Bond Funds Post Mixed Results in 2024’s First Quarter

Rising yields crush Treasuries but elevate bank loans.

The bond market’s 2023 fourth-quarter performance proved to be a tough act to follow. The Morningstar US Core Bond Index, a proxy for the US-dollar-denominated investment-grade bond market, soared 6.6% in last year’s final frame, but lost momentum in 2024’s first quarter and fell 0.8%.

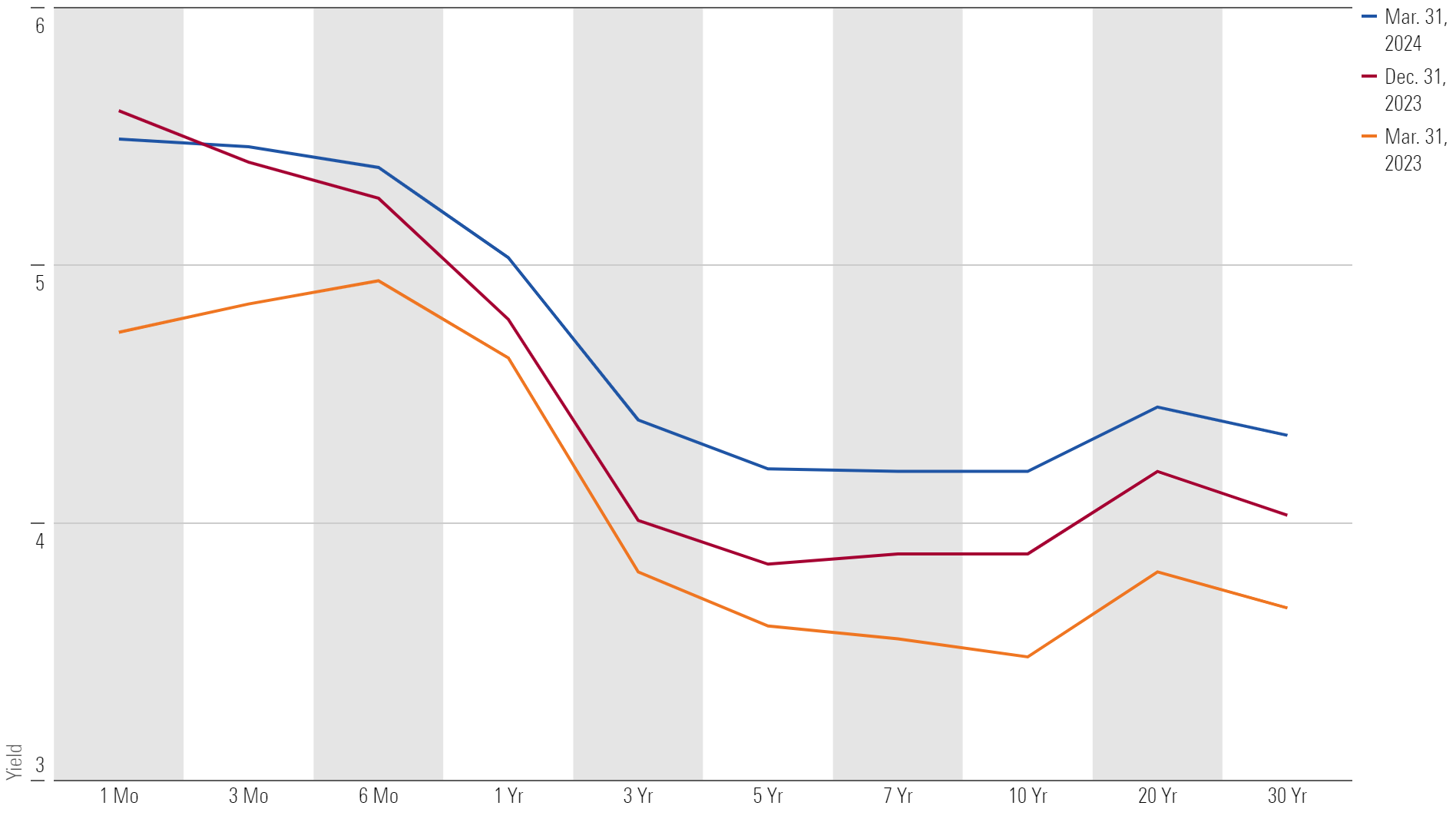

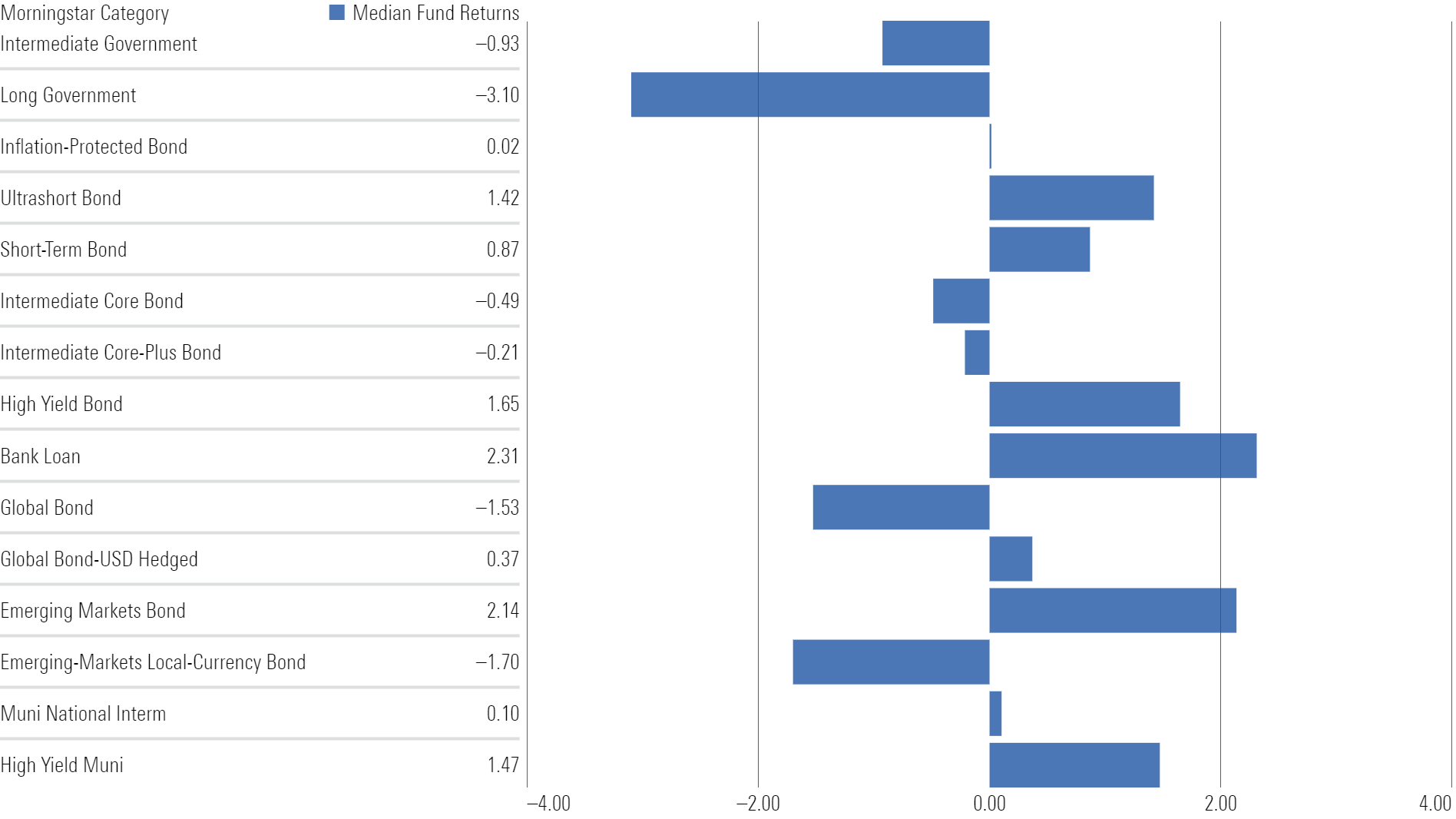

Interest-rate volatility persisted as strong economic data and reduced rate-cut expectations lifted yields higher over the quarter. Investors who accepted more duration risk, or sensitivity to shifting yields, felt the most pain. The typical long government Morningstar Category fund, which invests in long-dated Treasury bonds and carries a duration of 16.9 years, plummeted 3.1% during the year’s first three months.

Treasury Yield-Curve Changes

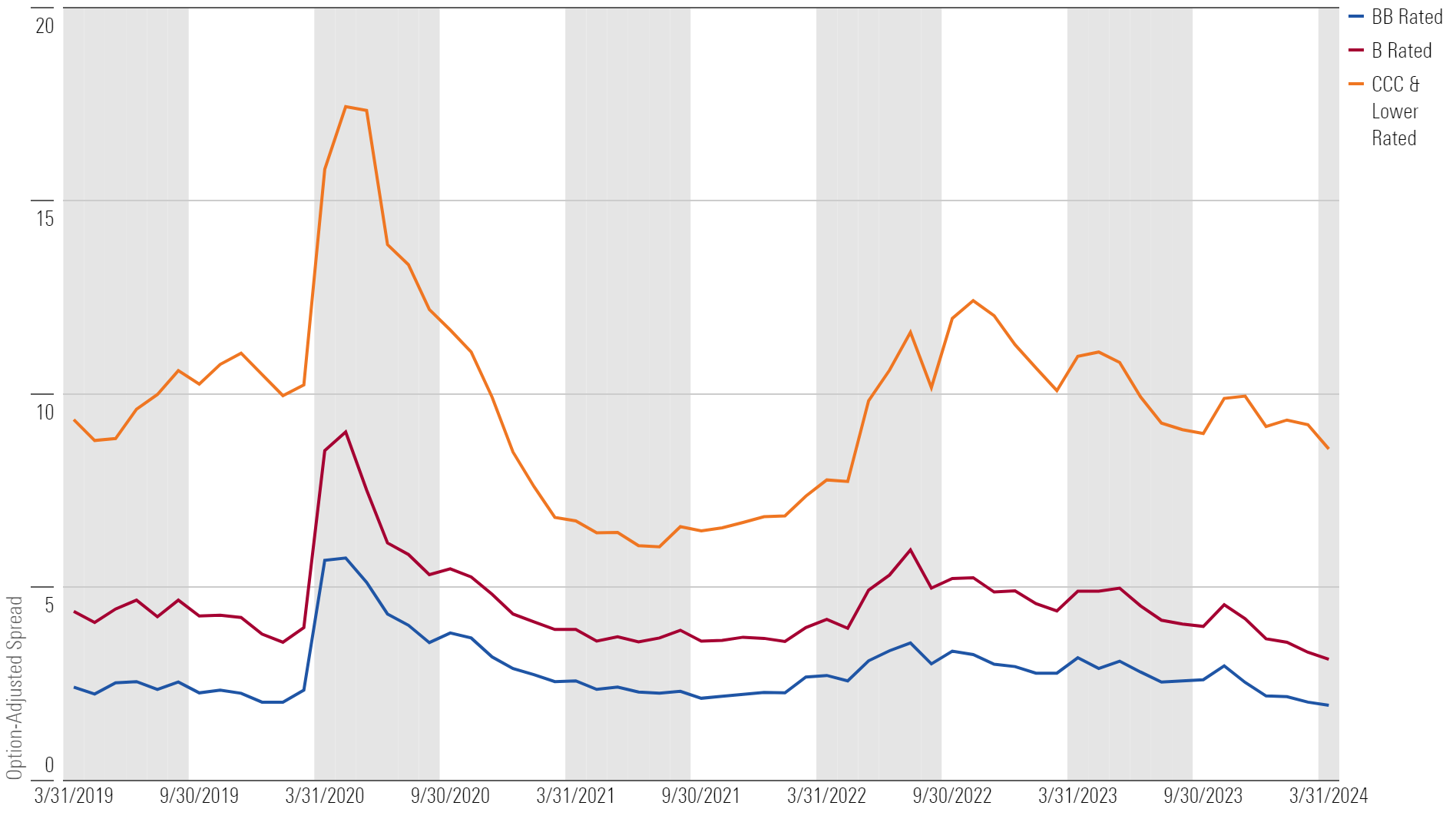

On the other hand, a relatively healthy economy continued to reward those who ventured into credit-sensitive sectors, such as bank loans and high-yield bonds, that tend to be resilient when yields rise. The median bank-loan and high-yield bond funds gained 2.3% and 1.7%, respectively, in the quarter.

Corporate Credit Spreads Continued to Tighten

Below, we dig a little deeper into a few fixed-income categories and highlight some good and bad performances from some of our favorite bond managers.

Fixed-Income Morningstar Category Returns in 2024's First Quarter

Bank Loans Lead the Way

Bank-loan managers who avoided hard-hit issuers, as well as those who leaned into lower-rated loans, tended to outperform their rivals during the quarter. The Morningstar LSTA US Leveraged Loan CCC Index, a proxy for the lowest-quality segment of the bank-loan market, rose 5.2%, while the highest-quality loans, as measured by the Morningstar LSTA US Leveraged Loan BB Index, gained just 2.0%.

Known as a higher-octane, leveraged offering, Eaton Vance Floating-Rate Advantage EIFAX, whose institutional share class has a Morningstar Medalist Rating of Bronze, gained 2.5% and beat 70% of peers during the quarter. These results follow the fund’s impressive 14.4% gain in 2023 that outpaced nearly 95% of its bank-loan rivals. Gold-rated Fidelity Advisor Floating Rate High Income FIQSX, the largest fund in the category, had similar success and beat 60% of peers.

Another Gold-rated offering, T. Rowe Price Institutional Floating Rate RPIFX, failed to keep pace during the quarter. This team favors BB and B rated loans and is picky about CCC and lower-rated loans. So, the portfolio tends to perform around the median during markets that favor corporate credit, such as in 2023 and 2024′s first quarter. Its 2.2% return in the first quarter, while respectable, slightly lagged the typical peer’s 2.3% advance.

Core Bond Funds Grapple With Rate Volatility

Core bond managers, who invest in a mix of Treasuries, agency mortgages, and investment-grade credit, have faced many tough decisions over the past two years, including where to position their portfolio’s duration relative to a benchmark or most peers. Some managers weathered the storm, while others struggled and nearly wiped out their impressive long-term track records.

Silver-rated TCW Core Fixed Income’s TGCFX 7.0-year duration stood two thirds of a year longer than its typical peer’s and led to a 1.0% loss that lagged over 95% of peers during the first quarter.

Bronze-rated Invesco Core Bond OPBYX finished toward the top of its peer group because its managers navigated interest-rate volatility better than most by keeping its duration closer to 6.0 years. While it still lost 0.1% during the quarter, it beat more than 80% of peers.

Global Bonds Hit a Rough Patch

The US dollar strengthened and weighed down global bond returns during the first quarter as surprisingly robust US economic data curbed bets on rate cuts. That helped the hedged Morningstar Global Core Bond Index limit its slide to 0.1%, while the unhedged version dropped 2.1%. In similar fashion, the typical global bond category fund fell 1.5%, while the global bond—USD hedged median eked out a 0.4% gain.

Bronze-rated BrandywineGLOBAL Global Opportunities Bond GOBIX stumbled out of the gates in 2024. The fund’s 4.8% loss trailed every peer during the quarter because of the portfolio’s persistent underweighting to the US dollar, a long-standing bet on the Japanese yen, which weakened, and above-average duration.

Dodge & Cox Global Bond DODLX, a Gold-rated strategy, had better fortunes because its affinity for corporate credit typically lifts returns in credit-friendly markets. The team’s tendency to keep non-US dollar exposure below 20% of assets also boosted returns; more-aggressive competitors may invest more than half of assets in foreign securities. While the fund still lost 0.5%, it bested almost 70% of its peers during the quarter.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)