Investors Turn to Foreign Stocks in August

International-equity fund flows remain strong.

Editor's note: This is adapted from the Morningstar Direct U.S. Asset Flows Commentary for August 2021. Download the full report here.

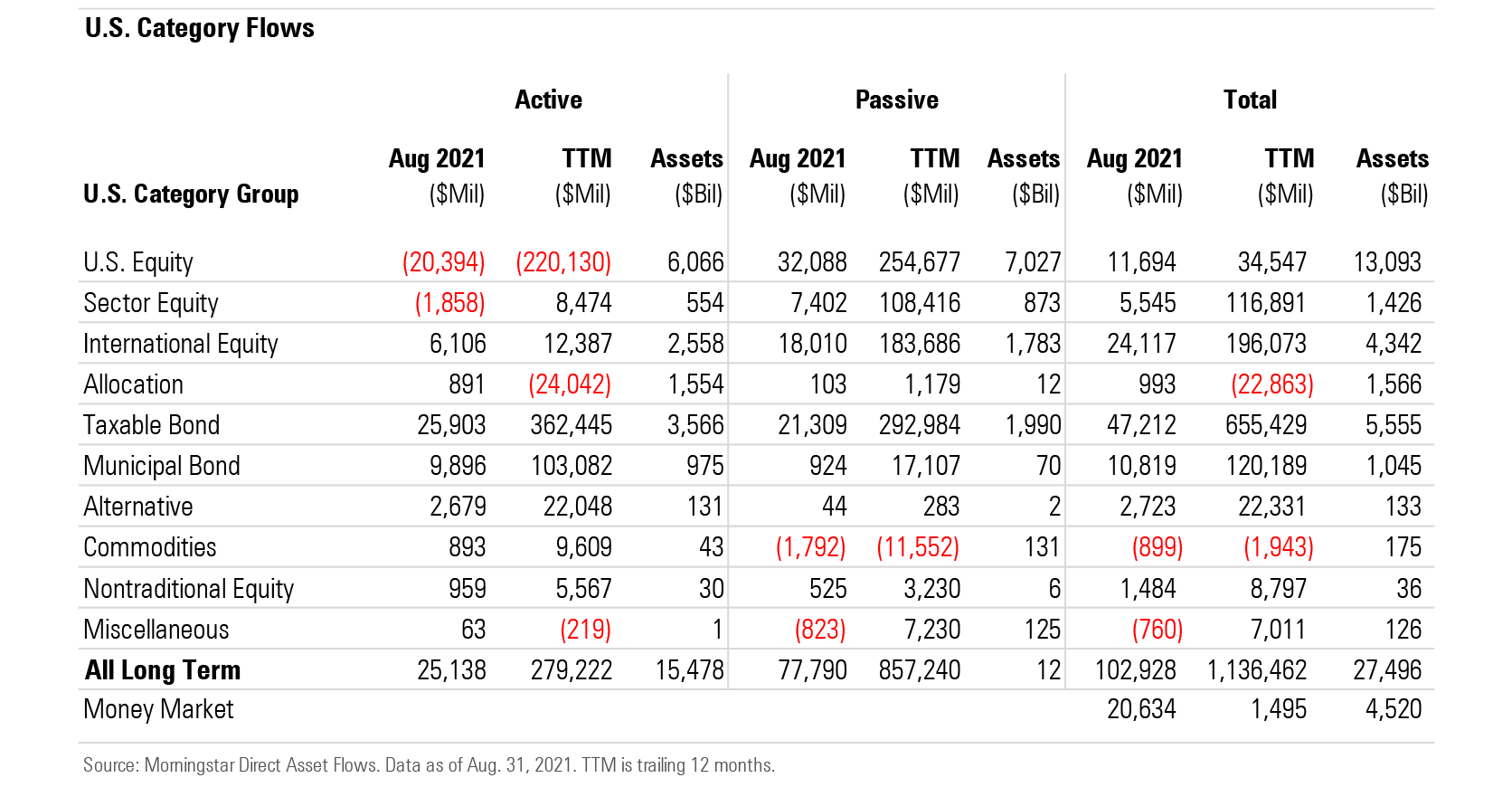

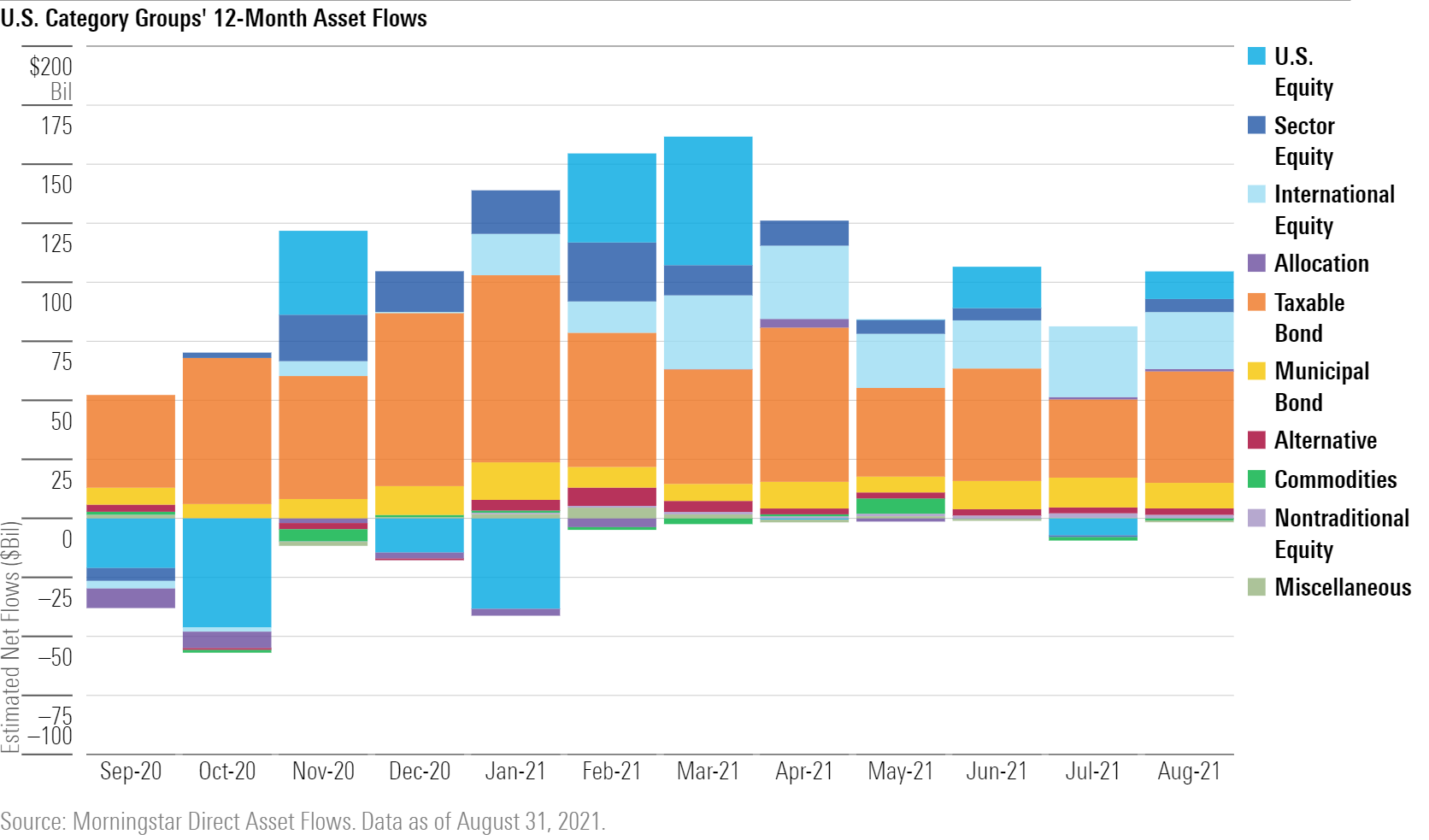

Long-term mutual funds and exchange-traded funds collected $103 billion in August 2021, more than July's $71 billion intake but still well short of the $120 billion-$160 billion hauls seen from February through April. Passively managed strategies gathered $78 billion, driven by inflows into U.S. equity, international-equity, and taxable-bond ETFs. Actively managed funds took in about $25 billion, led by flows into open-end bond funds.

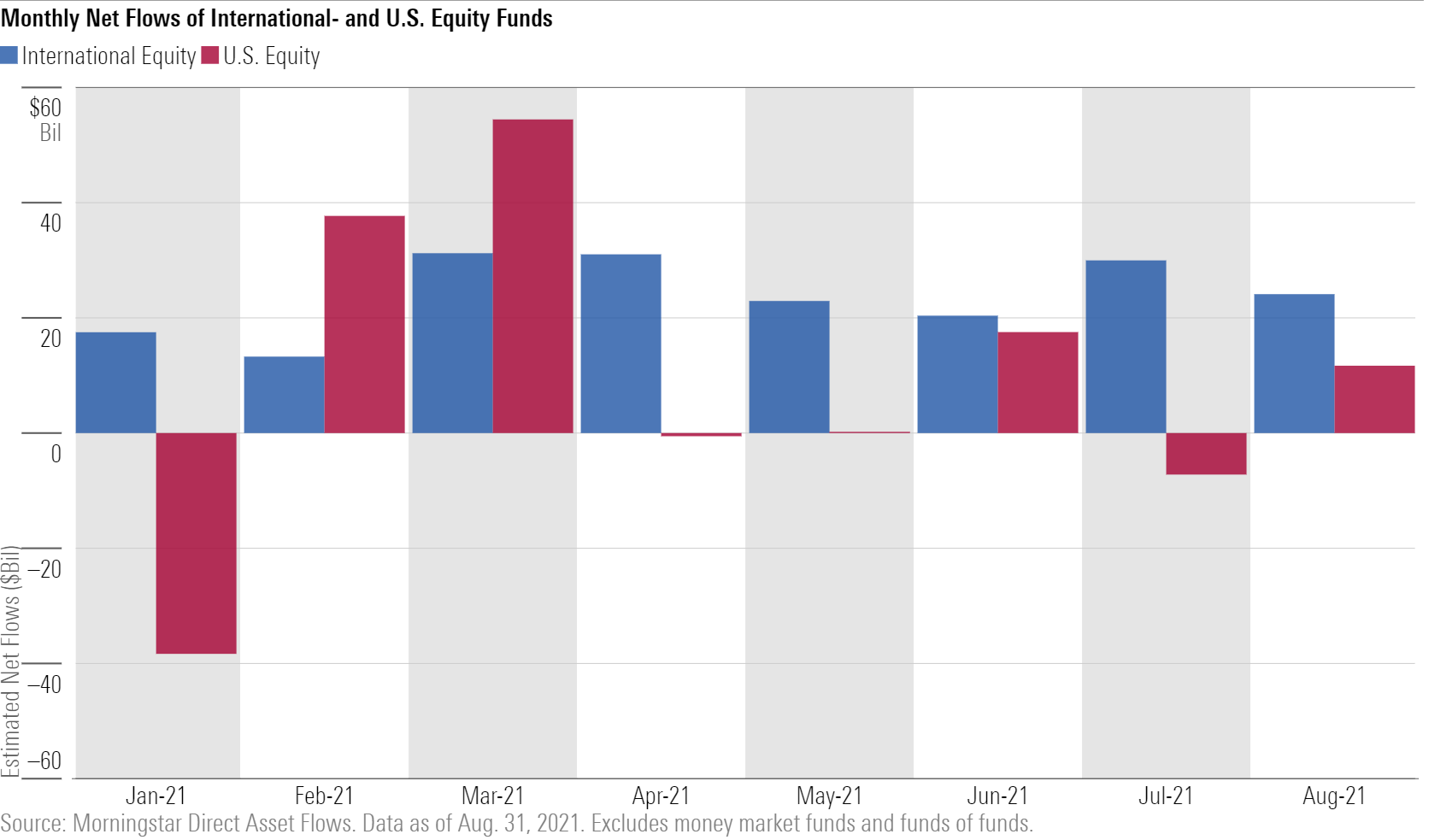

Continued strong performance from U.S. equities in 2021 might have enticed investors to look abroad for stock exposure. With a $24 billion intake in August, international-equity funds have now enjoyed inflows for 10 consecutive months. They have gathered $193 billion for the year to date, the second-highest total of all U.S. category groups and more than the combined inflows of U.S. and sector-equity funds.

Foreign large-blend and diversified emerging markets are the two largest Morningstar Categories in the international-equity group by total assets, and they've accordingly gathered the greatest inflows in 2021 with $67 billion and $53 billion, respectively. But the two hottest categories on an organic-growth basis are Europe stock and China region. The Europe stock category has seen its asset base expand by 32% over the first eight months of the year, while China region funds experienced a 28% increase despite ongoing economic and political concerns.

Investors' appetite for U.S. equity funds hasn't been as consistent. Flows have oscillated between sharp increases, as seen in March's record $54 billion haul, and months of meager flows such as those in April and May. After shedding $7.6 billion in July, U.S. equity funds added $11.7 billion in August.

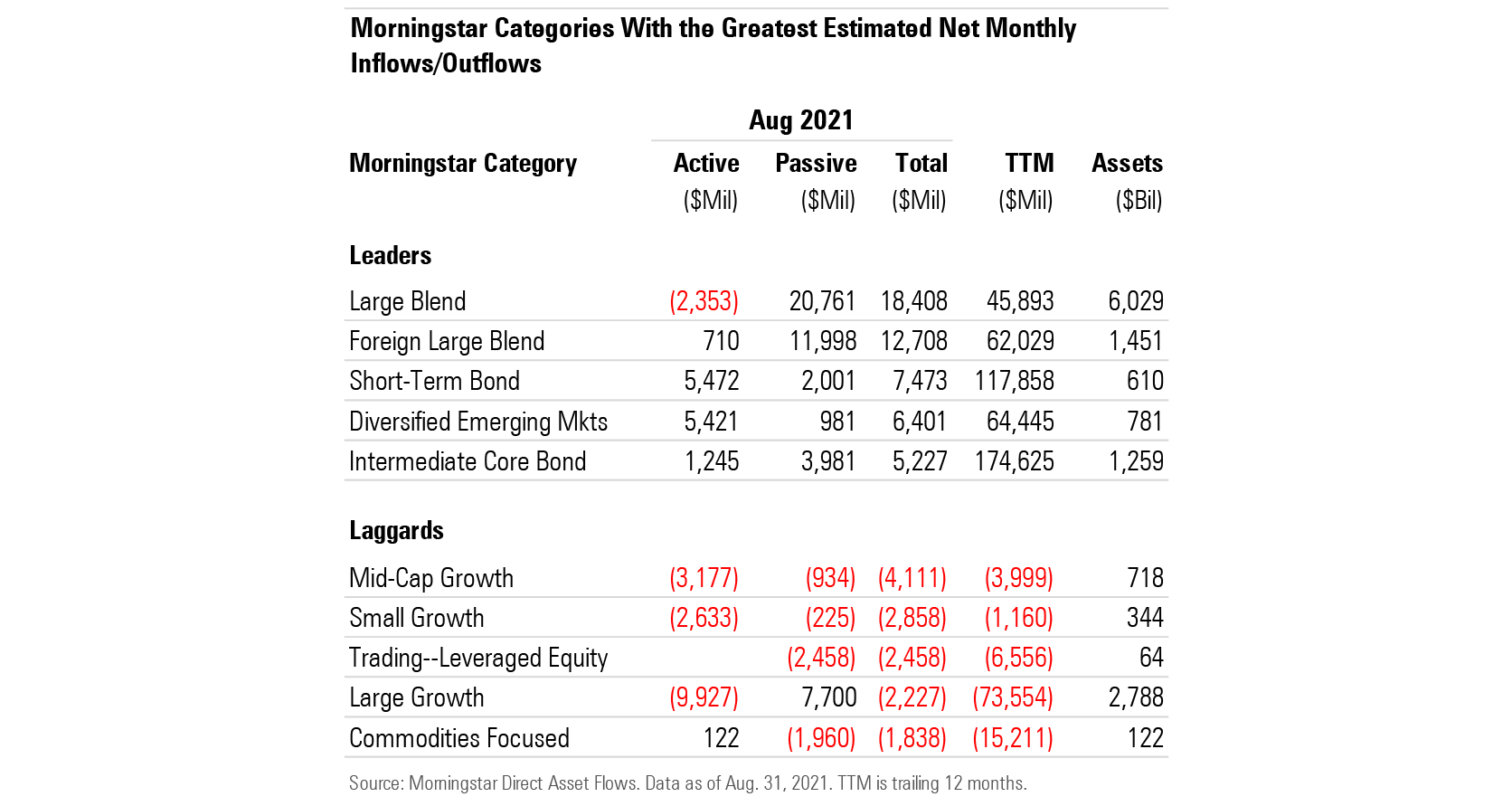

Investors' taste in styles has also fluctuated. Value funds attracted heavy inflows through the first six months of the year but reversed course in July. Data from August indicate a slight reversion toward value but remain mixed overall. Large-blend funds gathered the vast majority of flows into the category group with an $18.4 billion intake. After a roaring first half of 2021, large-value fund flows have pulled back. While their $4.1 billion inflow in August made up for the $1.1 billion outflow from July, it fell short of the stretch of inflows from February through June, which ranged between $4.4 billion and $20 billion per month. Small-value funds' pivot has been more severe. After an equally hot start to the year, they shed a record $3.6 billion in July and another $1.5 billion in August.

U.S. growth funds have been no strangers to outflows over the past decade despite growth stocks' strong performance for much of that period, suggesting that investors may have rebalanced away from those strategies. The trend continued in August as large-, mid-, and small-growth funds all suffered outflows, though the redemptions were steeper for the latter two categories. Mid-growth funds shed $4.1 billion, just eclipsing March 2020's tally for their greatest outflow since 2000, though noticeably without a direct catalyst like the then-developing pandemic to prompt such a flight from those funds.

Sector-equity funds picked up $5.5 billion in August after shedding a modest $750 million in July. They've now collected inflows in 15 out of the past 17 months dating to April 2020. Their $117 billion intake over the trailing 12 months equates to an organic growth rate of 11.5%--much higher than U.S. equity funds' 0.4% and even international-equity funds' 5.8%.

Rather than favoring one style, investors embraced a mix of value- and growth-oriented sector-equity funds. Financial funds pulled in the highest total in the category group with $2.9 billion of inflows, but technology funds collected the fourth-most dollars with $1.1 billion. Value-leaning real estate and utilities funds each grabbed about $1.1 billion, but energy equity funds suffered $1.6 billion in outflows.

Taxable-bond funds gathered roughly $47 billion in August, good for their 17th consecutive month of inflows. They've taken in $424 billion for the year to date and $655 billion over the trailing 12 months, both tops among category groups.

Despite the Federal Reserve's stance that recent inflation has been due to transitory factors, bond-fund investors don't appear to agree. Funds that offer protection from rising interest rates continued to lead the way in August. Inflation-protected bond funds took in their lowest monthly total of the year but still collected $4.7 billion, good for the third-highest sum within the category group. Bank-loan funds collected $2.7 billion. Short-term bond funds, which are less-sensitive to rising rates than longer-dated bond funds, absorbed $7.5 billion.

Municipal-bond funds collected $10.8 billion in August, extending their inflow streak to 16 consecutive months. Investors opted for shorter-term funds in this space, too, possibly anticipating future rate rises. The muni national intermediate-term and muni national short-term categories garnered the most flows, netting $3.4 billion and $3.0 billion, respectively.

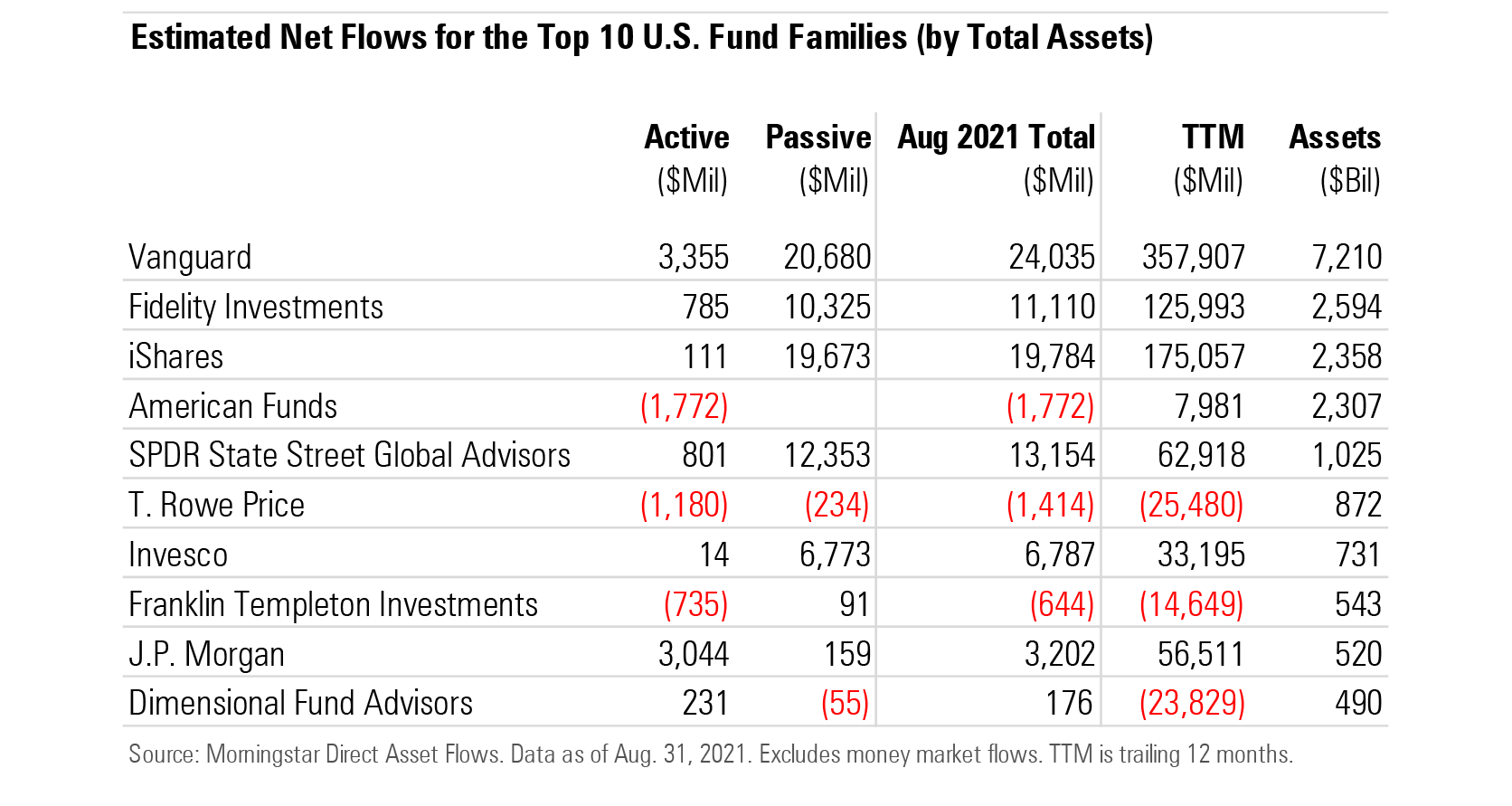

Vanguard pulled in over $24 billion of new money in August, leading all fund families for the ninth consecutive month. Its lucrative lineup of index funds has bolstered the firm's flows. That includes Vanguard 500 Index VFIAX, which has reeled in nearly $30 billion in 2021 after collecting $4.4 billion in August.

IShares was not far off Vanguard's lead, adding $19.8 billion. SPDR State Street Global Advisors, another major index fund provider, collected $13.2 billion in August after suffering outflows in July. Certain firms that are more reliant on active management were able to stand out as well, thanks to strong inflows into active bond funds. Pimco collected $4.2 billion in August, while Goldman Sachs brought in $2.7 billion.

Note: The figures in this report were compiled on Sept. 15, 2021, and reflect only the funds that had reported net assets by that date. Morningstar Direct clients can download the full report here.

The final exhibit of this article has been corrected to show that Dimensional Fund Advisors recorded inflows of $176 million in August 2021 instead of $80 million in outflows, as was originally reported.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)