5 Charts on Value Stocks’ Big Comeback

Having been out of favor for more than a decade, value stocks have caught back up with growth.

After more than 10 years of growth stocks leaving value stocks in the dust, the tables have turned. Value is catching up and starting to show signs of leadership.

The past two years had brought some of the widest performance gaps in favor of growth stocks, largely driven by high-flying technology giants. But as the same tech names collapsed in 2022, value stocks have remained buoyant during the bear market, with some value names managing to carve out gains.

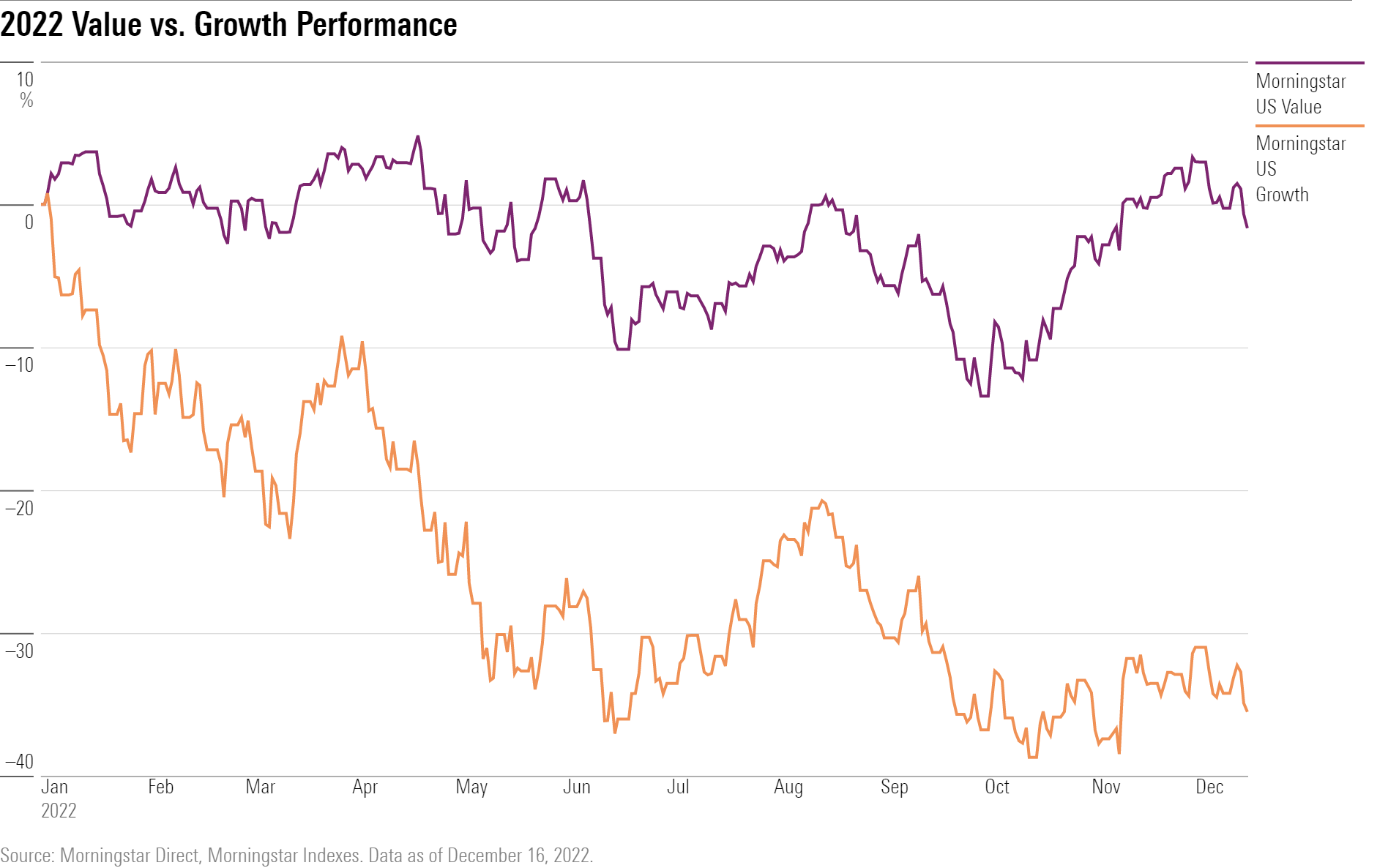

This year through Dec. 16, the Morningstar US Value Index is ahead of its growth counterpart by 33.9 percentage points, the widest that gap has been since the year 2000. Heading into 2022, the Morningstar US Growth Index had beaten the Morningstar US Value Index in nine of the past 10 calendar years.

“Value’s comeback is probably overdue,” says Russel Kinnel, director of ratings and manager research at Morningstar. The growth versus value gaps “had gotten very extreme.”

Of course, value’s outperformance in 2022 has been relative to the huge losses of growth stocks, and it didn’t mean investors necessarily made money on value stocks. The value index lost 1.7% through Dec. 16 compared with a 35.5% decline in growth stocks.

From here, it’s an open question as to whether value’s 2022 outperformance will be a short-term product of the bear market that ends once stocks have bottomed or whether it’s the beginning of a longer-term trend.

Leadership trends between growth and value tend to shift in multiyear cycles, says Kinnel, and it’s unclear where we are in the cycle. But there are signs that value stocks are starting to take a more durable lead again, because of factors such as rising interest rates and tailwinds for the energy sector.

“It’s very difficult to predict when a big shift will happen,” Kinnel says. But when changes in leadership do come, he says, “these trends can last a lot longer than we think.”

Closing the Gap

By several measures, value stocks are now catching up to growth beyond just 2022′s performance.

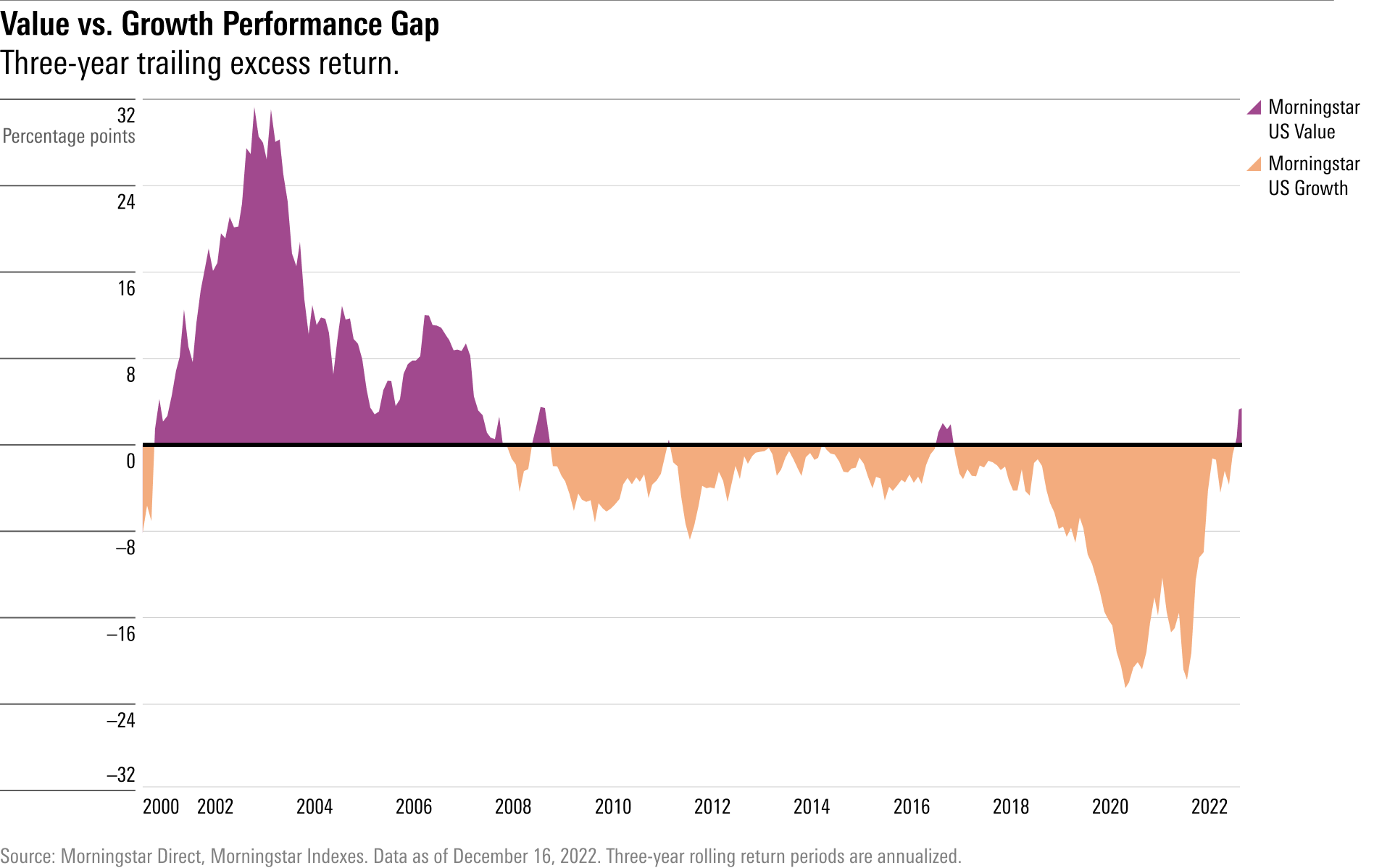

Except for two brief periods when the Morningstar growth and value indexes ran neck and neck, growth has outperformed consistently since 2008 on a trailing three-year basis.

But now, for the trailing three-year period ended Dec. 16, the Morningstar US Value Index is ahead of the growth index by 3.3 percentage points on an annualized basis. In contrast, at the end of 2021, three-year average annual returns on growth stocks were ahead of value by 19.3 percentage points.

Within the Morningstar Style Box, the details show other trends toward a narrowing of the performance gap between growth and value.

Over the past 12 months, the value-growth gap has been widest among large-cap stocks. The Morningstar US Large Cap Value Index is 37.2 percentage points ahead of the Morningstar US Large Cap Growth Index as of Dec. 16.

At the same time, small-cap value stocks are 25.2 percentage points ahead of small-cap growth stocks, and mid-cap value is 28.3 percentage points ahead of mid-cap growth.

But it’s a lookback over longer return periods that highlights the scale of value stocks’ catch-up with growth.

At the end of 2021, large-cap growth was ahead of large-cap value by more than 14 percentage points per year on a five-year trailing basis. Now, closing out 2022, large value is ahead of large growth by 0.2 percentage points per year. And the 10-year style box through Dec. 16 shows large growth 1.6 percentage points ahead of large value in terms of annualized performance over the past decade, down from nearly 7 percentage points at the end of 2021.

What Drove the Bounceback in Value Stocks This Year?

Most of the focus has been on the growth side of the equation. As the Fed raises interest rates to fight inflation, growth stocks took a hard hit, as higher interest rates make future cash flows look less attractive. As Morningstar strategist David Sekera noted, a significant part of the appeal of growth stocks is their future earnings potential. When rates are low, the value of those hefty future earnings is high. But when investors discount those future earnings at a higher rate thanks to rising interest rates, the present value for these stocks falls further and faster than the broader market, leading to lower prices.

But there were factors that also supported value stocks, Kinnel says.

“Value stocks often come from the kinds of industries that do well when the economy grows faster than we expect. This year, that was certainly the case.” Kinnel points to airlines, steelmakers, and commodity-based businesses as examples of industries that outperformed this year amid low unemployment and decades-high inflation, and despite persistent fears of a recession.

Kinnel adds that the strong year for energy stocks was another, largely unpredictable reason for value’s strong performance in 2022. Energy rose this year after Russia’s invasion of Ukraine affected global energy markets, he says. “It’s big macro events like these that make it hard for anyone to predict what will happen in the markets.”

Best-Performing Value Stocks of the Year

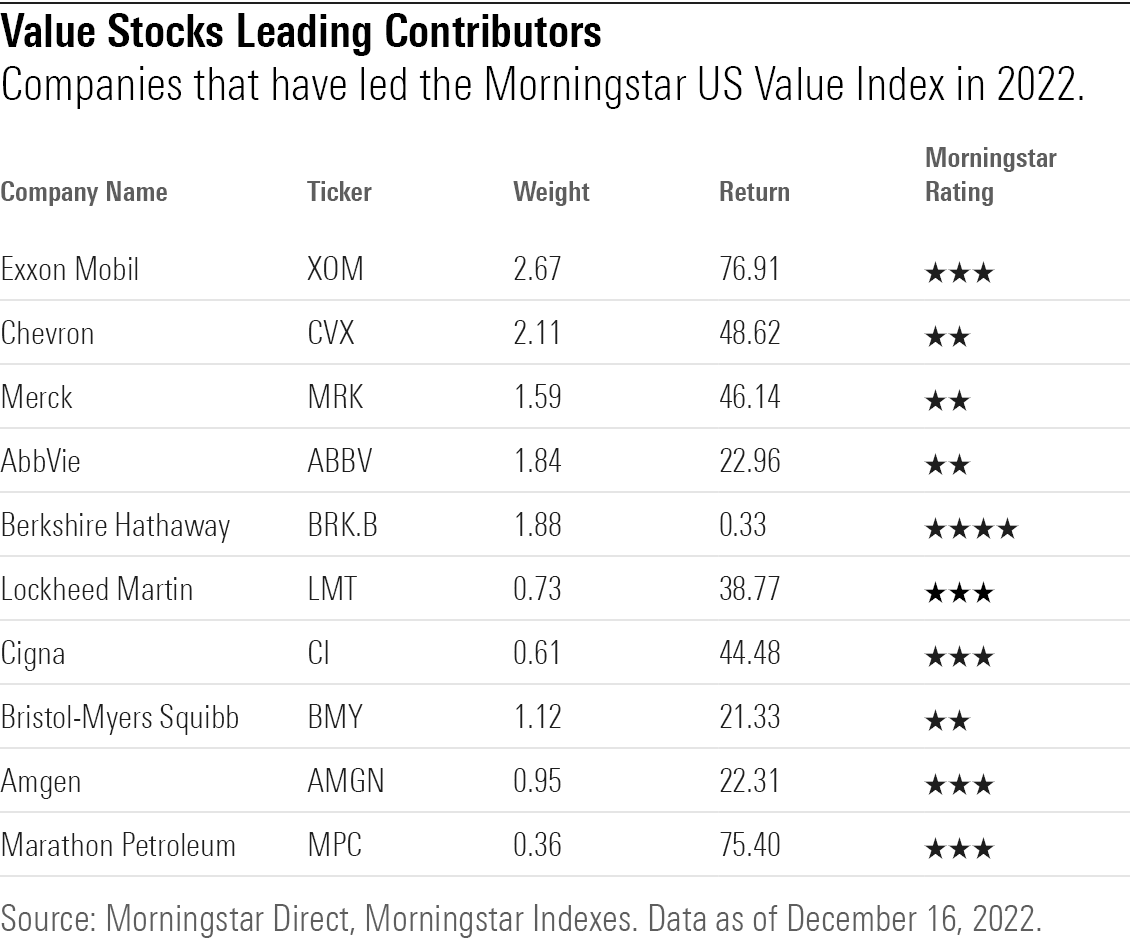

At the sector level, the leading contributor to the Morningstar US Value Index this year has been energy, which returned 53.9%. Healthcare, which makes up 18.8% of the value index by weight, returned 9.6% in 2022 through Dec. 16. The consumer defensive and utilities sectors also made contributions as each saw modest single-digit gains for the year.

Energy giants Exxon Mobil XOM and Chevron CVX have been the two top performers in the value index, with Exxon up 76.9% and Chevron gaining 48.7%.

Growth Stocks Left at Discount Prices

Among growth stocks, it was mainly names from the tech and communications services sectors that dragged the growth index down. This includes some of the market’s biggest tech stocks including Microsoft MSFT (down 26.5% since January), Amazon.com AMZN (down 47.3%), Meta Platforms META (down 64.5%), and Google parent company Alphabet GOOGL (down 37.7%). Each of the stocks are now trading at undervalued, discount prices according to their Morningstar analyst-assessed fair value estimates.

At current levels, growth stocks may be starting to look attractive. But, says Steve Sosnick, chief investment strategist at Interactive Brokers, “in this sort of climate, you can’t be investing on growth alone.”

Investors need to look for companies with strong earnings, dividends, and cash flow, Sosnick says. “We’re all value investors now.”

What’s Next for Value Versus Growth?

The outlook for value and growth depends partly on the Fed’s next policy moves, Kinnel says. On one hand, “if the Fed can thread the needle of tamping down inflation without crushing the economy, then growth stocks will thrive again.” What’s more likely, he says, is that the Fed will push the economy into recession. “That’s not good for either growth or value—but it’s worse for growth.”

For stocks of all kinds, Kinnel says, “it’s treacherous territory until the Fed stops hiking interest rates.” Things are looking slightly better for value compared with growth, according to Kinnel, but not meaningfully enough to merit any portfolio tilts.

Above all, says Kinnel, “the general proposition for stocks overall matters more than growth versus value.” Especially because the market has already dropped substantially, he says, “the potential for long-term returns is pretty good across the board.”

Kinnel says that in the long run, cash flow and earnings are what drive performance. “It’s a very bumpy ride, and so generally, it’s best to have equal amounts in both growth and value.” Shifting too far one way or the other, Kinnel says, means investors risk missing out on surprising rallies and good long-term returns.

“Different industries take their turns leading the market at different times, and you really don’t want to miss out on anything,” he says. “It pays to be diversified.”

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)