3 min read

Four Tips to Stay Ahead in Today’s Evolving Asset Management Industry

Key Takeaways

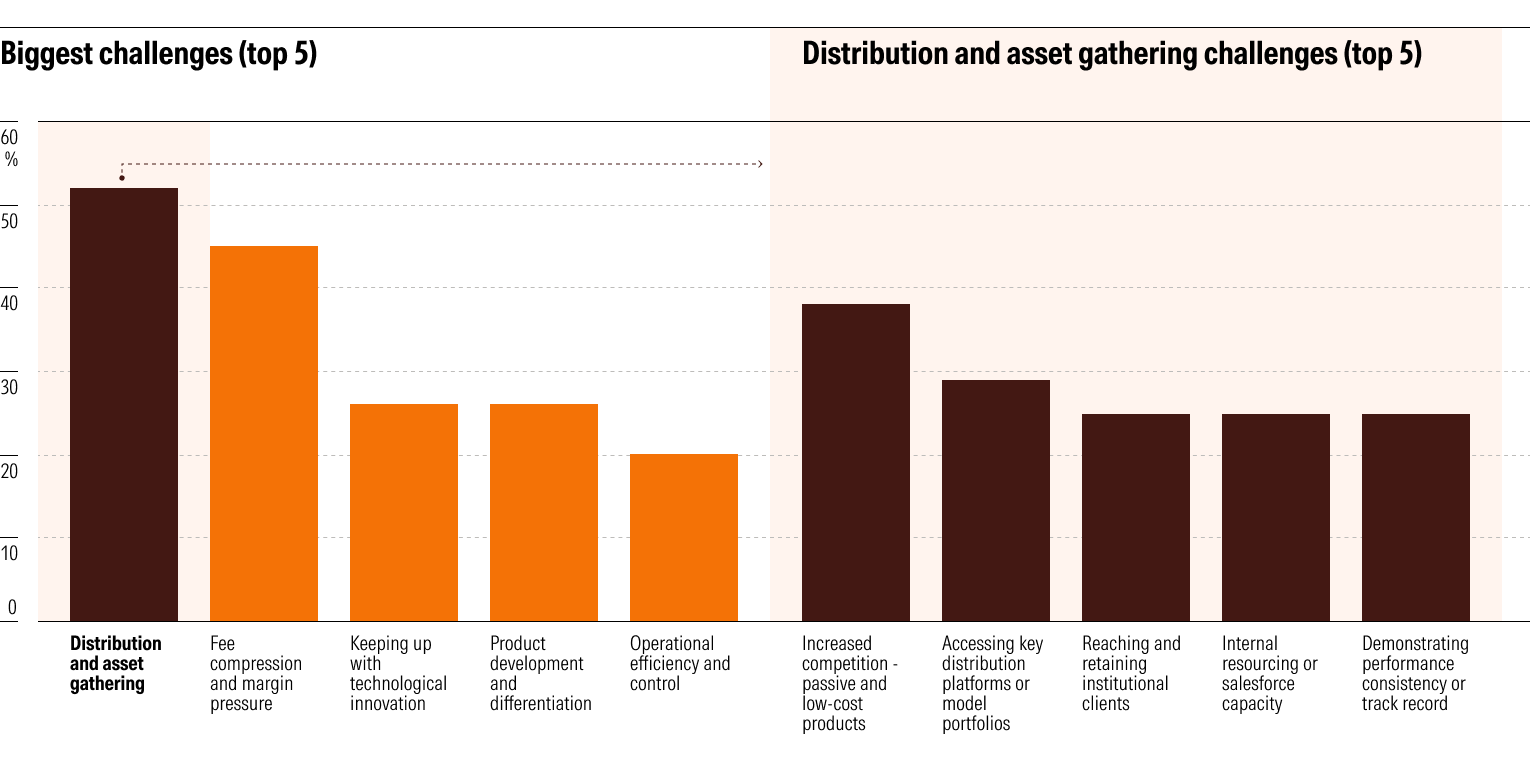

While every asset manager faces different obstacles, more than half of participants indicated distribution and asset gathering as their biggest challenge.

Advisors and asset managers still agree on what drives value, but advisor expectations are shifting fast.

The rising interest in private investments brings challenges and opportunities—differentiating private asset offerings in a niche market is currently the top obstacle.

Generative AI continues to be a powerful tool for streamlining workflows with research as the primary way that asset managers use the technology.

Amid a changing landscape and evolving client demands, today’s asset managers must deliver more than products to stand out. By knowing how to cut through the noise and address common obstacles, they can deliver true value.

Morningstar’s 2025 Voice of the Asset Manager study provides a deeper look at the wide-ranging perceptions and challenges of this group. Our US findings are based on 68 total online responses represented across gender, age, function, firm type, career tenure, investment approach, and total firm assets under management (AUM).

When asset managers confidently adapt to change, they can differentiate themselves and better support clients. Here are four practical ways to get started.

To read the full research report, download a copy.

Address distribution and asset gathering challenges

Even though asset managers face various obstacles and market concerns, their worries have a more macro focus compared to those of investors and financial advisors. Specifically, our survey finds that distribution and asset gathering is the most common challenge for the group. More than half (52%) cited this as their biggest obstacle with increased competition from passive and low-cost products (38%) and limited access to key distribution platforms or model portfolios (29%) as the top two challenges in this category.

To gain platform traction and scale business, asset managers must provide more transparency in areas like how they manage operational risks associated with owning private assets. They also need to communicate their investment philosophy, attribution, and risk controls in a way that aligns with the way advisors and platforms evaluate strategies—with consistent standards, independently verifiable data, and advisor-ready narratives. Choosing a platform backed by a deep history of data, research, and analysis like Morningstar Data + Analytics can make a difference in achieving key platform placements.

Distribution and asset gathering remains the biggest challenge for today’s asset managers.

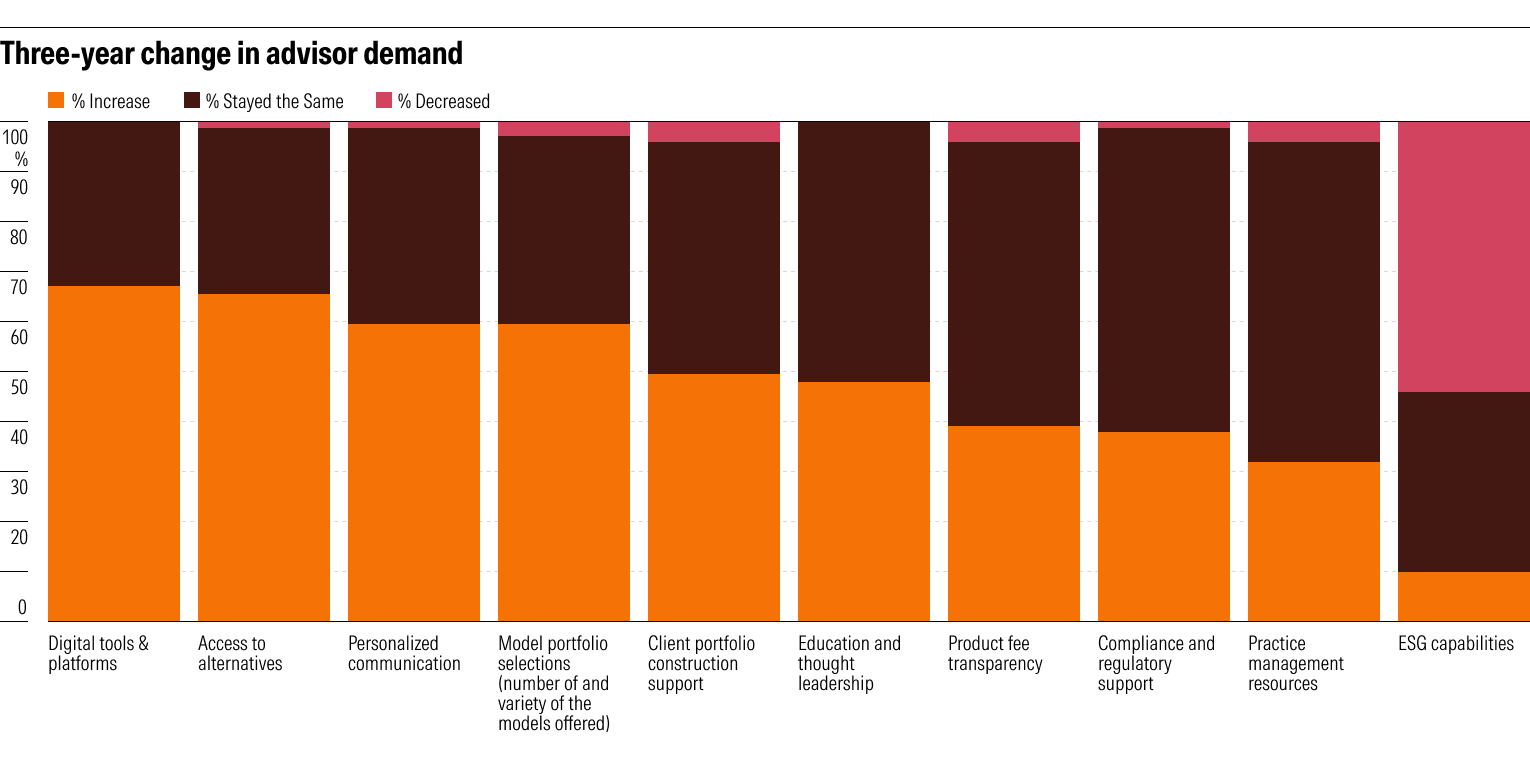

Identify advisors’ priorities

Advisors and asset managers continue to be relatively aligned on the value that is brought to their relationship—according to our study, the most valuable part of the relationship between advisors and asset managers is investment performance for both groups (51% and 41%, respectively) followed by trust and integrity (32% compared to 35%).

Still, advisors’ expectations are changing. In fact, asset managers reported an increase in advisor demand for digital tools and platforms (67%), access to alternatives (65%), and model portfolio selections (59%) compared to three years ago. This implies that advisors may expect asset managers to both adopt new technology and stay informed on trends to deliver tailored solutions. Integrating research, analysis, and technology into one ecosystem like Morningstar Direct can help asset managers deliver the holistic advice that advisors want.

The largest three-year change in advisor demand goes to digital tools and platforms.

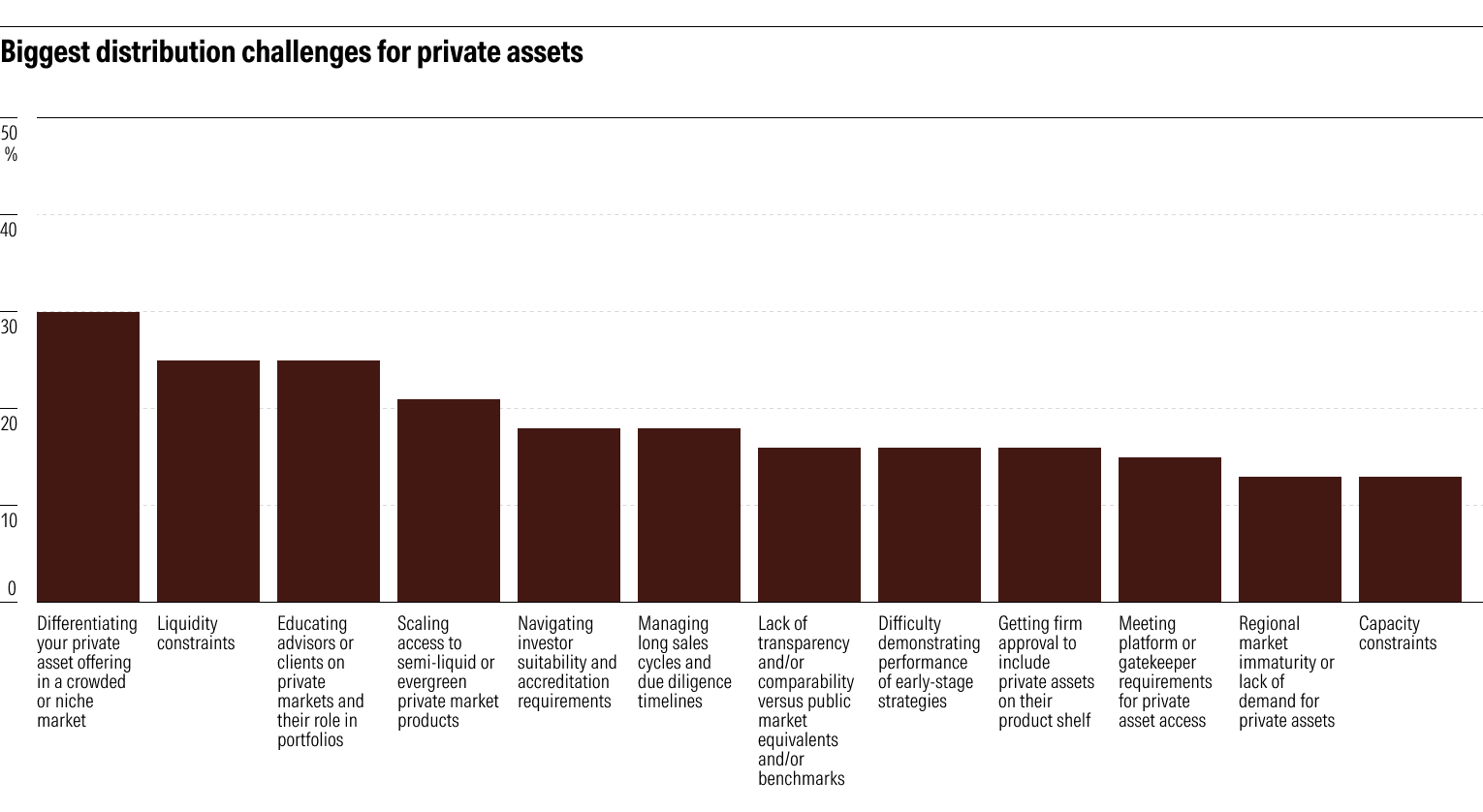

Find opportunities in private investments

As the interest in private markets rises, so do potential new opportunities for asset managers. The convergence of public and private markets, for example, has asset managers exploring private equity and private credit. Yet this group still faces private asset distribution challenges including differentiating private asset offerings in a crowded or niche market (30%), liquidity constraints (25%), and educating advisors or clients on private markets and their role in portfolios (25%).

To stay competitive, asset managers need to expand their capabilities, address access and liquidity concerns, and provide education around the role of alternatives in a portfolio. By avoiding poor or fragmented data sets, they can create a competitive edge and also make more strategic decisions.

Differentiating private asset offering in a crowded or niche market is the number one private asset challenge for this group.

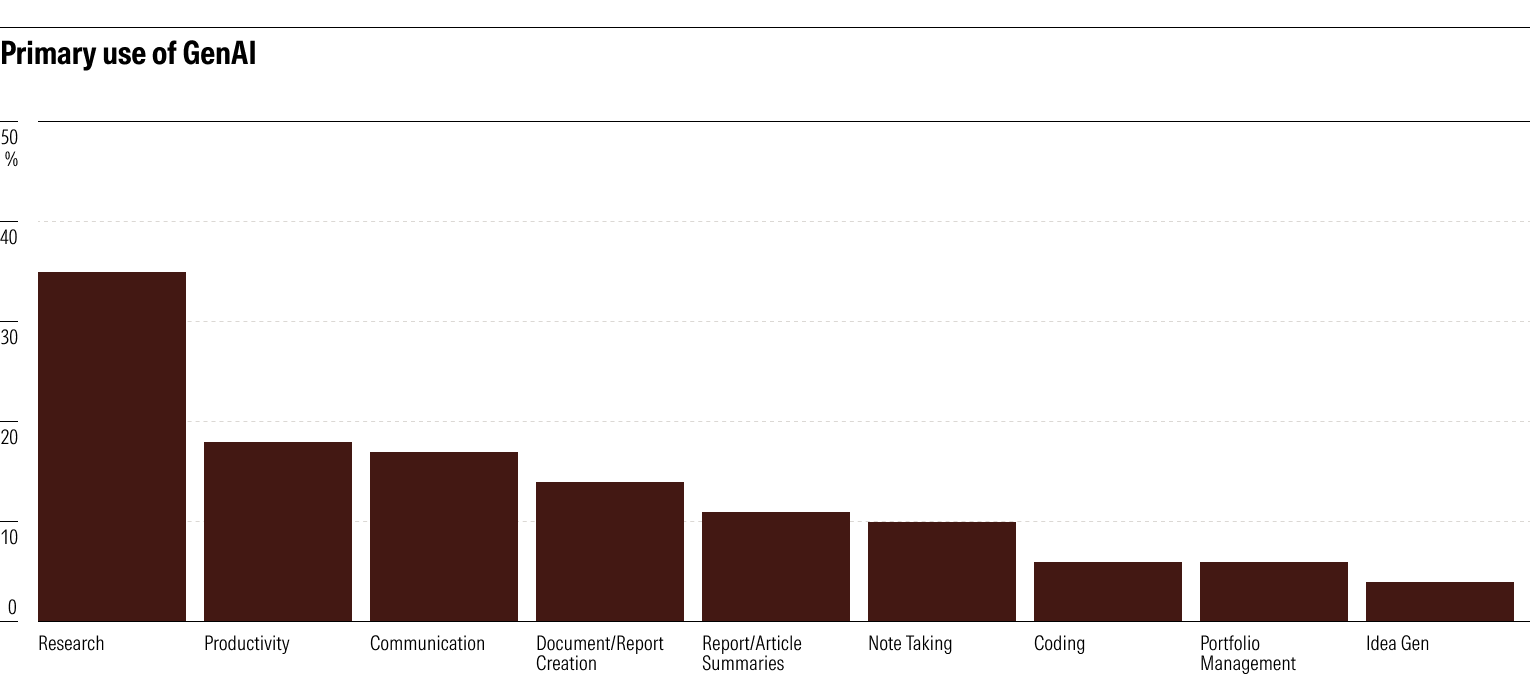

Adopt generative AI into workflows

Generative AI is changing the investing world. For asset managers currently using the tool, 53% reported that it moderately or significantly improved their efficiency with day-to-day work—additionally, 64% are likely or extremely likely to add more AI capabilities into their workflows in the next 12 months.

While the tool can support a wide range of tasks, the top ways asset managers apply it are for research (35%), productivity (18%), and communication (17%). If research is seen as the top benefit, tools like Mo—Morningstar’s AI chatbot—can conduct research and deliver answers so that asset managers may save time for clients.

The top way asset managers use AI is for research.

Build lasting partnerships

Asset managers are now competing on more than returns—they must differentiate through holistic solutions that reflect clients’ evolving goals and expectations. Join Morningstar’s Joseph Agostinelli, Senior Director of Market Research, and Ben Johnson, Head of Client Solutions for Asset Management, as they share actionable survey findings to improve relationships and navigate industry complexities.