This Bond ETF Promises T-Bill Returns Without Taxable Income

BOXX may be a viable alternative to money market funds and other cash vehicles.

Exchange-traded funds have been praised for their improved tax efficiency over mutual funds, but the ETF tax advantage only applied to stock funds. Until now.

Alpha Architect 1-3 Month Box ETF BOXX aims to replicate the performance of 1-3-month Treasury bills without the tax bill, and it has delivered so far.

Unlike a regular short-term bond fund, BOXX doesn’t produce income and gives investors the choice of when to realize capital gains, which makes it possible for investors to pay long-term capital gains tax rates on a T-bill-like investment. Investors have taken notice: BOXX, which was created in December 2022, recently reached $1 billion in assets.

We take a closer look at BOXX’s strategy, what it means for investors, and how the fund has performed.

This ETF Thinks Inside the Box (Spread)

BOXX is the first ETF intended to access risk-free rates via an options strategy called a box spread.

A box spread utilizes option contracts that cancel out risk exposures while insulating its payout from movements in the underlying security. The two positions in a box spread move in opposite directions, but they don’t cancel each other out at zero. The box’s payoff at expiration nets out at a constant, positive amount equal to the difference between the two strike prices. BOXX is effectively harvesting a risk-free rate of return from the box spreads.

BOXX buys a box spread using S&P 500 options and, separately, a box on single-stock options. The bulk of the portfolio is in S&P 500 options, while the managers invest a small stake in single-stock box spreads to increase tax efficiency. Short-term capital losses on the single-stock box can offset the index options’ short-term gain, and vice versa. These options can also be redeemed in-kind, meaning the fund managers can choose to shed gains on options through in-kind redemptions while taking losses on the options that are down money.

This strategy allows BOXX to avoid realizing gains, which eliminates year-end gains distributions and allows the fund to be taxed like a stock. The fund has yet to distribute any capital gains since its 2022 inception, which shows that the management of the single-stock box spreads has offset gains from the S&P 500 box spreads.

What Does the BOXX Strategy Mean for Investors?

Cash plays an important role in portfolios. Individual investors may keep a portion of their portfolio in cash to meet short-term obligations. But an inverted yield curve means cash yields are higher—or at least competitive with—longer-dated bonds, making cash a worthy investment right now.

The problem with holding cash is that yield is taxed as ordinary income. That means paying up to a 37% tax rate on gains. Investors often seek out long-term capital gains tax treatment for other investments like stocks because the highest tax rate is only 20%.

For BOXX, investors get cashlike risk and return, but they can choose when to realize capital gains from the fund when they sell their shares. Investors who hold the fund for longer than a year could pay long-term capital gains tax rates on cash, which isn’t possible for other cash alternatives. That would mean saving 17% of gains for investors in the highest tax bracket.

Of course, this only helps in taxable accounts. And the managers do not aim to regularly distribute income like a money market or bond fund, so this isn’t meant to be an income product. However, investors looking to optimize the tax efficiency of their cash may find this ETF to be an attractive alternative to a money market fund or T-bills.

How Has BOXX ETF Performed?

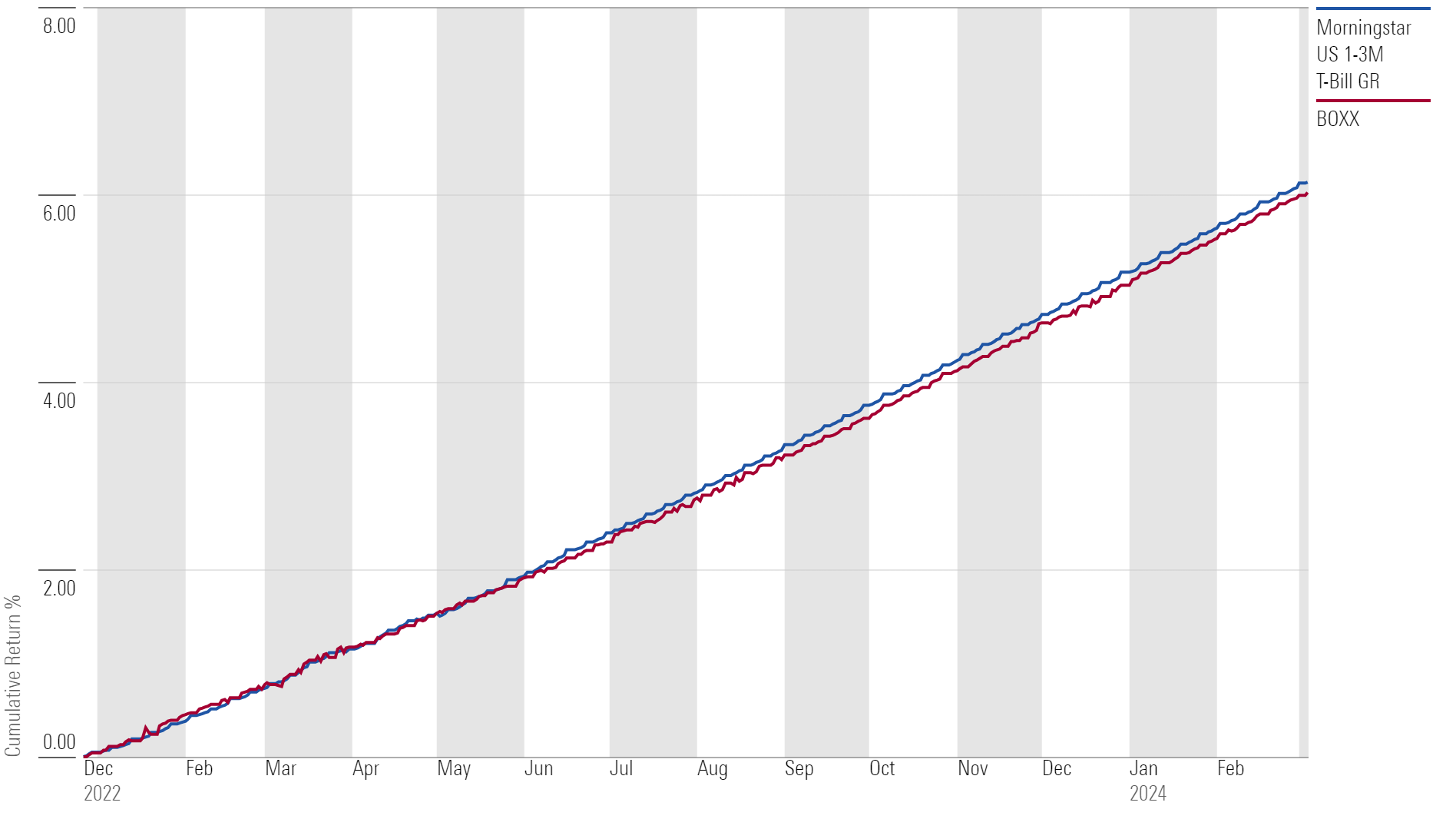

From its December 2022 inception through January 2024, it climbed by 5.03% annually, while the Morningstar US 1-3 Month Treasury Bill Index gained 5.12% annualized. Its performance has hewed closely to that of the index on a monthly basis, deviating at most by 8 basis points. Minimal deviations are to be expected, as Treasuries do carry a convenience yield over the options-derived risk-free rate thanks to their cashlike properties and eligibility for collateral.

BOXX Tightly Tracks the Performance of 1-3 Month T-Bills

The fund has reached the $1 billion mark for assets under management, but capacity should not be a concern in the near future. S&P 500 options are among the most liquid in the world. As of January 2024, average daily volume stands at over 3 million contracts, translating to nearly $1.5 trillion in notional value. Options with 30–90 days to expiration account for around 10% of the total volume on S&P 500 options, providing ample liquidity for the fund.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)