Active Funds Fell Short of Passive Peers in 2023

Long-term trends and low costs can help investors decide between active and passive funds.

The script flipped from value to growth in 2023, but the narrative stayed the same for active managers.

Of the nearly 3,000 active funds included in our analysis, 47% survived and outperformed their average passive peer in 2023.

We further analyze these findings in the year-end 2023 installment of the Morningstar Active/Passive Barometer, a semiannual report that measures the performance of US active funds against passive peers in their respective Morningstar Categories. The Active/Passive Barometer spans over 8,300 unique funds that accounted for approximately $18 trillion in assets, or about 55% of the US fund market, at the end of 2023.

You can learn more about the background of our approach to the report in this article.

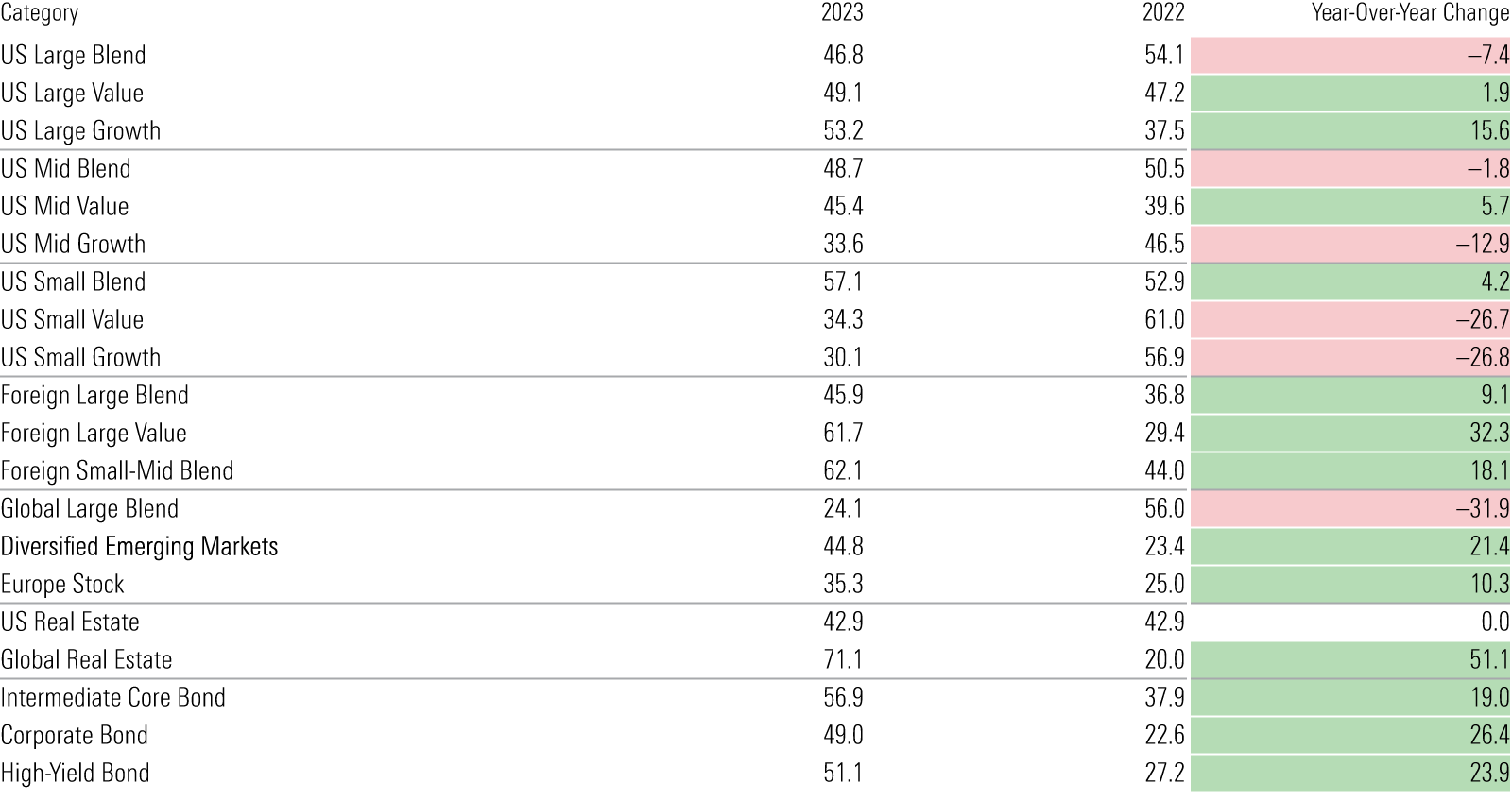

Most Active Managers Failed to Capitalize in 2023

When viewed as a whole, active funds had less than a coin flip’s chance of surviving and outperforming their average passive peer in 2023, although results varied widely across asset classes and categories.

Foreign and fixed-income active funds bounced back in 2023, but were weighed down by US stock-pickers’ declining performance. That group notched a success rate of 46% in 2023, versus success rates above 50% for foreign and fixed-income managers in aggregate.

Active bond funds struggled during the risk-off market in 2022, but they staged a significant comeback last year. Each fixed-income category included in our report saw its success rate increase by 19 percentage points or more in 2023. This trend aligns with active managers’ willingness to take on more credit risk than market-value-weighted passive peers. Tightening credit spreads worked in active managers’ favor last year while widening spreads hurt in 2022.

Year-Over-Year Change in Active Funds' One-Year Success Rate by Category (%)

But one year isn’t a sufficient time horizon from which to draw conclusions. Success rates can fluctuate wildly from year to year, depending on what’s going on in the markets and how that reflects on the actively managed portfolios as well as in the passive funds we measure them against.

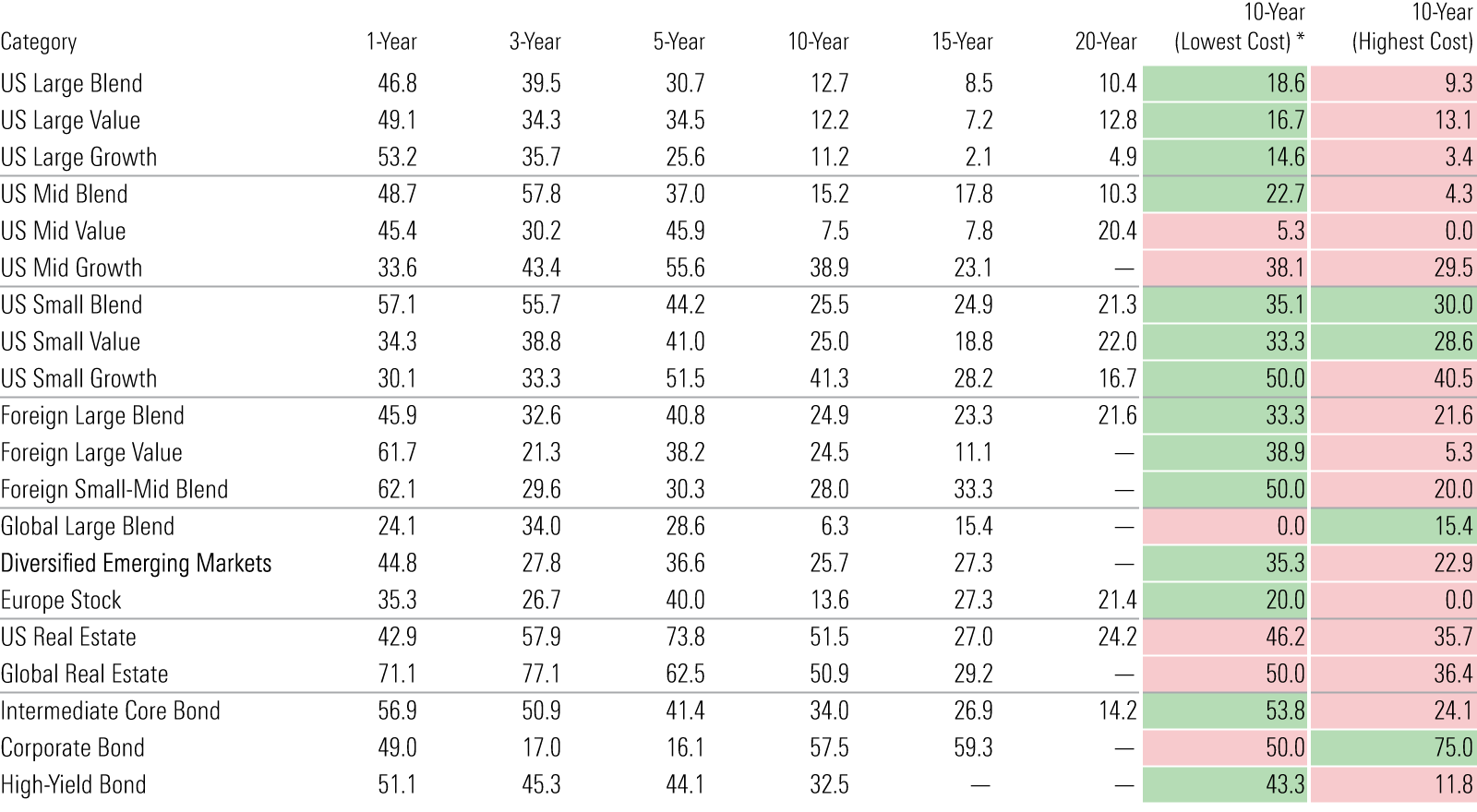

Longer horizons provide stronger signals that investors can incorporate in their selection process. In general, actively managed funds have failed to survive and beat their benchmarks, especially over longer time horizons. Less than one out of every four active funds topped the average of their passive rivals over the 10-year period ended December 2023.

But success rates vary across categories. Long-term success rates were generally higher among the bond, real estate, and US small-cap categories, where active management may hold the upper hand. Investors can use this data to identify areas of the market where they have better odds of picking winning active funds.

Active Funds' Success Rate by Category (%)

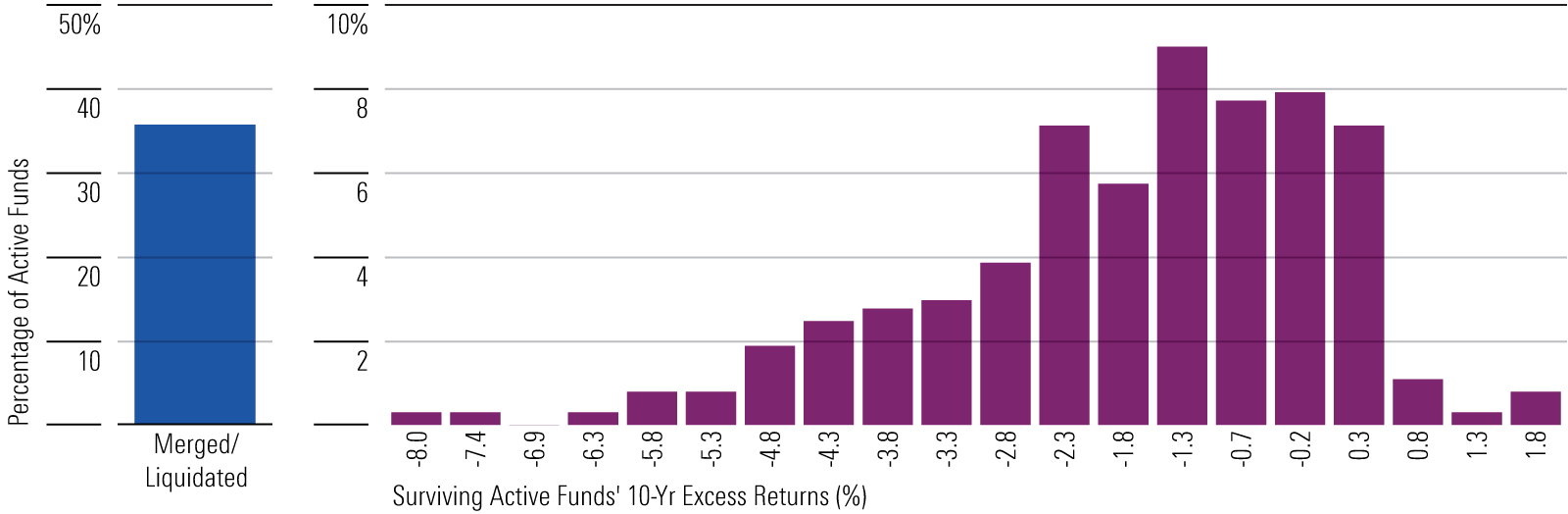

Sizing Relative Performance of Passive and Active Investing

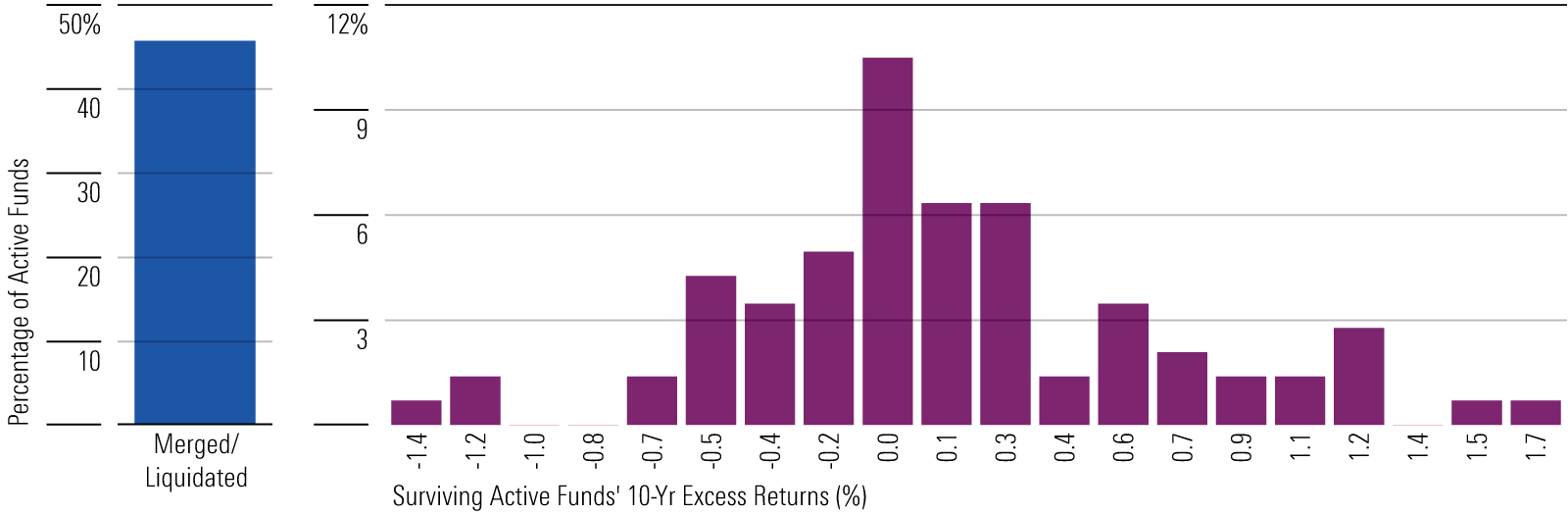

Success rates alone only tell half the story. The other half is the prospective payoff for choosing a winning fund and the penalty for picking a loser. The Active/Passive Barometer contains this information in the form of plots of the distribution of 10-year excess returns for surviving active funds versus the average of their passive peers.

Much like success rates, these distributions vary widely across categories. In the case of US large-cap funds, the distributions skew negative. This paints a bleak picture for active funds in these categories. They have low long-term success rates, while penalties can be high for picking a loser (per the negatively skewed distribution).

The opposite tends to be true of fixed-income, real estate, and certain foreign-stock categories, where long-term success rates have generally been higher and excess returns among surviving active managers skewed positive over the past decade. The exhibits below show the distributions of excess returns for surviving active funds from the large-blend and intermediate-core bond categories.

Distribution of 10-Year Annualized Excess Return for Surviving Active Large-Blend Funds

Distribution of 10-Year Annualized Excess Returns for Surviving Active Intermediate Core Bond Funds

Costs Matter for Both Passive and Active Strategies

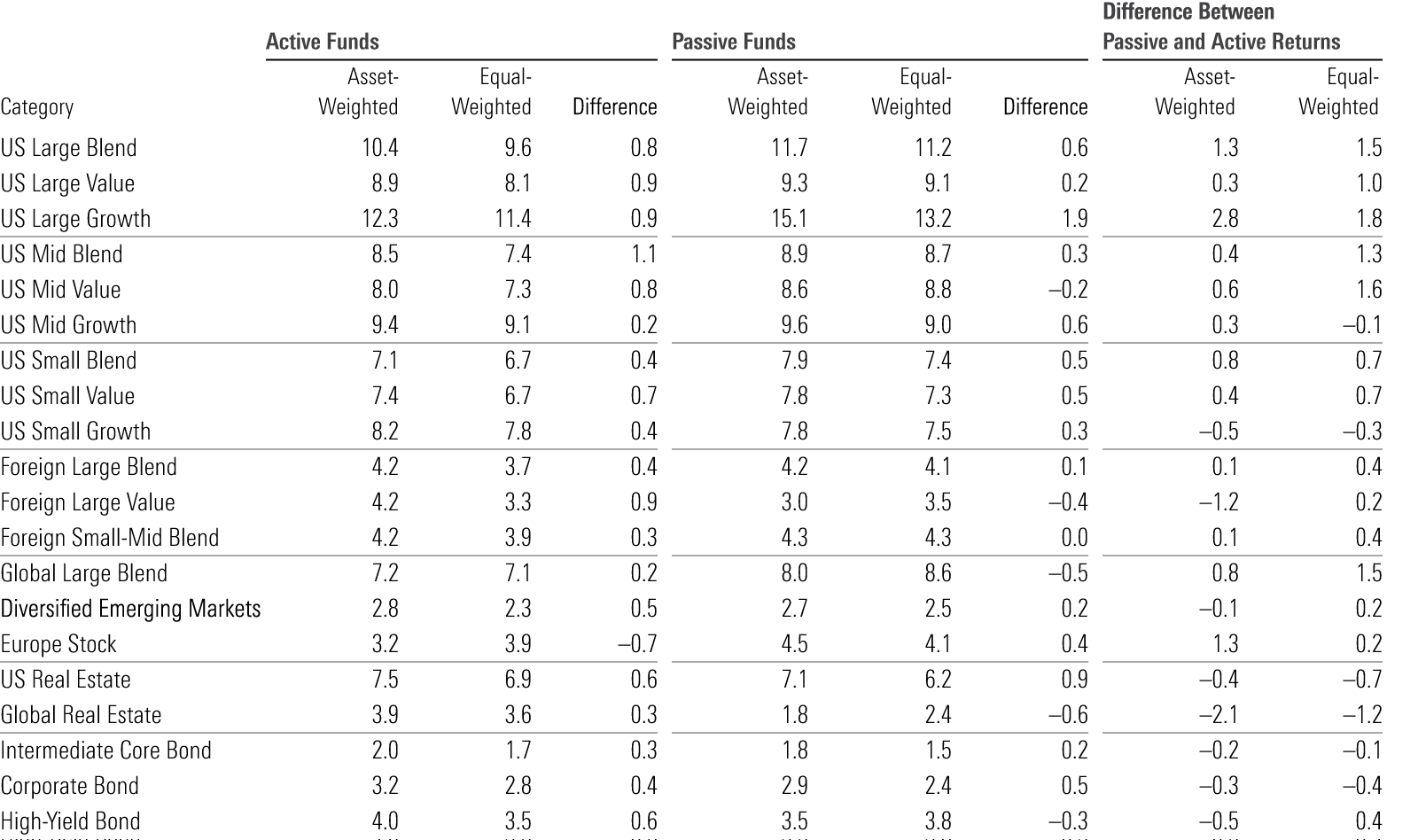

The signal that rings loud and clear in this dataset is that fees matter. Funds in the cheapest quintile succeeded more often than funds in the priciest one (29% success rate versus 18%) over the 10-year period through 2023.

Investors have caught on. Over the past 10 years, the average dollar invested in active funds (asset-weighted average return) outperformed the average active fund (equal-weighted average return) in 19 of the 20 categories examined, as seen in the first three columns of the below table. That implies investors favor cheaper, higher-quality strategies.

Comparison of Asset- and Equal-Weighted 10-Year Returns %

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)