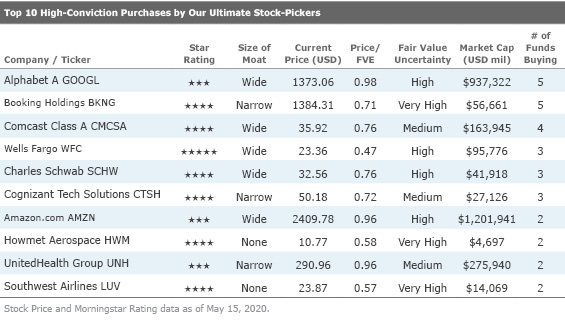

Our Ultimate Stock-Pickers' Top 10 High-Conviction Purchases

Several funds see value in industrials and financial services; Berkshire Hathaway sells airlines stock.

For roughly the past decade, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that reflect the most recent transactions of our Ultimate Stock-Pickers in a timely enough manner for investors to get some value from them. In cross-checking the most current valuation work and opinions of Morningstar’s own cadre of stock analysts against the actions of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig into a bit deeper to see if they warrant an investment. With 23 of our Ultimate Stock-Pickers having reported their holdings for the first quarter of 2020, we now have a good sense of the stocks that piqued their interest during the period.

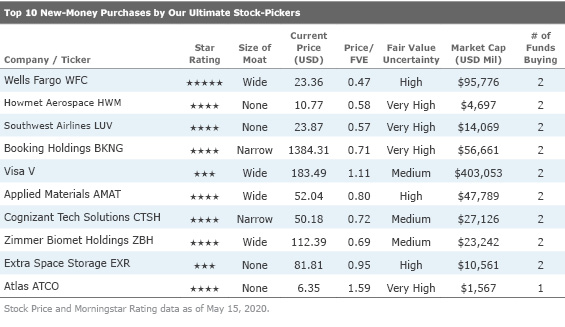

Recall that when we look at the buying activity of our Ultimate Stock-Pickers, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We recognize that our Ultimate Stock-Pickers' decisions to purchase shares of any of the securities highlighted in this article could have been made as early as the start of January, so the prices paid by our managers could be substantially different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

Over the last few months, the world has seen its fair share of adversity, as large swathes of the global economy have been shut down as a result of the COVID-19 pandemic. While the market outlook appeared rosy at the beginning of the quarter, the spread of the novel coronavirus upended markets and economies in the latter months. Certain industries such as airlines and retail have been particularly hard-hit, and governments worldwide have been taking actions to mitigate some of these impacts. The U.S. Federal Reserve cut the federal funds rate to 0.00%-0.25% in the beginning of March as an initial step, and the U.S. government has taken many more drastic measures since then to cushion the blow on the economy. Amid all this volatility and uncertainty, our Ultimate Stock-Pickers have managed to find value in certain stocks in a wide range of sectors such as financial services, industrials, consumer cyclical, and communication services. The current economic downturn has caused significant price declines for many stocks, potentially opening up more attractive purchase opportunities.

Looking more closely at the top 10 high-conviction purchases, the buying activity was distributed among different sectors, with marginally higher purchases in the communication services, consumer cyclical, and financial services sectors. Each of these sectors received two high-conviction purchases this quarter. It is interesting to note that bets are being placed in some sectors that are considered riskier in the current market environment. As mentioned, the new-money purchases list is somewhat concentrated within the industrials sector, with three stocks in the top 10 list. The financial services and technology sectors had two stocks each in the top 10 list. As was the case during prior periods, a majority of the high-conviction buying was focused on high-quality names with defendable economic moats. Morningstar's analysts have concluded that eight out of the 10 companies that received the most high-conviction purchases have either a wide or a narrow economic moat. The three names we find most interesting on the high-conviction purchases and new-money lists are wide-moat rated Wells Fargo WFC and Visa V, and no-moat rated Southwest Airlines LUV. Wells Fargo had three high-conviction purchases, with two of them also being new-money purchases. Southwest Airlines had two high-conviction purchases that were also new-money purchases, and Visa had two new-money purchases.

As already mentioned, there was a moderate amount of crossover between our two top 10 lists this period, with five names appearing on both lists. This quarter, one stock received five high-conviction purchases from our Ultimate Stock-Pickers: Artisan Global Value Investor ARTGX, Diamond Hill Large Cap DHLAX, FPA Crescent FPACX, Sequoia SEQUX, and Fairfax FRFHF made conviction purchases in narrow-moat rated Booking Holdings BKNG. Two stocks received three new-money purchases, as well: Sound Shore Investor SSHFX, AMG Yacktman YACKX, and Allegheny Y purchased Wells Fargo, while Boston Partners All Cap Value Institutional BPAIX, AMG Yacktman, and Diamond Hill Large Cap purchased Cognizant Technology Solutions CTSH. FPA Crescent and Oakmark Equity and Income Investor OAKBX purchased Howmet Aerospace HWM, and Artisan Global Value Investor and Parnassus Core Equity Investor PRBLX both purchased Southwest Airlines.

Berkshire Hathaway BRK.B reported its holdings later than usual, and the data was not incorporated in the tables at the time of writing. However, we did learn some interesting information at this year's Annual General Meeting. The main tone Warren Buffett has employed over the last few months is one of caution. In spite of his famous adage to "be fearful when others are greedy and greedy when others are fearful," Berkshire Hathaway has exited some of its holdings and has focused on growing its cash balances over the first quarter. The company exited its airlines holdings and significantly reduced its stake in Goldman Sachs GS, and has remained guarded for the time being, with Buffett not seeing many undervalued yet viable opportunities. Berkshire did make a purchase in PNC Financial Services PNC, which recently sold its 22% stake in BlackRock BLK. Berkshire is likely to focus on building and maintaining its cash reserves for the time being, unless interesting investment opportunities arise in the near future.

One high-conviction purchase that is in line with our investment research is Sound Shore Investor, AMG Yacktman, and Allegheny's purchase of wide-moat Wells Fargo, one of the largest banks in the United States. We have covered this high-uncertainty stock in a few previous editions, as the bank continues to remain undervalued. Wells Fargo currently trades at roughly a 50% discount to Morningstar analyst Eric Compton's fair value estimate of $50. Compton argues that Wells Fargo has built sustainable cost advantages and switching costs that support its wide moat rating. Even though the bank has had its fair share of troubles over the last few years and has been the subject of many negative headlines due to all the scandals it has been embroiled in, it still remains one of the top deposit gatherers in the U.S. and has viable consumer, commercial, and wealth franchises. Wells remains a turnaround story, but we don't see a fundamental reason why the bank can't eventually turn things around and return to more normal profitability over time.

The bank reported a difficult first quarter on the back of the COVID-19 pandemic, and a large reserve build against future loan losses was the biggest reason for this. Compton argues that even though earnings will be hurt in the short to medium term, the question surrounding banks is not one of earnings per share, it is one of capital and liquidity. Based on past stress test results, the bank's current capital levels, and its history of good credit risk management, Compton believes Wells Fargo has likely shored up enough capital and liquidity to weather the downturn. Even though the bank still faces many additional regulatory hurdles such as the removal of the asset cap and improvement of its reputation, Wells Fargo still has one of the strongest branch networks in the U.S., has a large advisory network, and outperforms in the middle-market commercial arena, which should support enough profitability to get the bank through the current downturn.

Wells Fargo has the scale required to be one of the leaders in its industry, being one of the largest U.S. banks by assets and maintaining leading share in key competitive areas. The bank is one of the largest U.S. issuers of credit and debit cards, has a strong commercial banking franchise, and has a leading consumer franchise catering to about 70 million customers and small businesses. Wells Fargo further has a history of conservative underwriting and didn't suffer as much as peers during the 2008 financial crisis. Since then, the bank has maintained and improved its positive underwriting abilities, thus generating cost advantages. Additionally, in spite of some structural hurdles in areas such as asset management, Wells Fargo's operating efficiency is on par with if not better than peers'. Legal and other charges also appear to be dissipating. The bank still needs to satisfy outstanding regulatory consent orders, get the asset cap removed, and will likely remain in turnaround mode for at least several more years, but we think these challenges are doable.

Our Ultimate Stock-Pickers see some value in the currently downtrodden airlines industry. Artisan Global Value Investor and Parnassus Core Equity Investor both made high-conviction new-money purchases in Southwest Airlines.

Southwest Airlines is the largest domestic carrier in the United States. This no-moat rated stock currently trades at approximately a 40% discount to Morningstar analyst Brian Bernard's fair value estimate of $42. Like the rest of the airline industry, Southwest has been forced to grapple with a sudden decline in the demand for air travel as more and more people are choosing to stay home due to the COVID-19 pandemic. Unsurprisingly, management plans to reduce capacity by a minimum of 60% in the upcoming quarter and has indicated mounting pressures in the near term. While the firm is likely to face short- to medium-term losses due to declining revenue and a large fixed cost base, Bernard argues that this is temporary as air travel demand should start to normalize by 2021; this will allow Southwest to return to previous capacity levels by 2022.

Southwest is also relatively better positioned than its peers, with comparatively lower debt and higher cost efficiency. Historically, the airline had been profitable for over 40 years, with skilled execution of its low-cost carrier strategy; this includes short-haul routes, utilization of secondary airport channels, fleet commonality, and a differentiated company culture. Southwest also outperforms on the distribution channel front, making roughly 85% of bookings without having to make use of third-party ticket distributors. Before the pandemic shook the aviation market, the airline had been modifying this low-cost carrier approach to something more similar to legacy carriers like Delta DAL. The airline was seeking opportunities such as international routes, long-haul domestic routes, and was marketing to price-inelastic business travelers. This would lead to higher unit costs and unit revenue as Southwest expands its amenity offerings to take market share away from legacy airlines.

Although the firm has historically had attractive returns on capital, we think that the airline business model is not conducive to economic moats. Southwest’s low-cost carrier strategy helped generate attractive profits via its frequent flyer program, dense route network, and fleet commonality (exclusively operating the 737), though the transition toward the new model will erode some of its productivity and thus reduce the company's moatworthiness. Even so, Southwest has a large domestic presence, having over 50% of market share in a considerable number of midsize markets. The airline can also enter new locations and offer lower fares, all while buoying fares in pre-existing markets, allowing the airline to gain new share while maintaining a strong presence in incumbent cities. It would not be easy for smaller low-cost carriers to reproduce Southwest's immense presence, given that it already controls 24% of the U.S. domestic market. Moreover, it would require further consolidation among players to try to match Southwest's pricing, or else risk starting a price war. As a result, Southwest remains comfortably positioned in the domestic market and is able to operate with enough frequency in normal economic conditions to continue to expand its customer base.

Even though Southwest will face some near-term pain and had to raise capital to stay afloat, Bernard posits that the eventual return of air travel will lead to a recovery in 2021--albeit growth will be a little slower from there. Alongside the impact of the COVID-19-induced economic shutdown, the grounding of the 737 MAX has hampered capacity for the airline, which had historically relied on the 737 fleet to conduct business. However, Bernard believes the MAX should re-enter service at the latest by 2021, and the return of the model coupled with an abating virus-linked downturn will mean Southwest should be able to improve returns once again.

Our Ultimate Stock-Pickers also invested in Visa Inc.--Artisan Global Value Investor and Diamond Hill Large Cap each made new-money purchases into this stock. It is currently trading at a 10% premium to Morningstar analyst Brett Horn's fair

As the world's largest payments processor, Visa enjoys a wide moat rating due to significant network effects and cost advantages as the company is essentially universally accepted in a majority of developed markets. As the shift toward electronic payments has increased, Visa has emerged as one of the largest beneficiaries, processing over $9 trillion in purchase transactions in fiscal-year 2019. The company also holds over 50% market share in geographies such as the U.S., Europe, Latin America, and the Middle East/Africa. Visa also processes twice as many transactions as Mastercard MA, its closest competitor. It would be difficult to build up to Visa's network in the electronic payments world, especially in the foreseeable future, cementing Visa's place in the industry. The company has further enjoyed high operating margins--due to the inherent scalability, as well as asset-light nature of the business, helping Visa generate healthy returns over time. As a result, the company is well positioned for a future in the payments space and warrants a wide moat rating.

Due to the COVID-19-induced economic shutdown, Visa has seen some pressure on growth and returns in recent times. Cross-border transactions, which are fairly lucrative for the company, have seen and will continue to see significant declines as international travel recedes in the face of the pandemic. Additionally, smaller, regional networks have been focusing on growing out cross-border transaction capacity, which would impede Visa's growth to some degree in the future, though Horn has not seen this materialize in the present. Visa is also sensitive to transaction volumes, with its largest market being the United States. Slower economic growth due to the novel coronavirus is causing increased unemployment and is also keeping people at home, leading to a large decline in transaction volumes, at least in the near term. However, Horn does not see this as a long-term threat and posits that the scalability of Visa's business will allow it to grow over time and expand margins, albeit at a slightly more modest pace. While Horn doesn't see Visa as undervalued at current prices, he still believes the long-term business model remains as strong as ever.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Nupur Balain and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)