The Best Small-Cap ETFs

Subtle but important differences set these funds apart.

Investing in stocks comes with risk, and that risk tends to be amplified in the small-cap market. Small companies offer the greatest potential for outperformance but also the greatest risk of loss. Academic research supports this risk/return relationship in small-cap stocks. Eugene Fama and Kenneth French recognized the small-size effect as a reliable investment factor in their 1992 paper “The Cross-Section of Expected Stock Returns.” They posit that over the long term, small stocks outperform larger stocks but with greater volatility. To summarize, small stocks are risky, but that risk is rewarded over the long term.

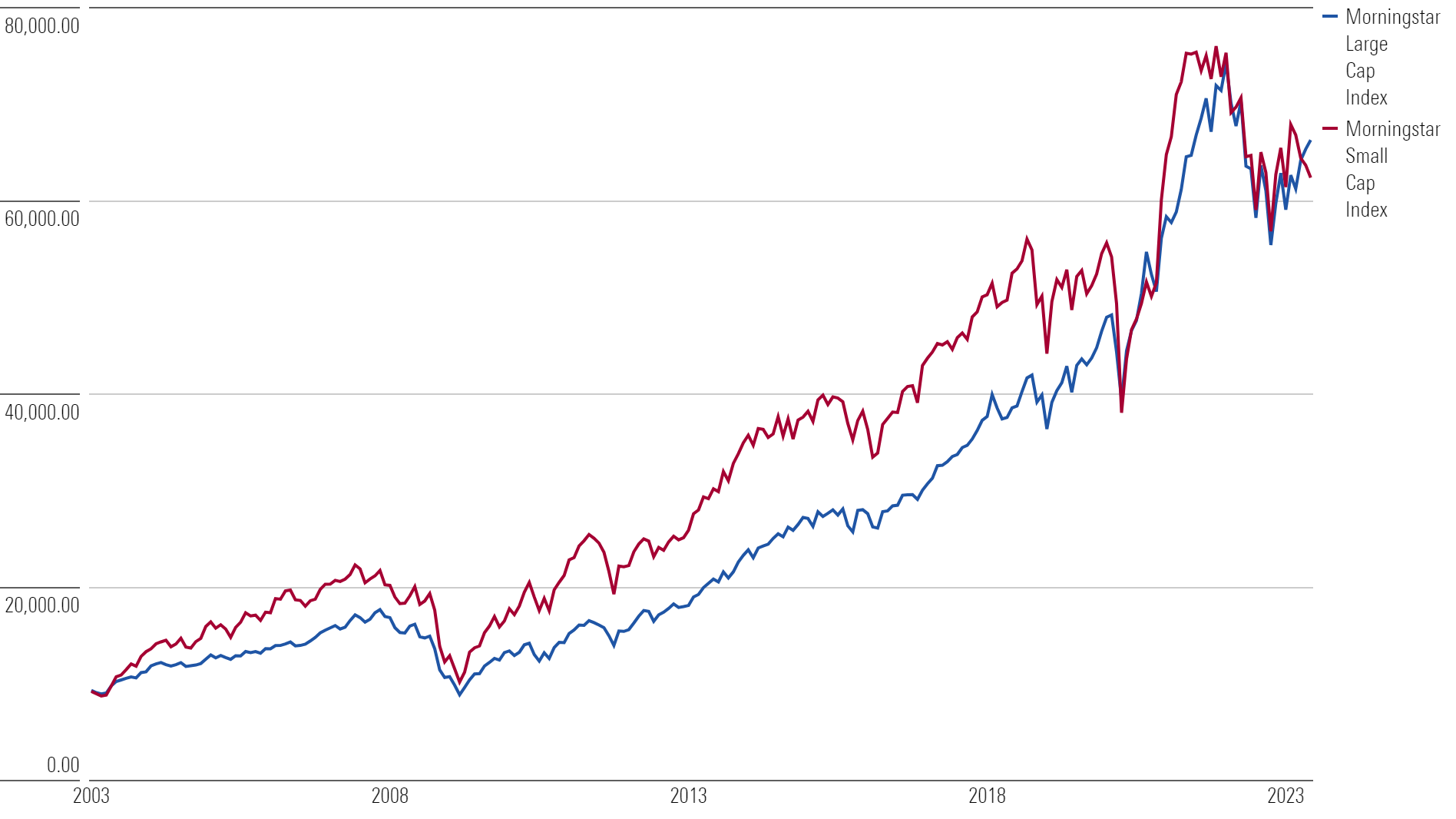

Growth of $10,000

Only recently did the Morningstar US Large Cap Index overtake the Morningstar US Small Cap Index. The small-cap index raced ahead in bull markets but lost all that ground during bear markets. Since inception in 2002, the small-cap index captured 113% of the large-cap index’s upside while realizing 120% of its downside.

The Seen Risks of Small Stocks

Smaller companies are risky because they don’t usually possess the same meaningful competitive advantages as larger firms. Only 1% of companies in the Morningstar US Small Cap Index boast a wide Morningstar Economic Moat Rating, compared with 67% of constituents in the Morningstar US Large Cap Index. The financial performance of wide-moat companies is usually more predictable than it is for narrow- or no-moat companies. This makes their stock performance relatively more stable overall and more resilient during recessions or bear markets. But the larger size of most wide-moat companies makes them less nimble and potentially slower to innovate. This gives small caps the edge during bull markets.

The relative size and competitive positioning of small-cap companies allow them to quickly capitalize on new business opportunities. These opportunities may be risky but can lead to big payoffs for companies that execute effectively. Investors are willing to pay up for companies like these during bull markets, driving their share prices higher. Because of this, small-cap stocks in aggregate can perform especially well when markets rise.

The Unseen Risks of Small Stocks

Investors should not simply choose an exchange-traded fund with the smallest average market cap and expect exceptional performance. Yes, smaller stocks are more volatile, but they are also less liquid. The latter point can detract from total returns, but its source can be hard to trace.

Index funds periodically rebalance to maintain allocations identical to those of their benchmarks. At each rebalance, an index fund must buy and sell securities to match its benchmark’s portfolio. Consider an index of 100 stocks. When it replaces 10 holdings, funds tracking that benchmark must sell their stake in the deleted stocks and buy the 10 that were added. These trades cost very little for large, liquid stocks like Apple AAPL and Tesla TSLA, but trading costs can quickly add up for tiny securities with wide bid-ask spreads.

Relatively few buyers and sellers exist in the smallest corners of the market. Many of these stocks are not listed on an exchange and are instead traded over the counter, where counterparties are harder to attract. This makes trading the smallest stocks a relatively cumbersome and expensive process. On the scale of some ETFs, this can be a multi-million-dollar headache.

On the rebalance date, a passively managed ETF sometimes has no choice but to move a considerable portion of a small stock’s outstanding share count. This is because these ETFs are beholden to their indexes and are essentially forced buyers or sellers and have little negotiating power as a result. This can lead to them settling for unfavorable prices in these transactions. The difference can be pennies, but for hundreds of small stocks with their positions totaling billions, it adds up. This makes an index’s approach to rebalancing and turnover particularly important.

Assessing the Risks

The Process Pillar of the Morningstar Medalist Rating for small-cap ETFs is conscious of the seen and unseen risks in that market. Funds tracking indexes that address these risks earn higher Process ratings than those that don’t.

Indexes that screen the opportunity set for minimum liquidity and float ratios are viewed favorably because they make an index easier to track. Buffer rules at each rebalance are also important because they reduce turnover and the associated transaction costs. While not the only criteria considered, these are important building blocks of the best small-cap index funds.

Along with top-rated ETFs in other categories, small-cap ETFs rated Bronze, Silver, and Gold are well-diversified and representative of the opportunity set available to active managers in the category. Usually, these ETFs hold hundreds, if not thousands, of stocks and stash only a small percentage of assets in their top 10 holdings. Sector allocations usually look like the average of their category peers, too. Below is a table of some highly rated small-cap ETFs.

Top Picks

| Investment | Ticker | Index | Mstar Medalist Rating | Process Pillar Rating | 10-Year Annlzd Return (%) | 10-Year Stnd Deviation | Fee (%) |

|---|---|---|---|---|---|---|---|

| Vanguard Small-Cap ETF | VB | CRSP U.S. Small Cap | Gold | Above Average | 8.43 | 18.33 | 0.05 |

| iShares Core S&P Small-Cap ETF | IJR | S&P SmallCap 600 | Silver | Above Average | 8.89 | 19.40 | 0.06 |

| Schwab U.S. Small-Cap ETF | SCHA | Dow Jones U.S. Small-Cap Total Stock Market | Silver | Above Average | 7.67 | 19.28 | 0.04 |

| Vanguard Russell 2000 ETF | VTWO | Russell 2000 | Bronze | Average | 7.40 | 19.44 | 0.10 |

| Small-Blend Morningstar Category Average | 6.82 | 18.50 | 0.99 |

Despite the Russell 2000 Index’s popularity, it lacks the buffer rules incorporated by the most appealing indexes in the small-blend category. This can saddle funds tracking that index, like Bronze-rated Vanguard Russell 2000 ETF VTWO, with elevated trading costs that can eat into returns. Instead, indexes from CRSP, Dow Jones, and S&P do a better job managing these costs, and funds tracking those indexes earn higher Process Pillar ratings because of it.

Investing in small-cap stocks can be a risky but potentially rewarding endeavor. Index ETFs, like those listed above, give investors diversified exposure to that market for a low cost. Not all index ETFs are created equal, though. ETFs tracking small-cap indexes that effectively control for the unique risks of that market should give investors the best chance for outperformance over a full market cycle.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)