10 Undervalued Wide-Moat Technology Stocks

Salesforce and Tyler Technologies are among the companies trading at discounted prices.

Technology stocks are on the upswing again this year after suffering double-digit losses in 2022, but there are still plenty of opportunities for long-term investors. Among companies trading at discounted prices are Salesforce CRM and Tyler Technologies TYL.

“We remain confident in secular tailwinds in technology, such as cloud computing and rising semiconductor demand,” writes Brian Colello, technology sector director for Morningstar. “We’d encourage investors to focus on the bright long-term prospects in software as a service and data center expansion, despite the cautious tones that we’re hearing because of macroeconomic concerns.”

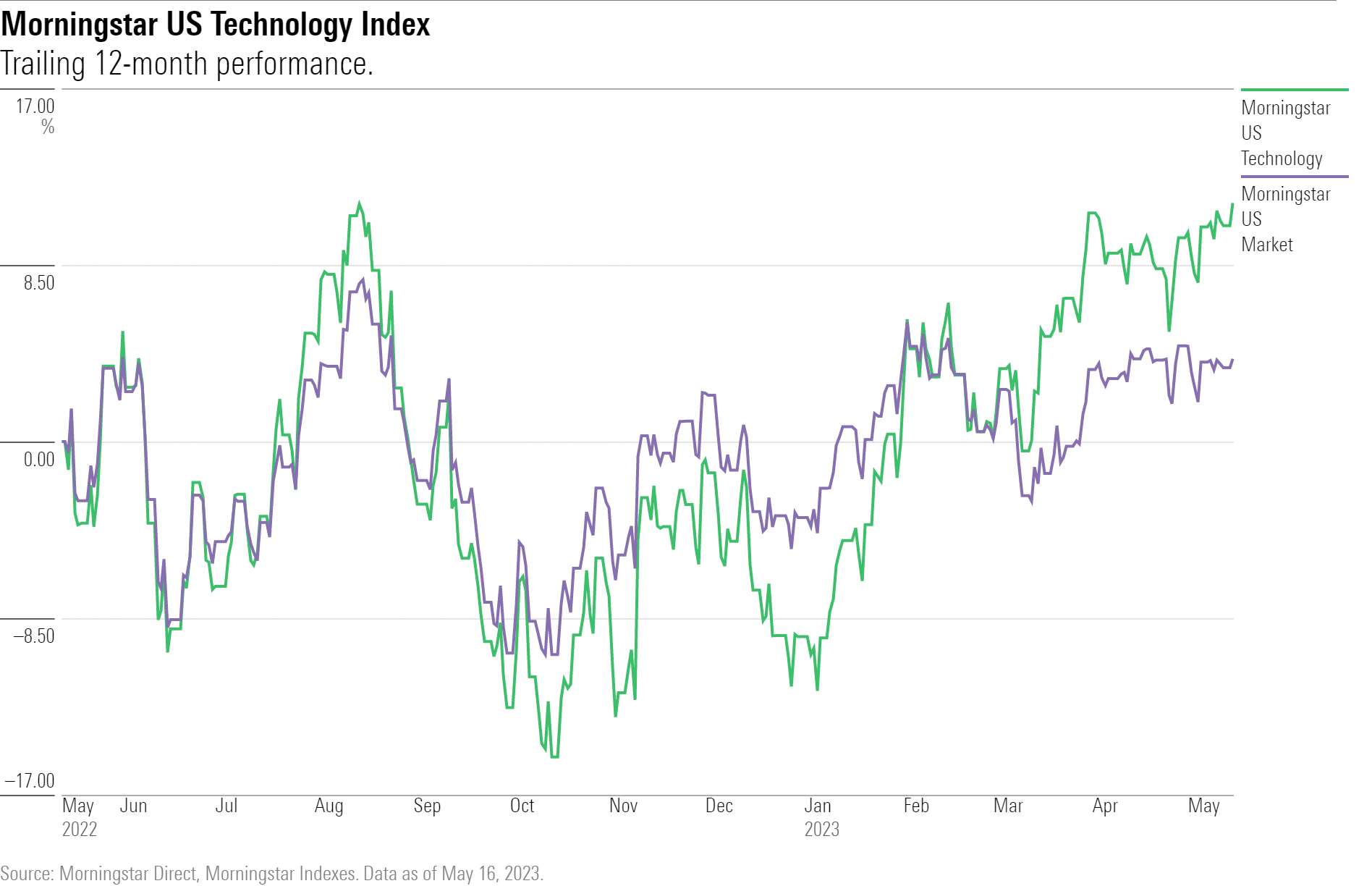

Despite 2022 battering tech stocks, the group has made up lost ground this year. Through May 16, 2023, the Morningstar US Technology Index was up 11.5%, while the Morningstar US Market Index rose 4.0%. The tech rally in 2023 has lifted the sector index to an 11.5% return for the trailing 12-month period, while the U.S. market index has gained 7.9%.

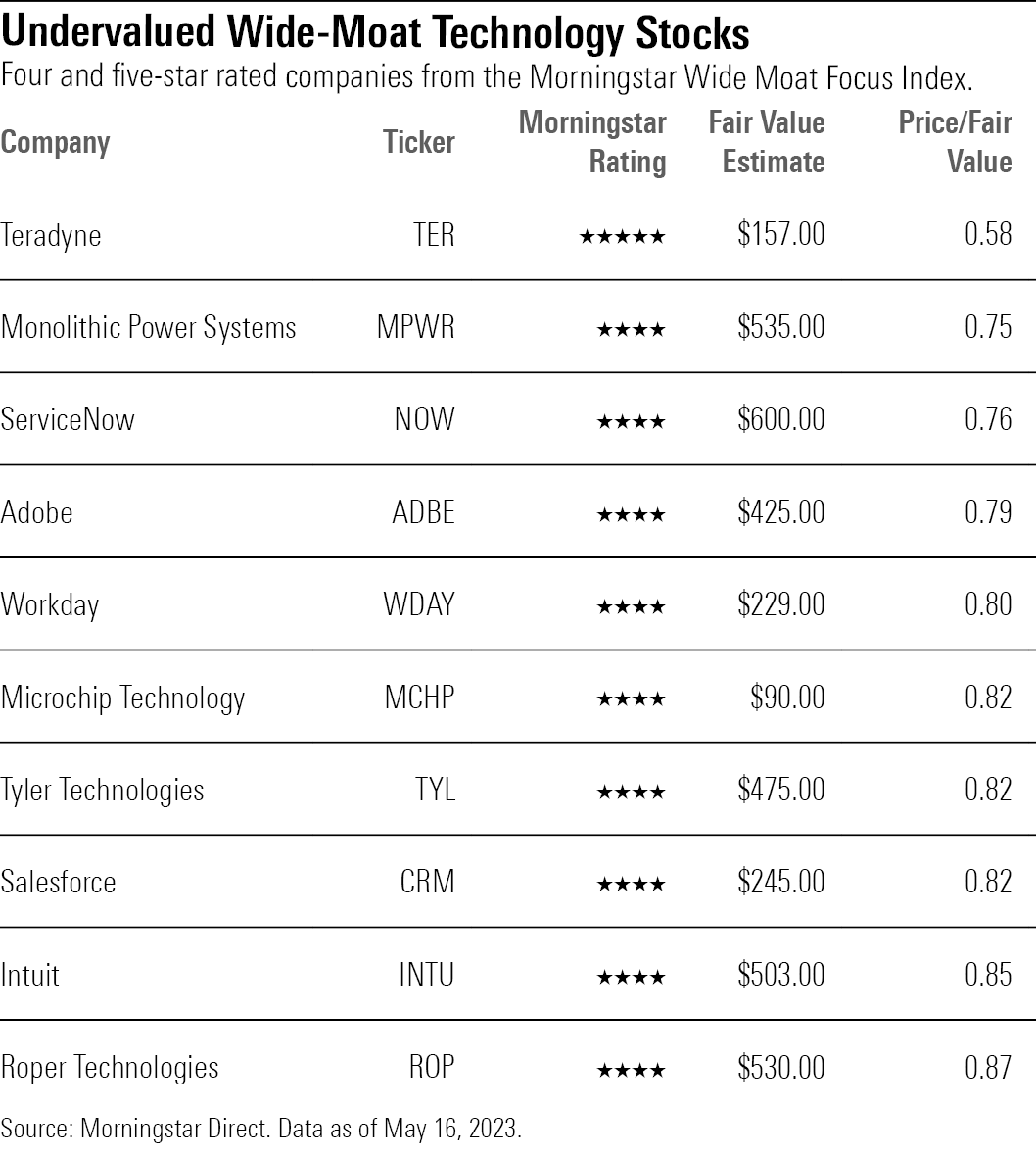

To find undervalued, high-quality tech stocks, we screened the Morningstar Wide Moat Focus Index—a collection of stocks with Morningstar Economic Moat Ratings of wide that are trading at the lowest current market price/fair value ratios.

Economic moats reflect the degree to which a company has durable competitive advantages. A company with an economic moat can fend off competition and earn high returns on capital for many years to come. Morningstar analysts assign companies moat ratings of wide, narrow, or none. The combination of wide economic moats and low valuations has proved to be a winning mix over the long term.

What Qualifies as a Technology Stock?

Tech companies design, develop, and support computer operating systems/applications and provide computer and tech consulting services. They also make computer equipment, data storage and networking products, semiconductors, and components. This index includes four industries within the technology sector: semiconductors, semiconductor equipment and materials, software applications, and software infrastructure.

Technology companies fall under the Morningstar Sensitive Super Sector, which includes industries that ebb and flow with the overall economy, but not severely. Sensitive industries fall between defensive and cyclical, as they are not immune to a poor economy.

Undervalued, High-Quality Tech Stocks

A screen of the Morningstar Wide Moat Focus Index reveals the most undervalued technology stocks with durable competitive advantages. Here are 10 with wide moats and Morningstar Ratings of 4 or 5 stars:

- Teradyne TER

- Monolithic Power Systems MPWR

- ServiceNow NOW

- Adobe ADBE

- Workday WDAY

- Microchip Technology MCHP

- Tyler Technologies

- Salesforce

- Intuit INTU

- Roper Technologies ROP

The most undervalued on the list is Teradyne, trading at a 42% discount to its analyst-assessed fair value estimate. The least undervalued is Roper Technologies, trading at a 13% discount.

Teradyne

- Industry: Semiconductor Equipment and Materials

- Stock Price: $94.22

- Fair Value Estimate: $157

“Teradyne is a heavyweight supplier of automated test equipment for semiconductors, boasting market-leading capabilities that run the gamut of chips. It is one of two companies worldwide that can produce testers for the most cutting-edge semiconductors, thanks to robust engineering talent across hardware and software and a structural lead in organic investment. The firm is a vital partner to chipmakers across the industry and has an impressively strong relationship with Apple and Taiwan Semiconductor. Teradyne’s market leadership exhibits itself in industry-leading margins, strong returns on invested capital, and a top market share. We give the firm a wide economic moat rating.

“We expect Teradyne’s semiconductor sales to remain depressed in 2023 as customers digest inventory and demand remains weak. For 2024, we forecast a significant rebound enduring into 2025 as customer spending resumes and 3-nanometer chip production ramps more broadly. In the long term, we think Teradyne will enjoy strong growth in memory capacity along with advancements deeper into 3D NAND, and we expect further share gains in the NAND testing market.”

— William Kerwin, analyst

Monolithic Power Systems

- Industry: Semiconductors

- Stock Price: $412.56

- Fair Value Estimate: $535

“We think Monolithic Power Systems is a disruptor in the power management chip market, using its proprietary process technology to differentiate itself from larger competitors. In our view, electrical engineers tend to buy power management semiconductors from reputable vendors that use lagging-edge manufacturing. As a relative newcomer, MPS stands out via its unique fabless model, with which it develops advanced manufacturing processes that integrate many functions on a single chip to offer a smaller form factor and greater energy efficiency. While MPS remains a small player, we think revenue growth far above its largest competitors shows its differentiated approach to power management is gaining traction in the market.

“We think MPS has intangible assets from its innovative chip designs and advancements in manufacturing that carve out a wide economic moat, in our view. We think analog incumbents are likely to continue serving a wide array of end customers with lagging-edge in-house chip manufacturing, rather than competing for MPS’ higher-tech sockets. Like its larger rivals, MPS also benefits from high customer switching costs once its chips are designed into end products, especially in end markets with long product life cycles. We think the asset-light fabless model will allow MPS to extract high returns from a low invested capital base, even as competition grows.”

— William Kerwin, analyst

ServiceNow

- Industry: Software Applications

- Stock Price: $463.14

- Fair Value Estimate: $600

“ServiceNow has been successful thus far in executing a classic land-and-expand strategy. First it built a best-of-breed SaaS solution for IT service management, or ITSM, based on being modular and flexible, having a superior familiar user interface, offering a way to automate a wide variety of workflow processes, and becoming a platform to serve as a single system of record for the IT function within the enterprise. Having established itself in ITSM and then the much larger IT operations management, or ITOM, market, the firm moved beyond the IT function. The same set of product design features and technologies has allowed ServiceNow to bring its process automation approach to human resources service delivery, customer service, finance, and operations. More recently, ServiceNow has been offering higher pricing tiers with an increasing array of features, along with industry-specific vertical solutions, which have higher average selling prices and help drive revenue growth.

“We believe that having the IT function within an enterprise as the initial landing pad is fortunate, as it provides a built-in advocate for software (an IT responsibility) for other functional areas of the enterprise. ServiceNow will continue to use its position to land new IT-driven customers and upsell ITOM features on the platform, but we believe it will increasingly cross-sell emerging products in HR and customer service along with the platform-as-a-service offering. In our view, product strength, market presence, and a strong sales push into areas outside of IT will continue to drive robust growth.”

— Dan Romanoff, senior equity analyst

Adobe

- Industry: Software Infrastructure

- Stock Price: $345.67

- Fair Value Estimate: $425

“Adobe has come to dominate in content creation software with its iconic Photoshop and Illustrator solutions, both now part of the broader Creative Cloud. The company has added new products and features to the suite through organic development and bolt-on acquisitions to drive the most comprehensive portfolio of tools used in print, digital, and video content creation The December 2021 launch of Adobe Express helps further broaden the company’s funnel, as it incorporates popular features of the full Creative Cloud but comes in lower-cost and free versions. We think the company is properly focusing on bringing new users under its umbrella and believe converting these users will become more important over time.

“We foresee solid growth in both digital media and digital experience even as both steadily slow over time. Digital experience should benefit from increasing penetration into a $110 billion market as defined by Adobe. We believe a relatively frictionless cross-selling opportunity exists for the company, as creative professionals are already steeped in Adobe products. The desire to consolidate vendors makes Adobe an obvious choice for needed marketing software solutions, and the fact that the company’s products are strong should initially help in what we believe is a large greenfield opportunity. Within digital media, we have been impressed by Adobe’s ability to draw in new users that many did not believe existed.”

— Dan Romanoff, senior equity analyst

Workday

- Industry: Software Applications

- Stock Price: $185.46

- Fair Value Estimate: $229

“We consider Workday to be a best-of-breed cloud-only platform for human capital management, or HCM, software. By debuting in 2005 as a first mover in the cloud HCM space at an ideal time—when enterprises were looking to make the move from on-premises to cloud software solutions—Workday has benefited from its timeliness, as well as its high-quality product and reputation for smooth implementations. Now that customers have transitioned to a cloud solution with Workday, we think it’s unlikely that another vulnerable event would leave Workday susceptible to customers switching. Instead, we see wide-moat Workday as having robust switching costs which will only get stronger as the company builds off its core HCM offering.

“We assign Workday a Morningstar Uncertainty Rating of High, which is mostly derived from the possibility of facing tougher competition from either incumbents SAP or Oracle catching up, or from new entrants. We think Microsoft could be a threat to Workday eventually. Microsoft currently has an HCM solution called Dynamics 365 Human Resources, which was rebranded in 2020 from its Microsoft Dynamics 365 Talent Attract and Talent Onboard applications. The latest versions of Microsoft 365 come with a feature called MyAnalytics, which shares productivity insights on individual employees.”

— Julie Bhusal Sharma, equity analyst

Microchip Technology

- Industry: Semiconductors

- Stock Price: $75.38

- Fair Value Estimate: $90

“Microchip Technology is a leading supplier of microcontrollers, or MCUs, which are semiconductors that act as the brains in a wide variety of common electronic devices, from garage door openers to electric shavers to home appliances like dishwashers. We view Microchip as one of the best-run firms within the chip space and like its ability to generate free cash flow under virtually any economic scenario.

“Overall, we foresee healthy demand for Microchip’s products. As more and more electronic devices become ‘smarter’ and connected to the internet, Microchip’s MCUs and analog chips stand to benefit. Microchip may also make acquisitions to further expand its product portfolio.”

— Brian Colello, sector director

Tyler Technologies

- Industry: Software Applications

- Stock Price: $393.73

- Fair Value Estimate: $475

“We view Tyler Technologies as the clear leader in a slow-moving and underserved niche market of government operational software. We believe there is a decadelong runway for normalized top-line growth near 10% at Tyler, especially as demand accelerates for SaaS and the need intensifies for local governments to modernize their legacy enterprise resource planning systems.

“The company generally trades at high multiples relative to peers, which is exacerbated by the fact that it is expected to grow only near the median of the software group over the next few years.

“Despite impressive growth and a revenue base well in excess of $1 billion, Tyler is organically transitioning from perpetual licenses to subscriptions. Perpetual deals can get pushed out or pulled in within a year and can have a material impact on quarterly results. Since deal size is increasing, it is possible that a couple of large deals leaking into the next several quarters could cause a quarterly earnings miss.”

— Dan Romanoff, senior equity analyst

Salesforce

- Industry: Software Applications

- Stock Price: $203.33

- Fair Value Estimate: $245

“We believe Salesforce represents one of the best long-term investment opportunities in software, particularly as the company should provide investors with a nice balance between revenue growth and improving profitability. Even as revenue growth has decelerated over time, we believe a new focus on margin expansion should continue to compound strong earnings growth for years to come.

“After introducing the SaaS model to the world, Salesforce has assembled a front-office empire it can build on for years to come. Sales Cloud represents the original salesforce automation product, which streamlined process management for sales leads and opportunities, contact and account data, process tracking, approvals, and territory tracking. Salesforce’s critical differentiator was that the software was accessed through a web browser and delivered over the internet, thus inventing the SaaS delivery model.

“In our view, Salesforce will benefit further from natural cross-selling among its clouds, upselling more robust features within product lines, vertical solutions, pricing actions, and international growth.”

— Dan Romanoff, senior equity analyst

Intuit

- Industry: Software Applications

- Stock Price: $426.21

- Fair Value Estimate: $503

“Intuit is the giant behind U.S. small-business accounting software QuickBooks and do-it-yourself U.S. tax software TurboTax. With online sales of TurboTax and QuickBooks having eclipsed their desktop sales, Intuit has now transitioned into a cloud-first company. This has enabled Intuit to leverage customer data to streamline the user experience across disparate products and natively market its offerings, in turn supporting switching costs and a network effect, which we consider to already form the backbone of Intuit’s wide moat.

“Over the past several years, Intuit has continued to innovate. It has realized the insecurity customers have in accomplishing the consequential tasks of tax filing or business accounting on software alone. In turn, for both its small-business and consumer customers, Intuit has launched matchmaking systems. In accounting that means matching small businesses with accountants, and in tax that means adding a human review to the filing process. We think both matchmaking mechanisms pose meaningful opportunity ahead, in the form of increased customer retention on both sides and getting exposure to the assisted tax market. Now that Intuit is starting to reap the benefits of playing matchmaker, next up is to take big bets on QuickBooks complements, such as creating an omnichannel sales platform for small businesses. While these buildouts will take time, we think such a direction will help propel the QuickBooks network effect as customers continue to demand all-in-one software to run their businesses.

“We expect Intuit’s revenue growth to outpace its growth in sales and marketing expense in the years ahead, leading to operating leverage and rising operating margins.”

— Julie Bhusal Sharma, equity analyst

Roper Technologies

- Industry: Software Applications

- Stock Price: $461.88

- Fair Value Estimate: $530

“Roper acquires software companies with large amounts of deferred revenue, which they have because many such businesses receive cash in advance of when services are rendered. Roper uses this cash to invest in businesses at incrementally higher rates of return. Its targets have large bases of recurring revenue in oligopolistic niche markets with small total addressable markets. That revenue base is protected by strong moats that frequently post gross retention rates greater than 95%. Roper’s businesses typically don’t own their own infrastructure, which further contributes to its asset-light business model. Over 20 years, Roper’s net working capital as a percentage of sales dropped from 18% to negative 17%.

“Roper’s application software businesses specifically focus on professional or specialized niches like the attorney market, government contracting, and engineering and construction firms, which present their own challenges and circumstances. Roper’s offerings specifically address these needs, which we believe creates a stickier offering and makes it harder for large players to displace them. It also offers Roper greater-than-inflation pricing power, giving us confidence that this segment can grow its organic top-line compound annual growth rate at 5% over the next 10 years.”

— Joshua Aguilar, senior equity analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)