These Stocks Are Leading the Growth Rebound

Tech stocks such as Apple, Nvidia, Block, and Lattice Semiconductor are fueling the growth stock rally in 2023.

The new year has brought a change in fortune for growth stocks, which have surged ahead of the value side of the market after facing brutal losses in 2022.

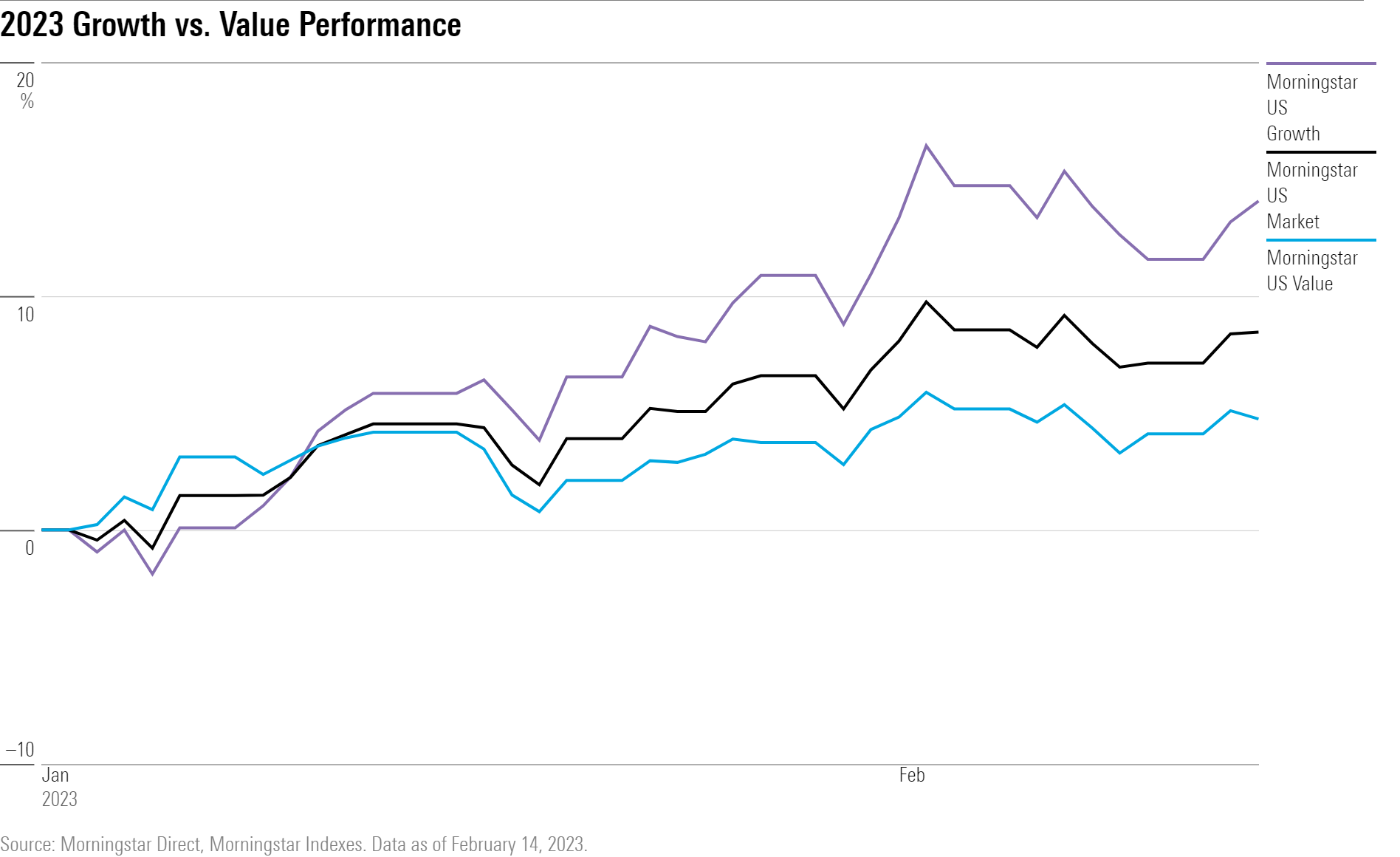

The Morningstar US Growth Index has risen 14.1% for the calendar year through Feb. 14, nearly 10 percentage points ahead of the Morningstar US Value Index, which is up 4.7% for the same period.

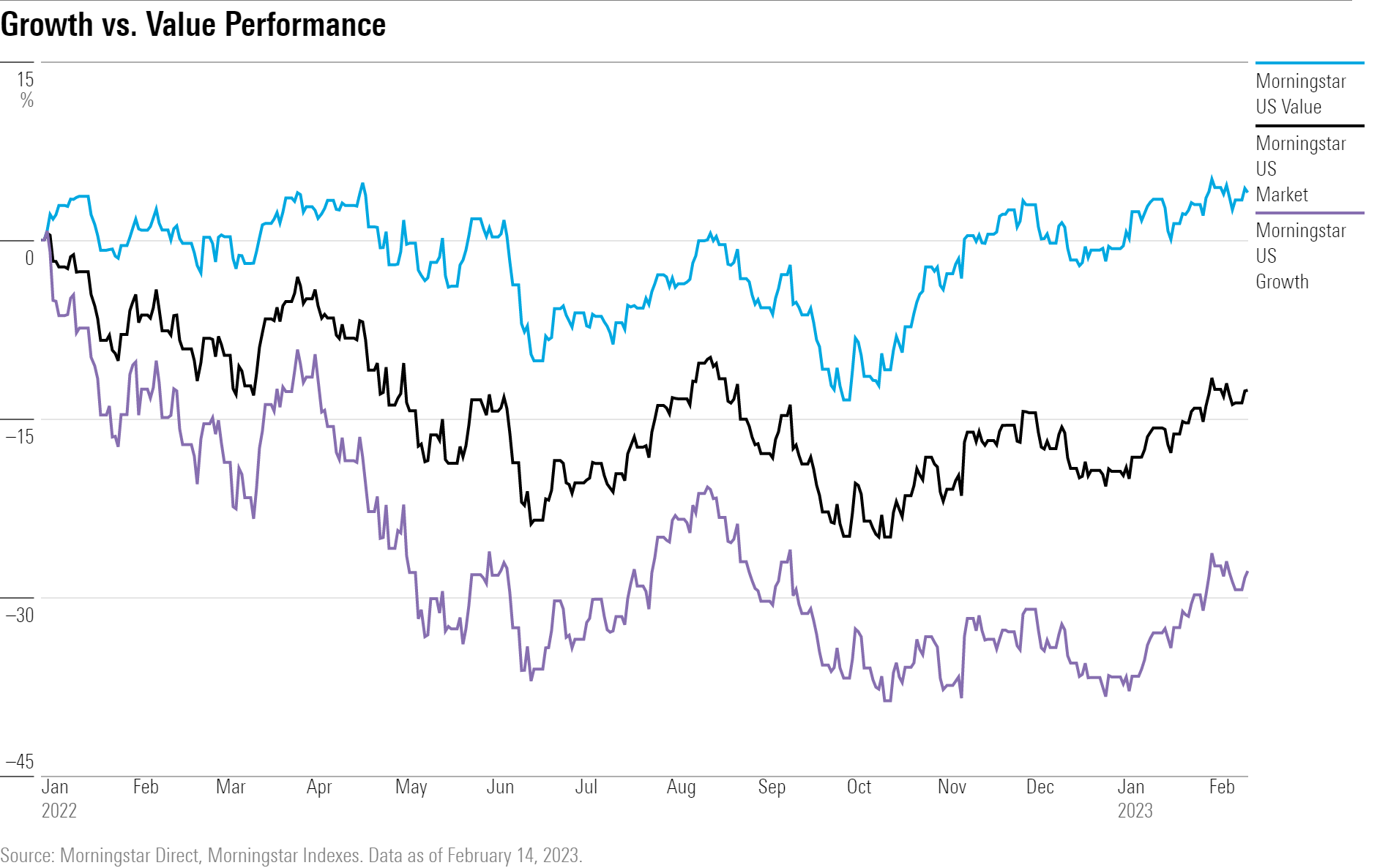

Growth stocks were left bloodied at the end of 2022, hammered by a year of aggressive interest-rate hikes from a near-zero starting point. Meanwhile, value stocks held up much better, a significant reversal of years of underperformance relative to growth.

However, growth stocks have been on a rally in recent weeks, as investors expect that the Federal Reserve may pause rate hikes soon.

Among growth stocks, large-cap companies have been leading the bounce: The Morningstar US Large Growth Index has risen 14.1% since the start of the year through Feb. 14. During the same period, the stocks of mid-size growth companies rose 12.0% and small-cap growth stocks gained 12.4% as a group.

These gains have been led by tech giants such as Apple AAPL, up 18.1% in 2023 through Feb. 14, as well as smaller names including sports betting and entertainment company DraftKings DKNG, which gained 45.7% for the period, and Lattice Semiconductor LSCC, which has risen 37.6%. But with tech stocks composing heavy percentages of the growth stock universe, their recent jump has been critical to the rebound.

Still, it’s probably too early to break out the Champagne for growth stocks. For one, the early trend could easily get quashed as recent data show that progress in bringing inflation down is moving slower than many in the markets had been thinking was the case. As a result, the Fed may have to hold rates high for longer than expected.

Not only that, but the damage done to growth stocks last year was so significant that the Morningstar US Growth Index would need to rally roughly 44% just to get back to where it started last year. Thanks to last year’s drubbing, value stocks have erased the longer-term performance advantage held by growth stocks prior to 2022.

Growth Stock versus Value Stock Performance History

The rebound in growth stocks is the latest in a back-and-forth within the market between outperformance and underperformance for the two styles of stocks.

Morningstar assigns every stock it covers a style score. These scores are relative, with companies landing in the value, core, and growth categories of the Morningstar Style Box.

A company’s style score is based on metrics such as growth rates for earnings, sales, book value, and cash flow. It also factors in dividend yields and relative valuations such as the price/projected earnings ratio, price/book, price/sales, and price/cash flow.

Growth stocks have been more sensitive to the current cycle of interest-rate increases, and interest rates in general, because their stock prices depend heavily on expectations for future earnings.

Heading into 2022, interest rates were at rock-bottom levels thanks to the Fed’s efforts to rescue the economy from the pandemic-driven recession. But as inflation surged, the Fed stepped in and raised interest rates at an unprecedented pace.

In addition to interest-rate sensitivity, another factor making growth stocks vulnerable to outsize declines in 2022 was the fact that many were trading at rich valuations at the start of the year.

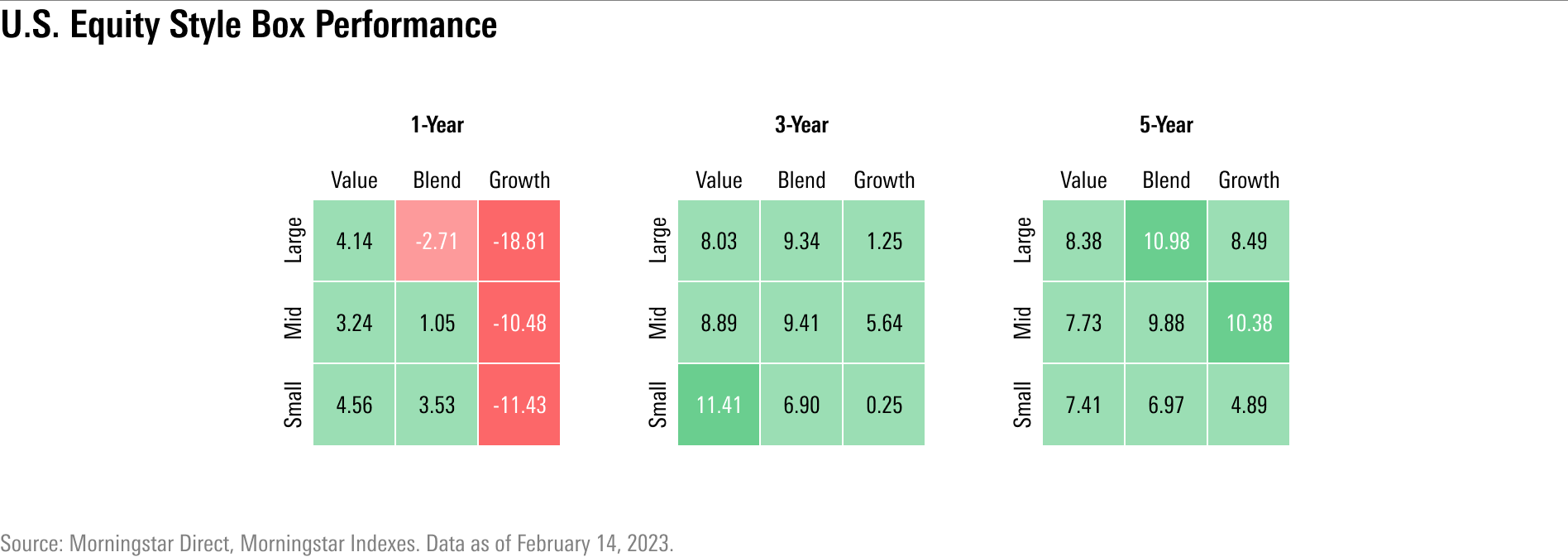

A look over the past 12 months shows the resulting performance gap in favor of value: The Morningstar US Value Index is up 3.9% through Feb. 14, while the Morningstar US Growth Index is down 15.3%.

Over the three-year trailing period, value stocks have also seen higher returns with an 8.5% average annual return, ahead of a 5.7% average annual return for growth-oriented names.

During this three-year period, small-cap value led the Morningstar Style Box with an average annual return of 11.4%. Small growth fared the worst with a 0.3% average annual return, lagging just behind large growth’s 1.3% average annual return.

But for the five-year trailing period, growth stocks have held onto the performance advantage that dominated the market prior to 2022. The Morningstar US Growth Index is up 11.2% per year for the last five years while value is up 8.2% per year. Within the Morningstar Style Box, large core stocks have been the best performer with an average annual return of 11%, just ahead of mid-growth.

To start 2023, growth stocks are being lifted by changing expectations around the outlook for the economy and the Fed. Increasingly, investors believe the Fed is nearing the end of its interest-rate hikes, and, at the same time, the U.S. economy can avoid a recession. Both developments would be good news for stocks where valuations depend heavily on expectations for robust future earnings growth.

Relative to past rallies, the latest growth stock surge may look big, but context matters. In 2022, the Morningstar US Growth Index fell 36.7%. To rebound to where the index started last year would require a 57.9% rally. That would mean another 43.8% more than growth stocks have already gained.

Not only that, if the bear market continues, this will have turned out to be yet another false breakout. Last summer, growth stocks hit a low point on June 16 then rallied 20.3%, only to fall into another bear-market low in mid-October. In the current environment, there’s a wide range of opinions about whether the current rally can last.

Which Growth Stocks Have Led the Rally?

Technology stocks have been the leaders in the Morningstar US Large Growth Index’s 14.2% rally this year. The sector—which composes 40.1% of the growth index—has returned 19.1% so far this year. The next-largest contributor has been consumer cyclical stocks, returning 30% so far this year.

At the industry level, software infrastructure stocks have contributed the most to the growth rally, with returns totaling 16% so far this year. Software application stocks, which compose 10.8% of the weight in this index, have shown returns of 20.1%. Semiconductor stocks have also been a significant driver of the large growth rally.

Among individual stocks, Tesla TSLA and semiconductor manufacturer Nvidia NVDA have been the leading contributors to performance in the large growth index this year. Tesla has returned 69.9% so far in 2023 and Nvidia 57.2%. Apple has also been a key driver of returns with a gain of 18.1%.

Compare those gains with 2022′s losses: Apple was down 26.4%, Tesla down 65%, and Nvidia down 50.3%.

For mid-cap stocks, the technology sector has been the leading contributor to the 12% year-to-date return in the Morningstar US Mid Growth Index, where they make up 32.1% of the index. Mid-cap tech stocks are up 17.4% so far this year. The next-largest contributor was the industrial sector, returning 11.9%.

Driving those gains are two semiconductor stocks, Onsemi ON and Marvell Technology MRVL. Onsemi has returned 39.3% so far in 2023, having lost 8.2% in 2022, while Marvell has gained 27.7% after losing 57.5% last year. Another top contributor has been payments company Block SQ, which lost 61.1% last year, but has gained 25.4% in 2023.

While the technology sector put up big gains within the Morningstar US Small Growth Index, leaders also came from industrial and healthcare stocks. The small growth index is up 12.4% so far in 2023.

The largest contributor to small-cap growth’s performance has been Lattice, which has gained 37.6% in 2023 after a 15.8% decline in 2022. But online gambling company DraftKings has been the second-largest contributor with a 45.7% return so far this year, which follows a 58.5% drop in 2022. Another semiconductor company, Silicon Laboratories SLAB, ranks third with a 42.2% rally in 2023. The fourth-largest contributor has been transportation company Saia SAIA, which has gained 32.5%.

At the industry level, software infrastructure companies have been leading contributors to the gains in the small growth index, with returns totaling 18.9%. Semiconductors, software application stocks, and auto parts companies also added to the index’s returns with double-digit gains.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)