Funds Give WeWork Valuations the Ax

As the privately held coworking company struggles, funds have trimmed their views of what it, Airbnb, and other "unicorns" are worth.

What happens at a mutual fund when one of its private-investment "unicorns" comes crashing down?

The past few years have seen a boom in private-investment markets. During this period, many so-called unicorns--private companies valued at over $1 billion--have had their valuations moved, as they delayed going public longer than historically has been the case. (At that level, those still-private stocks would skip small-cap status once public and go straight into the mid-cap universe.)

But one of the highest-profile unicorns, WeWork, has stumbled badly. It's also one of the most widely held private investments among mutual funds, so it makes for a good test case for how fund companies respond to bad news.

For this article, we surveyed fund companies that had reported, as of Nov. 15, 2019, portfolio holdings for the end of September. That sample included several major mutual fund companies that are relatively active in the private-investment space: Fidelity Investments, Vanguard Group, T. Rowe Price, and Wellington Capital Management (which acts as a subadvisor on the funds).

Here's what we found:

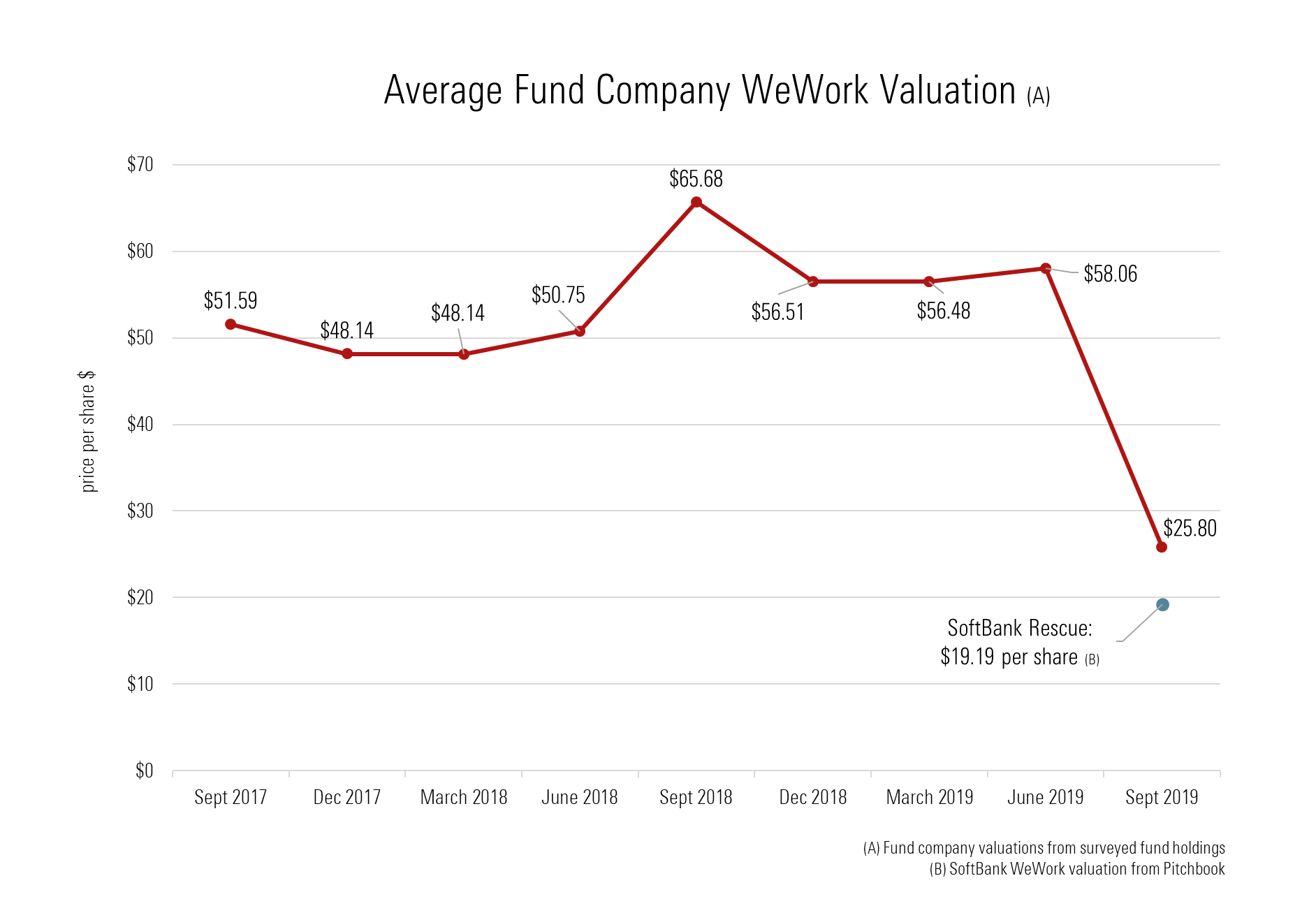

- Mutual funds with private investments in WeWork slashed their valuations of the troubled company by upward of 70%.

- There were signs of a broader markdown of private-investment stakes by mutual funds against a backdrop of falling share prices for a number of high-profile, newly minted public stocks that had once carried the so-called unicorn label.

- Among the fund-company reports sampled for this article, those write-downs were, for the most part, generally limited to single digits.

- For Airbnb, whose mega-IPO is expected in 2020, funds reported a mix of valuation of increases and decreases.

The WeWork episode highlights the risk and complexity of holding an investment with little to no transparency in its market value. This and the difficulty of exiting these investments are the primary reasons most stock funds don't own stakes in private companies, and those that do, keep their exposure to a minimum.

Within our sample, mutual funds cut their valuations of WeWork between 33% and 70%, for an average haircut of 57%.

(Note: These valuations predated SoftBank's October rescue package of financing for WeWork, which PitchBook pegged at a valuation of $19.19 per share. They also predated the November news announcing that WeWork was slashing jobs and closing noncore businesses.)

Source: Morningstar Direct.

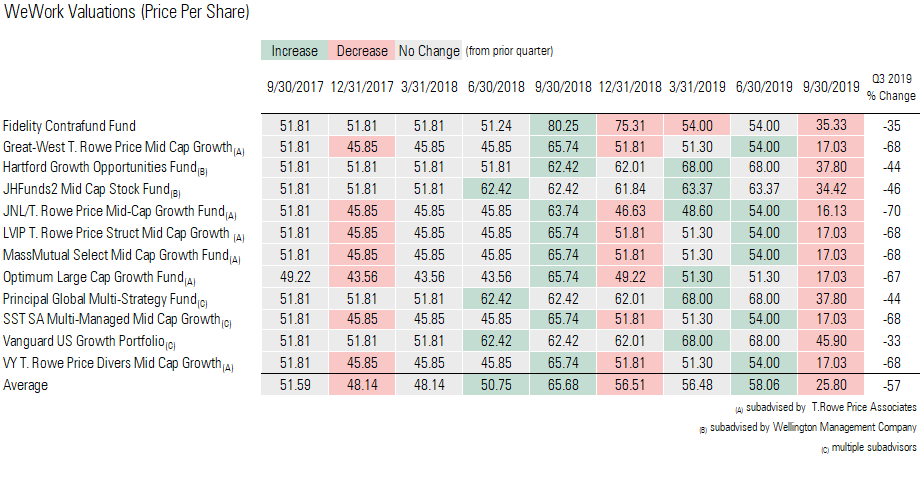

As we've noted in previous articles on private holdings in mutual funds, there is no specific industrywide process for attaching valuations to private holdings. Various fund companies will look at the same holding and attach a different price based on their assessment of the company's prospects along with market conditions.

The table below shows the disparity in valuations assigned to shares of WeWork across fund companies and the portfolios that they advise.

Source: Morningstar Direct.

Funds have slashed WeWork's valuation by an average of 56.7%. The largest drop was in funds that are subadvised by T.Rowe Price, falling to only $17.03 per share from $54 in June 2019.

Vanguard U.S. Growth Portfolio, which is managed by several subadvisors, including Wellington, has a 0.09% weighting in WeWork and valued it the highest of the group at $45.90.

Hartford and Principal, both subadvised by Wellington, put WeWork's price per share at $37.80. John Hancock, also subadvised by Wellington, priced WeWork a bit lower at $34.42.

In terms of portfolio impact, the small size of the positions would have muted the damage. Of the funds surveyed, the average weight of WeWork was less than 0.50%. John Hancock Mid Cap Stock JIMSX had the largest weighting at 0.77% of the portfolio.

Fidelity Contrafund FCNTX, which has a 0.18% weighting in WeWork, priced it at $35.33.

WeWork Ripples? Was the fallout from WeWork, along with a weakening of share prices for publicly traded former unicorns, broader among private-holding valuations?

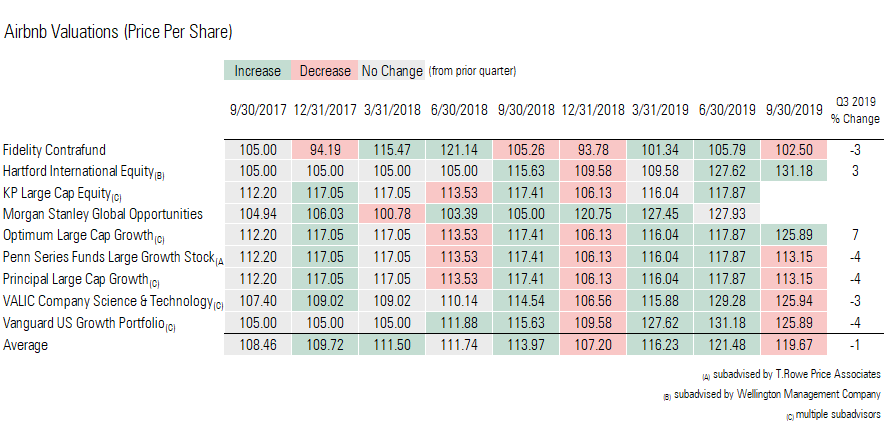

We started with Airbnb, which is expected to launch its high-profile IPO in early 2020.

Airbnb is rare among unicorns in that the company hasn't sought out additional funding in the past two years, which means private shareholders don't have a transaction to use as a benchmark for their valuation. The last funding round came in September 2017 at a price per share of $105.

In the first half of 2019, funds across the board took their valuations of Airbnb to new highs. At end of the second quarter, Airbnb was valued as low as $105.79 by Fidelity and as high as $131.18 by Vanguard.

However, it was a mixed picture in the most recent quarter, with fund companies reporting so far that there was moderate upward or downward valuations.

Source: Morningstar Direct.

Beyond these two high-profile examples, we performed a spot-check of valuations that have been reported by funds managed by Fidelity, Wellington, and T. Rowe Price. For this exercise we limited our check to unicorns.

Among unicorn valuations we found a downward bias. But it was by no means across the board, as when investments were marked down, it was generally only by single-digit percentages.

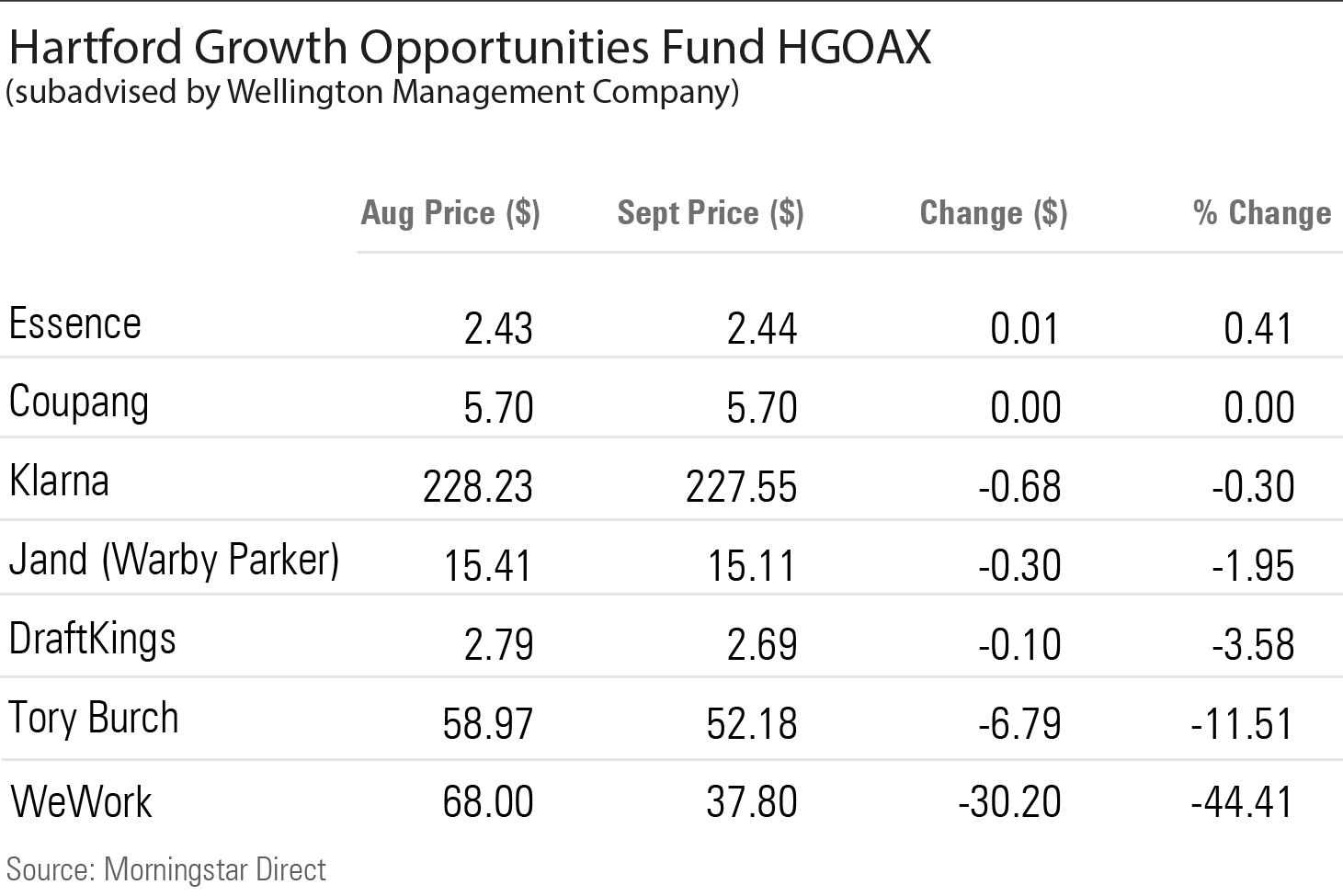

We started with the $4.7 billion Hartford Growth Opportunities HGOAX, which is subadvised by Wellington. As of Sept. 30, it held 16 private companies, 10 of which fell into the unicorn group.

The valuation for DraftKings, a fantasy sports platform, was lowered to $2.69 from $2.79. According to PitchBook, the company is rumored to be in talks with Diamond Eagle Acquisition regarding a potential acquisition on Oct. 31, 2019, for an undisclosed amount.

Hartford hadn't decreased its valuation on Warby Parker, the online eyeglasses seller, since December of last year. At September's close, it was marked down $0.30 from August to $15.11.

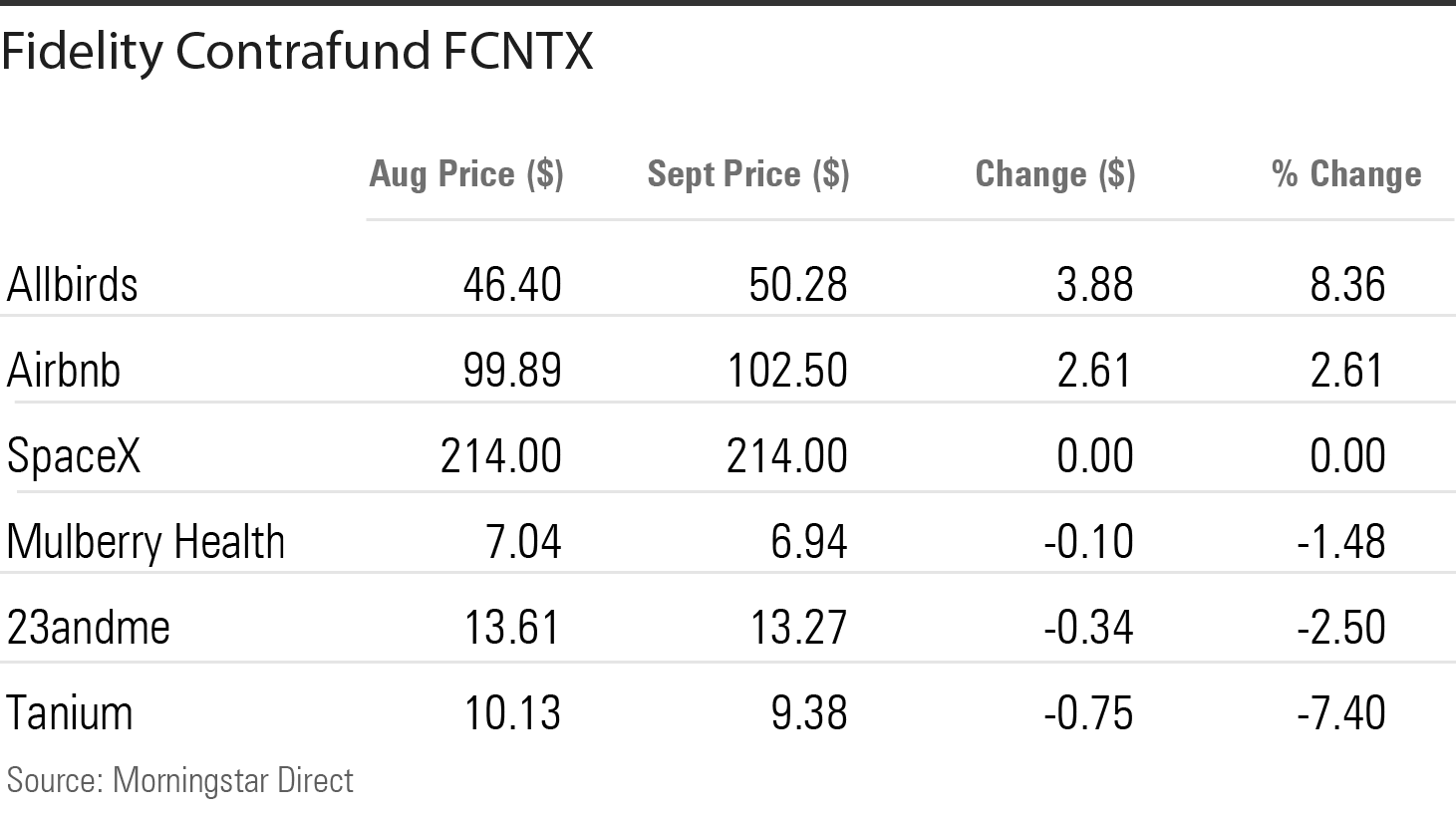

Among Fidelity Contrafund's holdings of unicorns, it was more of a mixed picture. The fund held 25 private investments at its end-of-September report, six of which fell into the unicorn category, according to PitchBook.

WeWork by far took the largest hit, but security-software company Tanium was also marked down by 7.4%. Valuations for Mulberry Health, an online health insurance provider, and 23andMe, the genetic testing company, were also lowered.

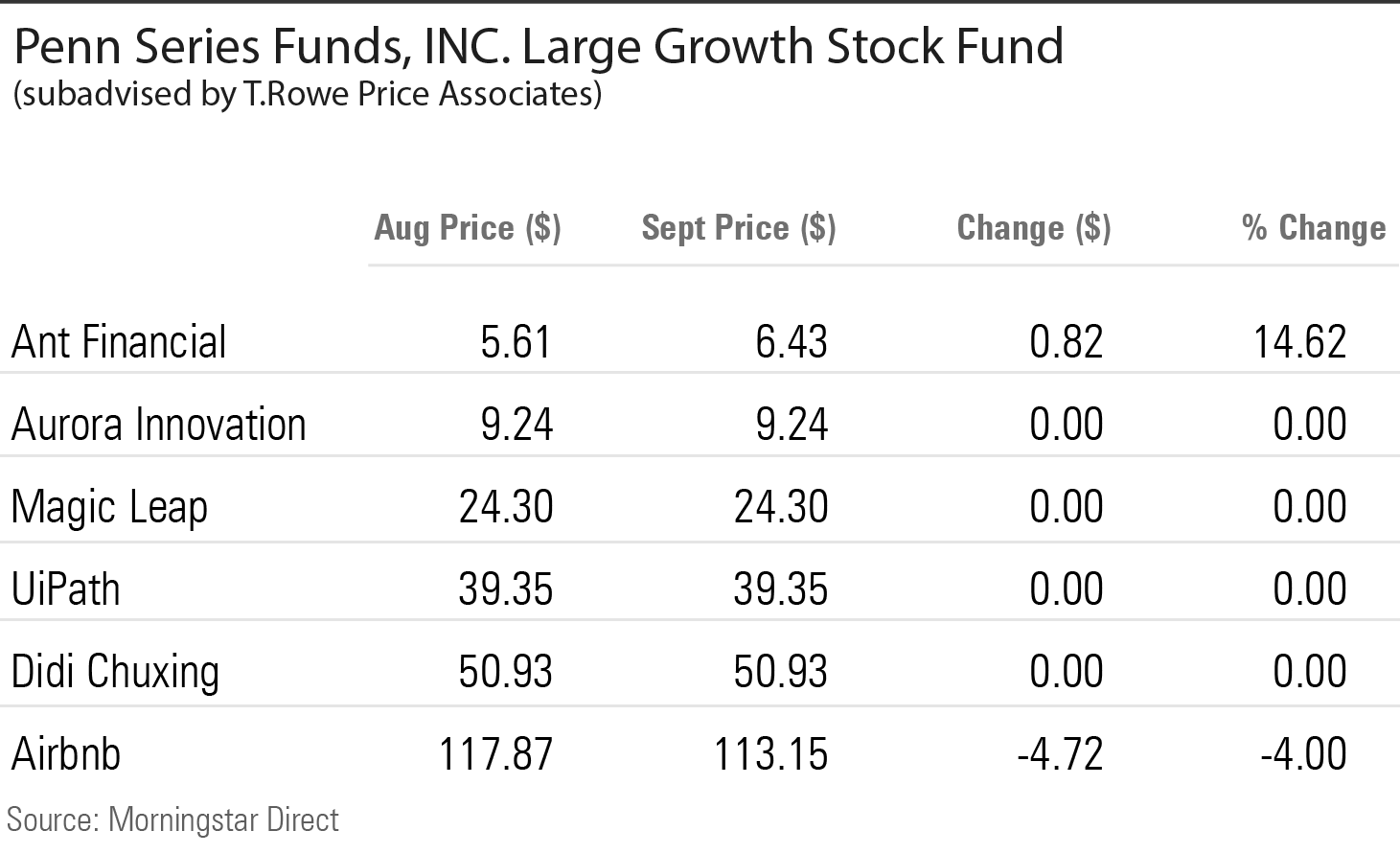

For T. Rowe Price, we've included a portfolio from a subadvised fund. (T. Rowe-branded funds report position details with a longer lag, and as of this writing they were not available.) In this fund, T. Rowe Price holds six private investments in addition to WeWork, all of which rank as unicorns. For a number of the holdings in this fund, valuations haven't tended to change often over the past year. However, the third quarter brought a mix of valuation changes.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)