Securities Lending Provides Value. But Is It Enough To Make a Bad Fund Good?

Understanding this additional source of return (and risk).

Securities lending is a seldom talked about but important aspect of fund management.

Most funds make use of this practice, which involves lending portfolio securities to third parties to generate additional income that can moderately enhance returns.

Securities lending has evolved since its birth into a mutually beneficial and low-risk practice for both investors and fund sponsors.

In our new report, “An Inside Look at Securities Lending,” we explore the potential benefits investors stand to gain from the additional income that can offset fund fees, as well as how fund sponsors can use securities lending to improve peer-relative performance.

What Is Securities Lending, and How Does It Work?

Securities lending entails a fund lending out portfolio securities (like stocks or bonds) to an interested party, such as a broker/dealer or hedge fund, for a tidy fee. It’s a common practice that can help recoup a fund’s management fee and give its returns a nudge. Borrowers, for their part, might borrow a security to avoid settlement failure when short or to take advantage of arbitrage opportunities.

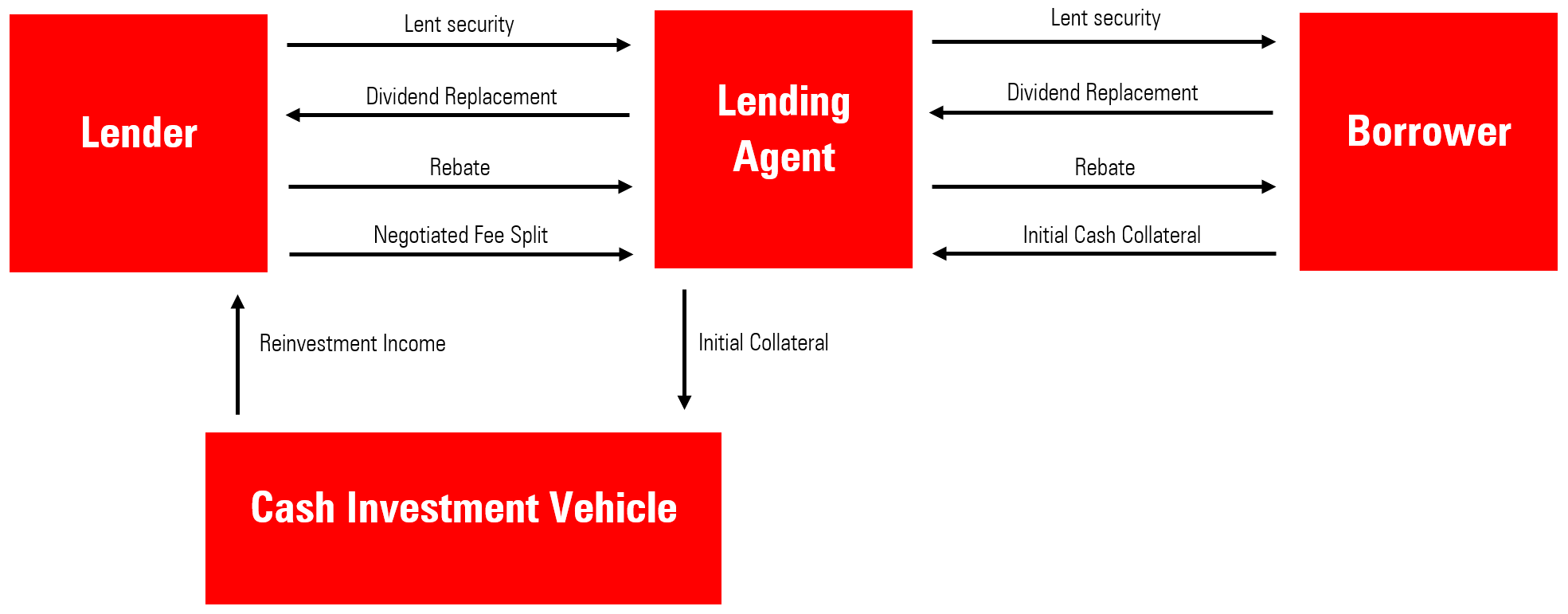

To protect the lender from the risk of loss, lent securities are always collateralized using cash or securities. Cash collateral is more common in the United States, while Europe tends to favor other forms of collateral. For simplicity, we’ll focus on cash collateral scenarios here. But in either case, the revenue received by the lender is dependent on the demand value of the security on offer. The exhibit below shows a securities-lending transaction with cash collateral.

Overview of a Securities-Lending Transaction With Cash Collateral

In exchange for the interest on posted cash collateral, a rebate is paid to the borrower at a rate negotiated by both parties. The rebate rate is the lender’s lever for generating income. It is determined by the demand value of the stock or bond on loan.

Securities in high demand are stocks or bonds of typically small, illiquid, or otherwise unpopular companies—which hedge funds might be selling short, betting their price will fall. For example, heavily shorted meme-stock darlings GameStop GME, Beyond Meat BYND, and AMC Entertainment Holdings AMC were among the most profitable stocks to lend in 2022.

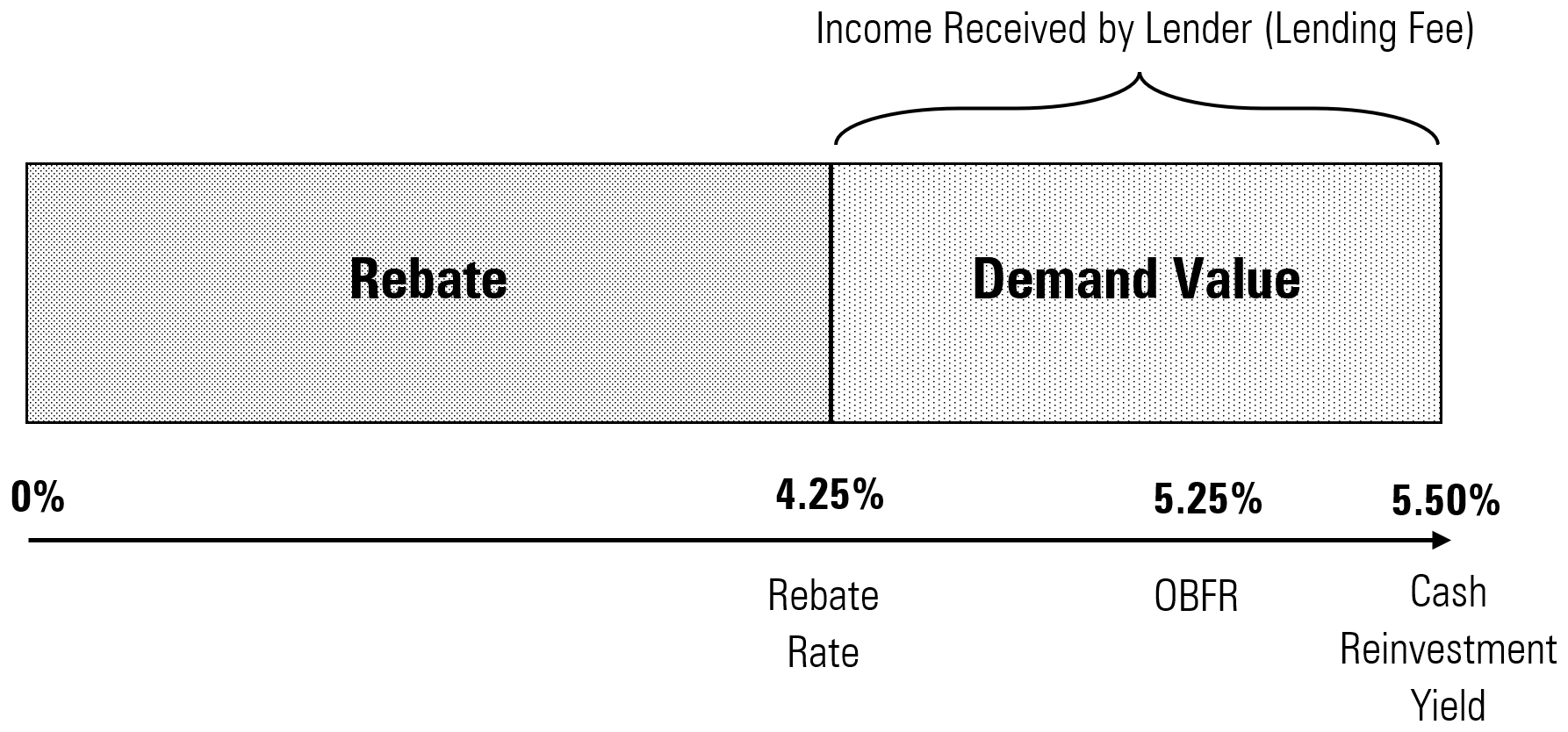

The higher demand for securities like these means the lender can negotiate more-favorable terms on the loan, allowing it to lower the rebate rate and maximize the demand value and thus increase the securities-lending income. The breakdown of securities-lending income for cash collateral scenarios is shown in the exhibit below.

Securities-Lending Income Breakdown for Cash Collateral Scenarios

The demand value is essentially the fee paid by the borrower to the lender. Securities with a high demand value are commonly referred to as “on-special” or “hard-to-borrow.”

By offering securities in high demand, the lender can negotiate a much lower rebate rate than the overnight bank funding rate, or OBFR, earning a higher profit. A hypothetical demand value of 1.25% is considerable and suggests the security on loan is in high demand.

The OBFR represents the yield the lender can receive by investing the cash collateral in a risk-free instrument. In this example, the reinvestment vehicle yields 0.25% above the OBFR. This difference represents the additional income gained for taking marginally more risk than reinvesting in a cash fund earning exactly 5.25%. The breadth of acceptable reinvestment choices is narrow,[1] but some low-risk vehicles do offer slightly better yields than the OBFR.

Risk Determines Securities-Lending Reward

Operational and strategy risk determine potential securities-lending returns.

- Operational risk is the risk assumed by the fund sponsor in operating a securities-lending program.

- Strategy risk is the investment risk assumed by the fundholder.

The most salient component of operational risk is the reinvestment risk of the cash reinvestment vehicle. As noted, some reinvestment choices can contribute to modestly higher securities-lending returns, but in extreme circumstances they can saddle fund investors with unexpected losses.[2]

Ultimately, though, strategy risk determines the earning potential of a securities-lending program.

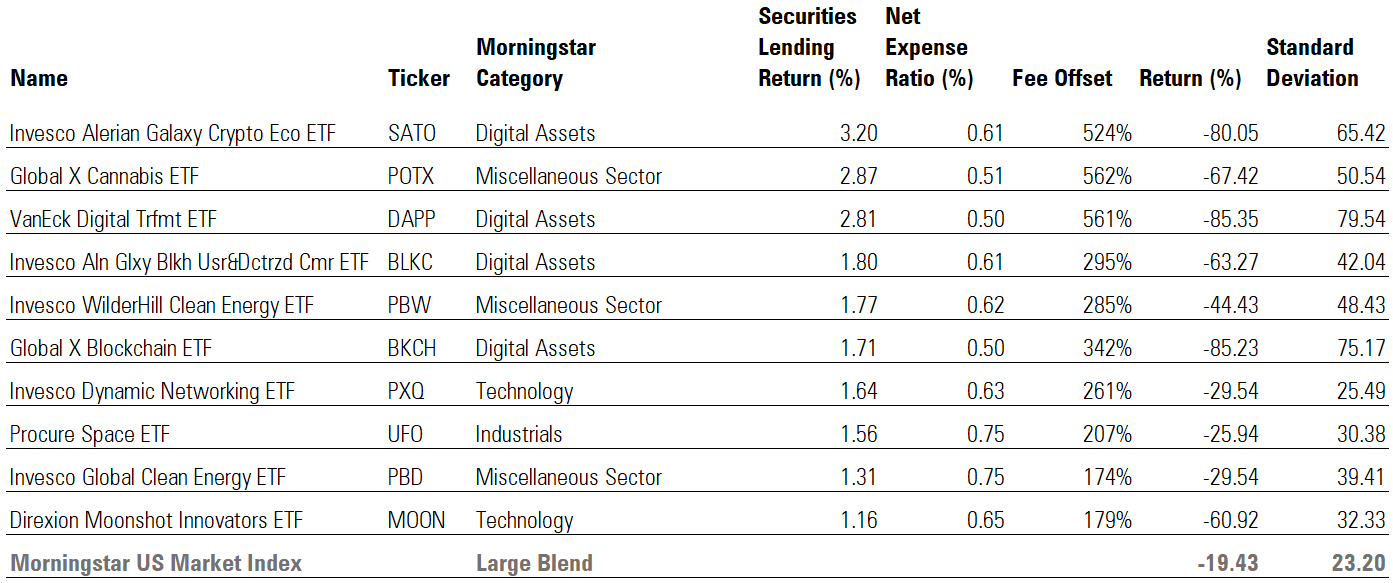

Hard-to-borrow securities generate the highest securities-lending returns but can be some of the most volatile in the market. If a portfolio consists largely of these risky names, lending income may be high, but the strategy may also be quite risky. Thematic funds with concentrated portfolios typically earn the highest securities-lending returns because of this.

For example, Invesco Alerian Galaxy Crypto Economy ETF SATO added more than 3 percentage points to performance through securities lending in 2022, offsetting its fee by more than 500%. Still, the fund lost 80% for the year. None of the top 10 funds by securities-lending return outperformed the market in 2022, and many experienced much higher volatility.

Risky Funds Earned the Highest Securities-Lending Returns in 2022

Investors should always prioritize strategy risk considerations over securities-lending returns. Funds that boast the highest securities-lending returns often hold some of the market’s most unloved companies and can falter because of it.

How Does Your Fund Sponsors’ Securities-Lending Program Stack Up?

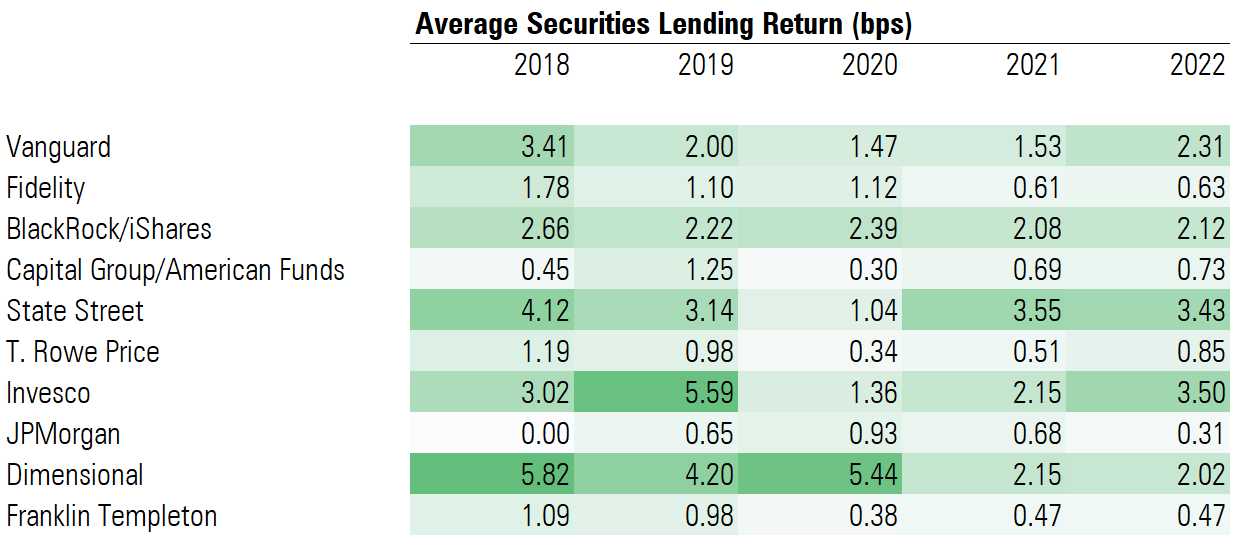

Certain fund sponsors generate more revenue than others. The table below displays the average securities-lending return across the 10 largest fund sponsors in the past five years (including only funds authorized to lend securities).

Average Securities-Lending Return by Fund Sponsor in Basis Points

Large index fund sponsors tend to perform better than their active-focused counterparts, as index funds’ lower turnover and broader portfolios are more conducive to securities lending. State Street and Invesco stood out in this sample for providing consistently high securities-lending income, wrapping up 2022 with around 3.5 basis points in average lending return. Investors in BlackRock, Vanguard, and Dimensional funds also enjoyed some success.

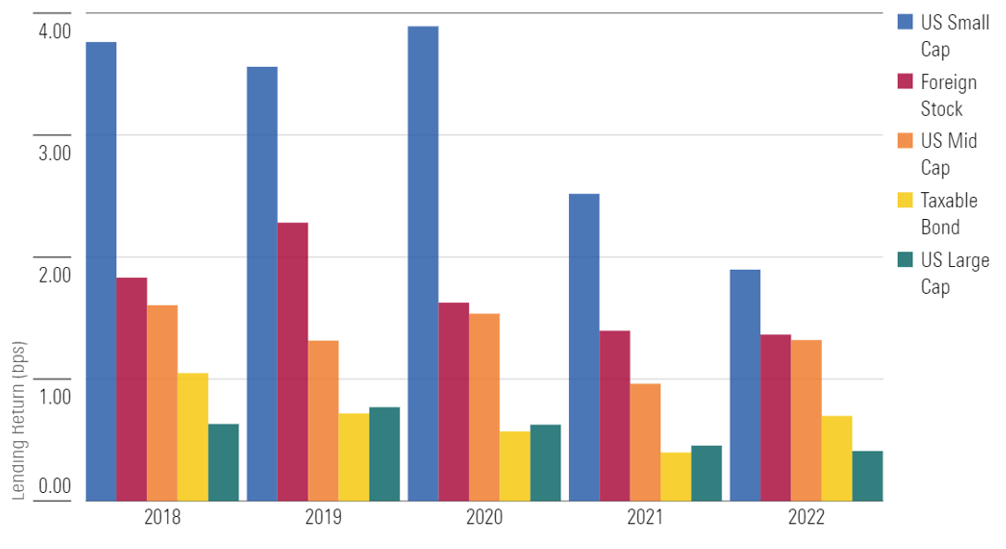

Certain asset classes generate more returns than others, too. The small-cap category group still commands the highest return among those sampled here, though its lead over other categories has dwindled in recent years. After small-cap funds, U.S. mid-cap and foreign stock funds offer consistently higher securities-lending returns compared with funds in the taxable-bond and U.S. large-cap cohorts.

Average Securities-Lending Return by Category Group in Basis Points

How Do Investors Benefit From Securities Lending?

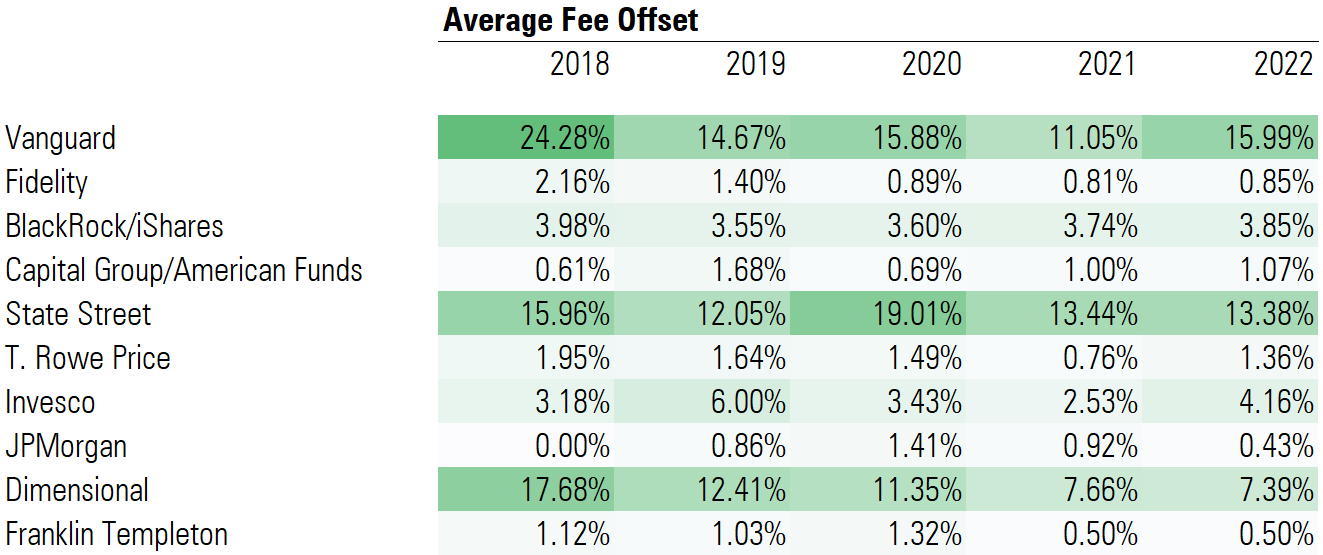

Successful securities-lending programs may not generate huge returns, but investors can instead think of lending revenue as a way to offset fees.

In some cases, it can offset a meaningful portion of a fund’s expense ratio and put more green back in investors’ pockets. For example, Vanguard Russell 2000 ETF VTWO, a popular small-cap ETF, earned an average securities-lending return of 0.11% annually from 2018 through 2022. This exactly offset its average expense ratio for the period.

Most strategies don’t offset fees to that extent, though cheaper funds usually do better because their low fees are easier to earn back. The table below illustrates this point, with low-cost leaders Vanguard and State Street offsetting the highest proportion of their funds’ fees on average.

Average Fee Offset Percentage by Fund Sponsor

Securities Lending: Proceed With Caution

Securities lending plays a small role in overall fund management, but it’s a useful tool for offsetting fund expenses and slightly boosting returns. Fund sponsors use differing approaches, but each of the sampled programs benefits investors.

Broad-market funds from firms like Vanguard and J.P. Morgan are usually conservative in their securities-lending approaches. Other firms, like Dimensional, take a more aggressive approach, attempting to capture as much of their holdings’ demand value as possible. All three are successful in their practices, but it’s important to remember that the underlying strategy will always be the main driver of risk and return.

In short, securities lending is helpful, but not enough to make a bad fund good. Hard-to-borrow securities tend to be those that the market expects to do the worst. Investors should be cautious about owning them.

Interested readers can find our full-length report on this topic here.

A version of this article was published on April 19, 2023.

[1] In 2010, the SEC mandated tighter quality, duration, and liquidity requirements for securities eligible for investment by money market funds: https://www.sec.gov/rules/final/2010/ic-29132.pdf

[2] During the 2008 global financial crisis, a number of index mutual funds and ETFs incurred a securities-lending loss, causing the funds to lag their benchmarks by much more than anticipated: https://www.forbes.com/forbes/2009/0622/mutual-funds-pension-securities-lending-meltdown.html?sh=5a8173f224b9

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)