Don’t Overthink Your Approach to Bonds

For most investors, tactical trading isn’t worth the effort.

The bond market’s top benchmark, the Bloomberg U.S. Aggregate Bond Index, lost 1.2% over the first nine months of 2023. Yet investors still poured nearly $136 billion into taxable-bond funds over this period. As the federal-funds rate stood at 5.33% and recessionary fears loom over the market, bonds are reclaiming their place in investors’ portfolios. Some investors are taking a tactical approach to bonds amid conflicting macroeconomic signals. But for most investors, the trouble of tactically trading bond funds isn’t worth the effort.

It’s Raining Yields

After a decade of near-zero interest rates and tepid yields, investors can finally count on bonds for a reasonable income stream again. Curiously, investors are disproportionately favoring the two extreme ends of the yield curve instead of adding to all maturity buckets. In the first eight months of 2023, money market funds attracted an impressive $722 billion of investors’ money. On the other end of the curve, the intermediate core bond and long-term bond Morningstar Categories respectively took in $96 billion and $5 billion. The short-term bond category bled more than $39 billion over this period, despite carrying more-attractive yields and less risk than longer-term peers. Investors, on aggregate, are taking a barbell approach.

It’s easy to see the appeal of the extremes. Money market funds, which are considered among the lowest-risk bond-fund options, still pay out 5% in yield and keep up handsomely with a 3.2% inflation rate. But this level of yield might not stay for long. The market expects the Fed to cut interest rates sometime between 2024 and 2025, which would likely bring yields back down to earth. Buying longer-term bonds now will lock in the high rates for longer, so taking a small cut to diminish reinvestment risk isn’t the worst bargain.

Does that mean investors should abandon short-term bonds? The answer is less clear. This might not be the peak of the tightening cycle. The Fed has left the door open to another rate hike in 2023, depending on economic data come November. If rates do continue to increase, investors will have wished they stayed in short-term bonds. While the yields on intermediate-and long-term bonds are climbing to decade-highs, they’re still not high enough to completely insulate them from a rise in interest rates. On the other hand, yields on short-term bonds have largely achieved this. As of September 2023, the average yield-to-maturity on iShares 1-3 Year Treasury Bond ETF SHY stood at over 5%, while its effective duration was only 1.87 years. Even with a full percentage-point rate increase, its total return should still be over 3% in the black. This concept is otherwise known as escape velocity, the idea that high yields can cushion bonds from interest-rate risk.

Market-Beating or Market-Missing

This dilemma points to the difficulty of taking duration bets: One must predict the Fed’s policy decisions and the market’s reaction to them. Yields on 20-year Treasuries climbed to 5 percentage points on Oct. 2 following positive employment data and the Fed’s signaling of keeping rates higher for longer. But yields were just 3.8% in April this year when cooling inflation data raised market participants’ optimism for rate cuts, despite signals to the contrary from the Fed. Even if you correctly predict the federal-funds rate, it’s still difficult to gauge how the market might respond.

Interest rates alone don’t drive bond prices. Expectations of future rates weigh heavily on current prices. Rising yields over the past couple of months were driven in part by delaying expectations for 2024 rate cuts to the end of the year. While rates are forecast to begin declining by the end of 2024, there’s a long way to go until then. If rates are elevated through much of 2024, taking a big bet on long-term bonds right now means weathering a long stretch of mediocre performance. But keeping your cash in shorter-dated instruments could be a drag should the Fed relax its stance earlier than anticipated.

Investors should also be cognizant of the additional costs of making bets on bonds. More targeted investments typically come with higher fees and trading costs. Consider a simple version of a barbell strategy, which uses a money market fund alongside a long-term Treasury exchange-traded fund. This can set an investor back by 7-10 basis points annually compared with a broad-market bond index fund that costs 3 basis points a year. More-complicated strategies cost more, with some basic target-duration ETFs costing upward of 15 basis points a year. While trading costs for ETF investors should not be significant, turnover within an investor’s portfolio can add to that cost. In a taxable account, jumping in and out of positions can result in unnecessary taxable events.

Investors that need high income in the near term might still be interested in taking on a tactical position despite these drawbacks. In these cases, it’s necessary to establish clear rules for entering and exiting these positions and to stick to them. Strong short-term market movements can sway investors’ emotions and open the door for errors. Keeping tabs on the yield curve, interest-rate futures, and reading the Fed’s signals are critical to understanding market movements and implementing tactical trading rules in a timely manner. Even then, it may be impossible to carve out an edge.

Core-Satellite

The cost of juggling the many variables affecting bond prices should be considered against the relative contribution from your bond holdings. A small stake intended to provide diversification and ballast to a portfolio would likely benefit from a basic, broadly diversified bond fund.

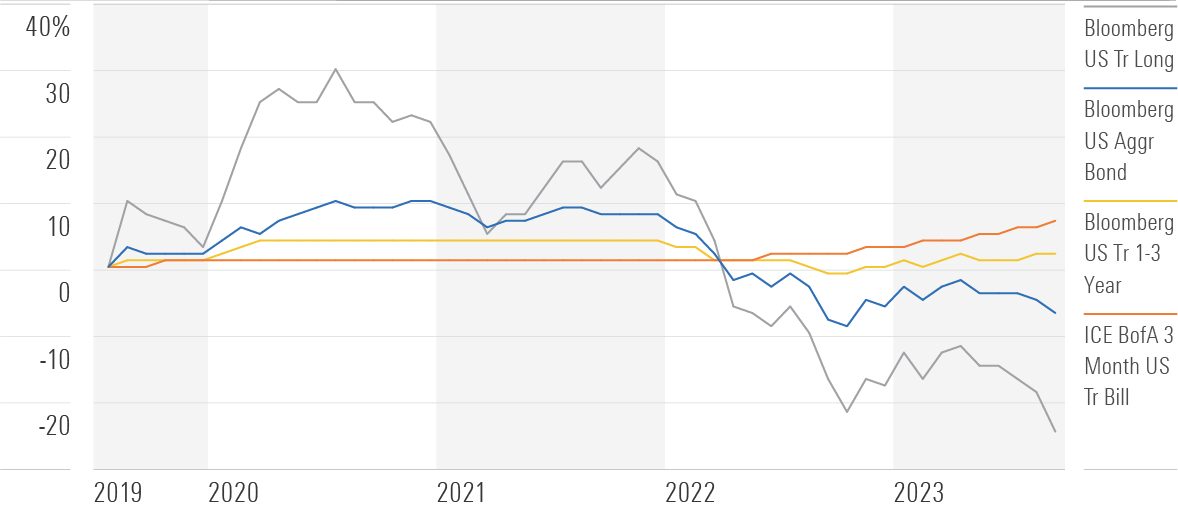

Growth of the Aggregate Index and Various Treasury Target Maturities

Exhibit 1 displays the growth of the Aggregate Index against U.S. Treasury ETFs of different maturity buckets (0-3 months, 1-3 years, and 10-plus years) starting at the end of August 2019, the month when the yield curve briefly inverted because of recession fears. If investors tactically bought long-term Treasuries at this point to brace for rate cuts, they would have enjoyed a great rally in 2020 despite having no way to predict the global pandemic from which Treasuries benefited. However, much of that growth would have eroded by early 2021. Investors in long-term Treasuries went through a tough stretch over the past two years as well, and most might not have had the behavioral tolerance or risk capacity to keep holding on. In the past two years, the standard deviation of returns for the Bloomberg US Treasury Long Index clocked in at a staggering 14.72%, versus only 5.83% for the Aggregate Index. Not everyone can stomach this high level of volatility and significant drawdowns in their bond allocation. Those willing to take on more risk may still want to consider a core-satellite approach to smooth out the ride, where a more stable, broad bond fund acts as the core and a small stake in long-term bonds acts as the potentially value-adding satellite.

Even broad index bond funds have holes in their design. They often fail to include the ultrashort end of the curve, which could leave yield on the table when the curve inverts. Core-satellite investors may find value in moving idle cash into money market funds or ultrashort securities to take advantage of the current yield.

Nonetheless, keeping a broad bond fund as a core holding is a good place to start, amid the uncertainty over current economic growth and rising expectations for a recession next year. The yields on most bonds have improved to a point where they can provide a reasonable cushion should equities fall next year. Tactically investing on one end of the curve or employing a barbell strategy might seem reasonable as an idea, but real-life success is heavily dependent on cost and market-timing. Investors can avoid missing out on the top-performing portion of the bond market by holding the entire thing and narrow their margin for error.

This article appeared in the October 2023 issue of Morningstar ETFInvestor. For a free issue sample, visit the site.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)