were those focused on stocks with high price/earnings multiples, hard-to-predict fortunes, or tech. ARK Innovation ETF ARKK, Morgan Stanley Institutional Growth MSEQX, and PGIM Jennison Focused Growth SPFZX soared.

The effect applied to more than just U.S. growth funds. Others that leaned toward faster-growing or higher-priced fare within their respective non-U. S. value categories, such as Oakmark International OAKIX and Causeway International Value CIVIX (both members of the foreign large-value category) and Oakmark International Small Cap OAKEX (foreign small/mid value), trounced their category rivals. Meanwhile, funds with above-average exposure to yield, the energy sector, or U.S. regional banks generally delivered below-average results in the first half.

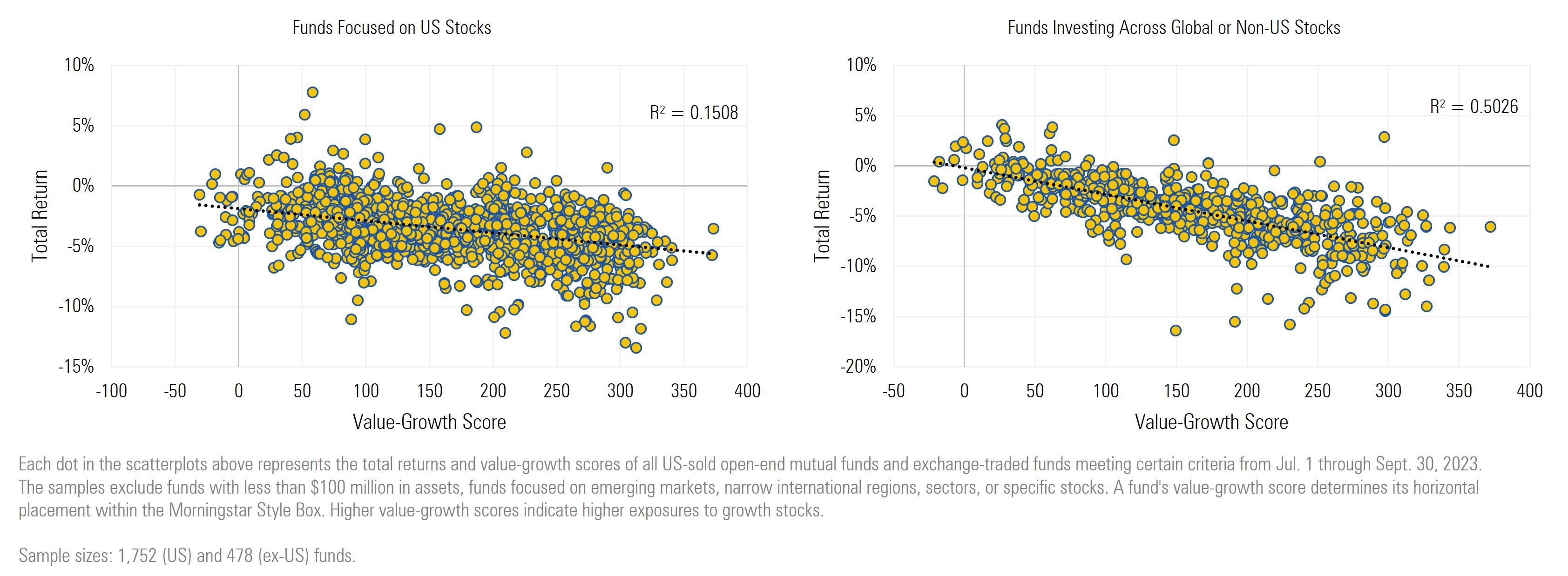

The investment climate changed with the season in the third quarter. Funds with the most extreme risk/reward profiles felt the pinch the most. The digital assets category average and ARKK fell 10%. Morgan Stanley Institutional Growth dropped 8%. Acute growth stock exposure was a liability.

Downturn Abbey

Funds with below-average growth stock allocations tended to perform the best. Some of the biggest or most prominent funds fit this mold. For example, Fidelity Contrafund FCNTX and near-clone Fidelity Contrafund K6 FLCNX, whose nearly $140 billion in combined assets make the strategy the world’s biggest fund run by a single manager, beat nearly all other large-growth funds by treading water as most other rivals sank. The strategy’s excellent relative results included a mediocre first six months, when its large-blend tilt held it back relative to its large-growth peers. Funds run by Primecap, including large-growth funds Primecap Odyssey Growth POGRX and Vanguard Capital Opportunity VHCOX, sprang from the worst-performing 15% of their category to the best-performing 5% in the third quarter, thanks largely to their relatively light helpings of the priciest growth stocks. Meanwhile, first-half front-runners like Oakmark International, Causeway International Value, and Oakmark International Small Cap faced stronger currents.

Despite growth stocks’ third-quarter troubles, they, and the funds that own a lot of them, retained a substantial lead for the year through September.

Tables Turned

The energy sector also rebounded in 2023′s third quarter following its lousy performance during the year’s first six months. That boosted funds run by GQG Partners, including GQG Partners Global Quality Equity GQRIX, Goldman Sachs GQG Partners International Opportunities GSIMX, and GQG Partners Emerging Markets Equity GQGRX, whose hefty energy stakes ranged between 13% and 20%. Fidelity Growth & Income FGRIX, Fidelity Advisor Capital Development FDETX, and Fidelity Large Cap Stock FLCSX, each run by Matt Fruhan, held up better than their large-blend category rivals thanks largely to their energy overweightings.

Not all segments of the global equity universe saw their fates reverse. Chinese stocks, for instance, seemed stuck in a quagmire. Within the diversified emerging-markets category, funds with the largest China stakes floundered. Fidelity Advisor Focused Emerging Markets FAMKX and T. Rowe Price Emerging Markets Stock PRMSX, which each had more than 30% in Chinese stocks, ranked in their category’s worst-performing quintile for the year to date. (The Fidelity fund was flat, and T. Rowe’s offering tumbled about 3%.) Meanwhile, category rivals with light China allocations, such as Cullen Emerging Markets High Dividend CEMFX and Pzena Emerging Markets Value PZIEX, posted double-digit-percentage gains for the year to date.

The third quarter of 2023, however, reshuffled the performance rankings of much of the rest of the fund landscape. Certain funds stood out for their resilience, consistently ranking in the top quartile throughout the year. Strong healthcare and industrials stock picks, for instance, helped mid-growth fund Artisan Mid Cap ARTMX, overcome the drag of its tech overweighting and steep growth stock tilt. Similarly, Fidelity Advisor Diversified Stock FDESX, a large-blend fund that often leans toward growth stocks, held its ground in the third quarter.

3 Great Aggressive Growth Funds

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)