Undervalued Dividend Payers From Our Ultimate Stock Pickers

These stocks are among the top holdings of some of our favorite investment managers.

The vast majority of our Ultimate Stock-Pickers are not dividend investors. That said, a handful of them--Amana Trust Income AMANX, Columbia Dividend Income LBSAX, Oakmark Equity & Income OAKBX, and Parnassus Equity Income PRBLX--focus more on income-producing stocks in their pursuit of investment return. Warren Buffett at Berkshire Hathaway BRK.B has spoken highly of companies that return capital to shareholders and is not against investing in and holding higher-yielding names.

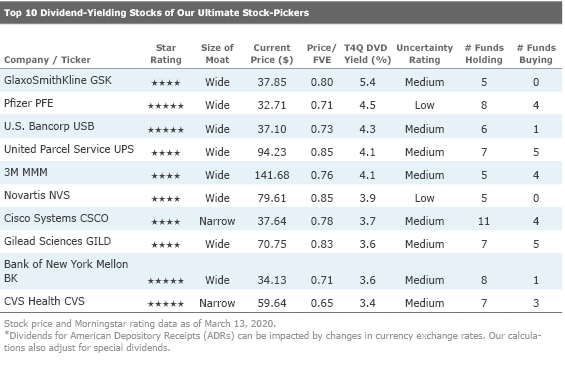

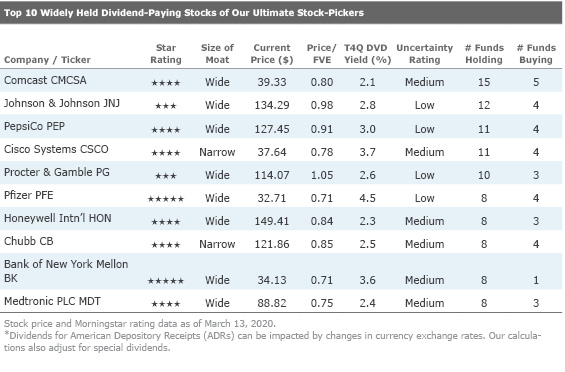

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to find the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have sustainable competitive advantages that should allow them to generate the excess returns necessary to maintain their dividends over the longer term. We also look for firms where there is lower uncertainty on our analysts' part regarding their future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, have wide or narrow economic moats, and have uncertainty ratings of either low or medium.

Once our filtering process is complete, we create two different tables—one that reflects the top 10 stocks with the highest dividend yields and another that lists stocks that are widely held by our Ultimate Stock-Pickers and pay dividends in excess of the S&P 500, which is currently yielding 2.1% as of Feb. 28. We note that the dividend yield calculations in each of our two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from last time around, we note that a small portion of the new list is composed of the previous list. Wide-moat rated Gilead Sciences GILD, Novartis NVS, United Parcel Service UPS, and Pfizer PFE were part of the old list, as well. Wide-moat rated Gilead Sciences moved down the list, wide-moat rated Novartis moved up the list, wide-moat rated United Parcel Service moved up the list, and wide-moat rated Pfizer moved up the list. The top 10 widely held dividend-paying stocks also changed slightly, but over half the names were present on the old list as well. Seven of the 10 widely held dividend-paying stocks were present in the second quarter's top 10 list. Honeywell International HON, Chubb CB, and Medtronic MDT emerged as new names on the top 10 widely held dividend-paying stocks this period.

After the initial discovery and quick spread of the novel coronavirus (COVID-19), the World Health Organization has officially declared it a pandemic. Even before this declaration, markets had been volatile as the extent of viral contamination increased rapidly and finally hit the United States. As community spread has become more rampant and countries have enacted restrictions both externally and internally on movement, many industries have been hard-hit and will continue to feel the effects of this in the near to medium term.

This economic uncertainty has been further exacerbated by Saudi Arabia's initiation of an oil price war with Russia, which caused the stock market to plunge. On March 12, 2020, the S&P 500 plunged into bear market territory, dropping 9.5%. This was the largest one-day drop since October 1987. On the back of volatility in the stock market in February and March, the market fell into bear territory after 16 trading sessions. Since then, stocks have stabilized somewhat as the Federal Reserve has gone down the route of quantitative easing. The S&P 500 was trading at a forward price/earnings ratio of about 15.1 on March 13.

Due to the recent volatility in the market, sectors such as financial services, industrials, and consumer cyclical remain undervalued, as investors flee equities for the safety of the bond market. Searching for yield in this type of environment can be fairly risky, as price risk remains on most investors' radars and the risk that companies would not be able to sustainably meet dividends due to poorer near-term outlooks remains prevalent. To alleviate some of these risks, we eliminate high-uncertainty rated stocks from our screening process. Unsurprisingly, given the recent market movements, all the stocks that made our lists are also trading below their current fair value estimates. Wide-moat rated U.S. Bancorp USB, Pfizer, Bank of New York Mellon BK, and narrow-moat rated CVS Health CVS are all trading at over a 25% discount to fair value. The average price to fair value estimate for the top dividend-yielding stocks was 0.77, indicating that these high-yielding stocks are attractively priced in this economic environment.

The top 10 dividend-yielding stocks are heavily overweight in the healthcare sector, which contributed five names to the top 10 list. The mix is marginally different for our top 10 widely held dividend-paying stocks list, which includes three healthcare stocks, two consumer defensive stocks, and two financial services stocks. The most widely held stock that was also present on the top 10 dividend-yielding stocks list this period was wide-moat rated Comcast CMCSA. Wide-moat rated Comcast, Johnson & Johnson JNJ, PepsiCo PEP, and narrow-moat rated Cisco Systems CSCO were the most widely purchased top dividend-paying stocks this period.

Looking more closely at the list of top 10 widely held dividend-paying securities, there was a reasonable amount of overlap with our list of top 10 dividend-yielding stocks. Wide-moat rated Pfizer, Bank of New York Mellon, and narrow-moat rated Cisco Systems were on both top 10 lists. Continuing a recurring theme, the majority of names on our list of top 10 widely held securities are held by eight or more funds. This period's list of widely held dividend-paying stocks was less undervalued than the top dividend-paying stocks on the back of economic uncertainty. Eight of the 10 stocks were materially undervalued, averaging a price to fair value of approximately 84% compared with an average of 77% for our top 10 highest dividend-yielding stocks.

We continue to believe that the best way for investors to protect their capital is to invest in quality businesses that are trading at attractive prices. Our valuation shows that wide-moat rated U.S. Bancorp is trading at a significant discount to fair value, so we will focus on it in this piece. We also intend to highlight wide-moat rated United Parcel Service and Comcast, and narrow-moat rated Chubb as all these stocks remain undervalued at today's prices.

U.S. Bancorp USB Wide-moat rated U.S. Bancorp presents a compelling analysis as the financial services system has been one of the most affected in recent times. The stock trades at a 25% discount to Morningstar analyst Eric Compton's fair value estimate of $51. Compton sees the momentary battering of the banks as an attractive long-term investment opportunity for investors, as investors should look more at "through-the-cycle" performance rather than focusing on the short-term negative impact. If investors want to generate long-term value, Compton believes the banks, including U.S. Bancorp, would be a good investment even if the economy enters into a moderate recession.

U.S. Bancorp is one of the largest regional banks by assets in the United States and is one of the most efficient operators among its peers. Alongside its exposure to loans and deposits, it also has several attractive fee businesses, including investment management, mortgage banking, corporate trust, and payments. The bank's continued reinvestment in technology has played a role in its push toward becoming increasingly competitive in the omnichannel banking space. Compton believes that scale and technology are going to play an increasingly important part in surviving and thriving in the banking system, and U.S. Bancorp has done well to position itself in these fields.

The bank's wide moat results from a combination of cost advantages and switching costs. U.S. Bancorp's operating efficiency is one of the highest among the banks in Compton's coverage universe, as a result of its banking business as well as a combination of high efficiency in the non-banking arena. Compton highlights the bank's superior deposit share concentration, reflecting management's prudent decision-making with regard to entering scalable markets. The bank has one of the lowest costs per branch and uses integrated back-end systems, reducing costs by not utilizing several legacy platforms. Additionally, the payments segment greatly improves efficiency as it can perform a large number of transactions, with additional transactions not creating incremental costs. This helps the bank generate scale at no additional cost.

U.S. Bancorp remains a conservative underwriter, which was reflected during the last financial crisis. It performed better than other competitors, charging off fewer loans in spite of a higher exposure to credit cards than others. Throughout the crisis, U.S. Bancorp only reported profitable quarters, and Compton believes this conservatism still exists today. By only taking on risk in industries the bank can successfully navigate, Compton argues it has positioned itself well for the next downturn.

U.S. Bancorp also generates cost advantages via its trust and payments businesses. By being able to scale via no incremental costs over a single platform, it is able to charge lower transaction fees as the bank's scale increases. It would be difficult for smaller banks to replicate this, as taking away business from legacy providers would be expensive and time consuming.

Compton sees U.S. Bancorp as a worthy long-term investment, and the bank is well prepared to survive a downturn.

United Parcel Service UPS The shares of wide-moat rated United Parcel Service are also currently trading at a discount to our fair value estimate. The stock appears on our list of top 10 dividend yielding stocks. UPS is a behemoth in the parcel delivery service business and is one of the top three firms alongside FedEx FDX and DHL Express in this arena. Morningstar analyst Matthew Young thinks that UPS faces a growing threat from Amazon AMZN as Amazon works toward enhancing its in-house delivery capabilities. He sees a risk that Amazon could try to break into the commercial package delivery space serving shippers outside its own retail network, undercutting UPS on price in order to grab market share. Although UPS could be seen as an attractive partner for Amazon, Amazon might still choose to expand its capabilities and complete its needs in-house. Even so, recent market uncertainty leaves this stock modestly undervalued to our Morningstar fair value estimate of $111.

Young argues that cost advantages and efficient scale help drive a wide-moat rating designation for UPS. UPS has created a vast network that would be difficult to replicate and thus poses challenges for those trying to enter the market. Discounting Amazon's shift toward in-house delivery, Young believes it is highly implausible that a new player would try to enter this well-established parcel shipping system. This is mainly due to the difficulty in establishing the kind of volume that would mitigate the extremely high capital costs associated with breaking into this network. New firms would need to invest heavily in trucks, planes, flying rights, skilled labor, sorting facilities, and other investments that would cause the companies to rack up significant costs before taking any market share from incumbents.

UPS' wide-moat rating is also a result of efficient scale. Young points out that new entrants would have to mimic UPS' gigantic asset base in an attempt to gain a foothold in the industry. In the absence of actually gaining business, this would create sizable losses for a long time before seeing any kind of results. Young highlights DHL's foray into the U.S. domestic market as a prime example, with the company experiencing large losses for a period of six years before finally exiting the space.

Young acknowledges Amazon's potential toward becoming a commercial carrier, though he believes Amazon's national linehaul capacity is currently limited, with the company more focused on making local deliveries. It would also currently be difficult to provide services to non-Amazon customers, and it would have to expand networks significantly to have these capabilities. For now, UPS enjoys a solid market position, and for Young, it’s worthy of a wide-moat designation.

Comcast Corp CMCSA Wide-moat rated Comcast currently trades at approximately a 20% discount to Morningstar analyst Matthew Hodel's fair value estimate of $49. It is currently the top widely held dividend paying stock by our Ultimate Stock-Pickers. According to Hodel, the decline of the television business, while a hurdle for Comcast, will be offset by higher margins garnered by the Internet business. Comcast's acquisitions of NBCUniversal and Sky have left the company well positioned on the media side, with the acquisition of NBCUniversal adding greater value.

Comcast derives its wide moat largely from the potency of its core cable business. Most American homes receive Internet access either via their phone company or a traditional cable company. Comcast, as a cable company, has garnered nearly half of this market in the United States. Even though efficiency and network reliability has increased as a result of technological advancements, Hodel posits that the costs of entering this market are still too high to overcome easily. Technological deployment by new entrants requires a high level of construction spending as well as trying to combat regulatory hurdles often imposed by municipalities. Even if they are able to incur these costs, new entrants face losses as they try to steal market share from incumbents, especially as their product offering is not well differentiated and they are entering a maturing market. While several companies have tried to enter this space, few have succeeded. Hodel highlights Alphabet's GOOGL attempt to introduce Google Fiber. After six years in the market, it succeeded in garnering under 1% of market share within the United States before finally exiting the industry in 2016.

The introduction of a hybrid-fiber coax architecture in the 1990s/early 2000s combined with rapid technological advancements has allowed firms like Comcast to add scale and grow their network at limited incremental costs. The company's superior position has helped it garner market share rising from 39% five years ago to 48% today. Meanwhile, phone companies such as Verizon VZ and AT&T T have seen market share declines. As Comcast increases spending in certain neighborhoods and continues to outspend competitors on network upgrades and maintenance, it will continue to generate more and more operating efficiency. Hodel's main concern is that lobbying by phone companies toward regulators concerning profitability and market share could lead to an uptick in industry regulation.

Chubb CB The final stock we will highlight is narrow-moat rated Chubb, which was the eighth most widely held dividend-paying stock. Chubb currently trades at approximately a 15% discount to Morningstar analyst Brett Horn's fair value estimate of $143. Even though most insurance businesses are not seen as moatworthy, ACE's acquisition of Chubb in 2016 and the firm's entrenched position within P&C have helped generate a moat for this well-diversified insurance giant.

ACE's advantage comes primarily from its cost benefits pertaining to a strong property and casualty combined ratio of about 91% during the decade before the merger. Chubb's moatiness comes from its commercial business line, as the company is a leader in that space. In addition, Horn points out that Chubb also holds specialty lines, for instance in its executive liability and surety businesses, which grant it a moat reflected by an 89% average combined ratio in the decade prior to the merger with ACE.

Chubb's personal lines business has carried over, and though it can be difficult to argue for a moat here given policy standardization, Chubb mainly focuses on high net worth individuals. As these assets are higher in value and can sometimes be unique (e.g. artwork), insurance companies like Chubb require assessment of the current value of the asset, which increases the policyholder's duration and reduces cost of acquisition. Since individual exposures can be quite large, an insurer must also be of a substantial size, lowering the number of successful carriers operating in the field. This is a unique business and has generated an average combined ratio of 89% over the decade before the merger, reflecting its strong position in the industry. Although Horn does not believe the company's smaller segments are moatworthy, they have performed reasonably well, and the company's personal and commercial businesses make up 75% of overall premiums.

If you're interested in receiving e-mail alerts about upcoming articles from the Ultimate Stock-Pickers team, please sign up here.

Disclosure: Nupur Balain has no ownership interest in any of the securities mentioned here. Eric Compton has no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)