A Fresh Look at Active Equity ETFs

As more asset managers get into the active ETF game, here's a deeper dive into some of the traditional active equity players and their differences.

It seemed like they would never arrive. Now they’re showing up among the biggest fund companies.

For many years after the first exchange-traded fund hit the market in 1993, active ETFs were like the Holy Grail: often talked about and sought after, but hard to find in the investment industry.

They’ve gradually gained momentum among once-skeptical active managers in recent years, though, thanks to innovations designed to satisfy the concerns of heretofore hesitant active managers as well as desperation to stem the tide of asset flows from traditional mutual funds to ETFs.

Even Capital Group, the parent of the conservative American Funds Family, has gotten comfortable enough with the vehicle to launch its own active equity ETFs.

Let’s first review the basics of active ETFs and then look at some attractive offerings from some of the bigger entrants.

An ETF is a wrapper in which asset managers can package and distribute investment strategies to investors. ETFs have several structural advantages over traditional mutual funds, the biggest of which is that they’re typically cheaper. This is because most ETFs’ fees include only the management fee, while mutual fund levies include marketing, distribution, and other fees.

There are a few ways to package an active ETF. Originally, active ETFs could only be fully transparent, which meant they had to disclose their holdings daily, like passive ETFs, to give market makers the information they need to assemble the baskets of securities that enable ETF shares to trade intraday. Most active stock fund managers were hesitant to disclose holdings daily because they feared doing so would tip off others in the market about their funds’ latest moves and investment secrets. In 2019, the SEC passed rules that sped up filings and opened the door to nontransparent (or semitransparent) ETFs, which needed to disclose holdings only quarterly. This allowed traditional asset managers to protect their secret sauces while taking advantage of the growing ETF market. However, semitransparent ETFs can hold only securities traded on public exchanges in the same time zone as the ETF to ensure the most accurate pricing, which typically eliminates non-U.S. holdings unless they also have listed American depositary receipts.

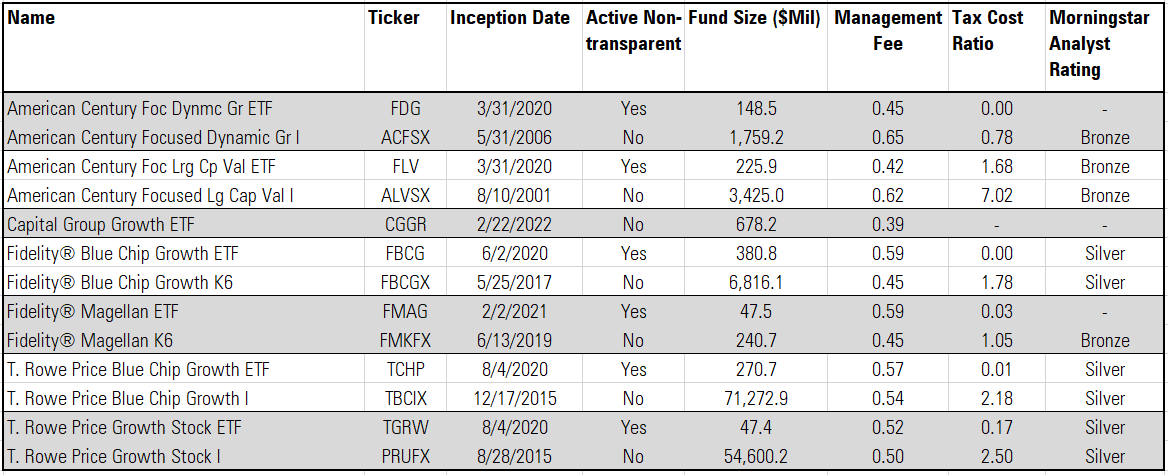

Several major fund families have entered the fray. So far, their offerings are similar to their existing strategies, but they are cheaper and more tax-efficient.

Fidelity

Fidelity rolled out nine semitransparent active ETFs, many them based on some of its flagship strategies, such as Fidelity Blue Chip Growth ETF FBCG, which earns a Morningstar Analyst Rating of Silver, and Fidelity Magellan ETF FMAG, which is rated Bronze.

The ETF versions of these strategies have the same managers as the mutual funds: Fidelity Blue Chip Growth’s Sonu Kalra and Fidelity Magellan’s Sammy Simnegar. Both the Blue Chip Growth and Magellan ETFs don’t share their mutual fund siblings’ non-U.S. holdings unless they also have listed ADRs. Still, the Blue Chip Growth ETF has more than 90% overlap with its mutual fund counterpart; as of June 2022, the Magellan portfolios were nearly identical. These ETFs’ 0.59% expense ratios are cheaper than all their accompanying mutual funds’ share classes except the retirement K6 shares.

Both ETFs have been tax-efficient. They did not report any capital gains in 2021 or for the first half of 2022, while Fidelity Blue Chip Growth paid out a roughly 9% of net asset value gain and Fidelity Magellan a 1% gain in 2021.

T. Rowe Price

T. Rowe Price’s five semitransparent ETFs include versions of T. Rowe Price Blue Chip Growth TRBCX and T. Rowe Price Growth Stock PRGFX, both rated Silver. The ETFs give investors without institutional-sized assets access to well-managed strategies at institutional prices. T. Rowe Price Blue Chip Growth’s manager Paul Greene spent nearly two years as an associate manager before taking over from its longtime lead manager in 2021. Joe Fath has steered T. Rowe Price Growth Stock since 2014 and has more than 20 years of investment experience. They both rely on the firm’s strong analyst bench. Both ETF portfolios have more than 90% portfolio overlap with the mutual fund versions, eliminating only non-U.S. holdings without ADRs and any shares of private companies, in which T. Rowe Price Blue Chip Growth has a small stake. T. Rowe’s ETF fees range from 0.50% to 0.57%, which are within 1 basis point of their institutional share class counterparts, but without the $500,000 minimum investment.

These ETFs also have been more tax-efficient than their mutual fund twins since they started in late 2020. Both T. Rowe Price Blue Chip Growth and T. Rowe Price Growth Stock distributed roughly 10% of NAV in capital gains in 2021 versus less than 1% for the ETFs, owing in part to the tax advantages of the ETF and the fact the new ETFs probably had lower embedded gains.

American Century

The six semitransparent ETFs American Century launched include versions of Bronze-rated American Century Focused Dynamic Growth ACFOX and American Century Focused Large Cap Value ALVIX. American Century Focused Dynamic Growth has one of the firm’s most stable and experienced investment teams, led by veterans Keith Lee and Michael Li. This strategy, one of three growth approaches the team runs, focuses on high-growth companies. American Century Focused Large Cap Value relies on a robust approach to finding quality-oriented value opportunities. The expense ratios of each of American Century’s ETFs are lower than the cheapest share class of their corresponding mutual fund. Both strategies have more than 90% portfolio overlap with their mutual fund counterparts.

American Century Focused Large Cap Value reported a roughly 20% of NAV capital gain in 2021 versus roughly 2% for the ETF.

Capital Group

Capital Group, parent of American Funds, was late to the active ETF party, but in February 2022 it launched five fully transparent equity strategies and one fixed-income strategy that are very similar to approaches it uses in some insurance accounts. As fully transparent ETFs that report their holdings daily, Capital’s vehicles can own non-U.S. securities that trade in different time zones. So, the family’s lineup includes two international strategies.

Like all of Capital’s strategies, multiple independent managers run these ETFs. Veteran Alan Wilson leads a group of five managers who each run different sleeves of Capital Group Growth ETF CGUS in flexible styles. Some of them prefer traditional growth stocks, others fallen angels, or even cyclicals. These strategies are not as similar to comparable open-end mutual funds in the family, but they draw on managers from the same talent pool. The ETFs’ expense ratios range from 0.33% to 0.54%, lower than all but a handful of share classes of similar American Funds.

These aren’t the only traditional asset managers that have launched active ETFs and they won’t be the last. Dimensional Fund Advisors, Davis Advisors, Invesco, JPMorgan, and Neuberger Berman have all launched active ETFs, and the list continues to grow. Active ETFs have arrived; now they have to deliver.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)