Should You Own a Covered-Call ETF Like JEPI?

You might be paying more than the expense ratio for option income.

Covered-call funds have recently come back into the spotlight. Investors poured over $26 billion into the now-$65-billion derivative income Morningstar Category in the trailing 12 months, and over half of those inflows went to J.P. Morgan Equity Premium Income ETF JEPI. Covered-call funds hold an underlying equity position, then sell call options against it and distribute the premium collected to shareholders. Their recent payouts were impressive: JEPI’s 12-month yield was 11.7% at the end of 2022, compared with only 1.7% for the S&P 500 index.

The majority of this yield came from selling one-month calls on the S&P 500 and paying out all the proceeds, or call premiums. The calls are staggered into weekly tranches to reduce path dependency and manage capacity. The equity sleeve aims to be defensive, which improves downside risk and further cushions returns during drawdowns.

We recently assigned the exchange-traded fund a Morningstar Medalist Rating of Bronze, which recognizes its incremental advantages over other funds in the derivative income Morningstar Category. Investors interested in JEPI can read our extended analysis. It is a reasonable choice if you are searching for a covered-call ETF. But do you need one in the first place?

What Can You Expect With a Covered-Call ETF?

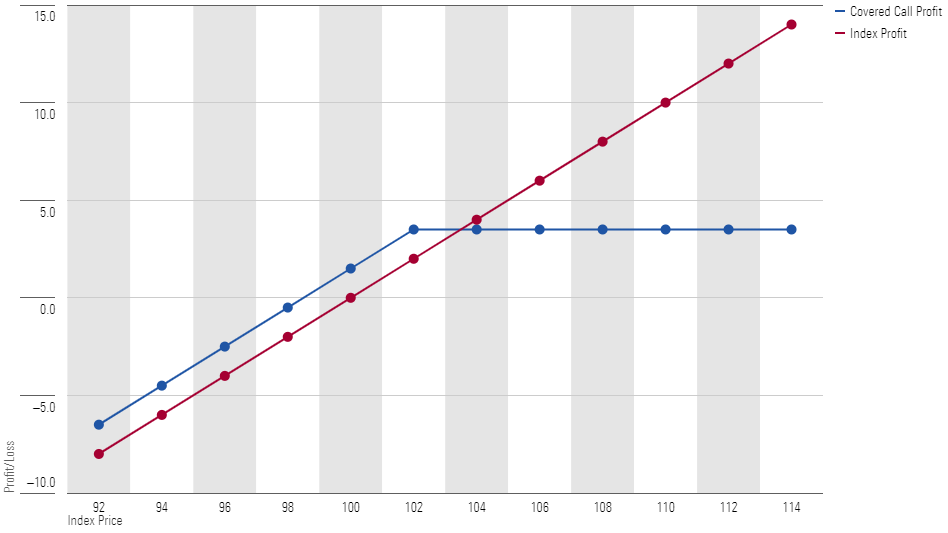

The payoff profile of a covered-call fund is asymmetrical by design. Imagine a hypothetical fund that writes calls on the S&P 500 with a strike price at 102% of the index’s current price, earning around 1.5% in call premiums monthly. The premiums are dictated by implied volatility, which can be thought of as the market’s expectation of future volatility.

When the index declines, the equity portion of the fund falls with it. When the index rises, the call option loses money past the strike price, which caps the upside for the fund. Most covered-call funds sell calls at or slightly out of the money, forgoing considerable upside on the underlying index. This upside cap is a trade-off for the call premiums, which provide an incremental buffer against down markets. When implied volatility increases, typically during market downturns like 2022, call premiums also increase and cushion losses further.

Payoff Diagram of a Covered-Call Strategy

Still, this is hardly the ideal payoff profile: capped upside with a limited buffer to the downside. During strong market rallies, options income generally won’t keep pace with equity gains and the fund will fall behind. Yet during major downturns, it still faces significant tail risk—albeit by a fixed amount less than holding the equity sleeve alone.

To JEPI’s credit, the ETF’s equity portfolio has generally fulfilled its defensive claim in major downturns. Taking some of the sting out of drawdowns helps even out the asymmetrical return profile typical of covered-call strategies. The ETF’s focus on a high payout, which it has so far delivered, nonetheless subjects it to a capped upside.

No Risk, No Returns

Eye-catching premiums from covered-call funds are simply compensation for transforming risk, same as virtually any investment. Options don’t have a special trick that earns them more than the risk given or taken by the investor.

At its core, a covered-call fund has two main sources of risk: equity risk and volatility risk, which can benefit investors if harvested correctly. The equity risk premium is a common concept for equity investors, but the volatility risk premium might be less familiar.

Options are essentially volatility insurance. Similar to other kinds of insurance, option sellers lose money if a specified event happens, like the strike price is breached. They require a premium for taking on this risk—the volatility risk premium. This premium can be observed through the gap between the implied volatility (which drives options prices) and realized volatility of a security. This is no different from the equity risk premium: Investors expect a certain level of returns on stocks for taking on equity risk.

To maximize return, a covered-call fund should be constructed around these risk/return trade-offs instead of focusing on a specific level of income. Unfortunately, this introduces a layer of market-timing risk. When market movements go against the manager’s expectations, this type of fund can underperform the basic covered-call funds they try to improve upon.

Income: Cash Flow vs. Total Returns?

Most investors don’t look at covered-call funds as a typical return-maximizing instrument. They’re instead used as income funds, owing to the fact that selling options generates a high level of cash flow. This confuses cash flow with total returns and overlooks forgone opportunities.

Cash flow comes from many sources: stock dividends, bond interest payments, annuity payments, or simply profits from liquidating positions. These different ways of cashing out your investments have different consequences on taxes and portfolios and should be assessed within this context. At the end of the day, the portfolio’s total returns (which includes all unrealized capital gains and distributed income) are the most important consideration for future cash value.

Investors with high cash needs should compare covered-call funds against other sources of distributions, paying special attention to their impact on returns. The reduced equity beta on a covered-call fund is different from actually reducing your equity positions: It’s asymmetrical on the upside and will fluctuate based on future volatility. If an investor cannot implement a disciplined plan to sell down their assets and/or wants to outsource this process, they can consider other income-generation methods, including covered-call funds.

Tax Rates of Covered-Call ETFs

Rarely is distributed income tax-free. Covered-call strategies are no exception. For index-based covered-call funds, 40% of the gain/loss from its calls are taxed at the short-term capital gains tax rate and 60% at the long-term capital gains tax rate. In comparison, profits from selling down equity positions held for over one year qualify entirely for LTCG treatment.

Tax implications for covered-call funds are complicated, but the main points are summarized below:

- A traditional covered-call strategy typically identifies, for tax purposes, as a straddle or a mixed straddle (different from an option trader’s typical straddle definition). This classification has two major tax implications.

- Implication 1: The holding period is suspended for stocks that are part of the straddle. This means their gain/loss will be considered short-term and their dividend cannot qualify for a reduced qualified dividend tax rate.

- Implication 2: Gain/loss is marked-to-market separately for the option and equity sleeve, then netted out daily to determine the fund’s total gain/loss. Any distribution in excess of the total gain is considered return of capital instead of dividends. Return of capital is not considered taxable income but reduces an investor’s cost basis in the fund and can eventually lead to higher capital gains when they sell shares.

Despite the 60/40 tax treatment, covered-call funds cannot always take advantage of the LTCG tax rate. For instance, if the equity sleeve had positive gains that were larger than the loss on the options sleeve, the fund will have a net gain that’s taxed as short-term gains (as it’s from the equity sleeve). In other words, a traditional covered-call fund won’t benefit from LTCG tax rate if its options profits are negative or are erased by equity loss.

A few active managers in the derivative income Morningstar Category have managed to consistently pay out most of their distributions as LTCG. Nonetheless, the payout from these funds tends to be on the lower side of the spectrum. Investors in the highest tax brackets are most likely to benefit from the tax advantage of these funds.

On the other hand, J.P. Morgan’s suite of covered-call funds are less tax-efficient, but their higher payout will likely even out the difference for investors in lower tax brackets. It packages its covered-call positions into equity-linked notes, a contract with the ELN issuer that mimics the payoff profile of a covered-call position. The ELN structure doesn’t classify the funds as a straddle for tax purposes, and it translates the option premiums into interest income. All the premiums are therefore taxed at the less favorable ordinary income tax rate. However, they pay out all the premiums they receive as dividends, instead of capping their distribution or reinvesting them back in the fund because of tax or accounting constraints. Additionally, their equity gains can also qualify as LTCG, and their equity dividends can be qualified because the stock holding period is not suspended.

| Treatment | Traditional Index-Based Covered Calls | Equity-Linked Notes |

|---|---|---|

| Total gain/loss calculation | Gain/loss is calculated separately for the option & equity sleeve, then netted out daily to determine overall fund G/L. Portion of total G/L that comes from options will receive options tax treatment & vice versa. | Normal accounting. |

| Distribution | Distribute up to the fund’s total G/L as dividend. Any excess distribution is considered return of capital. | All option premiums can be paid out as fund dividends. |

| Option gain/loss | Nonequity (index) option profits are taxed at 60% long-term/40% short term. | Premiums converted to interest income. Taxed at ordinary income rate. |

| Equity gain/loss | Equity positions that are part of straddle will have their holding period suspended. Equity G/L is considered short-term. Dividends will not be considered qualified. | Normal holding period treatment. Can qualify for long-term cap gains or qualified dividend. |

3 High Quality Stock ETFs

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)