5 min read

Building a Lasting Product Lineup for the Modern Asset Manager

As competition intensifies across the asset management industry, it's clear that traditional business models are being redefined. To earn a seat at the table with advisors and institutional investors, firms must embrace bold thinking and innovative strategies.

Here are top trends driving the need for more flexible product lineups and steps that asset managers can take to deliver value.

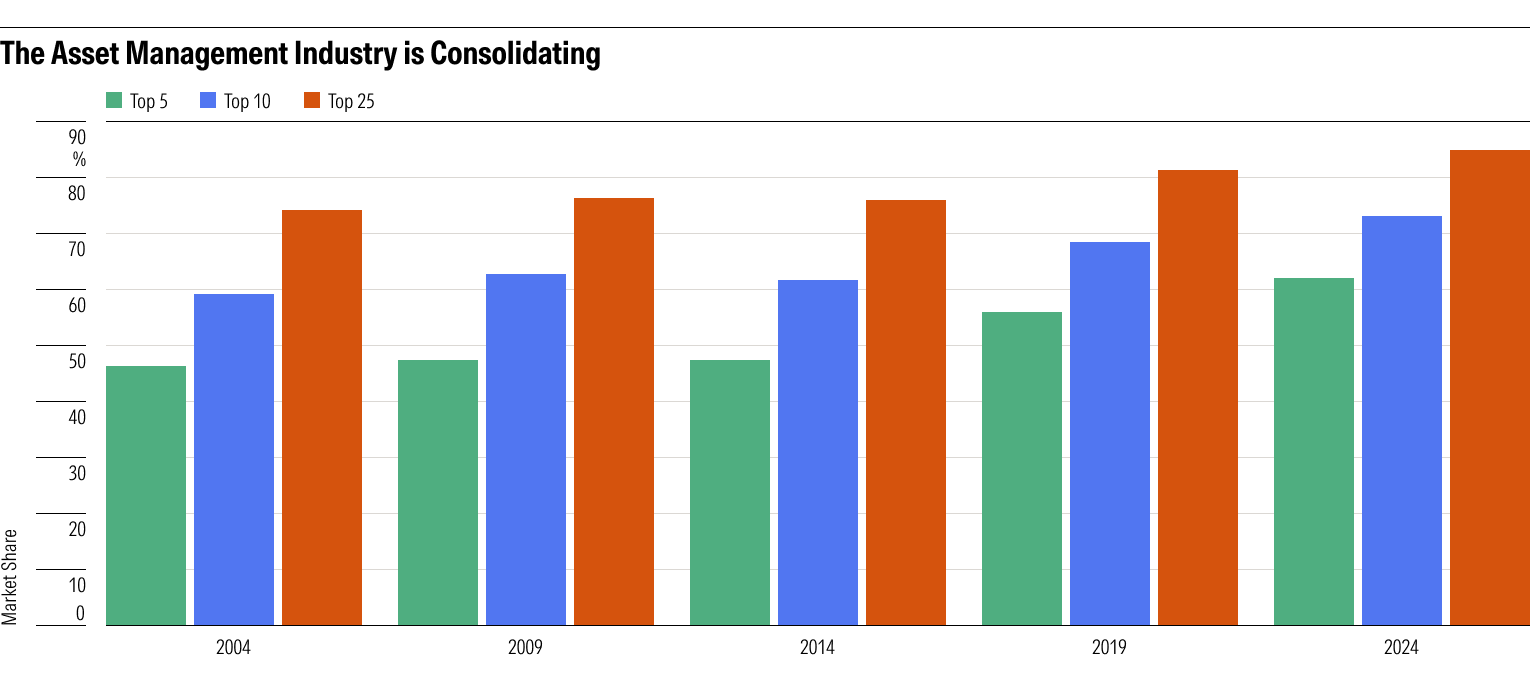

The Big Firms Are Getting Bigger

Key takeaway: Asset managers outside of the top 25 firms may find opportunities in targeted innovation such as separately managed accounts (SMAs) or interval funds.

Over the past two decades, the largest asset management firms have steadily increased their control of industry assets. Today, the top five firms manage more than 60% of total AUM, while the top 25 account for nearly 90%. These firms have scaled their distribution, product breadth, and technology to a point where it’s difficult for smaller players to compete head-to-head. For most asset managers, this trend means they can no longer win on scale alone.

Today’s top five asset management firms manage more than 60% of total AUM.

What can asset managers do?

In a market dominated by giants, the opportunity for asset managers outside the top 25 lies in targeted innovation such as niche strategies, private markets, customization (including separately managed accounts or SMAs), interval funds, or values-based investing.

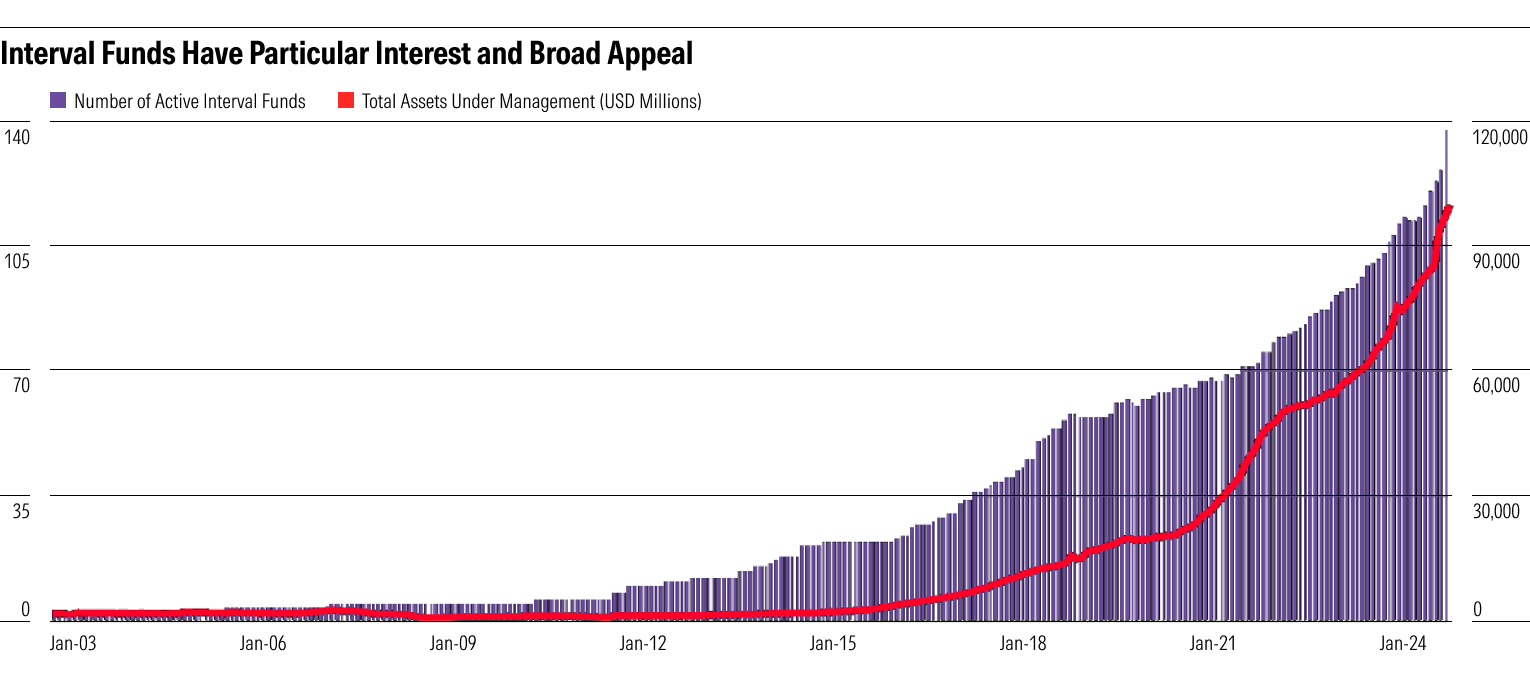

Interval funds have broad appeal.

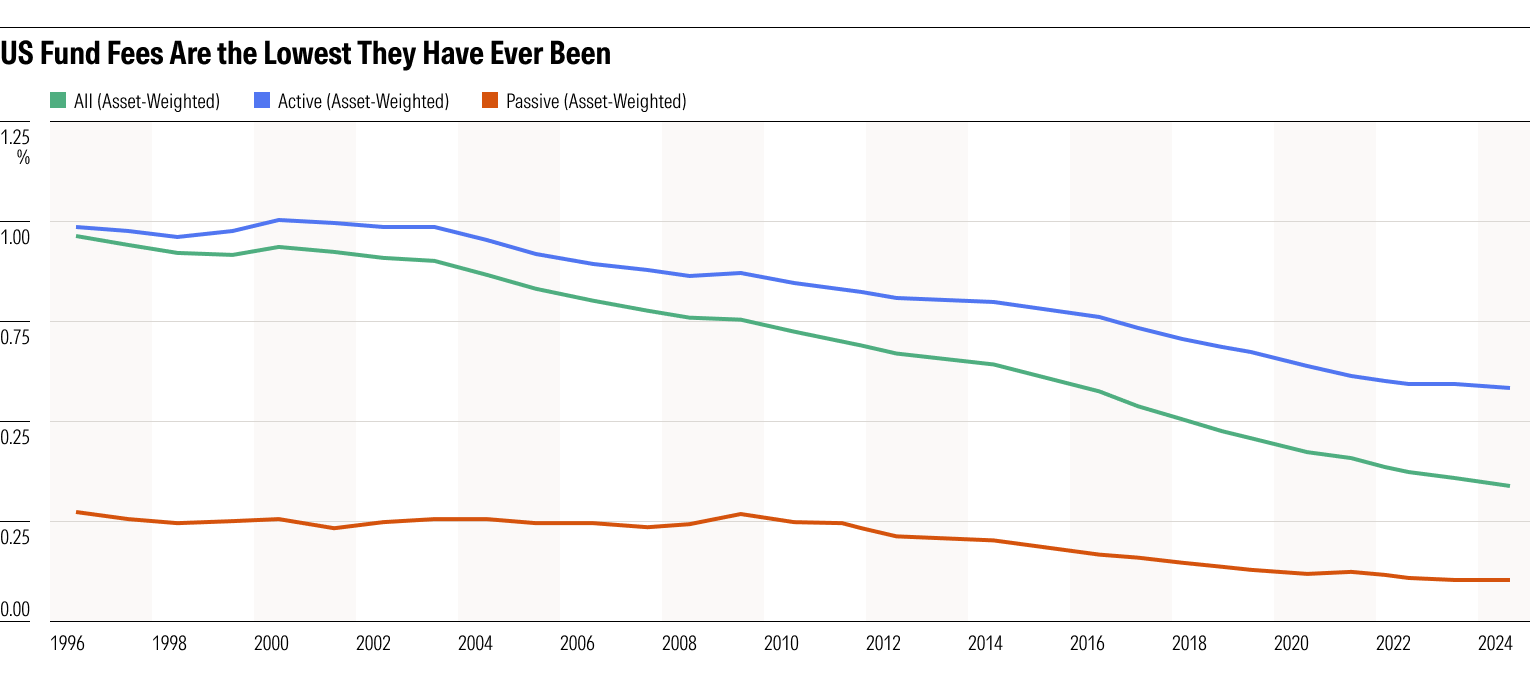

Fee Compression Isn’t Slowing Anytime Soon

Key takeaway: Pricing models like performance-based or hybrid fee structures can help asset managers address mounting fee pressure.

Fee pressure isn’t new, but it’s becoming harder to ignore. Over the last twenty years, passive strategies, particularly ETFs and index mutual funds, have captured the lion’s share of industry inflows due to their lower costs and transparency and in the case of ETFs, greater tax efficiency.

Investors are increasingly questioning the value proposition of actively managed funds, especially when net-of-fee performance doesn’t consistently beat benchmarks. Digital platforms, fee comparison tools, and regulatory initiatives (like MiFID II in Europe and Regulation Best Interest in the US) have made it easier for clients to compare fees across providers. In the US market, we can see the growing fee pressure asset managers are experiencing.

US asset managers are experiencing growing fee pressure.

Advisors have continued to pivot to building portfolios using lower-cost building blocks and seeking alpha through asset allocation, planning, or alternatives and not necessarily through expensive active funds.

What can asset managers do?

To stay competitive amid mounting fee pressure, asset managers must rethink how they deliver and price value. Innovative pricing models like performance-based or hybrid fee structures can potentially align incentives and help managers stand out in a crowded field.

At the same time, firms should focus on differentiation by offering unique strategies rooted in proprietary research or niche exposures that passive giants may have difficulty replicating. Finally, emphasizing a technology-first approach by using advanced data and analytics along with personalized tools can elevate the client experience and help justify the value firms add.

Distribution Favors the Powerful

Key takeaway: Asset managers need to access competitive intelligence like peer benchmarks and screening criteria to gain platform traction.

Much like asset managers facing fee compression, large wirehouses, broker-dealers, and advisory platforms are grappling with pressure from direct investment platforms—and they’re reevaluating revenue-sharing arrangements with product sponsors.

As a result, they’ve continued to streamline and consolidate their product menus and recommended lists, making it increasingly difficult for new products to secure shelf space. Because of their size, resources, and deep servicing infrastructure, many top firms are given placement priority.

What can asset managers do?

For asset managers, gaining platform traction increasingly requires going beyond the basics of due diligence. Access to up-to-date competitive intelligence—covering flows, peer benchmarks, and platform screening criteria has become essential for positioning strategies effectively. Technology platforms need to prove that their strategies are resilient in areas where scrutiny is rising. Asset managers must provide more transparency in areas like Al Model governance, how they manage operational risks associated with owning private assets, and how they fold ESG considerations into their investment process.

Finally, asset managers must communicate their investment philosophy, attribution, and risk controls in a way that aligns with how advisors and platforms evaluate strategies—with consistent standards, independently verifiable data, and advisor-ready narratives. Choosing a platform backed by a deep history of data, research and analysis will be the difference in achieving key platform placements.

Advisors Are Scaling Back

Key takeaway: To connect with financial advisors, asset managers must not only nail the due diligence process but show how they can support portfolio construction.

Our Voice of the Advisor 2024 survey revealed that about half of advisors work with 10 or more asset managers, though this varies by channel. Wirehouse advisors, on average, engage with more than 13 asset managers. Meanwhile, the average is just over eight in the RIA channel with 35% of RIAs working with fewer than five. The competition for advisors’ time, attention, and allocations has never been more intense.

Almost half of the advisors we surveyed work with 10 or more asset managers.

What can an asset manager do?

From an advisor perspective, the differentiator isn’t just passing due diligence, but building conviction. Managers who help advisors with model portfolios, portfolio construction tools, and scenario analysis create a groundswell of interest that goes beyond platform placement. The more a manager can connect their strategy to advisor workflows and client outcomes, the more likely advisors will lean in to explore the firm’s most compelling ideas.

Facing the Shift in What Clients Value

Key takeaway: As major industry shifts continue, asset managers should consider integrating deeper ESG data into their processes and offering clear education around alternatives.

Investor expectations are changing—not just in how portfolios are constructed, but in what they’re meant to achieve. Asset managers can no longer rely solely on traditional strategies to meet demand.

Two major shifts are driving the need for more flexible, forward-looking product lineups:

ESG and values-based investing

The demand for portfolios that reflect investors' personal values whether environmental, social, or governance (ESG)-related continues to grow across retail, advisor, and institutional channels. Investors want to know what they own and why it aligns with their beliefs.

What can asset managers do? Asset managers should consider integrating deeper ESG data and risk rating frameworks into their research and investment processes—which can demonstrate a measurable impact through transparent reporting and impact metrics.

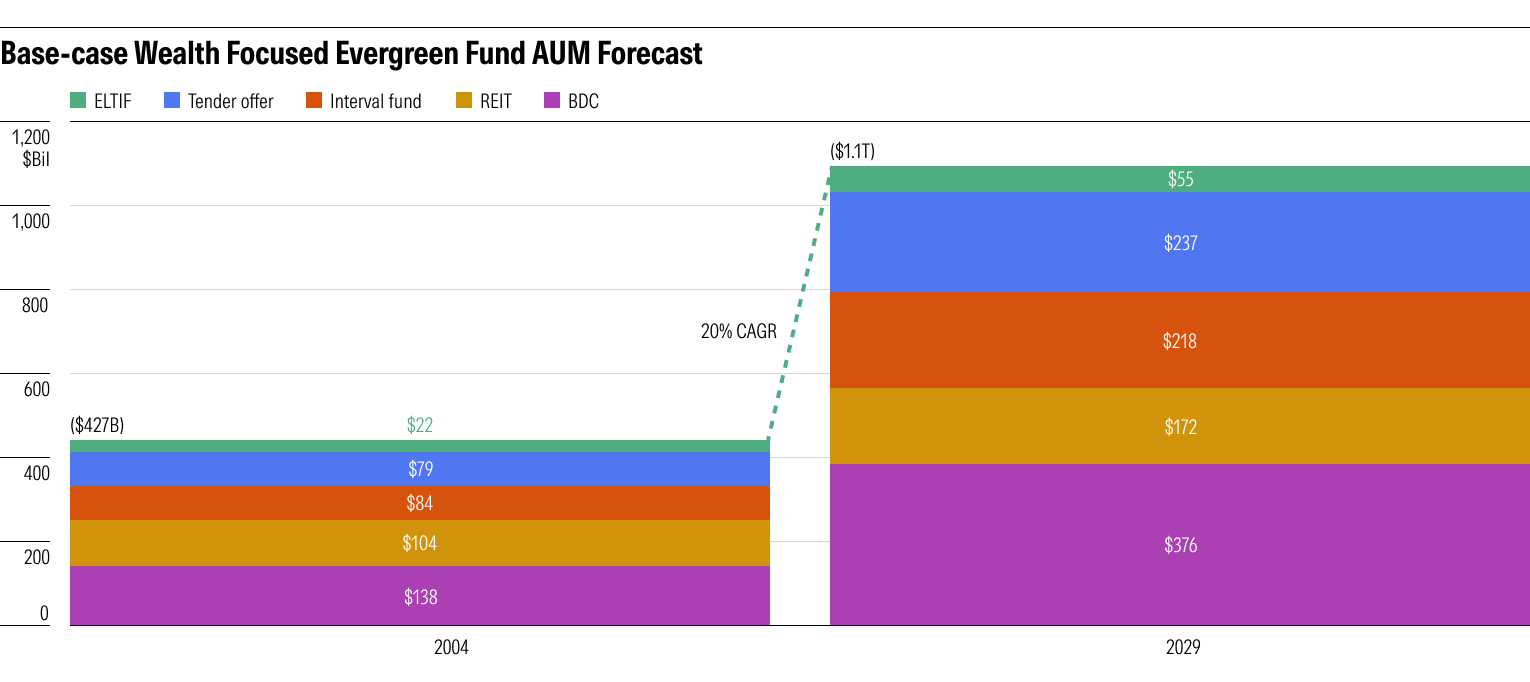

Alternatives and private markets

Investors are turning to alternatives and private assets in search of differentiated sources of return, income, and diversification. The proliferation of new wrappers such as interval funds and perpetual non-traded vehicles is accelerating the democratization of private markets.

Evergreen funds present an evolution of private markets.

What can asset managers do? Private equity, private credit, and real assets are gaining traction—especially among high-net-worth and institutional clients. To compete, asset managers need to expand their capabilities, address access and liquidity concerns, and provide education around the role of alternatives in a portfolio.

Stand Out From the Competition

It's no surprise that secular and emerging trends are requiring asset managers to take a closer look at their product lineups—not only to remove underperforming legacy products, but to identify gaps that align with new client expectations.

The most successful asset managers will be the ones that can quickly adapt to partnering with providers who have access to accurate data, objective research across multiple asset classes, investment vehicles, and securities. They’ll also have the tools they need to streamline the investment analysis and distribution workflows critical in bringing viable products to market.