What the Nasdaq-100 Rebalance Means for ETF and Index Fund Investors

Investors of funds tracking the index can expect a slightly different portfolio.

Editor’s Note: This article was updated on July 21 to reflect new data and information that came to light this week.

The Nasdaq-100 Index, the underlying index for the world’s fifth-largest exchange-traded fund—Invesco QQQ Trust QQQ—underwent a Special Rebalance to address overconcentration of the index on July 24.

Here’s what you need to know about what a special rebalance is; what prompts one; and what the July 24 rebalance means for index and ETF investors.

What is the Nasdaq-100 Index?

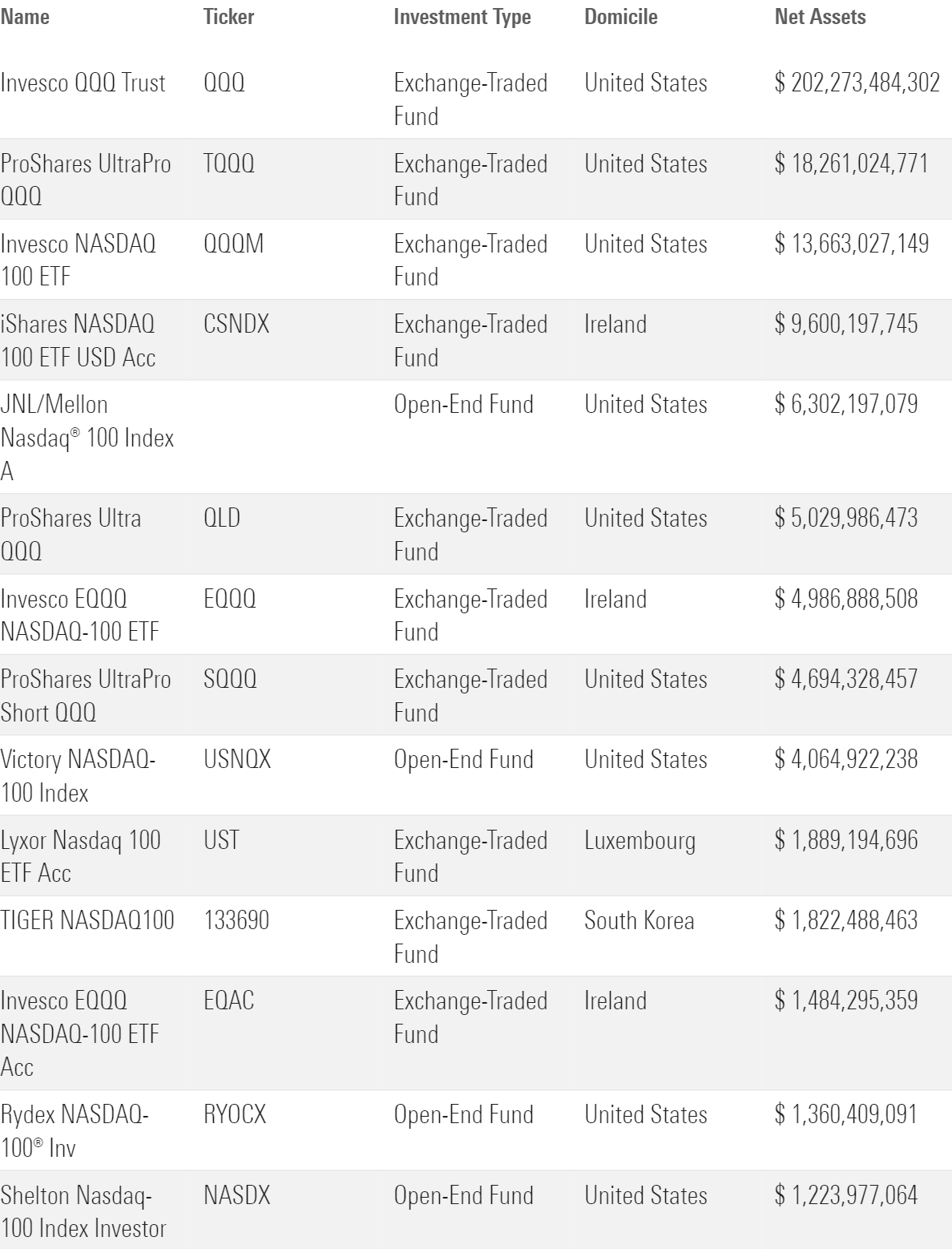

The Nasdaq-100 Index includes the 100 largest Nasdaq-listed nonfinancial companies. The index has become synonymous with tech investing, and it serves as a benchmark for ETFs and mutual funds globally. Funds tracking the Nasdaq-100 Index total nearly $300 billion globally, with $200 billion in assets under management for QQQ alone.

Below are the index funds tracking the Nasdaq-100:

Global Funds Tracking the Nasdaq-100 with Over $1 Billion AUM

What is a Special Rebalance?

The Nasdaq-100 Index methodology stipulates the following:

“A Special Rebalance may be conducted at any time based on the weighting restrictions described in the Index Rebalance Procedure if it is determined to be necessary to maintain the integrity of the Index.”

The special rebalance did not result in the removal or addition of any securities. Instead, it intended to reduce the index’s concentration in its largest constituents.

This marked the third Special Rebalance in the history of the Nasdaq-100 Index, with the first two coming in 1998 and 2011.

What prompted the Special Rebalance?

The performance of a small group of mega-cap stocks, now known as the “Magnificent Seven,” has powered strong performance for the Nasdaq 100 and the broad market. These stocks include:

- Microsoft MSFT (Year-to-date return 48.63% through July 19)

- Apple AAPL (50.52%)

- Nvidia NVDA (222.19%)

- Amazon.com AMZN (61.14%)

- Tesla TSLA (136.45%)

- Meta Platforms META (162.60%)

- Alphabet Class A GOOGL (38.31%) and Class C GOOG (38.37%).

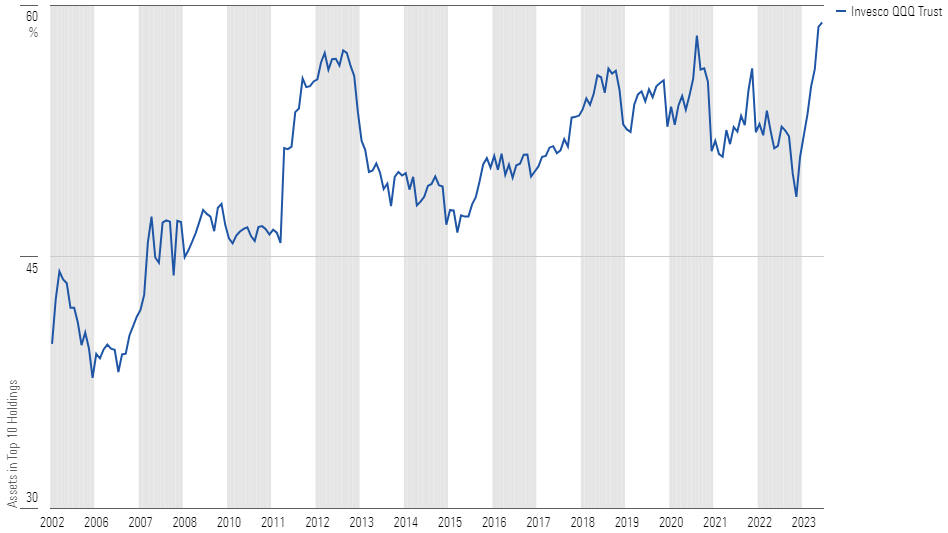

As these stock prices soared, so did their weight in the Nasdaq 100. On July 3, Tesla TSLA climbed to 4.53% of the index, violating a requirement that all stocks whose weight exceeds 4.5% may not collectively weigh more than 48%. That triggered the index’s first Special Rebalance since 2011.

QQQ Became Significantly More Concentrated in 2023

What is changed on July 24?

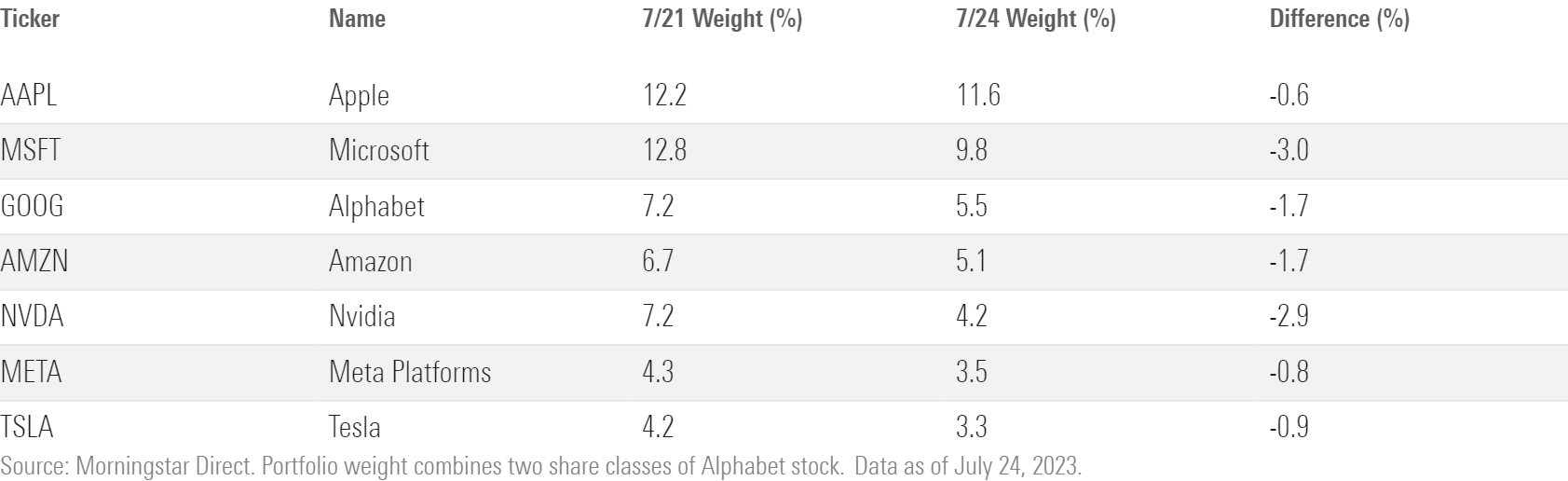

It’s no secret the Nasdaq-100 Index has long been overloaded, and the Special Rebalance is designed to dial back that growing concentration risk. On July 24, Nasdaq reduced the weight of all Magnificent Seven stocks by between 0.5% and 3%, redistributing the weight to the rest of the index portfolio. The other Nasdaq-100 constituents received a weighting boost proportional to their size. For instance, Broadcom AVGO, the index’s eighth-largest holding, received a larger increase than Lucid Group LCID, its smallest. The Special Rebalance reduced the Magnificent Seven’s portfolio weight from nearly 55% to about 43% of the index overnight.

Stock Weight Reductions

The Special Rebalance aims to reduce firm-level concentration, but it affected the index’s sector composition, too. Its tech, consumer discretionary, and communications allocations each slid between 1.2 and 1.6 percentage points. Consumer staples, industrials, and healthcare stocks picked up the slack, adding between 1 and 1.5 percentage points apiece.

How did funds administer the changes?

Funds tracking the Nasdaq-100 Index sold out of top holdings as prescribed by the index and reallocated that cash to other stocks in the portfolio. Those funds executed the trades at breakneck volumes upon the market close on Friday, July 21. About $10 billion of Nvidia NVDA stock traded hands, for example.

How were investors affected by the rebalance?

Investors of funds tracking the Nasdaq-100 Index woke up on July 24 with a different portfolio. Redistributing some of the Magnificent Seven’s portfolio weight helped to ease the concentration atop the portfolio. The rebalance also pulled the portfolio closer to true market-cap weighting, as recent performance and position limits from the December 2022 reconstitution shook up the cap-weighted pecking order. Overall, though, the rebalance did not change the key aspects of this index. Reduced concentration is a benefit for investors, but the main considerations that drive QQQ’s Neutral Medalist Rating remain intact.

Trading costs from the rebalance may have caused a minor drag on performance, and selling high-performing stocks may invite a tax bill for funds. Mutual funds may be especially susceptible to capital gains distributions. An ETF like QQQ is among the most heavily traded securities in the United States, which results in plenty of opportunities for it to utilize in-kind creations and redemptions to purge low tax-basis securities, making capital gains distributions unlikely. Tax implications may differ for investors in smaller funds or those in jurisdictions with different tax treatment of in-kind creations and redemptions.

Most investors in U.S. stocks were at least indirectly affected by the rebalance. Billions of dollars of stock changed hands in response to the rebalance. Luckily, the selling occurred in some of the world’s most liquid stocks, meaning the price impact should be limited. Markets may experience a bit higher volatility as the changes become known and the market repositions, but the special rebalance itself appeared to go off without a hitch.

What was the timeline of events for the Special Rebalance?

July 7: Special Rebalance announced.

July 14: Pro forma file released detailing index changes for upcoming rebalance.

July 24: Special Rebalance effective prior to the market open.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)